Florida Sample Letter for Attempt to Collect Debt before Legal Action

Description

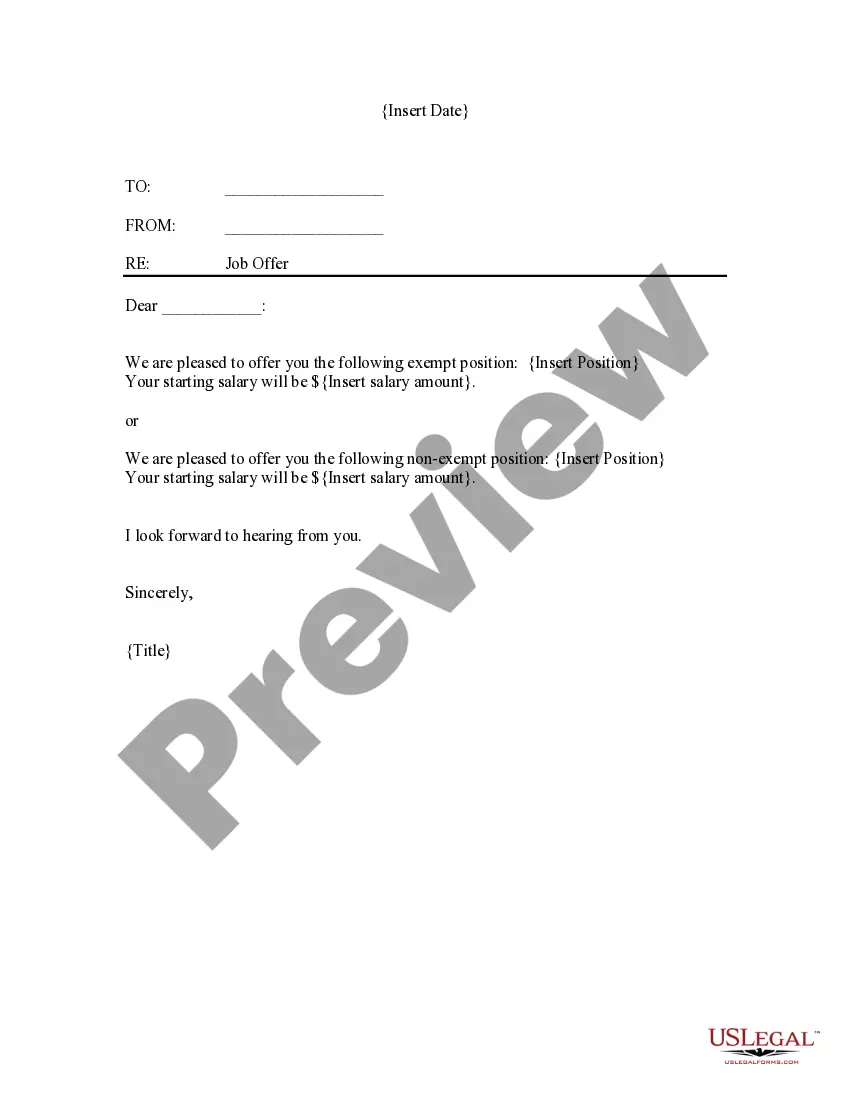

How to fill out Sample Letter For Attempt To Collect Debt Before Legal Action?

Finding the right legal document format might be a have a problem. Needless to say, there are a lot of themes available on the Internet, but how will you get the legal type you will need? Use the US Legal Forms web site. The support gives 1000s of themes, including the Florida Sample Letter for Attempt to Collect Debt before Legal Action, which can be used for business and personal demands. Every one of the forms are checked by pros and satisfy federal and state demands.

Should you be presently authorized, log in to your bank account and then click the Download option to have the Florida Sample Letter for Attempt to Collect Debt before Legal Action. Make use of your bank account to check from the legal forms you have bought in the past. Proceed to the My Forms tab of your bank account and acquire an additional duplicate of the document you will need.

Should you be a new consumer of US Legal Forms, here are easy recommendations that you can comply with:

- Very first, ensure you have selected the right type for your personal metropolis/region. It is possible to examine the shape using the Preview option and browse the shape explanation to make sure this is basically the best for you.

- If the type fails to satisfy your needs, use the Seach industry to get the appropriate type.

- Once you are certain that the shape would work, select the Buy now option to have the type.

- Choose the prices strategy you would like and type in the required details. Make your bank account and pay money for the transaction with your PayPal bank account or credit card.

- Select the submit formatting and acquire the legal document format to your device.

- Total, change and printing and indicator the obtained Florida Sample Letter for Attempt to Collect Debt before Legal Action.

US Legal Forms may be the most significant library of legal forms that you can find numerous document themes. Use the company to acquire skillfully-made papers that comply with express demands.

Form popularity

FAQ

THIRD & FINAL COLLECTION LETTER SAMPLE Your accounts is now __ days past due and you owe a total of $573.25. I regret to inform you that unless we receive payment in full by ___ or work out an agreed upon payment plan by this date, we will have to turn your invoice over to a collection agency and/or our attorney.

In other words, a Letter Before Action is a final demand letter that reminds your client or customer to make payment and requests one last time that they do so, before you take legal action.

Debt collection is when a collection agency or company tries to collect past-due debts from borrowers. You might be contacted by a debt collector if you haven't made loan or credit card payments and those payments are severely past due.

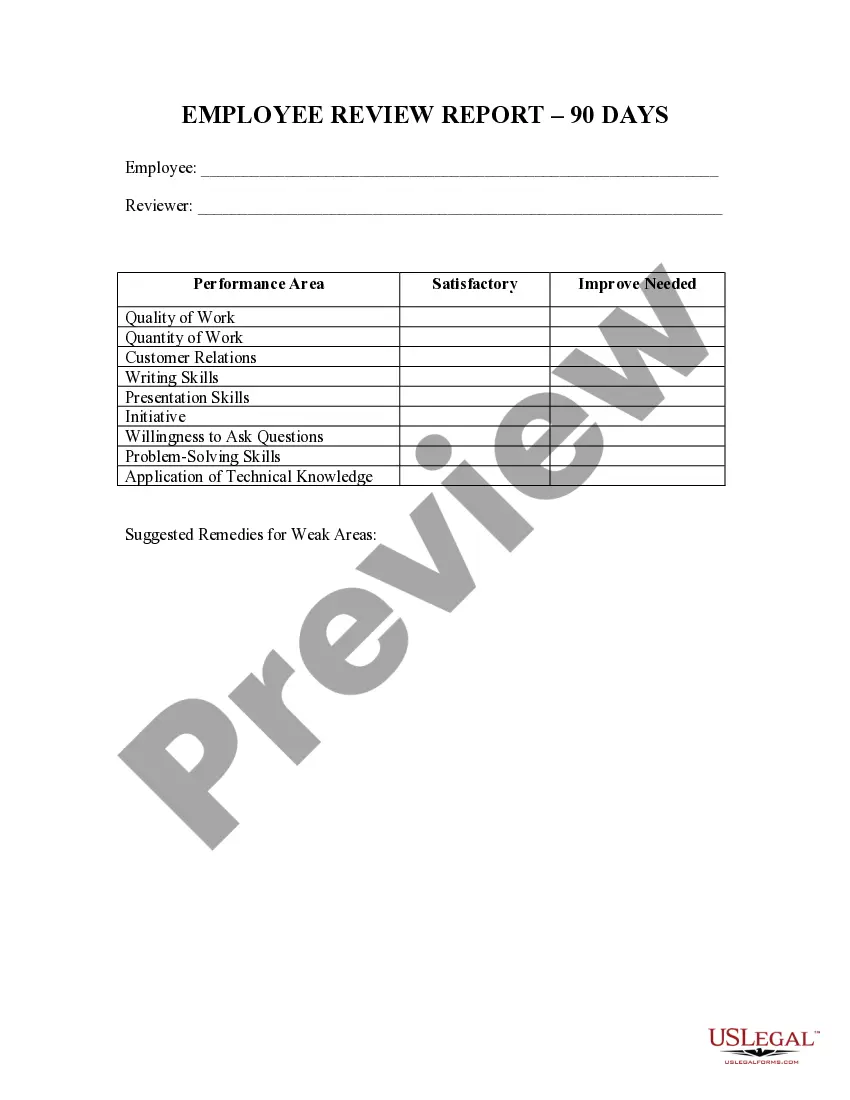

How to Write An Effective Collection Letter Reference the products or services that were purchased. ... Maintain a friendly but firm tone. ... Remind the payee of their contract or agreement with you. ... Offer multiple ways the payee can take action. ... Add a personal touch. ... Give them a new deadline.

An effective debt collection letter should include all of the following: The total amount the client owes you. The original date the balance was due. Instructions detailing how to make the overdue payment. The new due date, whether a specific date or as soon as possible.

Include your full name, company name, and mailing address. Address the letter to your client by their full name. State the problem: Specify and provide proof of the debt in question. Reference the original contract or agreement that states the services the client owes you for.

Responding to a debt collection letter depends on the type of debt your creditors are claiming you owe. If you feel the amount of the proposed debt is correct and you can afford to pay it, do so. This will be a sufficient form of response and should halt any collection activity.

Within five days after a debt collector first contacts you, it must send you a written notice, called a "validation notice," that tells you (1) the amount it thinks you owe, (2) the name of the creditor, and (3) how to dispute the debt in writing.