Florida Testamentary Provisions for Charitable Remainder Annuity Trust for Term of Years

Description

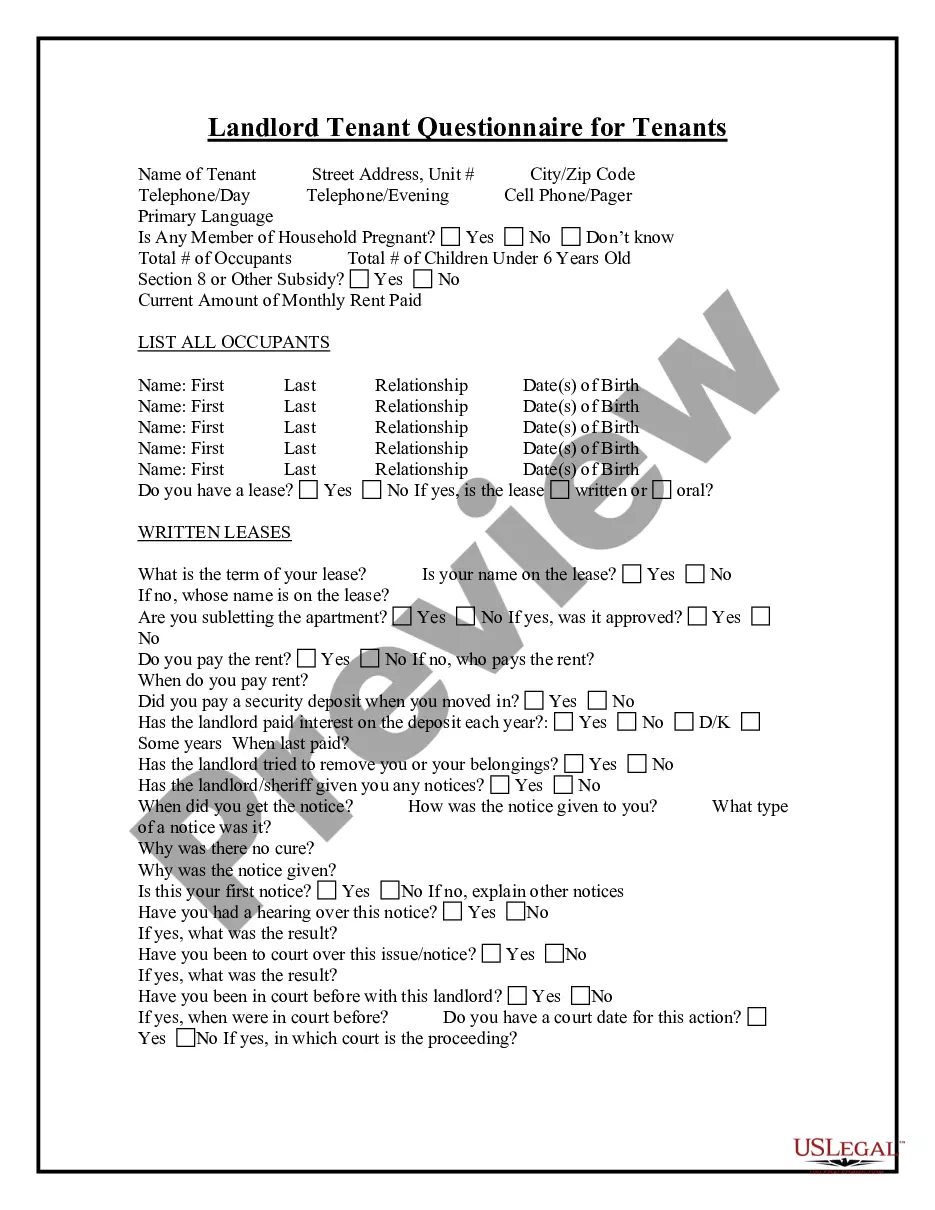

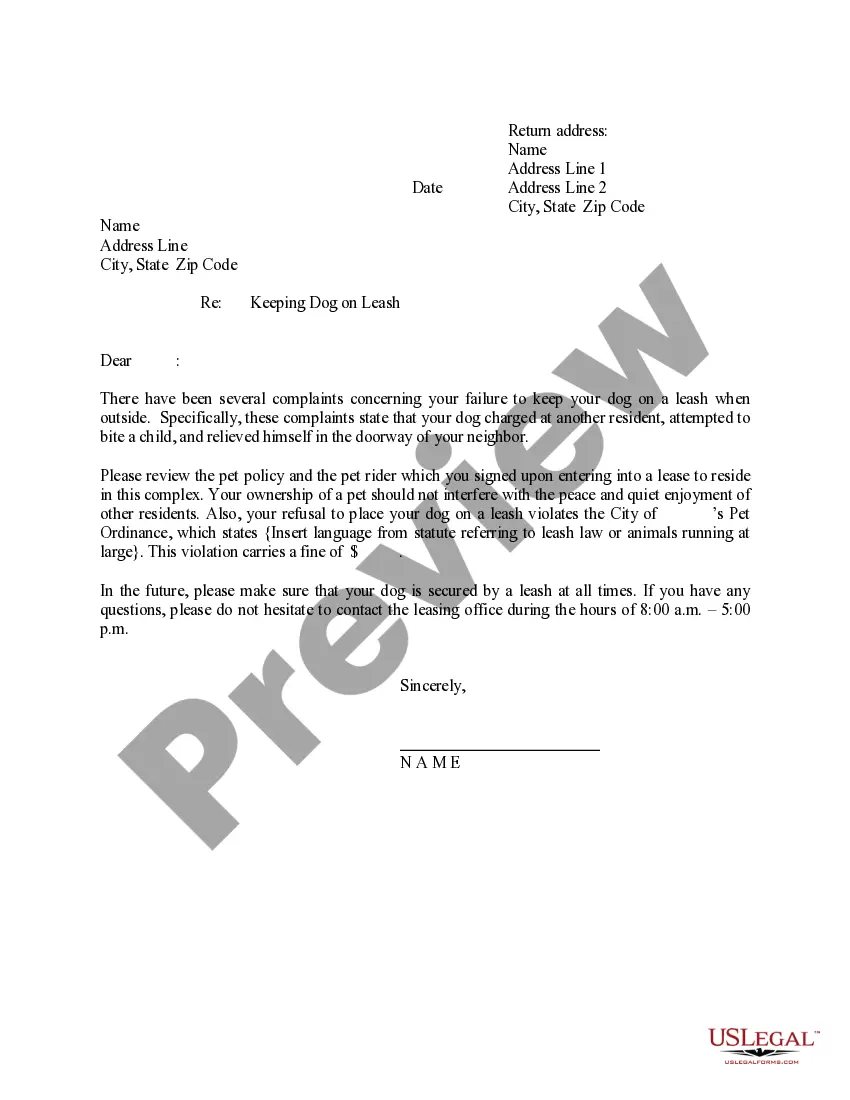

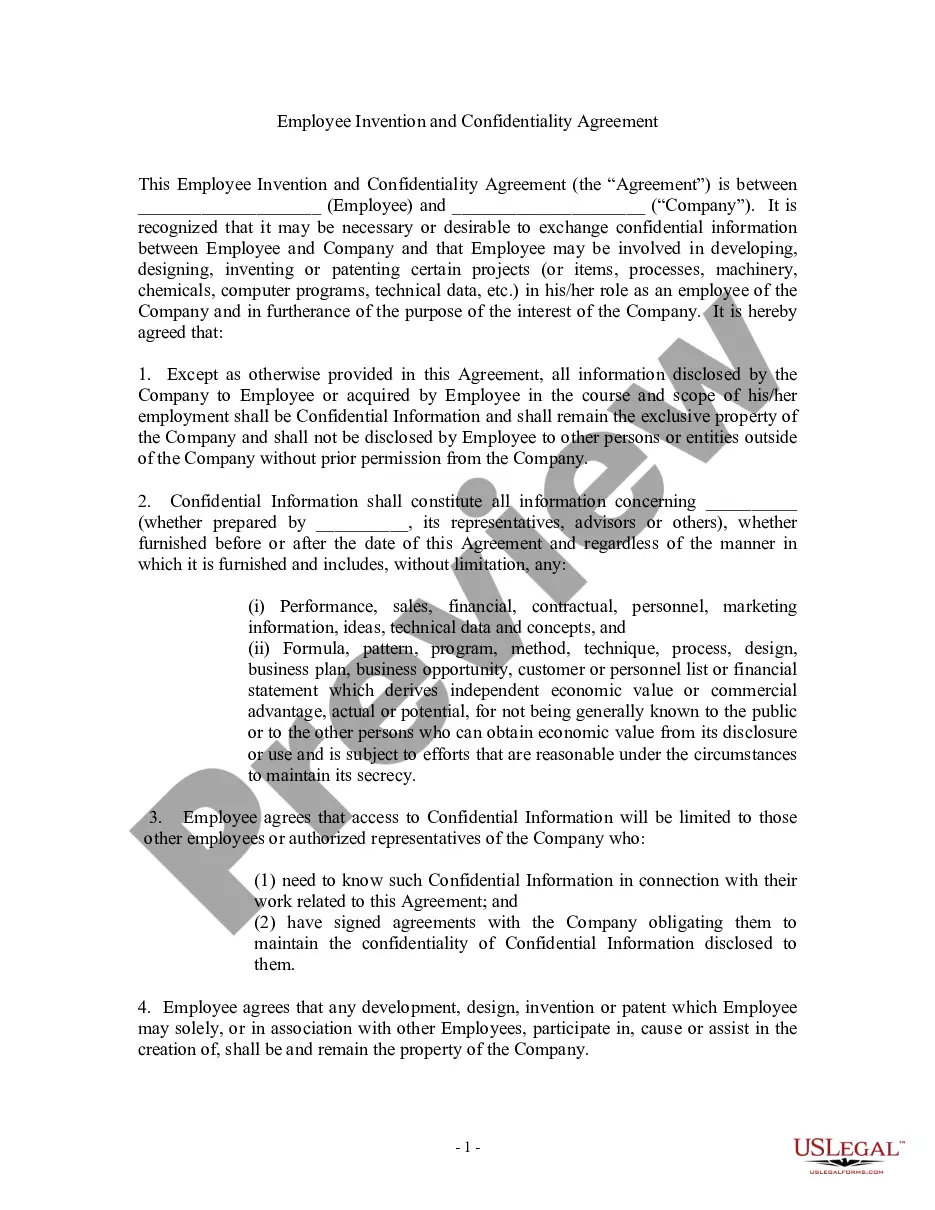

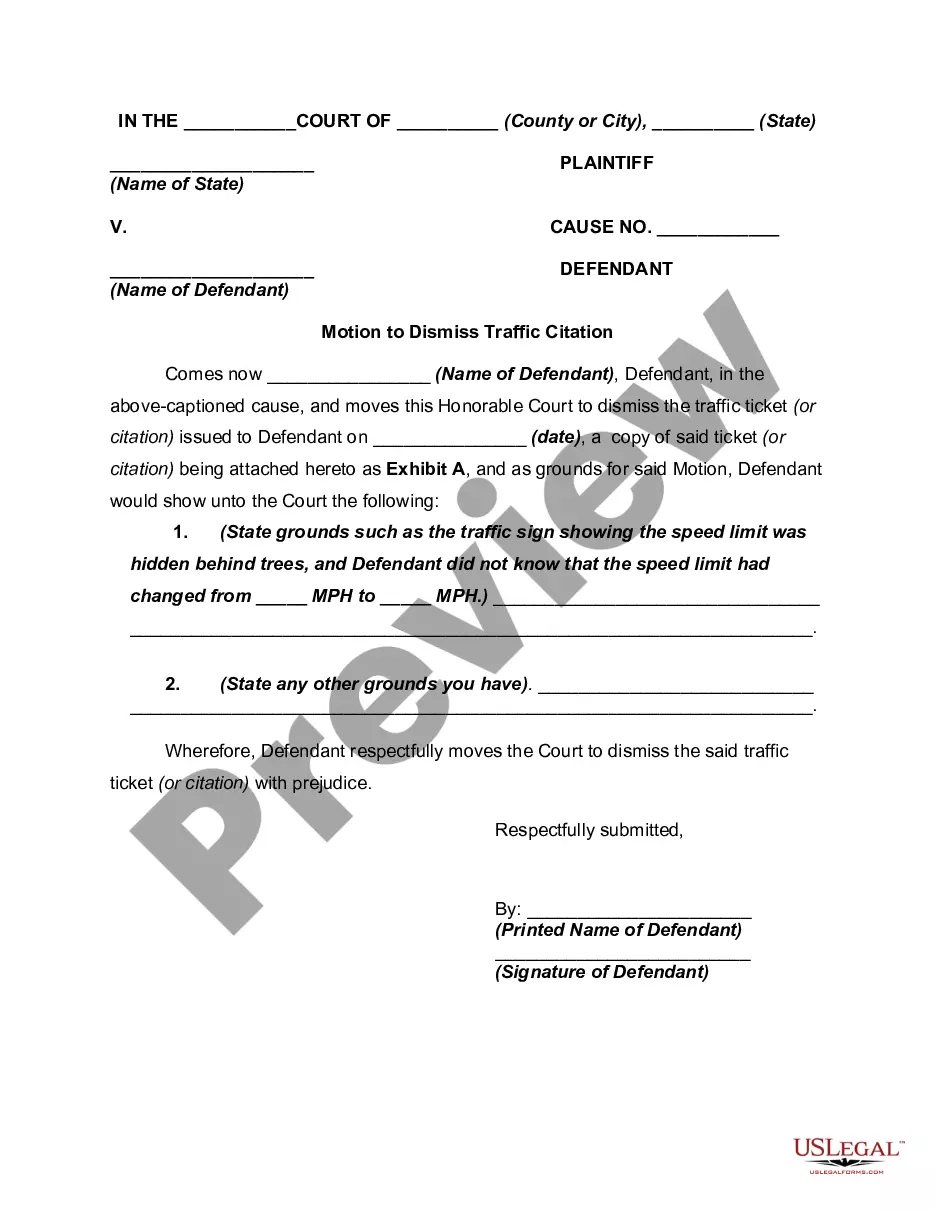

How to fill out Testamentary Provisions For Charitable Remainder Annuity Trust For Term Of Years?

You can spend countless hours online searching for the legal document template that aligns with the state and federal requirements you need.

US Legal Forms provides thousands of legal forms that have been reviewed by experts.

You can conveniently download or print the Florida Testamentary Provisions for Charitable Remainder Annuity Trust for Term of Years from my services.

If applicable, utilize the Preview button to review the document template as well.

- If you already have a US Legal Forms account, you can Log In and click the Acquire button.

- Afterwards, you can complete, edit, print, or sign the Florida Testamentary Provisions for Charitable Remainder Annuity Trust for Term of Years.

- Every legal document template you purchase is yours forever.

- To obtain another copy of a purchased form, visit the My documents tab and click the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for your preferred county/city.

- Review the form details to confirm that you have chosen the appropriate form.

Form popularity

FAQ

Any income that you receive from your charitable trust could reduce the total contribution that you end up leaving to your charity. You may risk leaving nothing to your charity if you plan to receive high payments from the trust while you're alive.

As an added benefit, a testamentary CRT is an irrevocable trust, meaning that assets in the trust are protected from creditors and lawsuits of the beneficiaries.

A CRT may last for the Lead Beneficiaries' joint lives or for a term of years (the term may not exceed 20 years).

No additional payments can be made, no matter what the need may be. When the income beneficiary dies, the assets in the trust are passed to the charity, not to the income beneficiary's children or other non-charitable beneficiaries.

Any income that you receive from your charitable trust could reduce the total contribution that you end up leaving to your charity. You may risk leaving nothing to your charity if you plan to receive high payments from the trust while you're alive.

How Long Can a Charitable Trust Last? Charitable Remainder Trusts can either last the lifetime of another beneficiary, or for a specified term (usually 20 years). At that point, any remaining value would go to your designated charitable organization. Learn more about Charitable Trust tax rules.

Charitable remainder unit trust (CRUT) pays the beneficiary a fixed percentage of the trust at least annually, often for life or a period up to 20 years. 2. Charitable remainder annuity trust (CRAT) pays the beneficiary a fixed amount, or annuity, for the term of the trust.

A CRT lets you convert a highly appreciated asset like stock or real estate into lifetime income. It reduces your income taxes now and estate taxes when you die. You pay no capital gains tax when the asset is sold. It also lets you help one or more charities that have special meaning to you.

How Long Can a Charitable Trust Last? Charitable Remainder Trusts can either last the lifetime of another beneficiary, or for a specified term (usually 20 years). At that point, any remaining value would go to your designated charitable organization. Learn more about Charitable Trust tax rules.