Florida Letter Agreement to Subordinate Liens against Personal Property is a legal document used in Florida to establish the priority of liens on personal property. This agreement provides a means for a creditor to subordinate their lien to another creditor, granting higher priority for the latter on the personal property in question. The purpose of this agreement is to facilitate the repayment of debts and establish a clear hierarchy of debts secured by personal property. By subordinating their lien, a creditor agrees to take a lower priority position, allowing another creditor to move ahead in recovering their debt from the personal property. This agreement is commonly used in various financial transactions, such as refinancing or restructuring existing loans, subordinating debts for the purpose of obtaining additional financing, or simply rearranging lien priorities to accommodate the needs of multiple creditors. There are various types of Florida Letter Agreement to Subordinate Liens against Personal Property, including: 1. General Subordination Agreement: This is the most common type of agreement used to establish the subordination of a lien against personal property. It outlines the terms and conditions agreed upon by the involved parties, such as the creditor subordinating their lien and the creditor who benefits from the subordination. 2. Refinancing Subordination Agreement: This type of agreement is used when a borrower wishes to refinance an existing loan. By obtaining a new loan, the borrower seeks to replace the existing lien on personal property with a new one. The refinancing subordination agreement ensures that the new creditor's lien takes priority over the old lien. 3. Intercreditor Agreement: Sometimes, multiple creditors have competing claims against the same personal property. In such cases, an intercreditor agreement is used to establish the priority and terms of the liens. This agreement ensures that each creditor's interests are protected while managing the overall creditor hierarchy. It is important to note that these agreements must be executed in accordance with Florida laws and regulations. Parties involved should ensure they fully understand the legal implications of the agreement and consider seeking professional legal advice if needed. Overall, a Florida Letter Agreement to Subordinate Liens against Personal Property serves as a means to clarify lien priorities, allowing for the smooth flow of financial transactions and debt repayment. It provides the necessary framework to protect the interests of all parties involved in securing debts against personal property.

Florida Letter Agreement to Subordinate Liens against Personal Property

Description

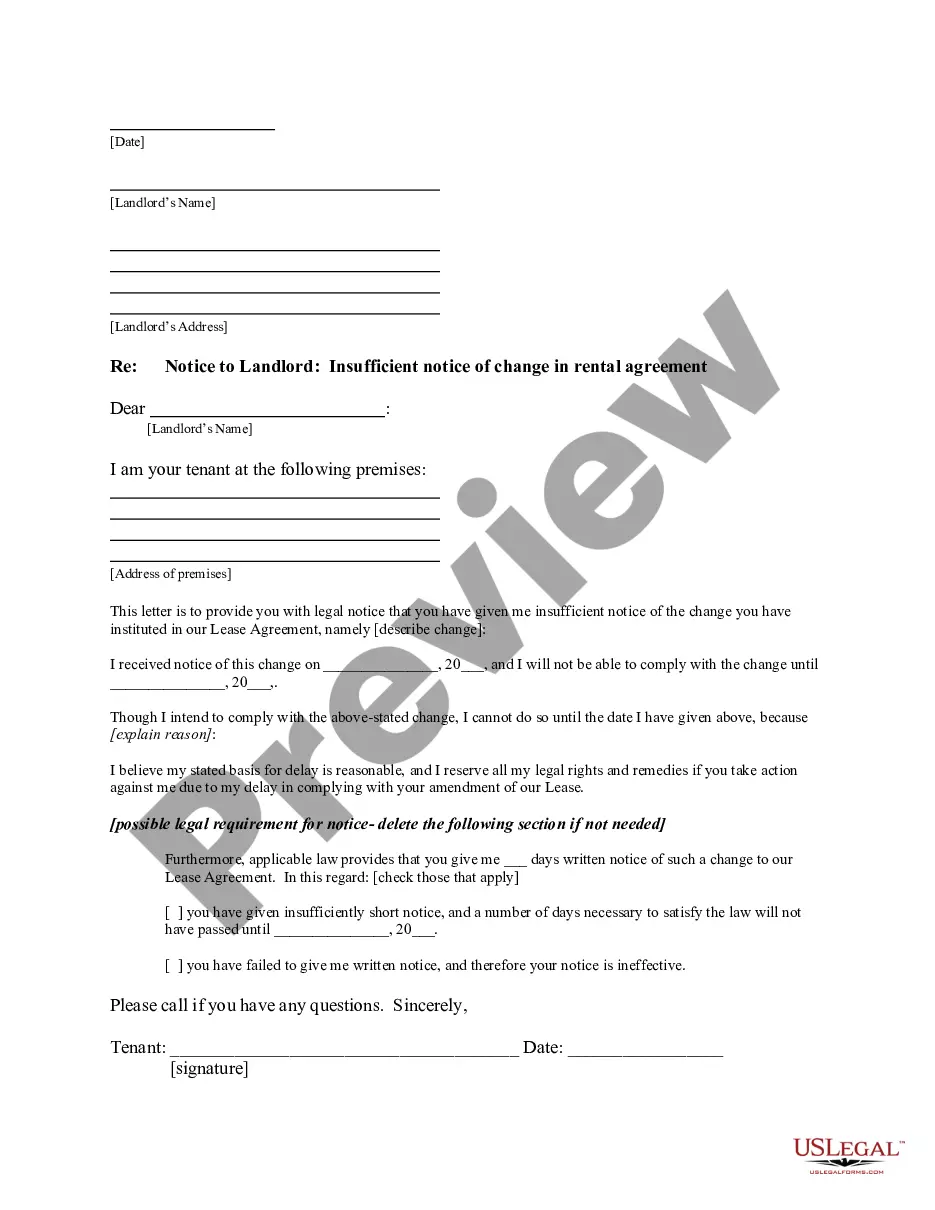

How to fill out Florida Letter Agreement To Subordinate Liens Against Personal Property?

Discovering the right lawful document web template can be a battle. Naturally, there are a lot of web templates available online, but how would you find the lawful develop you require? Utilize the US Legal Forms web site. The assistance provides 1000s of web templates, like the Florida Letter Agreement to Subordinate Liens against Personal Property, that you can use for enterprise and private needs. Every one of the kinds are checked by professionals and meet up with federal and state specifications.

In case you are presently authorized, log in for your accounts and click the Obtain switch to get the Florida Letter Agreement to Subordinate Liens against Personal Property. Utilize your accounts to appear with the lawful kinds you might have purchased previously. Go to the My Forms tab of your own accounts and have yet another copy from the document you require.

In case you are a whole new customer of US Legal Forms, listed here are easy directions that you should adhere to:

- Initial, make sure you have chosen the right develop for your city/state. You can look through the form using the Preview switch and browse the form explanation to guarantee this is basically the right one for you.

- In case the develop is not going to meet up with your expectations, take advantage of the Seach field to discover the proper develop.

- Once you are certain that the form is proper, select the Acquire now switch to get the develop.

- Choose the rates prepare you desire and enter in the necessary info. Make your accounts and buy your order using your PayPal accounts or credit card.

- Choose the file format and acquire the lawful document web template for your gadget.

- Complete, edit and print and signal the obtained Florida Letter Agreement to Subordinate Liens against Personal Property.

US Legal Forms is the largest catalogue of lawful kinds where you can find different document web templates. Utilize the service to acquire expertly-made files that adhere to state specifications.

Form popularity

FAQ

A new creditor may wish to be the senior lender, but the existing lender must consent to give up (or subordinate) their superior claim over a security interest. The Agreement thus defines the new senior and subordinated creditors and the priority of the two claims against specific collateral.

A subordination agreement prioritizes debts, ranking one behind another for purposes of collecting repayment from a debtor in the event of foreclosure or bankruptcy. A second-in-line creditor collects only when and if the priority creditor has been fully paid.

Four types of subordinate clauses are discussed in this feature: concessive, time, place and reason. A subordinate clause is a clause that supports ideas stated in the main clause. Subordinate clauses are also dependent on main clauses and would be otherwise incomprehensible without them.

The creditor usually will require the debtor to sign a subordination agreement which ensures they get paid before other creditors, ensuring they are not taking on high risks.

Example of a Subordination Agreement A standard subordination agreement covers property owners that take a second mortgage against a property. One loan becomes the subordinated debt, and the other becomes (or remains) the senior debt. Senior debt has higher claim priority than junior debt.

Who Benefits from a Subordination Clause? A subordination clause is meant to protect the interests of the primary lender. A primary mortgage usually covers the cost of purchasing the home; however, if there is a secondary mortgage, the clause ensures that the primary lender retains the number one priority.