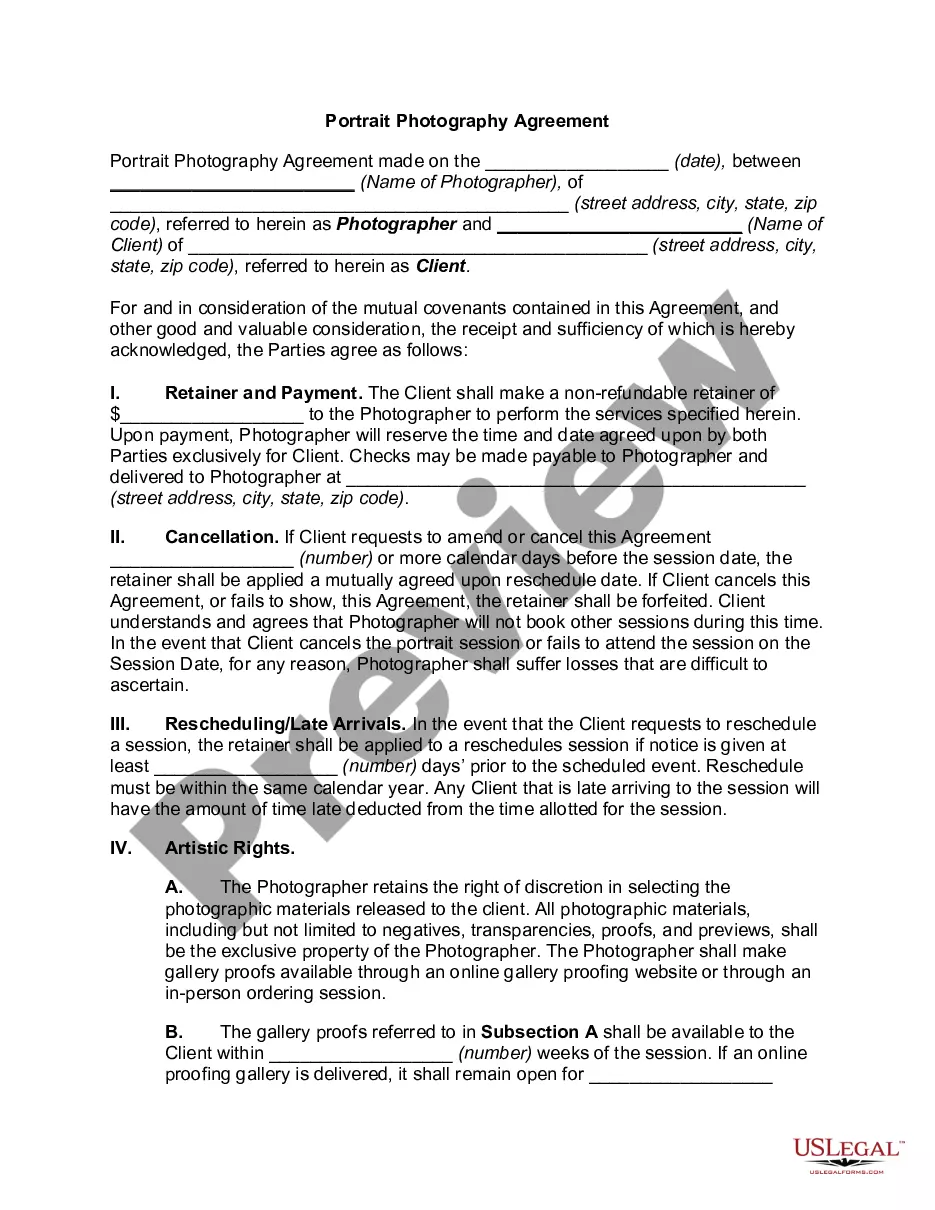

Subject: [Your Name] — Update on Estate Closure, [Estate Holder's Name] Estate, Florida Dear [Recipient's Name], I hope this letter finds you well. I am writing to provide you with an update on the closure of the estate of the late [Estate Holder's Name]. As the appointed executor/trustee, it is my duty to keep all concerned parties informed of the progress and status of the estate settlement process. Firstly, I would like to express my gratitude for your patience and understanding throughout this journey. Managing an estate can be a complex and time-consuming task, but with your cooperation, we have been able to navigate through the various legal and administrative procedures smoothly thus far. In accordance with Florida's probate laws and regulations, I would like to inform you of the following key developments: 1. Final Accounting: At this stage, the preparation of the final accounting is underway. This involves documenting all assets, income, expenses, debts, and distributions made since the beginning of the estate settlement proceedings. The final accounting will provide a comprehensive overview of the estate's financial affairs and will be submitted to the appropriate authorities for review and approval. 2. Estate Tax Filings: As required by the Internal Revenue Service (IRS) and the Florida Department of Revenue, we have filed the necessary estate tax returns. Our legal team has diligently worked to ensure compliance with tax obligations, minimizing any potential tax liabilities during the estate's closure process. 3. Distribution of Assets: Depending on the complexity of the estate, the distribution of assets may take more time than anticipated. We are carefully evaluating the estate's assets, including real estate properties, investments, personal belongings, and other belongings to ensure fair and accurate distribution among the designated beneficiaries or heirs listed in the Last Will and Testament. 4. Resolving Outstanding Debts and Claims: As per legal requirements, we have been diligently identifying and managing any outstanding debts or claims against the estate. This meticulous approach ensures that all liabilities are met before proceeding with the final distribution of assets. This process may take additional time, especially if there are significant debts or complex claims to be resolved. It is essential to note that the estate closure process can vary based on the unique circumstances of each case. Therefore, the timeline for the completion of the estate settlement may differ. Nonetheless, rest assured that we are working diligently to expedite the process while maintaining the utmost transparency and accuracy. In case you have any questions, concerns, or would like further information about the estate's closure, I encourage you to reach out to me directly. I will be more than happy to provide you with the necessary updates and address any queries you may have. Once again, I extend my heartfelt appreciation for your cooperation and understanding throughout these estates' settlement process. I will continue to keep you informed of any significant developments as we progress towards the final closure of the estate. Thank you for your continued support. Warm regards, [Your Name] [Your Contact Information]

Florida Sample Letter for Update to Estate Closure

Description

How to fill out Florida Sample Letter For Update To Estate Closure?

If you wish to comprehensive, acquire, or print lawful file themes, use US Legal Forms, the most important variety of lawful varieties, that can be found on-line. Use the site`s simple and easy practical look for to obtain the documents you require. A variety of themes for enterprise and specific uses are sorted by groups and suggests, or keywords. Use US Legal Forms to obtain the Florida Sample Letter for Update to Estate Closure within a few mouse clicks.

If you are already a US Legal Forms consumer, log in to your account and then click the Obtain key to obtain the Florida Sample Letter for Update to Estate Closure. You can even entry varieties you in the past delivered electronically from the My Forms tab of your own account.

If you use US Legal Forms the first time, follow the instructions under:

- Step 1. Be sure you have selected the shape for your appropriate town/country.

- Step 2. Use the Review choice to look over the form`s content material. Never neglect to learn the explanation.

- Step 3. If you are not happy using the form, take advantage of the Look for industry near the top of the screen to discover other models of your lawful form design.

- Step 4. After you have discovered the shape you require, click on the Buy now key. Select the rates program you like and add your qualifications to sign up for an account.

- Step 5. Process the purchase. You should use your credit card or PayPal account to finish the purchase.

- Step 6. Select the structure of your lawful form and acquire it in your product.

- Step 7. Total, revise and print or indication the Florida Sample Letter for Update to Estate Closure.

Each and every lawful file design you buy is yours eternally. You may have acces to every single form you delivered electronically with your acccount. Go through the My Forms area and decide on a form to print or acquire again.

Contend and acquire, and print the Florida Sample Letter for Update to Estate Closure with US Legal Forms. There are many specialist and status-specific varieties you can utilize for the enterprise or specific requires.