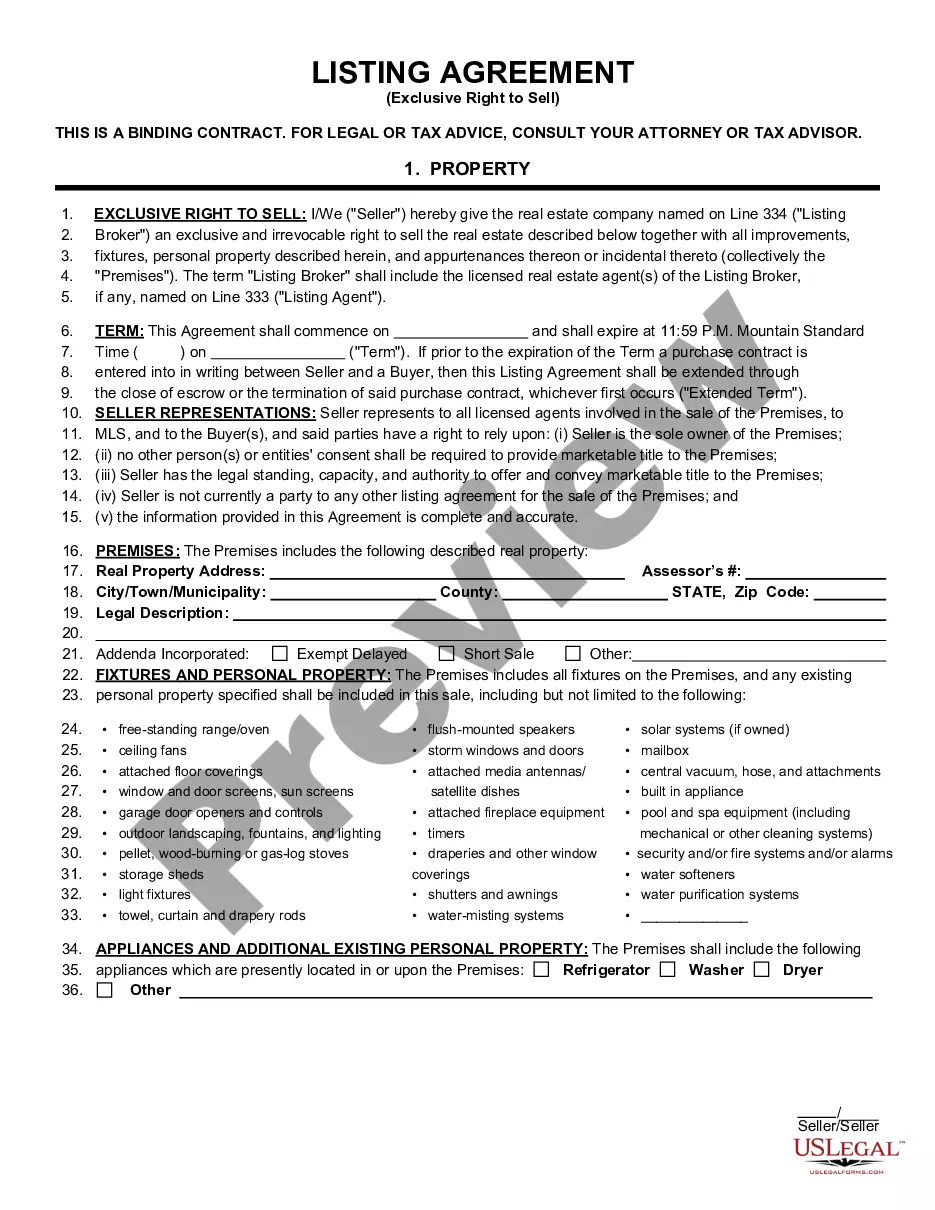

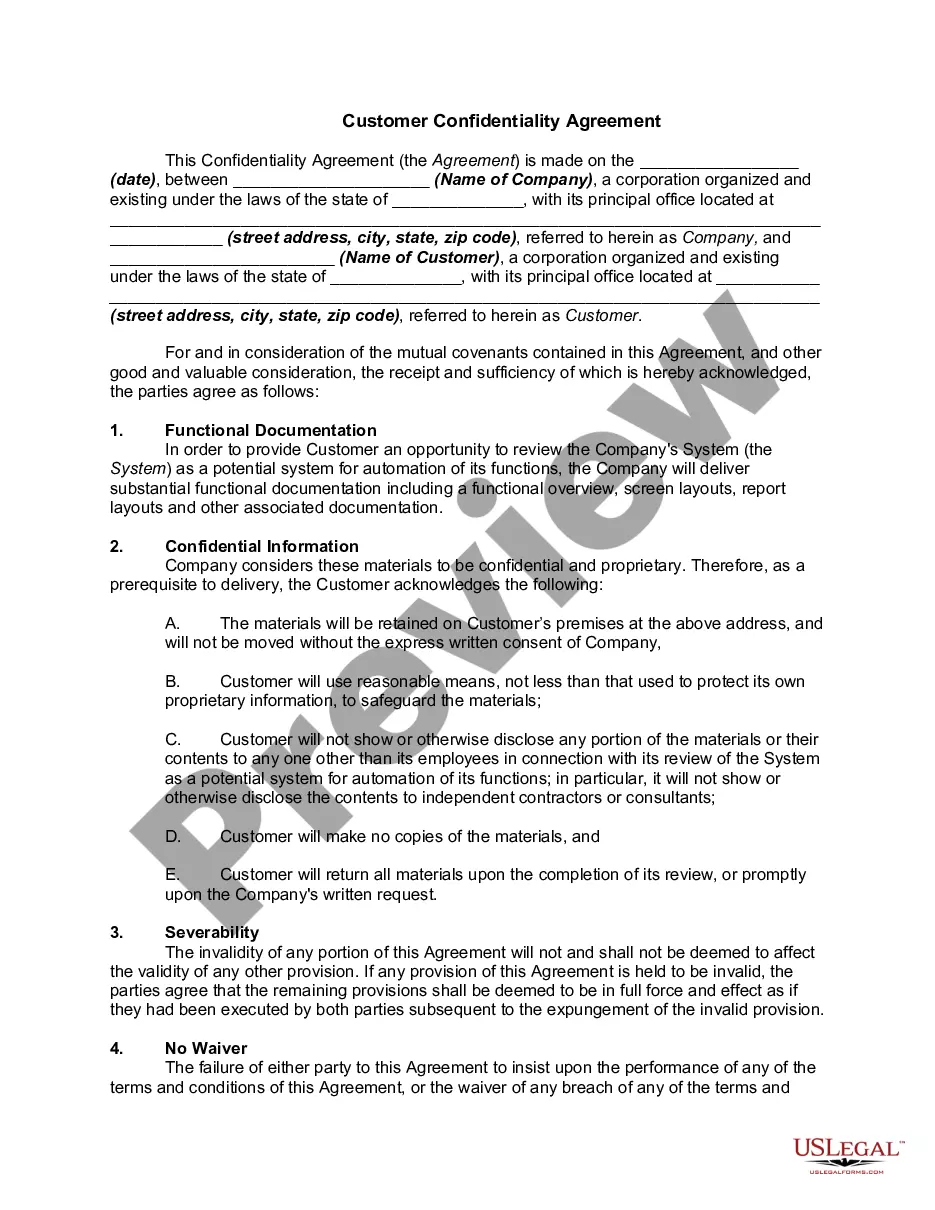

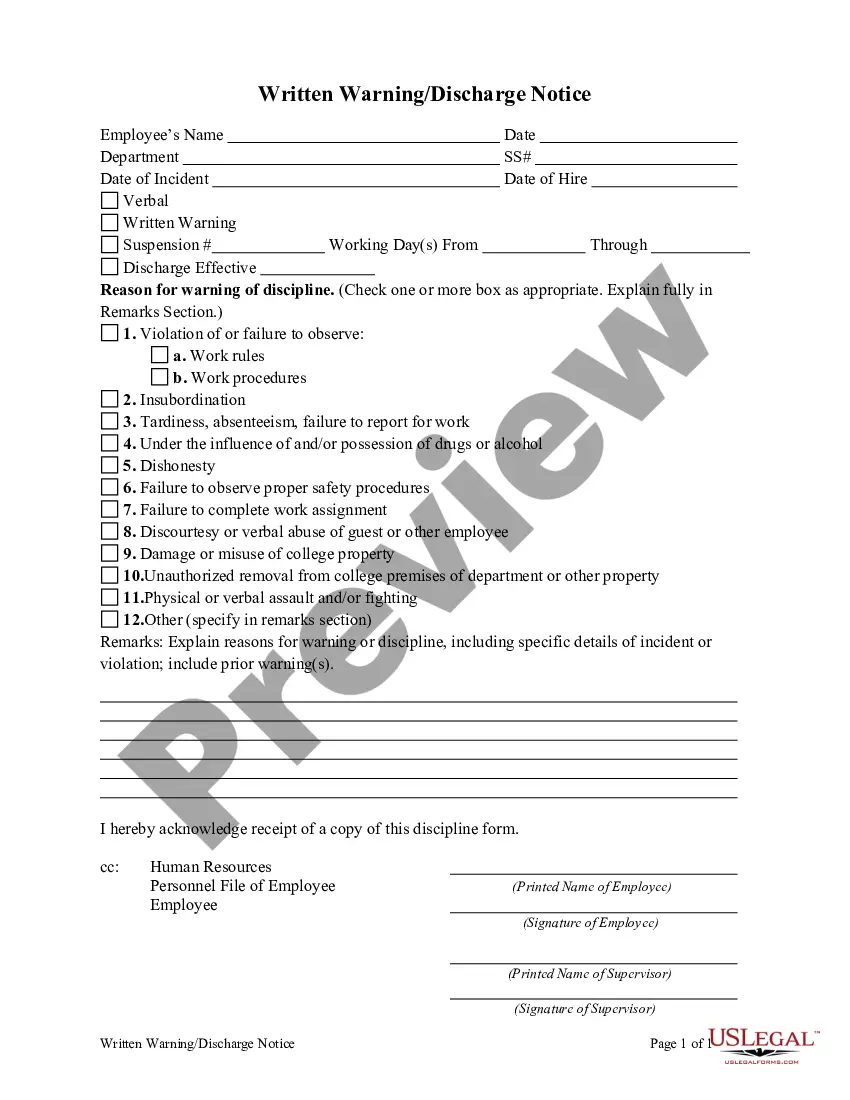

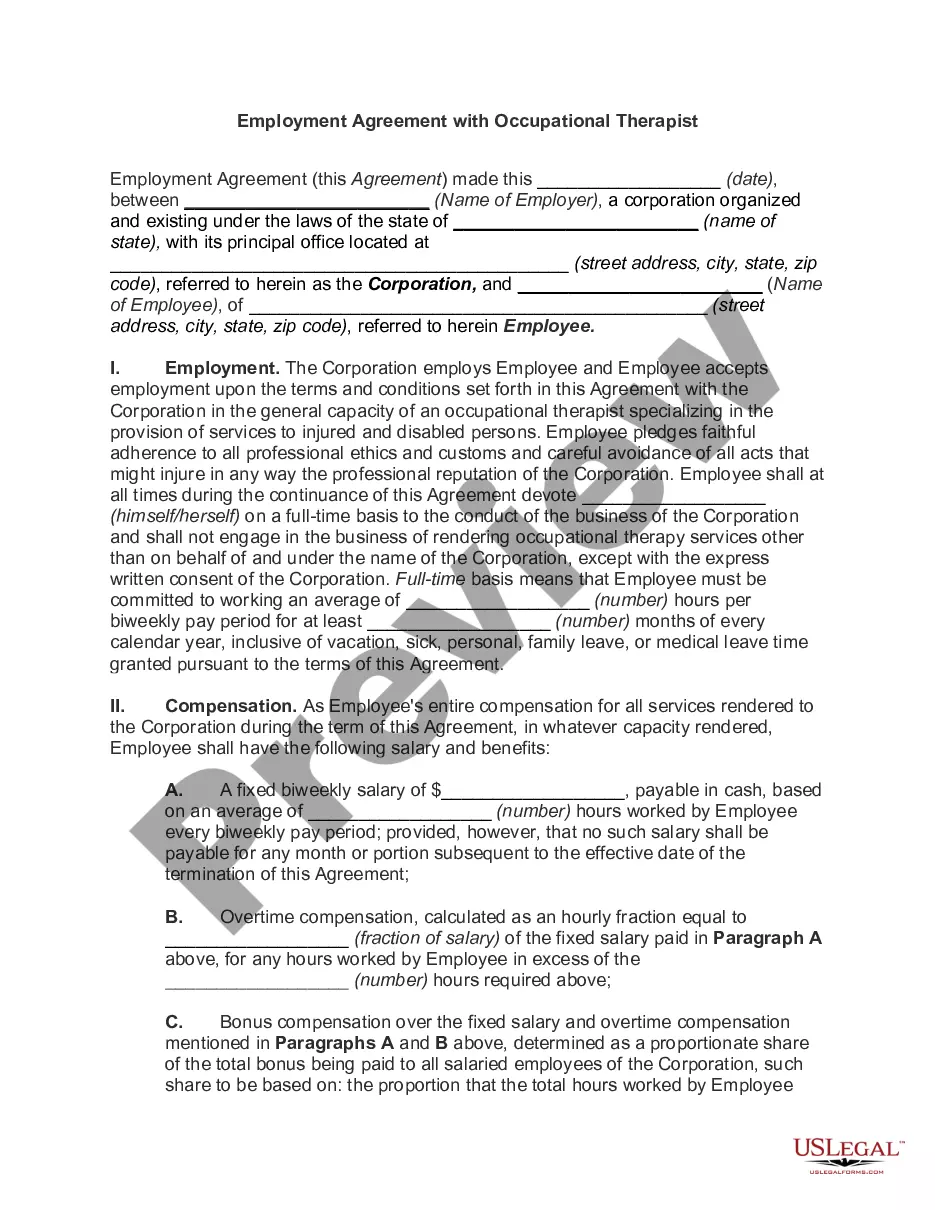

Florida Checklist — Sale of a Business: The sale of a business in Florida involves various legal and financial aspects that require meticulous attention to detail. To ensure a smooth transaction, sellers and buyers must adhere to a series of essential steps. Here is a comprehensive Florida Checklist — Sale of a Business that outlines the crucial considerations: 1. Legal Documentation: — Obtain and review all necessary legal documents related to the business, including contracts, leases, permits, licenses, and registrations. — Consult with an experienced business attorney to ensure compliance with Florida business laws and regulations. 2. Valuation and Financial Examination: — Conduct a thorough appraisal of the business's value to determine an accurate asking price. — Examine financial statements, tax returns, and other relevant records to assess profitability and financial health. — Engage with a qualified accountant to ensure accurate financial evaluation. 3. Restructuring and Agreement Terms: — Review and negotiate the terms of the sale, including purchase price, payment structure, non-compete agreements, and seller financing options. — Consider any exceptional circumstances, such as the sale of intellectual property, trademarks, or patents associated with the business. 4. Due Diligence: — Perform a comprehensive due diligence process to uncover any potential liabilities, pending litigation, or undisclosed information about the business. — Verify ownership of assets, inventory, and intellectual property rights. — Conduct background checks on key personnel and evaluate existing contracts with suppliers, vendors, or clients. 5. Licenses, Permits, and Taxes: — Identify and transfer all necessary licenses and permits required to operate the business. — Ensure compliance with all local, state, and federal tax obligations, including sales tax, payroll tax, and income tax filings. 6. Assignment and Transfer of Assets: — Prepare and execute agreements for the transfer of assets, such as real estate, equipment, inventory, trademarks, and customer lists. — Obtain any necessary approvals for the assignment of leases and contracts. 7. Employee Considerations: — Inform employees about the impending sale and provide appropriate notifications as per Florida labor laws. — Address any employee benefit plans, retirement accounts, or outstanding obligations related to the sale. Types of Florida Checklists — Sale of a Business: 1. Small Business Sale Checklist: Focused on the sale of small businesses, typically with fewer employees and/or lower annual revenue. 2. Large Business Sale Checklist: Geared towards the sale of larger businesses, involving multiple assets, complex financial structures, and extensive due diligence. 3. Franchise Sale Checklist: Specifically designed to guide the sale of a franchise business, which requires adherence to franchise agreement terms and obligations. By following this Florida Checklist — Sale of a Business, sellers and buyers can ensure a well-organized and legally sound transition of ownership. It is crucial to consult professionals, such as attorneys and accountants, who specialize in business transactions to navigate through the complex process smoothly.

Florida Checklist - Sale of a Business

Description

How to fill out Florida Checklist - Sale Of A Business?

You may devote hrs on the web searching for the authorized record format that meets the federal and state specifications you require. US Legal Forms provides a large number of authorized varieties which can be reviewed by professionals. It is possible to acquire or produce the Florida Checklist - Sale of a Business from my support.

If you have a US Legal Forms bank account, you may log in and click the Obtain key. Next, you may full, edit, produce, or signal the Florida Checklist - Sale of a Business. Every authorized record format you get is yours permanently. To obtain yet another duplicate associated with a obtained form, visit the My Forms tab and click the corresponding key.

If you are using the US Legal Forms website the first time, stick to the straightforward recommendations below:

- First, make certain you have selected the proper record format for that county/town that you pick. See the form description to make sure you have chosen the proper form. If offered, utilize the Review key to check from the record format also.

- If you wish to locate yet another model from the form, utilize the Look for discipline to obtain the format that meets your needs and specifications.

- When you have found the format you desire, just click Buy now to proceed.

- Choose the prices strategy you desire, key in your accreditations, and register for a free account on US Legal Forms.

- Total the deal. You may use your credit card or PayPal bank account to fund the authorized form.

- Choose the file format from the record and acquire it for your product.

- Make adjustments for your record if necessary. You may full, edit and signal and produce Florida Checklist - Sale of a Business.

Obtain and produce a large number of record templates while using US Legal Forms web site, that offers the most important assortment of authorized varieties. Use skilled and state-specific templates to take on your company or personal requirements.

Form popularity

FAQ

Typically, the due diligence period will last for 45-180 days, depending on the sophistication of the buyer and complexity of the deal. With more complicated deals, it could last six to nine months. Brutal! That said, it's important to remember the due diligence period is negotiable.

The Seller's Closing Statement, or Settlement Statement, is an itemized list of fees and credits that shows your net profits as the seller, and sums up the finances of the entire transaction.

A closing statement is a document that records the details of a financial transaction. A homebuyer who finances the purchase will receive a closing statement from the bank, while the home seller will receive one from the real estate agent who handled the sale.

Below, we take a closer look at the three elements that comprise human rights due diligence identify and assess, prevent and mitigate and account , quoting from the Guiding Principles.

- The final costs of a closing statement are often expressed in a document that is called the HUD or the HUD-1 Statement. HUD is an abbreviation for the Housing and Urban Development department part of the federal government that mandates the recording of certain information about real estate transactions.

The final or definitive pronouncement on or decision about a subject. the last word. concluding remark. final remark. final say.

Due Diligence Checklist - What to Verify Before Buying a BusinessReview and verify all financial information.Review and verify the business structure and operations.Review and verify all material contracts.Review and verify all customer information.Review and verify all employee information.More items...

Buyers should request bank statements, profit and loss statements, contracts with suppliers and employees, lease agreements and tax returns from the seller as part of their due diligence, said Alan Pinck, an enrolled tax agent and owner of A.

The closing statement or closing disclosure is intended to share the details of a loan right before closing so both the buyer and lender are on the same page. You can receive a closing statement for various types of loans issued, but a mortgage closing statement is the most recognizable and commonly discussed.

How to sell a business in Florida: a step by step guideStep 1: Initial Meeting.Step 2: Comprehensive Business Analysis.Step 3: Marketing Strategy.Step 4: Private Meeting with Buyer.Step 5: Accept Offer & Due Diligence.Step 6: Closing.Step 7: What's Next.