Florida Subrogation Agreement Authorizing Insurer to Bring Action in Insured's Name

Description

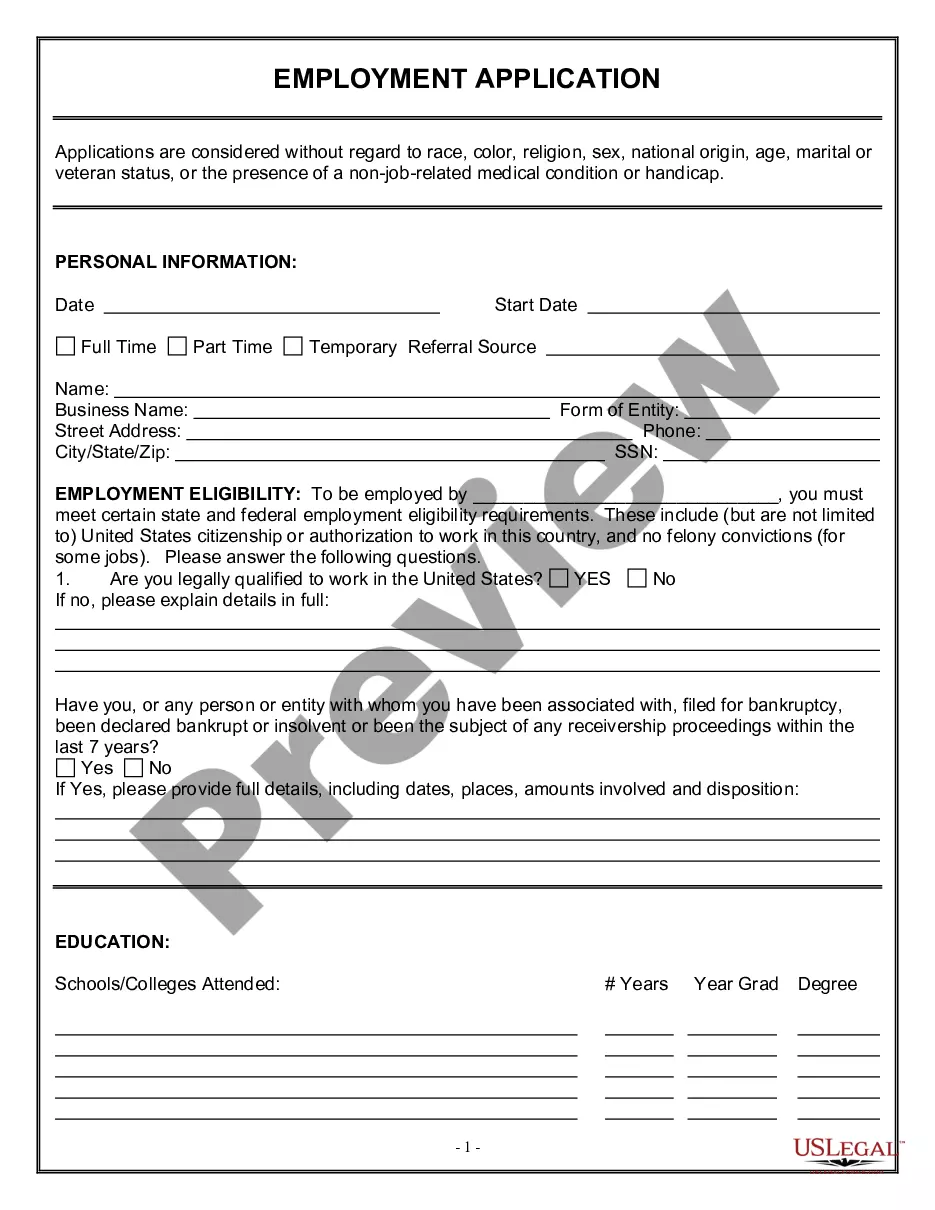

How to fill out Subrogation Agreement Authorizing Insurer To Bring Action In Insured's Name?

You can spend time on the web searching for the legitimate record web template that meets the state and federal specifications you will need. US Legal Forms gives a huge number of legitimate varieties which are analyzed by professionals. You can actually download or printing the Florida Subrogation Agreement Authorizing Insurer to Bring Action in Insured's Name from the assistance.

If you already have a US Legal Forms account, it is possible to log in and then click the Obtain button. Next, it is possible to comprehensive, edit, printing, or signal the Florida Subrogation Agreement Authorizing Insurer to Bring Action in Insured's Name. Every single legitimate record web template you acquire is your own for a long time. To have one more backup of any bought develop, go to the My Forms tab and then click the corresponding button.

If you work with the US Legal Forms web site for the first time, keep to the easy recommendations beneath:

- Very first, make certain you have chosen the right record web template for your county/town that you pick. See the develop outline to make sure you have selected the proper develop. If accessible, use the Preview button to appear with the record web template also.

- If you want to get one more model of your develop, use the Research industry to obtain the web template that suits you and specifications.

- After you have discovered the web template you want, click Acquire now to continue.

- Select the prices plan you want, type in your credentials, and register for an account on US Legal Forms.

- Comprehensive the financial transaction. You can utilize your bank card or PayPal account to cover the legitimate develop.

- Select the structure of your record and download it to the product.

- Make modifications to the record if needed. You can comprehensive, edit and signal and printing Florida Subrogation Agreement Authorizing Insurer to Bring Action in Insured's Name.

Obtain and printing a huge number of record themes utilizing the US Legal Forms website, that provides the greatest assortment of legitimate varieties. Use professional and status-particular themes to take on your company or specific needs.

Form popularity

FAQ

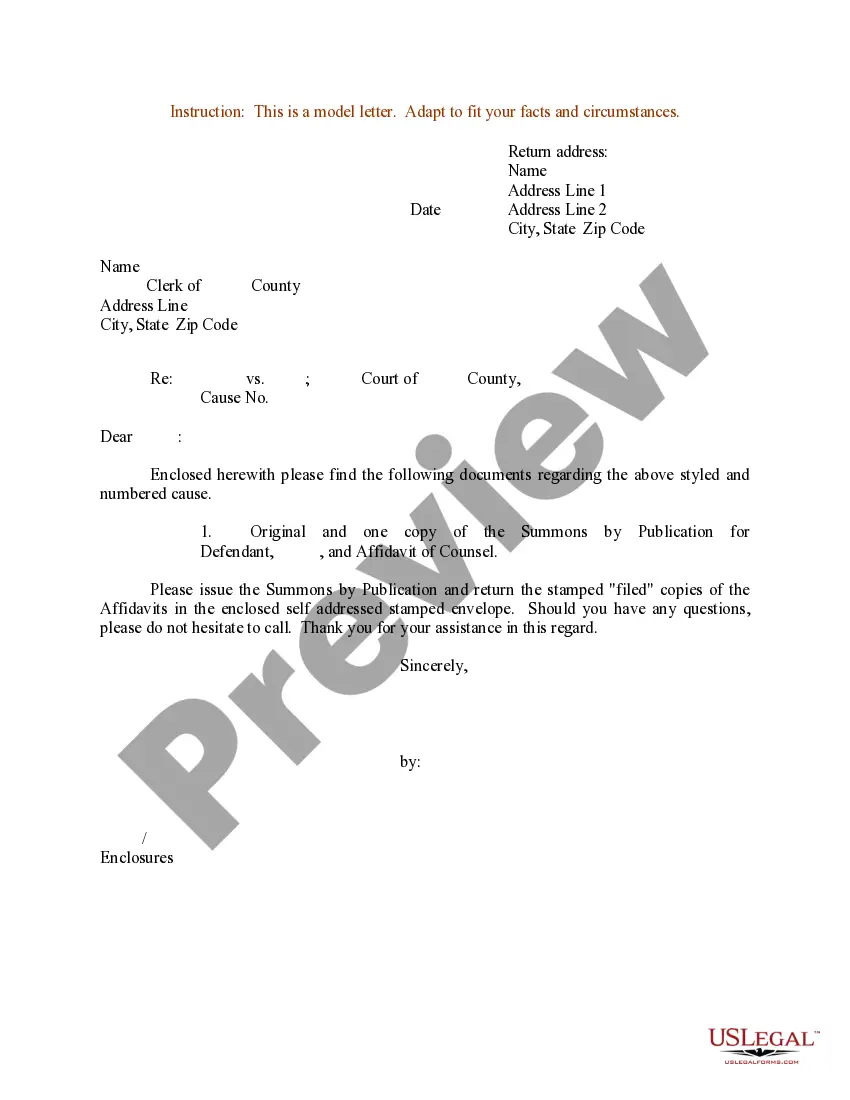

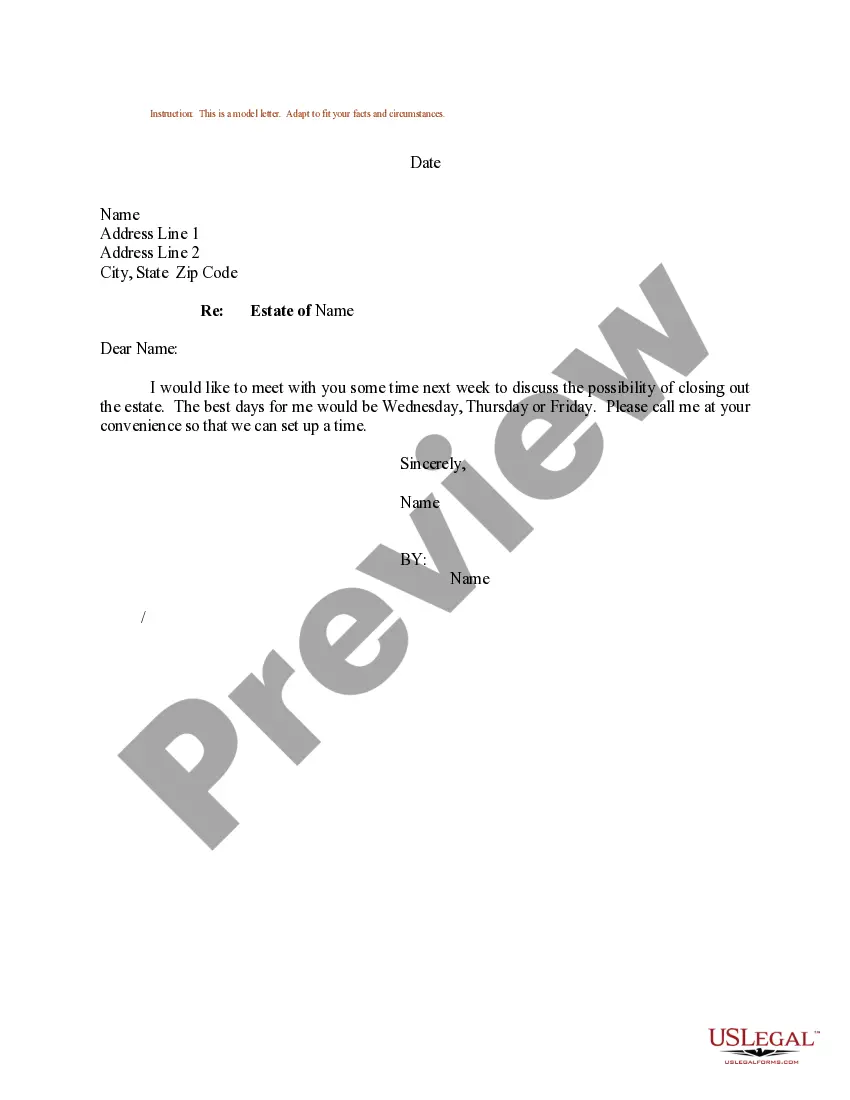

If you've been in an accident and filed a claim with your insurance company, you may have received a subrogation letter. This document allows the insurance company to pursue a claim against a third party that caused damage to their insured, after the insurance company has paid out a claim to the insured.

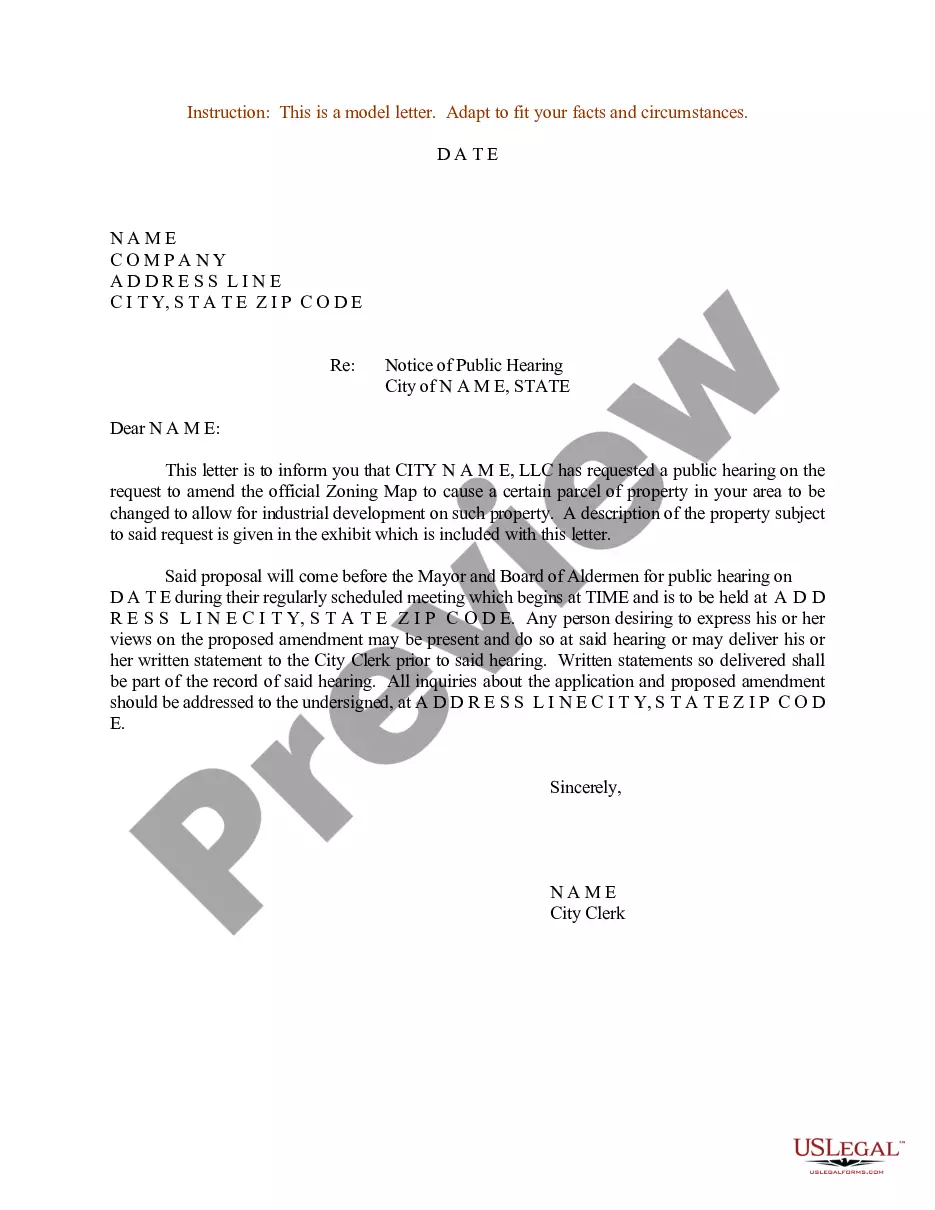

Insurance subrogation is a principle recognized under Florida law that allows an insurance company to pursue reimbursement from a third party responsible for the losses it has paid to its insured.

At the minimum, your subrogation file should contain all elements corresponding to liability determination and proof of damages. Being able to prove who is at fault is essential. You'll want to include documentation and any information you've gathered, such as witness statements or police reports.

Additional Details letter creation date. insured name. claim number and policy number. date of loss. recipient name. damage amount. claims specialist name and title.

Simply put, subrogation protects you and your insurer from paying for losses that aren't your fault. It's common in auto, health insurance and homeowners policies. It lets your insurer pursue the person at fault to recover the money paid out for a claim that wasn't your fault.

And we hereby subrogate to you the rights and remedies that we have in consequence of or arising from loss/damage to our insured goods and we further hereby grant to you all power to take and use all lawful ways and means to demand, recover and to receive the said loss/damage and all and every debt from whom it may ...

There is no requirement to respond, but it can be in your best interests to reply. The subrogation claim will likely be sent to a collection agency, and that collection agency may be willing to accept less than the total amount owed in order to settle the debt.

It can be claimed when the insured individual has suffered injuries due to a third party's mistake and intends to bear their expenses. For example, if an insured person receives ? 5 lakh while claiming their health insurance, the company can collect the same amount from the defaulter as part of subrogation.