Florida Accident Policy

Description

How to fill out Accident Policy?

Have you ever found yourself in a situation where you need documents for either business or personal purposes almost every day.

There are many legal document templates available online, but finding reliable ones can be challenging.

US Legal Forms offers a vast selection of form templates, including the Florida Accident Policy, designed to meet both state and federal requirements.

Utilize US Legal Forms, the most extensive collection of legal forms, to save time and prevent errors.

The service provides professionally crafted legal document templates that can be utilized for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After logging in, you can download the Florida Accident Policy template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- 1. Locate the form you need and confirm it is for the correct area/county.

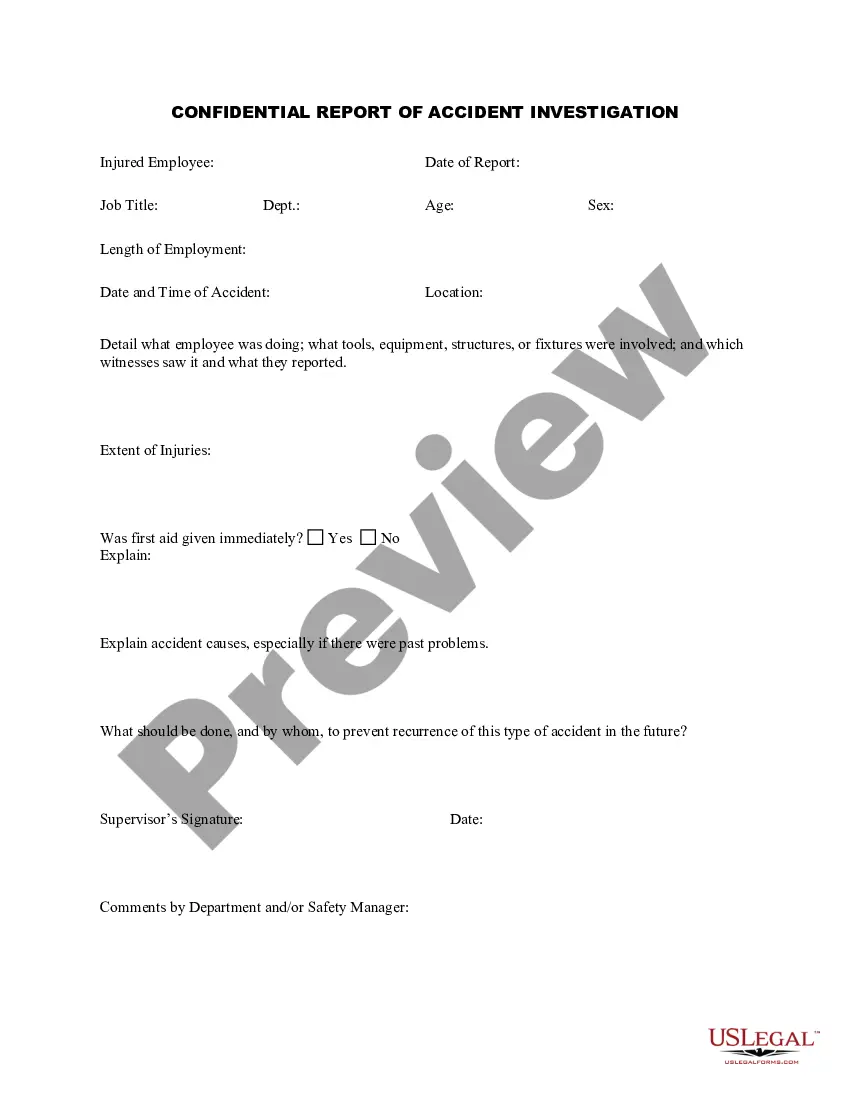

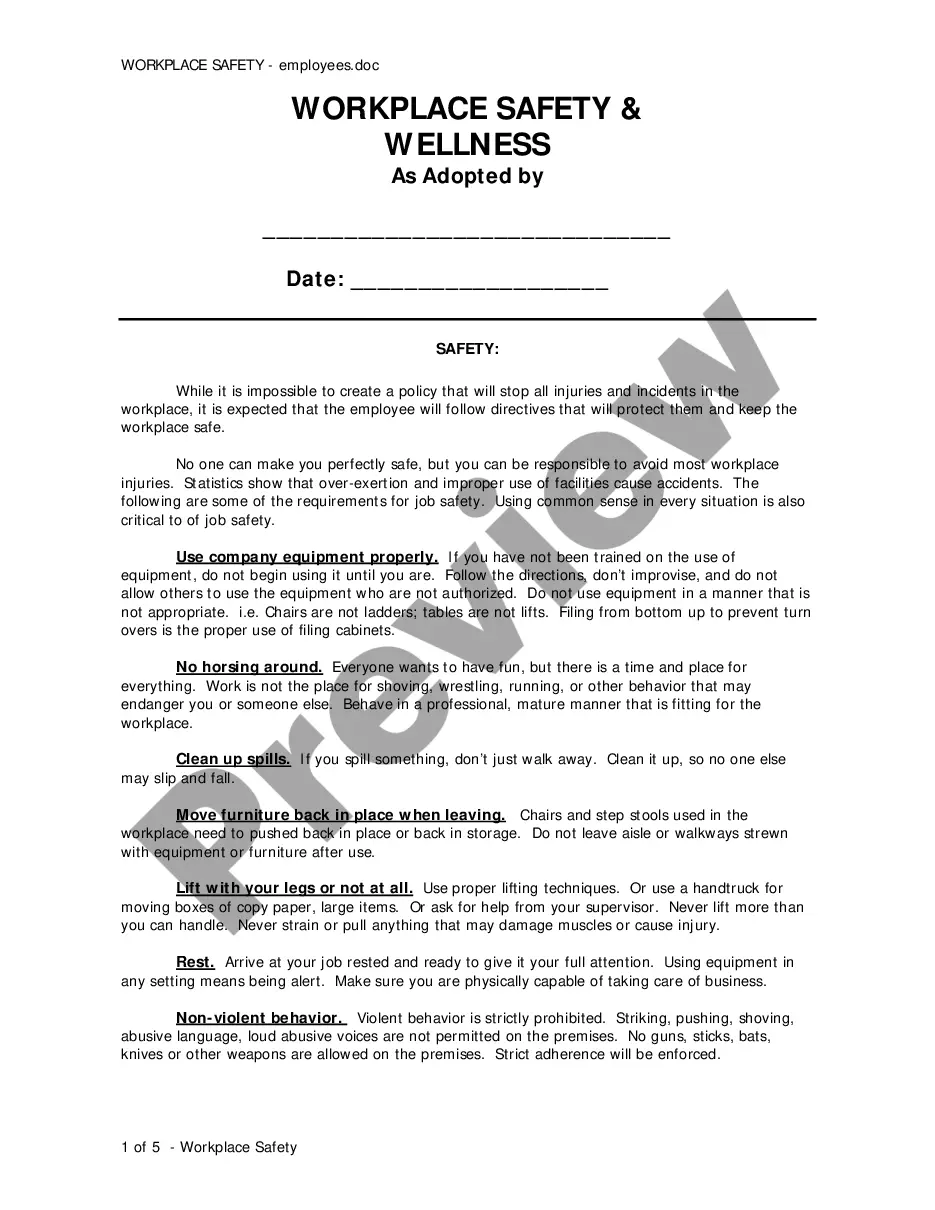

- 2. Use the Review button to examine the document.

- 3. Review the summary to ensure you have selected the correct form.

- 4. If the form is not what you are looking for, use the Search box to find the form that meets your needs and criteria.

- 5. Once you find the appropriate form, click Purchase now.

- 6. Choose the pricing plan you desire, enter the necessary information to create your account, and pay for your order using PayPal or credit card.

- 7. Select a convenient file format and download your copy.

- 8. You can access all the document templates you have purchased in the My documents section.

- 9. You can obtain an additional copy of the Florida Accident Policy whenever necessary, simply select the form you need to download or print the template.

Form popularity

FAQ

In Florida, all owners and operators of motor vehicles are responsible for having insurance coverage for damage they cause to someone else's vehicle in an accident. The penalties for not having such insurance could include suspension of one's driving privileges.

In Florida, a person injured in a car accident is entitled to sue the at-fault driver and the owner of the at-fault driver's vehicle personally. Even if the at-fault driver has insurance, the injured person can still file a lawsuit for the amount of their damages against both the at-fault driver and the vehicle owner.

Florida is a "no-fault" car insurance state, which means the insurance claim process is meant to be more efficient after a car accident, since your own insurance pays for your medical bills and other economic losses.

Florida No-Fault Car Insurance Laws Florida is a no-fault state, which means each driver carries their own insurance to cover medical bills and car repairs up to a certain amount. More specifically, Florida Statutes § 627.736 requires drivers to carry PIP and property damage coverage policies of up to $10,000.

The Florida No-Fault Motor Vehicle Law requires drivers to carry Personal Injury Protection coverage as part of their auto insurance; this No-Fault coverage pays the insured's bills, regardless of fault, up to the limit of the insurance (minimum limit is $10,000).

Now, Florida is a no-fault state, which means that injured accident victims are required to go through their own insurance companies first and use up their personal injury protection coverage (PIP, which is $10,000) before seeking compensation from another source in a Florida chain reaction car accident.