Florida Business Start-up Checklist

Description

How to fill out Business Start-up Checklist?

You can dedicate hours on the web attempting to locate the correct legal document template that meets the state and federal requirements you require.

US Legal Forms offers numerous legal documents that have been reviewed by experts.

You can download or print the Florida Business Start-up Checklist from the service.

If available, use the Review button to look through the document template as well.

- If you possess a US Legal Forms account, you can Log In and click on the Download button.

- After that, you can fill out, edit, print, or sign the Florida Business Start-up Checklist.

- Every legal document template you purchase is yours indefinitely.

- To obtain another copy of any purchased form, navigate to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have selected the appropriate document template for your state/area of interest.

- Read the form description to confirm that you have chosen the right form.

Form popularity

FAQ

In order to start a business in Florida, you'll need to go through the Florida Department of State's Division of Corporations. The Division of Corporations sets the rules, requirements and costs to form an LLC in Florida. You'll also need to follow their rules if you want to operate your out-of-state LLC in Florida.

In this section, founders describe when, why, and how they built the tech startup....Above all, the company summary should address the following:Business name.Business structure.Location.Mission statement.Competitive advantage.Date founded.

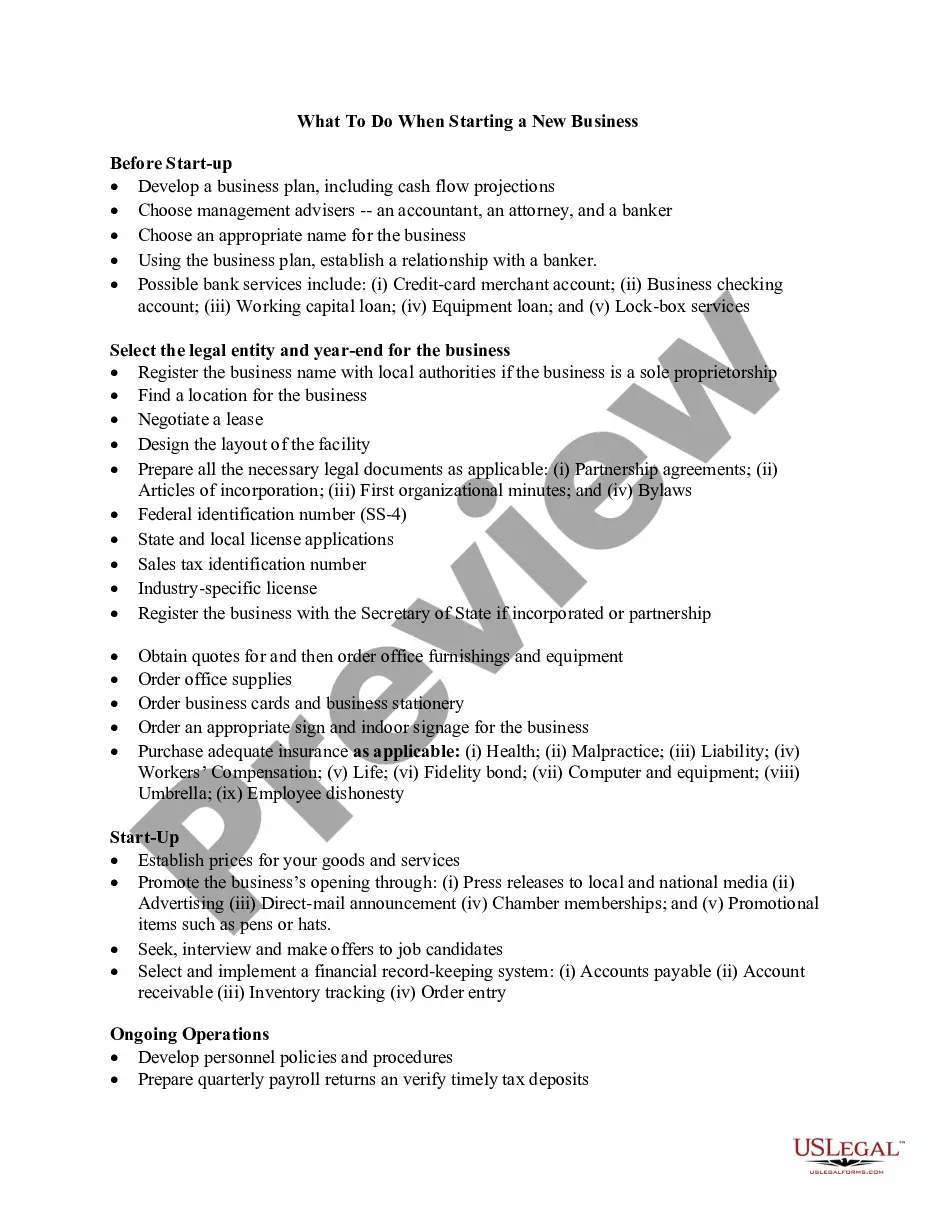

Business Startup ChecklistSelect a Name and Legal Structure.Write a Business Plan.Obtain your Federal Employer Identification Number (FEIN)Open the Company Bank Account.Lease Office, Warehouse or Retail Space (if not home-based)Obtain Licenses and Permits.Hire Employees (if applicable)More items...

While plans vary as much as businesses do, here's a summary of the seven main sections of a business plan and what each should include.Executive Summary.Company Description.Products and Services.Market analysis:Strategy and Implementation:Organization and Management Team:Financial plan and projections:

17-point checklist for starting a businessDefine your unique selling point.Find a business mentor.Create a business plan.Register web domains and trademarks.Set up your business structure.Ensure that your business will eventually be profitable.Set up a business bank account.Arrange business insurance.More items...

3 Things You Must Do Before Starting a New BusinessTake a business or entrepreneur training class. Take a business class or workshop before you start a business.Create a business plan. Yes, you really do need a business plan.Conduct real research.Let's review:Take the next step.

5 Things You Should Have Before Starting a BusinessA realistic personal budget. Article continues after video.Money in the bank. Make sure you can survive on this reduced budget for at least six months, if not longer.A marketing plan.A sales strategy.Stamina.

Experts say some good first steps in starting a business are researching competitors, assessing the legal aspects of your industry, considering your personal and business finances, getting realistic about the risk involved, understanding timing, and hiring help.

Business Startup ChecklistSelect a Name and Legal Structure.Write a Business Plan.Obtain your Federal Employer Identification Number (FEIN)Open the Company Bank Account.Lease Office, Warehouse or Retail Space (if not home-based)Obtain Licenses and Permits.Hire Employees (if applicable)More items...

Business Startup ChecklistFind a good business idea.Test your business idea and do market researchIf you're seeking funding, you may need a formal business plan.Brand your business.Make it legal.Get financed (only if you need it)Set up shop.Market and launch your business.