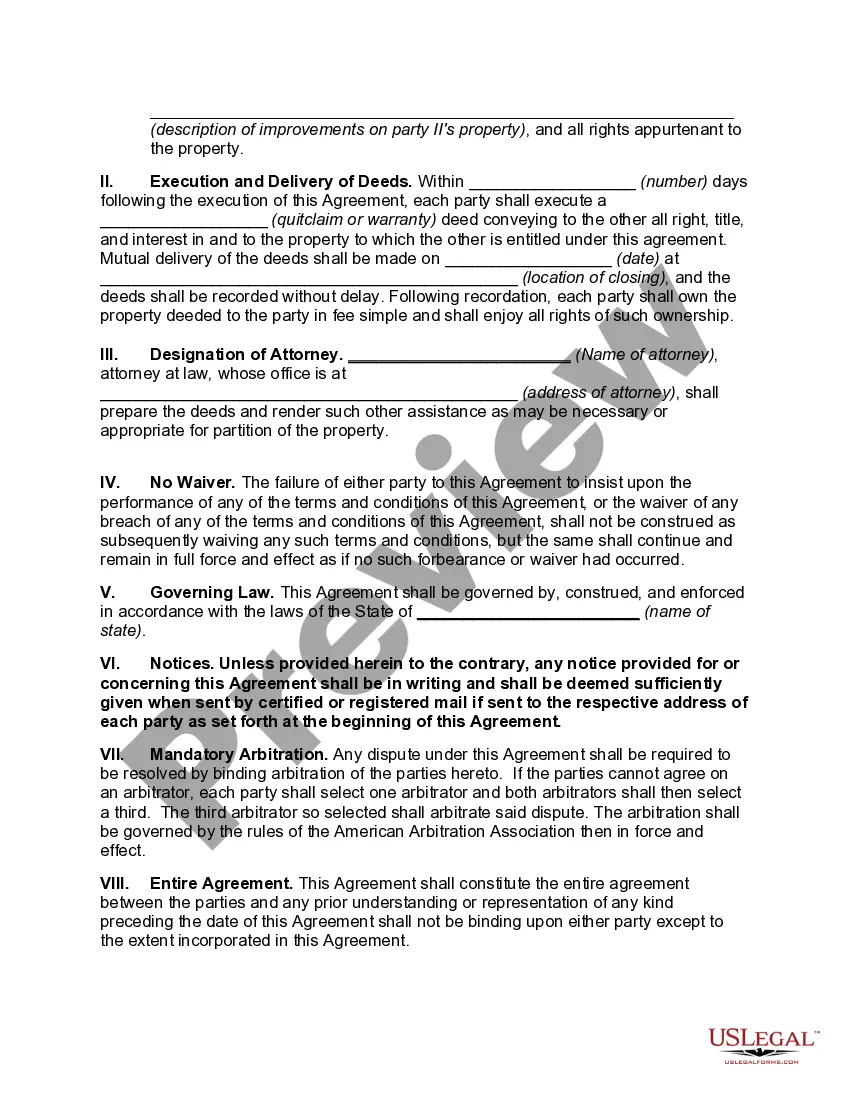

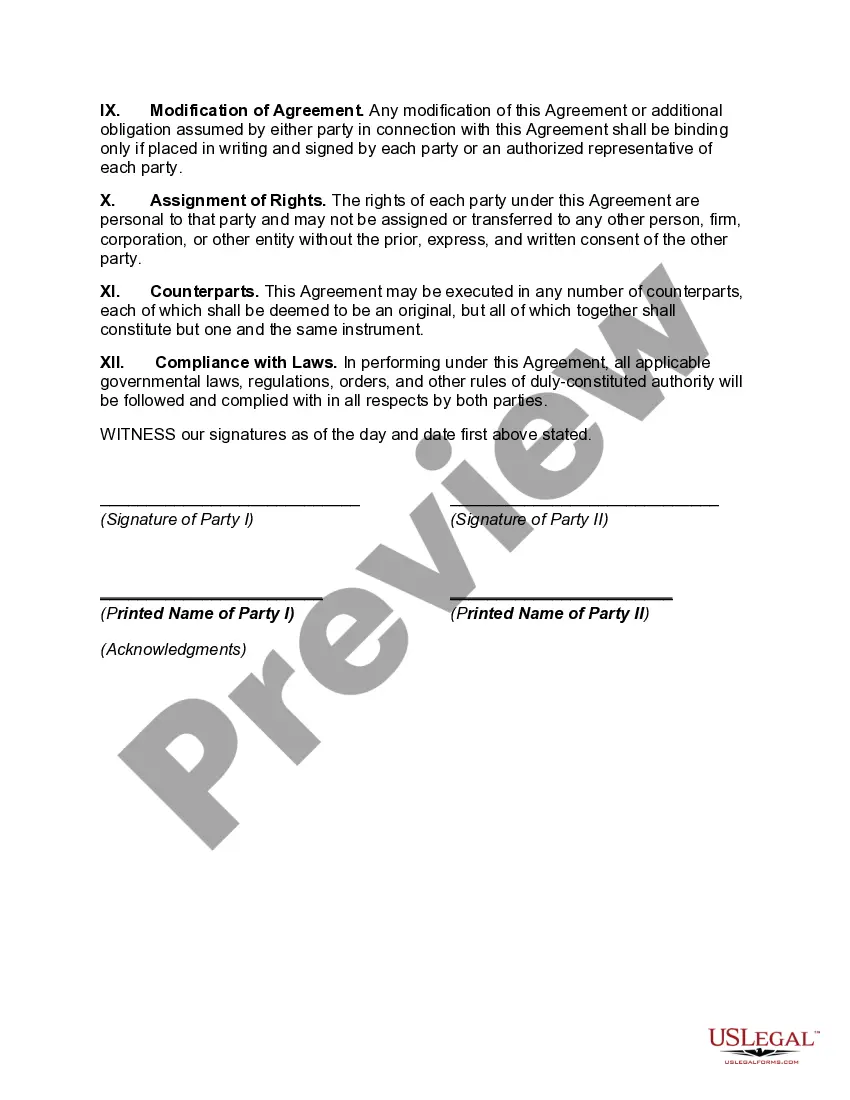

Florida Agreement to Partition Real Property Between Children of Decedent

Description

How to fill out Agreement To Partition Real Property Between Children Of Decedent?

Are you presently in the position that you will need papers for sometimes organization or personal purposes almost every day time? There are plenty of authorized document themes available online, but locating types you can rely on isn`t easy. US Legal Forms provides 1000s of kind themes, like the Florida Agreement to Partition Real Property Between Children of Decedent, that happen to be composed to fulfill federal and state demands.

Should you be presently familiar with US Legal Forms web site and have an account, just log in. Following that, you are able to obtain the Florida Agreement to Partition Real Property Between Children of Decedent web template.

Unless you have an account and want to start using US Legal Forms, adopt these measures:

- Find the kind you will need and make sure it is for the proper metropolis/area.

- Take advantage of the Review option to review the form.

- Read the description to actually have selected the appropriate kind.

- In the event the kind isn`t what you`re seeking, utilize the Research area to get the kind that fits your needs and demands.

- Once you get the proper kind, click Buy now.

- Opt for the costs plan you need, complete the required details to create your money, and buy your order making use of your PayPal or charge card.

- Select a hassle-free data file format and obtain your backup.

Discover all of the document themes you might have bought in the My Forms menus. You can aquire a extra backup of Florida Agreement to Partition Real Property Between Children of Decedent any time, if necessary. Just click the needed kind to obtain or print the document web template.

Use US Legal Forms, probably the most extensive selection of authorized types, to save time and prevent blunders. The services provides expertly produced authorized document themes which you can use for a variety of purposes. Make an account on US Legal Forms and initiate generating your way of life easier.

Form popularity

FAQ

Partition is the right that an owner has to divide real estate that he/she owns with another. Chapter 64 of the Florida Statutes allows co-owners that own real property along with others to force not only the division of that real property but also the sale of it.

If partition by sale is ordered by the court, then the co-owned land will be sold, and under court supervision if necessary. It can be sold by the co-owners at a private sale or at a public auction, and the proceeds of the sale are split ing to each co-owners percentage ownership of the real property.

Under Florida Statute 64.081, if a property is partitioned, either through a court order or by agreement between the co-owners, then every party is required to pay a share of the attorneys' fees and costs incurred in the partition process.

Partition is the right that an owner has to divide real estate that he/she owns with another. Chapter 64 of the Florida Statutes allows co-owners that own real property along with others to force not only the division of that real property but also the sale of it.

The Uniform Partition of Heirs Property Act (UPHPA) helps preserve family wealth passed to the next generation in the form of real property. If a landowner dies intestate, the real estate passes to the landowner's heirs as tenants-in-common under state law.

Previously, partition by appraisal only applied to inherited property. The Partition of Real Property Act, which went into effect on January 1, 2023, now allows a co-owner to buy out the interest of the co-owner requesting a partition by sale. Generally, the law favors a physical partition or a partition in kind.

Title to property vests to the heirs (becomes an immediate right) upon the date of death of the decedent. This means that an heir(s) may enter into a contract to sell property but that all parties involved in the sale would need to be made aware of the requirement for probate before a final sale could take place.

How Long Does a Partition Action Take in Florida? If a partition action goes to trial, it may take a year or even more, depending upon all the factors involved in the case and court scheduling issues. Partition actions that may be resolved outside the courtroom often take significantly less time.