A Limited Liability Company (LLC) is a separate legal entity that can conduct business just like a corporation with many of the advantages of a partnership. It is taxed as a partnership. Its owners are called members and receive income from the LLC just as a partner would. There is no tax on the LLC entity itself. The members are not personally liable for the debts and obligations of the entity like partners would be. Basically, an LLC combines the tax advantages of a partnership with the limited liability feature of a corporation.

An LLC is formed by filing articles of organization with the secretary of state in the same type manner that articles of incorporation are filed. The articles must contain the name, purpose, duration, registered agent, and principle office of the LLC. The name of the LLC must contain the words Limited Liability Company or LLC. An LLC is a separate legal entity like a corporation.

Management of an LLC is vested in its members. An operating agreement is executed by the members and operates much the same way a partnership agreement operates. Profits and losses are shared according to the terms of the operating agreement.

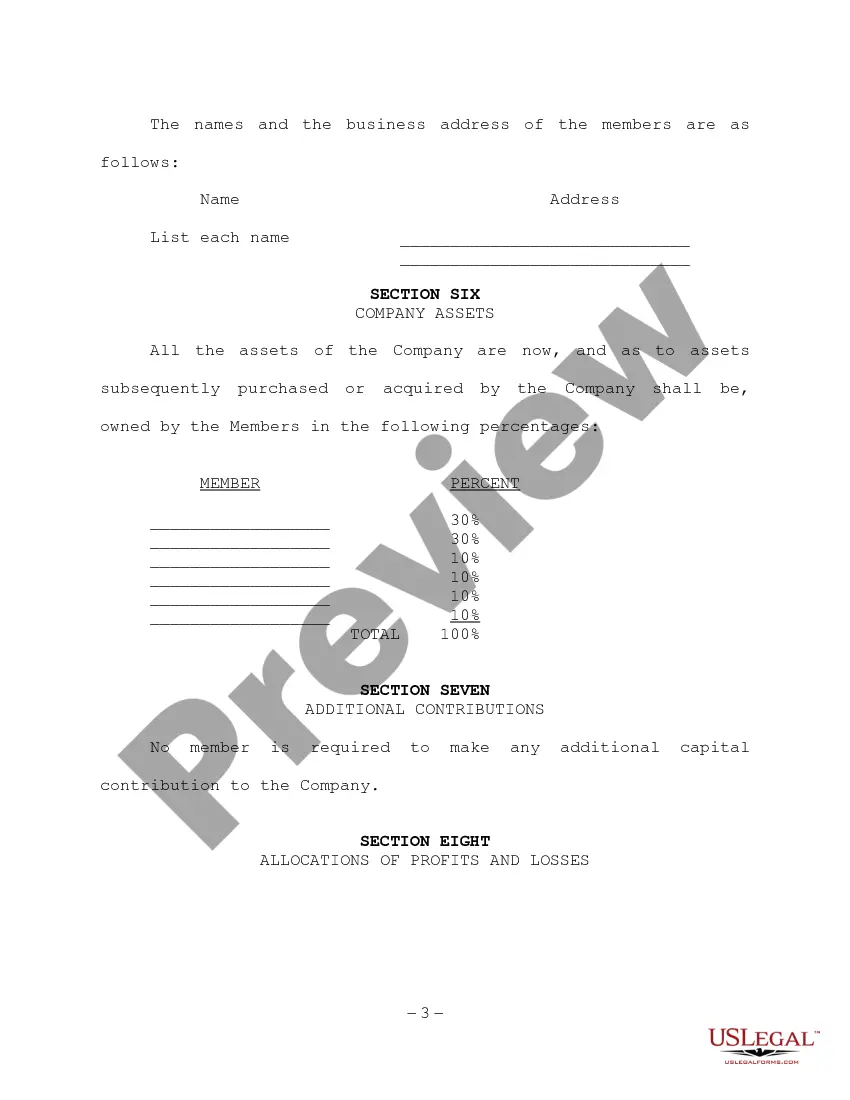

Florida Sample Limited Liability Company LLC Operating Agreement with Company Assets Divided into Ownership Shares Introduction: A Florida Sample Limited Liability Company (LLC) Operating Agreement is a crucial legal document that outlines the rights, responsibilities, and regulations governing the operation of an LLC in the state of Florida. This agreement serves as a blueprint for the company's operations, management structure, and asset division among its members. In this particular agreement, the company assets are divided into ownership shares which grant members a proportional interest in the LLC. Key Features and Components: 1. Formation: The operating agreement begins by outlining the formation details of the LLC, including the name, purpose, and duration of the company. It also establishes the effective date of the agreement and specifies the location of the LLC's principal place of business. 2. Membership: This section defines the rights, duties, and obligations of each member of the LLC. It includes provisions regarding admission of new members, withdrawal or removal of existing members, and restrictions on transferring ownership interests. 3. Management: The agreement outlines the management structure of the LLC, specifying whether it will be member-managed or manager-managed. In member-managed LCS, the members collectively make decisions and manage the operations, while in manager-managed LCS, designated managers handle these responsibilities. 4. Ownership Shares: The LLC's company assets are divided into ownership shares, which are distributed among its members. This section defines the number and value of ownership shares held by each member. It clarifies the membership's proportional interest and establishes the voting rights attached to these ownership shares. 5. Profit and Losses: The agreement outlines how profits and losses will be allocated among the members. It may be divided equally among all members or based on the proportion of ownership shares held by each member. 6. Capital Contributions: This section describes the initial capital contributions made by each member to establish the LLC. It may include both monetary contributions and non-monetary contributions, such as property or services. It further outlines the procedures and requirements for additional capital contributions in the future. 7. Dissolution and Termination: The agreement addresses the circumstances under which the LLC may dissolve and outlines the procedures for winding up the company's affairs. It also specifies the order in which the LLC's assets will be distributed among the members upon dissolution. Types of Florida Sample Limited Liability Company LLC Operating Agreements: 1. Single-Member LLC Operating Agreement: This agreement is designed for LCS with only one member or owner. It reflects the specific rights and obligations of a single-member entity. 2. Multi-Member LLC Operating Agreement: This agreement is suitable for LCS with multiple members. It accommodates the complexities associated with managing an LLC where multiple owners have varying roles and interests. Conclusion: A meticulously crafted Florida Sample Limited Liability Company LLC Operating Agreement is essential for ensuring the smooth functioning of an LLC. By accurately defining the division of company assets into ownership shares, this agreement provides clarity and structure to members' rights and responsibilities. It is crucial to consult legal professionals or utilize relevant templates to draft a customized agreement that aligns with the specific needs of the LLC and complies with Florida's legal requirements.Florida Sample Limited Liability Company LLC Operating Agreement with Company Assets Divided into Ownership Shares Introduction: A Florida Sample Limited Liability Company (LLC) Operating Agreement is a crucial legal document that outlines the rights, responsibilities, and regulations governing the operation of an LLC in the state of Florida. This agreement serves as a blueprint for the company's operations, management structure, and asset division among its members. In this particular agreement, the company assets are divided into ownership shares which grant members a proportional interest in the LLC. Key Features and Components: 1. Formation: The operating agreement begins by outlining the formation details of the LLC, including the name, purpose, and duration of the company. It also establishes the effective date of the agreement and specifies the location of the LLC's principal place of business. 2. Membership: This section defines the rights, duties, and obligations of each member of the LLC. It includes provisions regarding admission of new members, withdrawal or removal of existing members, and restrictions on transferring ownership interests. 3. Management: The agreement outlines the management structure of the LLC, specifying whether it will be member-managed or manager-managed. In member-managed LCS, the members collectively make decisions and manage the operations, while in manager-managed LCS, designated managers handle these responsibilities. 4. Ownership Shares: The LLC's company assets are divided into ownership shares, which are distributed among its members. This section defines the number and value of ownership shares held by each member. It clarifies the membership's proportional interest and establishes the voting rights attached to these ownership shares. 5. Profit and Losses: The agreement outlines how profits and losses will be allocated among the members. It may be divided equally among all members or based on the proportion of ownership shares held by each member. 6. Capital Contributions: This section describes the initial capital contributions made by each member to establish the LLC. It may include both monetary contributions and non-monetary contributions, such as property or services. It further outlines the procedures and requirements for additional capital contributions in the future. 7. Dissolution and Termination: The agreement addresses the circumstances under which the LLC may dissolve and outlines the procedures for winding up the company's affairs. It also specifies the order in which the LLC's assets will be distributed among the members upon dissolution. Types of Florida Sample Limited Liability Company LLC Operating Agreements: 1. Single-Member LLC Operating Agreement: This agreement is designed for LCS with only one member or owner. It reflects the specific rights and obligations of a single-member entity. 2. Multi-Member LLC Operating Agreement: This agreement is suitable for LCS with multiple members. It accommodates the complexities associated with managing an LLC where multiple owners have varying roles and interests. Conclusion: A meticulously crafted Florida Sample Limited Liability Company LLC Operating Agreement is essential for ensuring the smooth functioning of an LLC. By accurately defining the division of company assets into ownership shares, this agreement provides clarity and structure to members' rights and responsibilities. It is crucial to consult legal professionals or utilize relevant templates to draft a customized agreement that aligns with the specific needs of the LLC and complies with Florida's legal requirements.