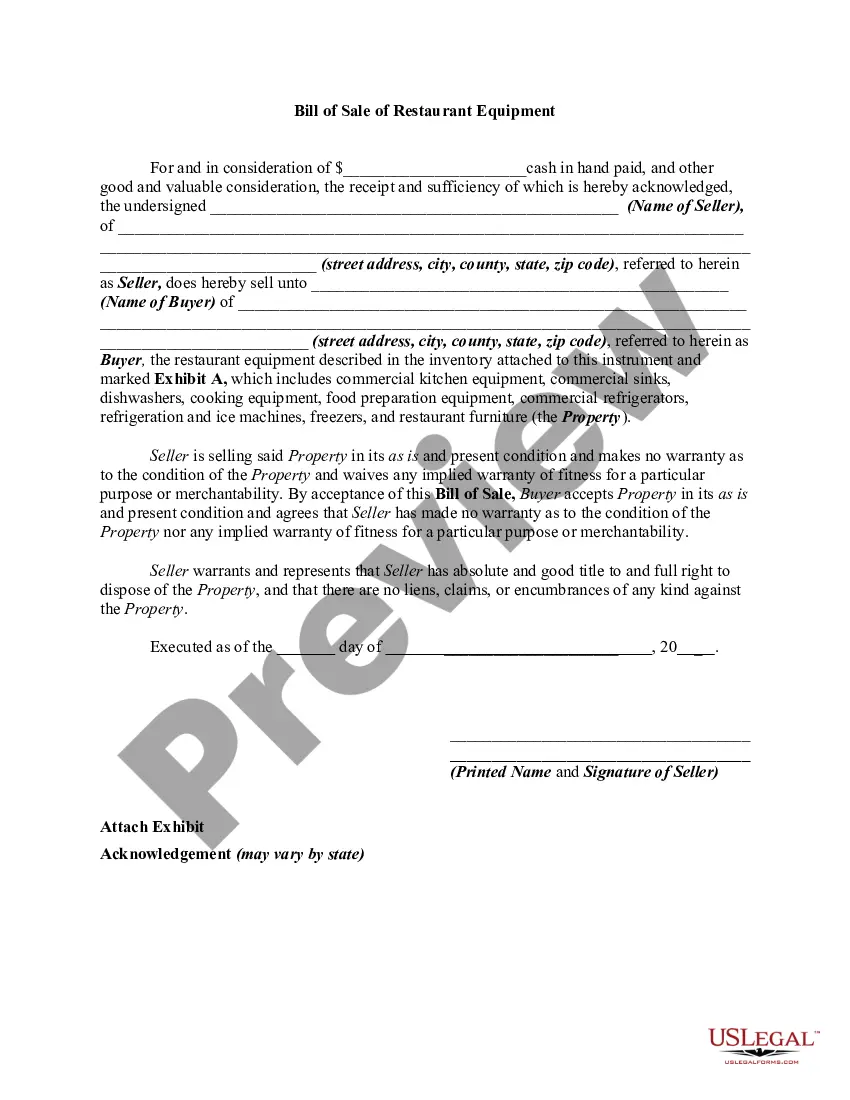

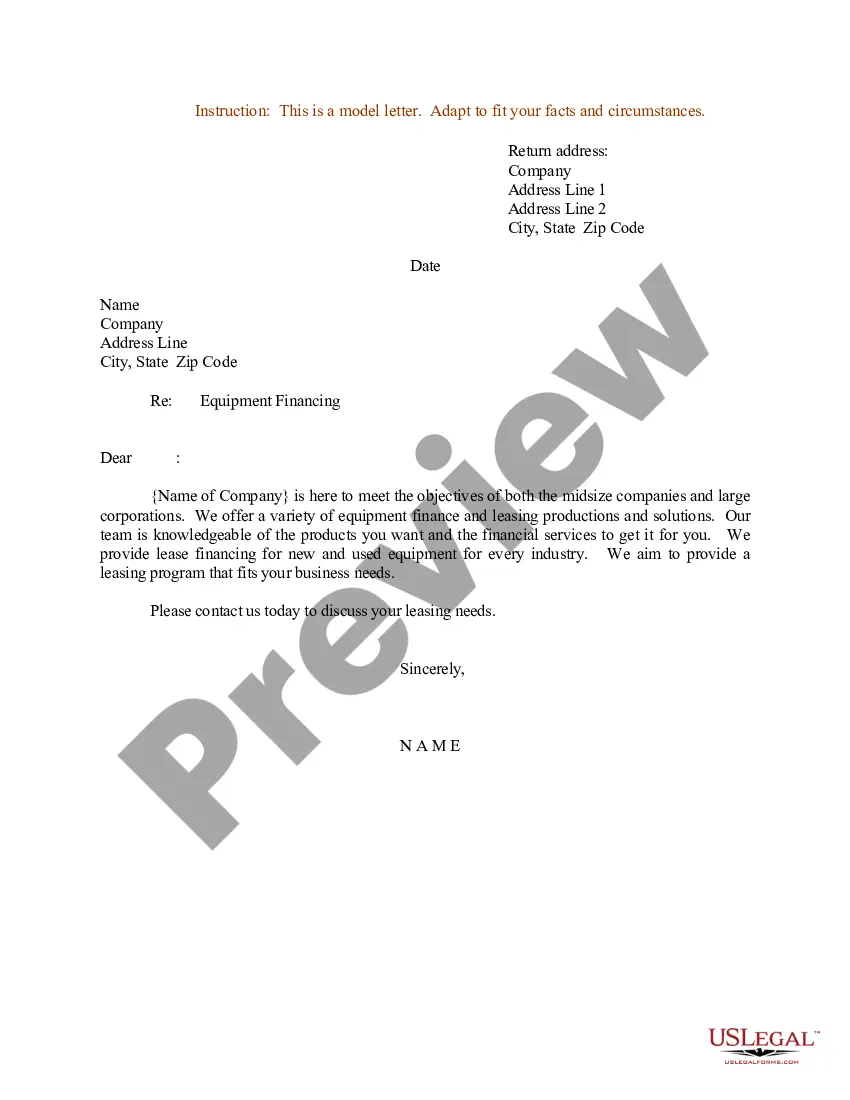

Subject: Expanding Your Business with Equipment Financing in Florida Dear [Business Owner/Manager], I hope this letter finds you well. At [Your Company Name], we understand the value of having the right equipment to drive your business forward. That's why we are thrilled to introduce our Equipment Financing options specifically designed to meet the unique needs of businesses in Florida. Florida is known for its vibrant business landscape, be it in hospitality, construction, healthcare, manufacturing, or any other industry. As your business continues to grow and evolve, it is essential to have access to modern and reliable equipment to stay competitive. However, we understand that acquiring and upgrading equipment can be a significant financial burden, particularly for small and medium-sized enterprises. That's where our Equipment Financing solutions come into play. Our tailored financing options help businesses in Florida obtain the equipment they need without compromising cash flow or exhausting existing lines of credit. With our flexible repayment plans and competitive interest rates, you can access the necessary funds to invest in vital equipment while keeping your finances healthy. Some key benefits of our Equipment Financing solutions include: 1. Streamlined Application Process: Our straightforward application process ensures a quick and hassle-free experience, allowing you to focus on what matters most — your business. 2. Customized Solutions: We understand that every business is unique, and our financing experts will work closely with you to create a personalized financing plan that aligns with your requirements and budget. 3. Competitive Interest Rates: Our partnerships with leading financial institutions enable us to offer competitive interest rates, ensuring that you can acquire the equipment you need without overburdening your financial resources. 4. Preserved Cash Flow: By opting for equipment financing, you can preserve your cash flow and allocate funds to other critical areas of your business, such as marketing, payroll, or expansion plans. 5. Up-to-date Technology: With equipment financing, you can constantly upgrade your equipment to the latest technology, giving your business a competitive edge and enhancing efficiency and productivity. Types of Equipment Financing available in Florida: 1. Leasing: Lease financing allows you to use the equipment without the burden of ownership. It provides flexibility, tax benefits, and the option to upgrade equipment as technology advances. 2. Equipment Loans: Equipment loans provide a lump sum amount specifically for the purchase of equipment. They come with a fixed interest rate and predictable monthly payments over a specified term. 3. Equipment Sale-Leaseback: This option allows you to free up cash by selling your existing equipment to us and leasing it back. It provides an immediate capital injection while still allowing you to utilize the equipment required for business operations. Our team of experts is committed to helping Florida businesses unlock their full potential by offering comprehensive Equipment Financing solutions tailored to individual needs. Whether you need machinery, vehicles, technology, or any other essential equipment, we have the expertise and resources to support your growth. Don't let financial constraints hinder your business's progress; seize this opportunity to invest in the future. Contact us at [Your Contact Information] to discuss how our Equipment Financing solutions can benefit your business in Florida. Thank you for considering [Your Company Name] as your trusted equipment financing partner. We look forward to helping you achieve your growth aspirations. Sincerely, [Your Name] [Your Title] [Your Company Name] [Your Contact Information]

Florida Sample Letter for Promotional Letter - Equipment Financing

Description

How to fill out Florida Sample Letter For Promotional Letter - Equipment Financing?

Are you presently within a situation where you need papers for either business or person uses nearly every time? There are a variety of legal record layouts available on the Internet, but discovering kinds you can trust isn`t simple. US Legal Forms offers thousands of develop layouts, such as the Florida Sample Letter for Promotional Letter - Equipment Financing, which can be composed to fulfill federal and state specifications.

Should you be presently acquainted with US Legal Forms website and also have a merchant account, just log in. Following that, it is possible to obtain the Florida Sample Letter for Promotional Letter - Equipment Financing web template.

If you do not offer an accounts and wish to start using US Legal Forms, follow these steps:

- Find the develop you will need and ensure it is for that appropriate metropolis/area.

- Utilize the Review switch to review the form.

- Look at the explanation to ensure that you have chosen the correct develop.

- In the event the develop isn`t what you are looking for, take advantage of the Look for discipline to find the develop that meets your needs and specifications.

- Once you find the appropriate develop, simply click Get now.

- Choose the rates strategy you desire, fill out the required information to make your account, and pay for the transaction utilizing your PayPal or bank card.

- Select a handy data file formatting and obtain your version.

Discover all of the record layouts you have purchased in the My Forms menu. You can obtain a additional version of Florida Sample Letter for Promotional Letter - Equipment Financing anytime, if required. Just go through the necessary develop to obtain or printing the record web template.

Use US Legal Forms, the most considerable collection of legal varieties, to save lots of efforts and stay away from mistakes. The service offers skillfully made legal record layouts which you can use for a range of uses. Generate a merchant account on US Legal Forms and commence generating your life easier.

Form popularity

FAQ

Key takeaways:When applying for a promotion, make a data-backed case as to why you should be promoted.In your letter, include the ways your current position makes you well-suited to the new job.Offer specific ways you've made an impact and why you're uniquely qualified to take on the responsibilities required.More items...?

Be direct about what the letter is for (financial aid) Briefly talk about why the school is a great fit for you and why you need the money in an straightforward and respectful way. Provide concise details regarding your specific financial situation, even if you gave these details in your original application.

I am writing to you because I would like to apply for a small business grant. (Describe on Type of business). I am starting up my own business and need some help with getting set up and would really appreciate a small loan from the government as this would be for the government.

The ultimate goal of a sales promotion letter is to attract new customers, so close your letter by asking the reader to purchase your product or service. Tell readers exactly what you want them to do next, whether that's come in for a product demonstration or sign up for a free trial of your service.

Introduce yourself and explain that you are writing to request permission to sell the company's products in the first paragraph. Briefly indicate your reason for wanting to sell the company's products and the specifics of how you'll sell the items.

Be direct about what the letter is for (financial aid) Briefly talk about why the school is a great fit for you and why you need the money in an straightforward and respectful way. Provide concise details regarding your specific financial situation, even if you gave these details in your original application.

Know Who Your Target Audience is. The first step to writing product descriptions is to define your target audience.Focus on the Product Benefits.Tell the Full Story.Use Natural Language and Tone.Use Power Words That Sell.Make it Easy to Scan.Optimize for Search Engines.Use Good Images.

How to write a letter requesting a promotionStart with a formal heading. If you choose to send a printed letter to your manager or team lead, start it with a formal heading.Use a professional salutation.State your request.Explain why you are a good fit.Suggest a plan for the transition.Thank them and end the letter.

Letter of Family Support: Showing your full name, how much money you are receiving from that family member and how frequently you receive it, the name of the family member, their contact information, and their signature.

How to write a marketing letterDefine your target audience.Envision your brand voice.Determine the purpose of your letter.Use an attention-getter.Introduce your business and services.Highlight the benefits of doing business.Reference your qualifications.Create a sense of urgency.More items...?