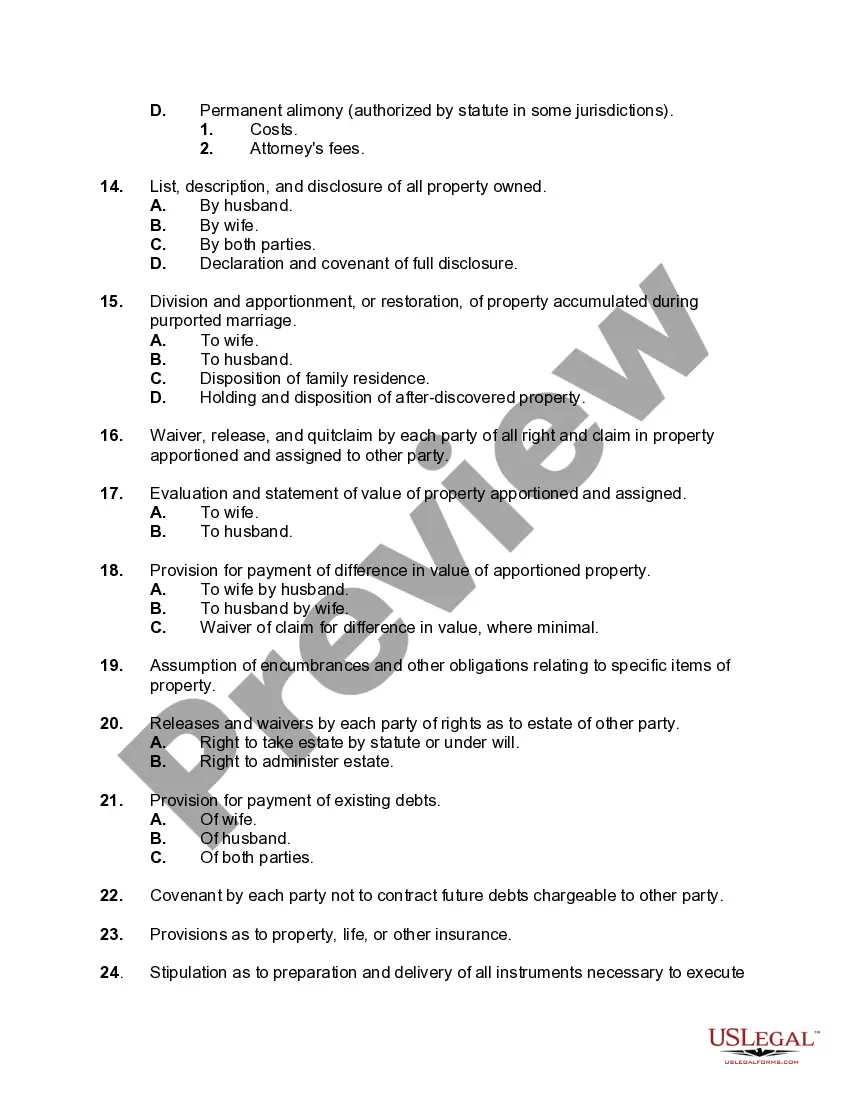

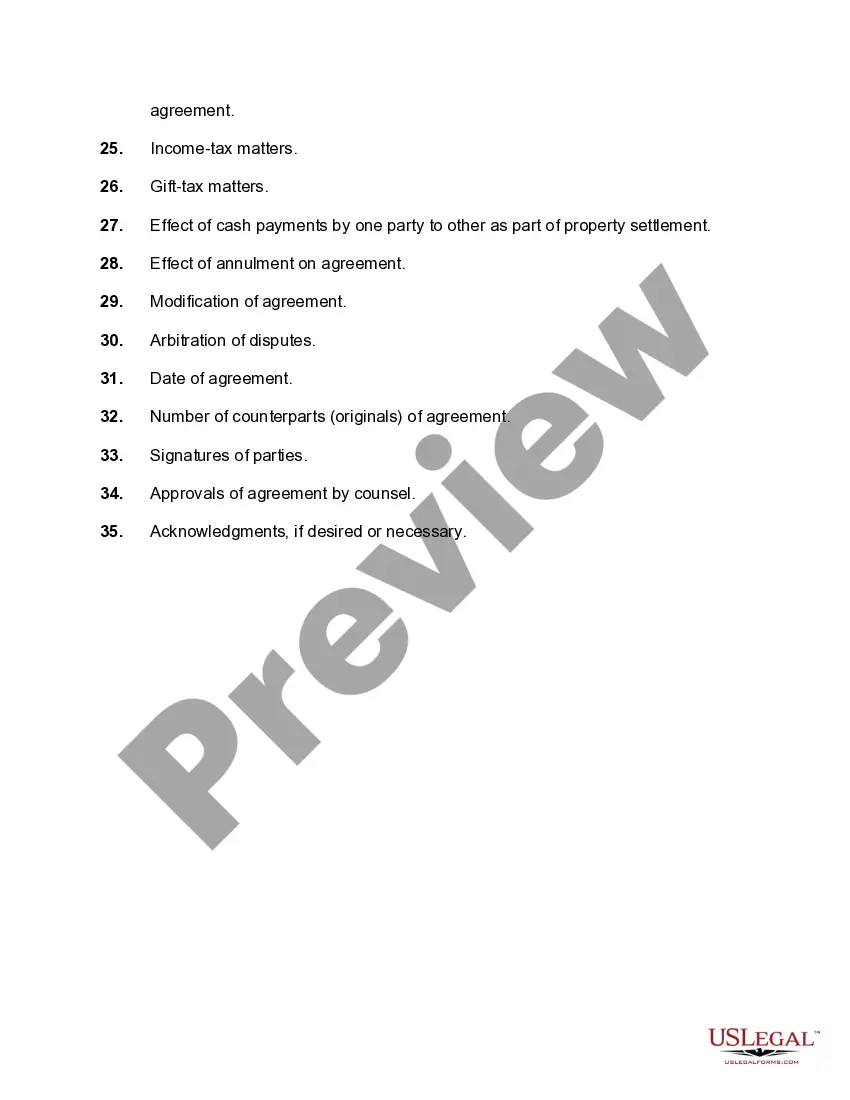

Florida Checklist of Matters to be Considered in Drafting an Agreement for Division or Restoration of Property in Connection with a Proceeding for Annulment of a Marriage is a comprehensive guide outlining the important factors to be considered when drafting an agreement for the division or restoration of property in connection with an annulment proceeding in the state of Florida. When going through an annulment proceeding, it is crucial to have a well-drafted agreement that addresses all the necessary issues related to property division or restoration. The Florida Checklist of Matters provides a structured approach to ensure that all important aspects are taken into account, thereby reducing potential disputes and ensuring a smoother process. Some key matters covered in the Florida Checklist include but are not limited to: 1. Identification and Valuation: The checklist emphasizes the need to clearly identify and value all assets and debts accumulated during the marriage, including real estate, personal property, financial accounts, investments, and liabilities. 2. Separate Property: It is important to distinguish between marital property (subject to division) and separate property (exempt from division). The checklist guides the parties to identify and document separate property claims properly. 3. Distribution of Marital Assets and Debts: The checklist suggests considering an equitable distribution of marital assets and debts, taking into account factors such as the duration of the marriage, financial contributions of each spouse, and the future financial needs of the parties. 4. Alimony: In some cases, one spouse may be entitled to receive alimony (spousal support) from the other. The checklist highlights the need to discuss and include provisions regarding the nature, duration, and amount of any potential spousal support. 5. Retirement Accounts and Pensions: If either spouse has retirement accounts or pension plans, the checklist recommends addressing these assets, including potential division or restoration. 6. Insurance Coverages: The checklist suggests evaluating the need for continued insurance coverage, such as health insurance, life insurance, or disability insurance, and addressing the responsibilities of each party regarding the premiums and beneficiaries. 7. Tax Considerations: Tax implications should not be overlooked. The checklist advises considering tax consequences related to the transfer or division of property and seeking appropriate professional advice if necessary. 8. Enforcement and Modifications: The checklist includes provisions regarding the enforceability of the agreement and the possibility of future modifications, ensuring that the agreement remains applicable and fair even in changing circumstances. It is important to note that the Florida Checklist of Matters may vary depending on the specific circumstances of each case. Different types of annulment cases may require additional considerations or have particular requirements. Therefore, it is always advisable to consult with an experienced family law attorney who can tailor the checklist to the individual needs and circumstances of the parties involved.

Florida Checklist of Matters to be Considered in Drafting an Agreement for Division or Restoration of Property in Connection with a Proceeding for Annulment of a Marriage

Description

How to fill out Florida Checklist Of Matters To Be Considered In Drafting An Agreement For Division Or Restoration Of Property In Connection With A Proceeding For Annulment Of A Marriage?

If you wish to comprehensive, obtain, or printing legal papers layouts, use US Legal Forms, the biggest variety of legal varieties, that can be found on the web. Use the site`s basic and convenient look for to get the documents you need. Different layouts for organization and specific uses are categorized by groups and suggests, or keywords. Use US Legal Forms to get the Florida Checklist of Matters to be Considered in Drafting an Agreement for Division or Restoration of Property in Connection with a Proceeding for Annulment of a Marriage within a couple of mouse clicks.

If you are previously a US Legal Forms client, log in for your accounts and then click the Download option to have the Florida Checklist of Matters to be Considered in Drafting an Agreement for Division or Restoration of Property in Connection with a Proceeding for Annulment of a Marriage. You can even entry varieties you previously saved from the My Forms tab of your own accounts.

Should you use US Legal Forms initially, follow the instructions under:

- Step 1. Be sure you have chosen the shape to the correct town/nation.

- Step 2. Make use of the Review choice to examine the form`s information. Don`t forget about to learn the explanation.

- Step 3. If you are not happy together with the kind, utilize the Research area at the top of the monitor to discover other types in the legal kind design.

- Step 4. Once you have identified the shape you need, go through the Buy now option. Pick the pricing program you favor and add your qualifications to sign up to have an accounts.

- Step 5. Approach the purchase. You may use your credit card or PayPal accounts to complete the purchase.

- Step 6. Pick the structure in the legal kind and obtain it on your system.

- Step 7. Total, edit and printing or signal the Florida Checklist of Matters to be Considered in Drafting an Agreement for Division or Restoration of Property in Connection with a Proceeding for Annulment of a Marriage.

Every legal papers design you purchase is your own eternally. You have acces to each kind you saved inside your acccount. Select the My Forms area and decide on a kind to printing or obtain again.

Remain competitive and obtain, and printing the Florida Checklist of Matters to be Considered in Drafting an Agreement for Division or Restoration of Property in Connection with a Proceeding for Annulment of a Marriage with US Legal Forms. There are millions of skilled and condition-specific varieties you can use to your organization or specific needs.