A bookkeeper is a person whose job is to keep the financial records for a business

Florida Employment Agreement between Church and Bookkeeper

Description

How to fill out Employment Agreement Between Church And Bookkeeper?

Are you in a situation where you need documentation for either business or personal reasons nearly every day.

There are numerous legal form templates available online, but finding ones you can trust isn't easy.

US Legal Forms provides thousands of template forms, like the Florida Employment Agreement between Church and Bookkeeper, which are designed to comply with federal and state regulations.

Select a convenient file format and download your copy.

Access all the form templates you have purchased in the My documents section. You can obtain another copy of the Florida Employment Agreement between Church and Bookkeeper at any time if needed. Simply click the required form to download or print the template.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Florida Employment Agreement between Church and Bookkeeper template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the form you need and ensure it is for your appropriate city/state.

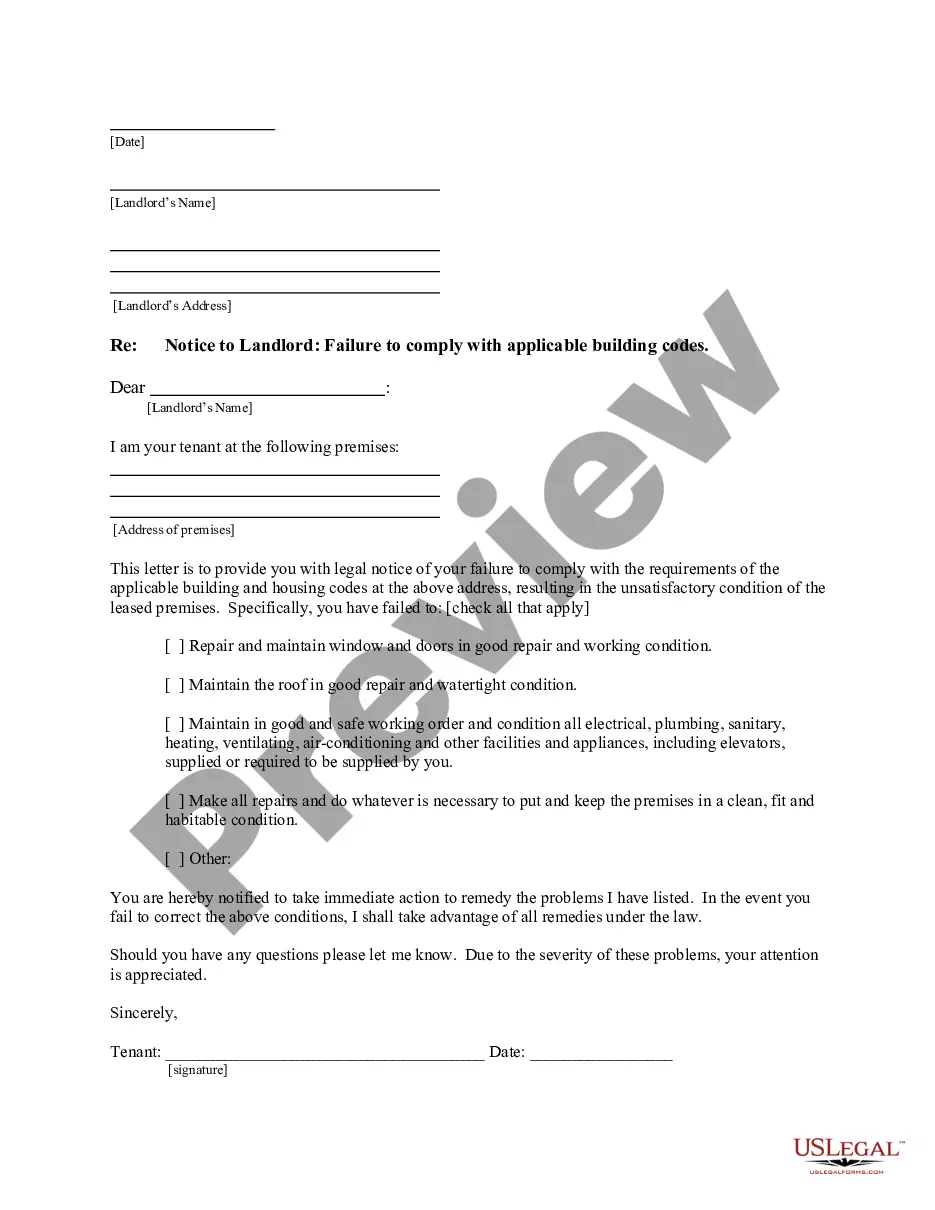

- Use the Preview button to review the form.

- Read the description to confirm that you have selected the right form.

- If the form isn’t what you're looking for, use the Search box to find a form that suits your requirements.

- Once you find the correct form, click Get now.

- Choose the pricing plan you prefer, fill in the necessary information to create your account, and pay for the order using your PayPal or credit card.

Form popularity

FAQ

To effectively manage bookkeeping for a church, start by maintaining detailed financial records of all donations, expenses, and operational costs. Implement accounting software designed for nonprofits to simplify tracking and reporting. A well-crafted Florida Employment Agreement between Church and Bookkeeper can ensure that the bookkeeper understands their role in maintaining the integrity of financial records.

A legal document of an employment contract outlines the terms and conditions of employment between a church and its bookkeeper. This document specifies responsibilities, compensation, and work expectations, providing clarity for both parties. With a well-crafted Florida Employment Agreement between Church and Bookkeeper, you can reduce misunderstandings and foster a positive working relationship.

These factors are: (1) the kind of occupation, with reference to whether the work usually is done under the direction of a supervisor or is done by a specialist without supervision; (2) the skill required in the particular occupation; (3) whether the employer or the individual in question furnishes the equipment used

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

As a result, it is vital to protect yourself before signing a contract....The Importance of a Construction Project ContractDefine everything in specific terms.List the extent of their obligations to each other.List the construction materials and work to be done.List payment terms.

What to Include in a ContractThe date the contract begins and when it expires.The names of all parties involved in the transaction.Any key terms and definitions.The products and services included in the transaction.Any payment amounts, project schedules, terms, and billing dates.More items...?

Here are some steps you may use to guide you when you write an employment contract:Title the employment contract.Identify the parties.List the term and conditions.Outline the job responsibilities.Include compensation details.Use specific contract terms.Consult with an employment lawyer.Employment.More items...?

The 5 personality traits that make a successful contractorConfidence. To become a successful contractor - it's important to have confidence in your own abilities.Personable.Flexibility.Problem Solving.Honesty.

An employee who receives a 1099 form is viewed as a contractor in the eyes of the IRS. These employees are also viewed as their own business owners; they contract out their work at a certain rate.

An independent contractor agreement is a legally binding document signed by a 1099 employee and the company that hires them. It outlines the scope of work and the terms under which that work will be completed, which goes a long way to making sure both parties are on the same page about the project from the start.