Title: Understanding Florida Renunciation of Legacy: Types, Procedure, and Key Considerations Introduction: In Florida, renunciation of legacy is a legal process through which an individual willingly gives up their rights to receive an inheritance from a deceased person's estate. This detailed description aims to provide an overview of Florida's renunciation of legacy, including its types, the procedure involved, and some key considerations. Types of Florida Renunciation of Legacy: 1. Partial Renunciation: This type of renunciation involves relinquishing a specific portion or asset within the inheritance, while maintaining the right to receive the remaining assets or benefits from the estate. 2. Full Renunciation: Complete renunciation entails giving up any claim to the entire inheritance, including all assets, properties, and benefits specified in a testamentary document. Procedure for Florida Renunciation of Legacy: 1. Validity Verification: The party considering renunciation must first establish the probate court's validity by confirming their relationship to the deceased and ensuring their eligibility for renunciation. 2. Written Renunciation: The renunciation must be submitted in writing, following Florida's legal requirements, which typically involve providing the renunciation document to the personal representative of the estate. 3. Timely Filing: Renunciations in Florida should be filed within nine months from the date the estate was initially opened, or within six months after the renouncing party's knowledge about the existence of the inheritance. 4. No Acceptance of Benefits: Renouncing parties must not accept any benefits from the estate before filing the renunciation, as acceptance implies consent to receive the inheritance. 5. Renunciation's Effect: Once the renunciation is accepted by the probate court, the renouncing party will be deemed to have never had any interest in the renounced inheritance. Key Considerations for Florida Renunciation of Legacy: 1. Legal and Financial Advice: It is advisable to consult an attorney or financial advisor to fully understand the implications of renunciation and its potential impact on estate planning, tax consequences, and the distribution of assets. 2. Document Authentication: The renunciation document should be properly notarized and may require witnesses to ensure its authenticity. 3. Family Impact: Renouncing an inheritance may have familial implications and should be considered with sensitivity, as it can affect beneficiaries and potential heir relations. 4. Deceased's Intent: It is crucial to evaluate the deceased person's testamentary documents and the implications of renouncing the legacy when honoring their intentions. Conclusion: Florida's renunciation of legacy serves as an essential legal tool for individuals wishing to forego their entitlement to an inheritance. The process involves carefully considering personal circumstances, consulting with professionals, and following the proper legal procedure. Whether a partial or full renunciation, it is imperative to gain a comprehensive understanding of the implications before proceeding with the renunciation process.

Florida Renunciation of Legacy

Description

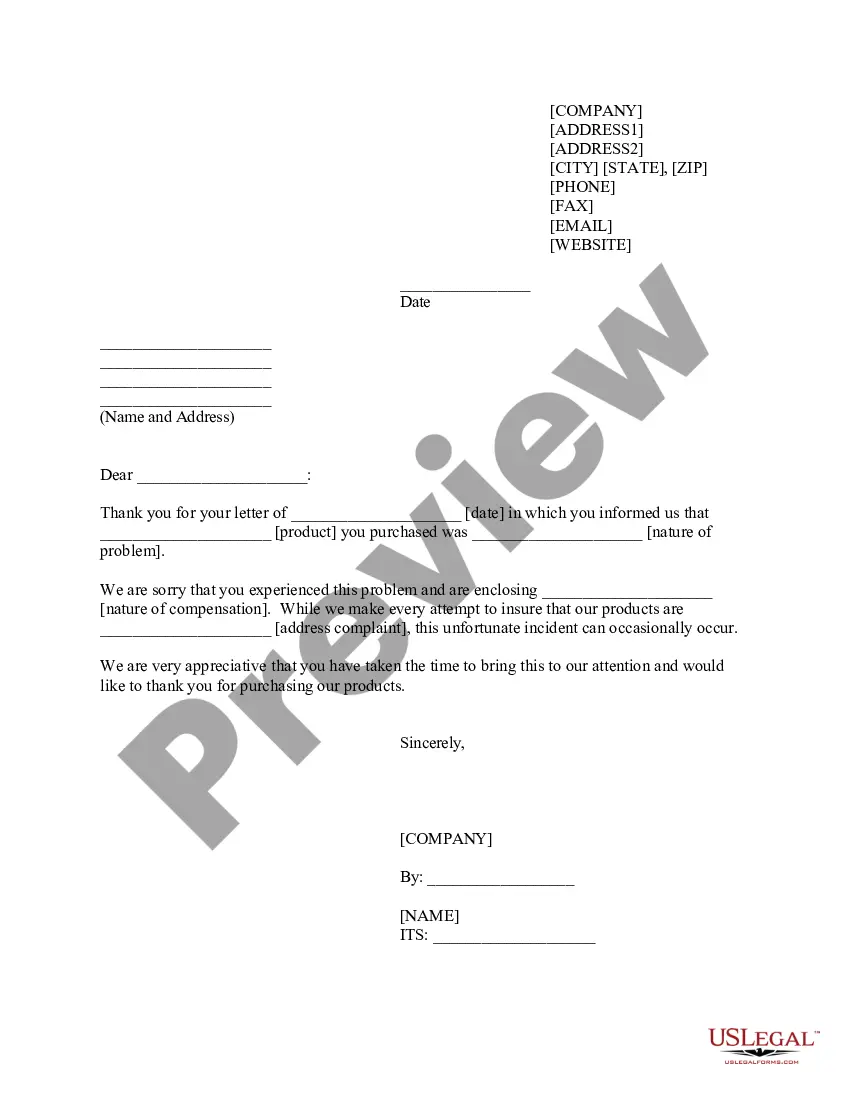

How to fill out Renunciation Of Legacy?

US Legal Forms - one of several largest libraries of authorized varieties in the States - delivers a wide array of authorized papers themes it is possible to acquire or printing. While using site, you can find thousands of varieties for organization and personal reasons, sorted by groups, says, or keywords and phrases.You will discover the latest models of varieties just like the Florida Renunciation of Legacy in seconds.

If you already have a membership, log in and acquire Florida Renunciation of Legacy through the US Legal Forms catalogue. The Down load button can look on every kind you view. You get access to all previously acquired varieties from the My Forms tab of the accounts.

If you wish to use US Legal Forms the first time, here are basic directions to obtain started off:

- Ensure you have chosen the best kind for the area/state. Go through the Review button to check the form`s content material. See the kind description to actually have selected the proper kind.

- In the event the kind doesn`t suit your requirements, take advantage of the Lookup area on top of the screen to get the one who does.

- Should you be content with the form, validate your selection by simply clicking the Acquire now button. Then, select the prices prepare you favor and provide your references to register for an accounts.

- Approach the transaction. Utilize your credit card or PayPal accounts to finish the transaction.

- Choose the formatting and acquire the form on the product.

- Make alterations. Load, revise and printing and indication the acquired Florida Renunciation of Legacy.

Every template you included in your account does not have an expiration date and is also yours for a long time. So, in order to acquire or printing an additional version, just proceed to the My Forms section and click on around the kind you need.

Get access to the Florida Renunciation of Legacy with US Legal Forms, the most substantial catalogue of authorized papers themes. Use thousands of skilled and condition-specific themes that meet your company or personal requires and requirements.

Form popularity

FAQ

(3) To be effective, a disclaimer must be in writing, declare the writing as a disclaimer, describe the interest or power disclaimed, and be signed by the person making the disclaimer and witnessed and acknowledged in the manner provided for deeds of real estate to be recorded in this state.

If your loved one died intestate, their property would pass to their spouses, children, grandchildren, the deceased's parents, and finally the decedent's siblings. If none of the heirs-at-law are still living, then other descendants may have a claim to the estate.

A person may disclaim the interest or power even if its creator imposed a spendthrift provision or similar restriction on transfer or a restriction or limitation on the right to disclaim. A disclaimer shall be unconditional unless the disclaimant explicitly provides otherwise in the disclaimer.

§ 739.204. If a trustee having the power to disclaim under the instrument creating the fiduciary relationship or pursuant to court order disclaims an interest in property that otherwise would have become trust property, the interest does not become trust property.

739.301 - Delivery or Filing. (1) Subject to subsections (2) through (12), delivery of a disclaimer may be effected by personal delivery, first-class mail, or any other method that results in its receipt. A disclaimer sent by first-class mail shall be deemed to have been delivered on the date it is postmarked.

§ 735.304. Section 735.304 - Disposition without administration of intestate property in small estates (1) No administration shall be required or formal proceedings instituted upon the estate of a decedent who has died intestate leaving only personal property exempt under the provisions of s.

In Florida, if you are married and you die without a will, what your spouse gets depends on whether or not you have living descendants -- children, grandchildren, or great-grandchildren. If you don't, then your spouse inherits all of your intestate property.