A Florida Loan Commitment Agreement Letter is a legal document that outlines the terms and conditions of a loan commitment in the state of Florida. It serves as an official confirmation from a lender to a borrower regarding the approval and terms of a loan. The agreement letter provides clarity to both parties involved about the loan amount, interest rate, repayment schedule, and any additional conditions that need to be met. Keywords: Florida Loan Commitment Agreement Letter, loan commitment, terms and conditions, legal document, loan approval, loan amount, interest rate, repayment schedule, lender, borrower, additional conditions. Types of Florida Loan Commitment Agreement Letters: 1. Residential Loan Commitment Agreement Letter: This type of loan commitment agreement letter is specific to residential loans, which are often used for purchasing a home or refinancing an existing mortgage. 2. Commercial Loan Commitment Agreement Letter: This type of loan commitment agreement letter is applicable to commercial loans, which are typically used for financing business ventures, constructing commercial properties, or expanding existing businesses. 3. Construction Loan Commitment Agreement Letter: This type of loan commitment agreement letter deals with construction loans, which are meant for financing the construction or renovation of residential or commercial properties. It may have specific provisions related to draw schedules, inspections, and disbursements. 4. Bridge Loan Commitment Agreement Letter: This type of loan commitment agreement letter is relevant to bridge loans, short-term loans that help borrowers bridge the gap between the purchase of a new property and the sale of an existing one. 5. FHA Loan Commitment Agreement Letter: This type of loan commitment agreement letter specifically refers to loans backed by the Federal Housing Administration (FHA). These loans have their own set of guidelines and eligibility criteria, and the agreement letter outlines the terms within those guidelines. 6. VA Loan Commitment Agreement Letter: This type of loan commitment agreement letter is specific to loans guaranteed by the Department of Veterans Affairs (VA) for qualified veterans, active-duty military personnel, and their eligible family members. The agreement letter outlines the terms and conditions within the VA loan program. In conclusion, a Florida Loan Commitment Agreement Letter is a crucial legal document that outlines the terms and conditions of a loan commitment in Florida. It ensures transparency between the lender and borrower, clarifying the loan details and conditions. Various types of loan commitment agreement letters exist, including residential, commercial, construction, bridge, FHA, and VA loan agreements.

Florida Loan Commitment Agreement Letter

Description

How to fill out Florida Loan Commitment Agreement Letter?

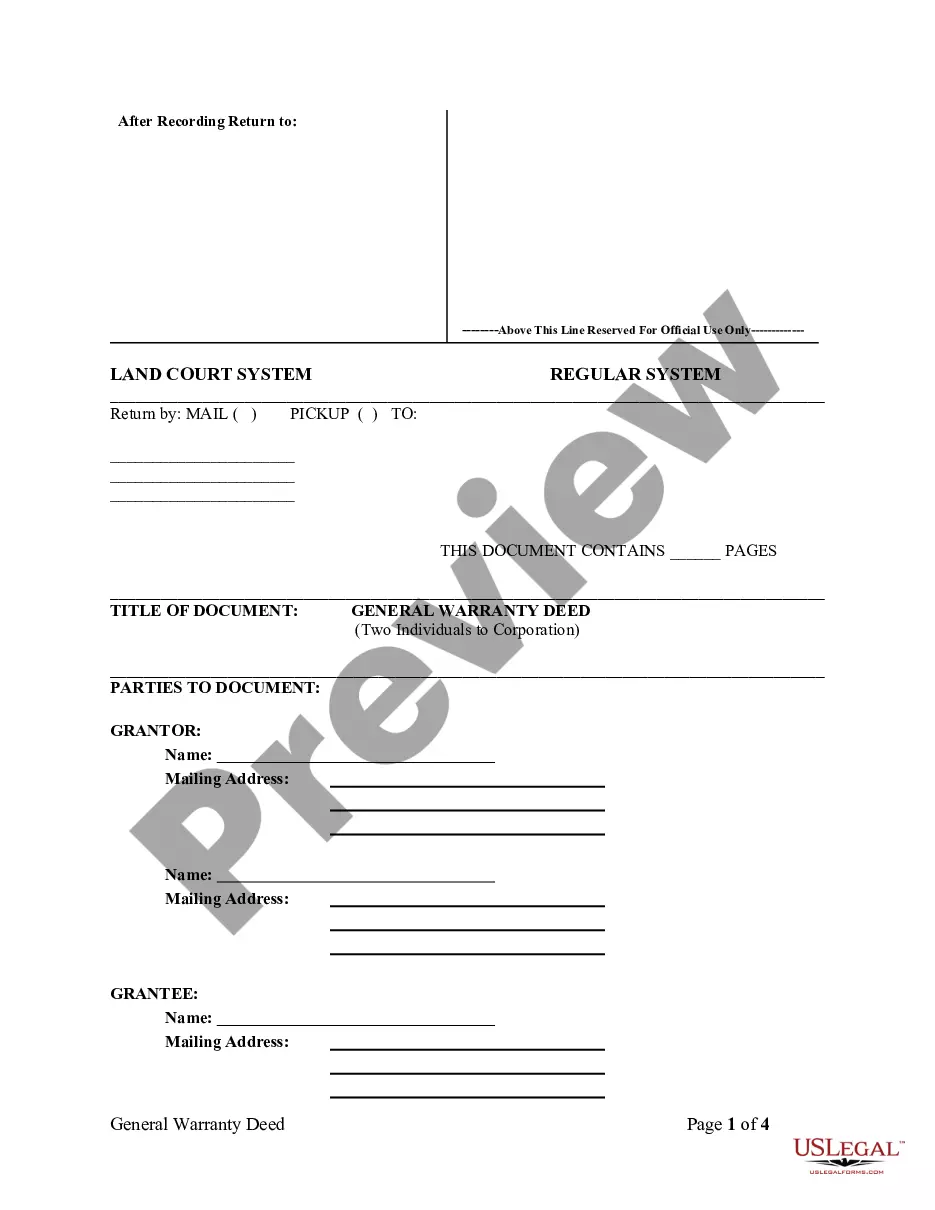

Finding the right authorized document web template might be a struggle. Needless to say, there are plenty of themes accessible on the Internet, but how do you find the authorized develop you need? Take advantage of the US Legal Forms website. The support delivers a large number of themes, like the Florida Loan Commitment Agreement Letter, that can be used for company and personal requires. All of the types are checked by experts and meet state and federal needs.

When you are previously registered, log in for your bank account and click on the Download key to obtain the Florida Loan Commitment Agreement Letter. Use your bank account to appear from the authorized types you possess purchased earlier. Check out the My Forms tab of your respective bank account and have an additional version from the document you need.

When you are a new user of US Legal Forms, allow me to share basic guidelines that you should adhere to:

- Very first, make sure you have chosen the right develop for your metropolis/region. You can look over the form while using Review key and read the form explanation to make certain it is the right one for you.

- In the event the develop will not meet your needs, utilize the Seach industry to obtain the proper develop.

- When you are sure that the form is proper, go through the Purchase now key to obtain the develop.

- Choose the pricing strategy you would like and enter the essential details. Make your bank account and purchase the order using your PayPal bank account or Visa or Mastercard.

- Choose the submit structure and down load the authorized document web template for your system.

- Complete, modify and print out and signal the attained Florida Loan Commitment Agreement Letter.

US Legal Forms will be the most significant local library of authorized types that you can see numerous document themes. Take advantage of the company to down load appropriately-created papers that adhere to express needs.

Form popularity

FAQ

A loan commitment is an agreement by a commercial bank or other financial institution to lend a business or individual a specified sum of money.

A mortgage commitment letter is not the same as final approval, but it shows that you're in a good position to buy a home. Once you make an offer on a home and the seller accepts it, you can move on to the full application process, which involves a more in-depth review of your finances and the property you want to buy.

A mortgage commitment letter is not the same as final approval, but it shows that you're in a good position to buy a home. Once you make an offer on a home and the seller accepts it, you can move on to the full application process, which involves a more in-depth review of your finances and the property you want to buy.

Before receiving the full mortgage contract, you will receive a letter of commitment (also known as an approval letter). It signifies that financing has been officially approved and represents a formal, binding contract between you and the lender once signed. This letter outlines the terms and conditions of the loan.

What is a Letter of Commitment? A letter of commitment is a formal binding agreement between a lender and a borrower. It outlines the terms and conditions of the loan and the nature of the prospective loan. It serves as the agreement that initiates an official loan borrowing process.

A commitment letter is typically not the final approval for a loan or financing. While a commitment letter indicates that a lender is willing to provide funding, it is usually contingent upon certain conditions being met.

As long as nothing changes financially with the applicant during the house hunting phase and the home's appraisal value covers the loan amount, the loan commitment generally stands. However, the lender reserves the right to reduce the loan amount or deny the application.

Ideally, borrowers and lenders are on the same page when they execute a mortgage loan commitment letter. The buyer (borrower) is committed to the loan and will follow all qualification guidelines while the lender will have fully completed due diligence and is ready to fund the loan for closing.