Florida Jury Instruction - 1.9.4.1 Employee Self-Employed Independent Contractor

Description

How to fill out Jury Instruction - 1.9.4.1 Employee Self-Employed Independent Contractor?

US Legal Forms - one of many most significant libraries of lawful varieties in the United States - gives a wide array of lawful papers layouts you can down load or produce. Making use of the site, you can find a large number of varieties for company and individual purposes, sorted by categories, claims, or keywords and phrases.You can get the most up-to-date types of varieties much like the Florida Jury Instruction - 1.9.4.1 Employee Self-Employed Independent Contractor within minutes.

If you have a membership, log in and down load Florida Jury Instruction - 1.9.4.1 Employee Self-Employed Independent Contractor through the US Legal Forms library. The Down load key can look on each and every form you see. You have access to all formerly saved varieties inside the My Forms tab of your respective bank account.

If you would like use US Legal Forms the very first time, allow me to share easy guidelines to help you started out:

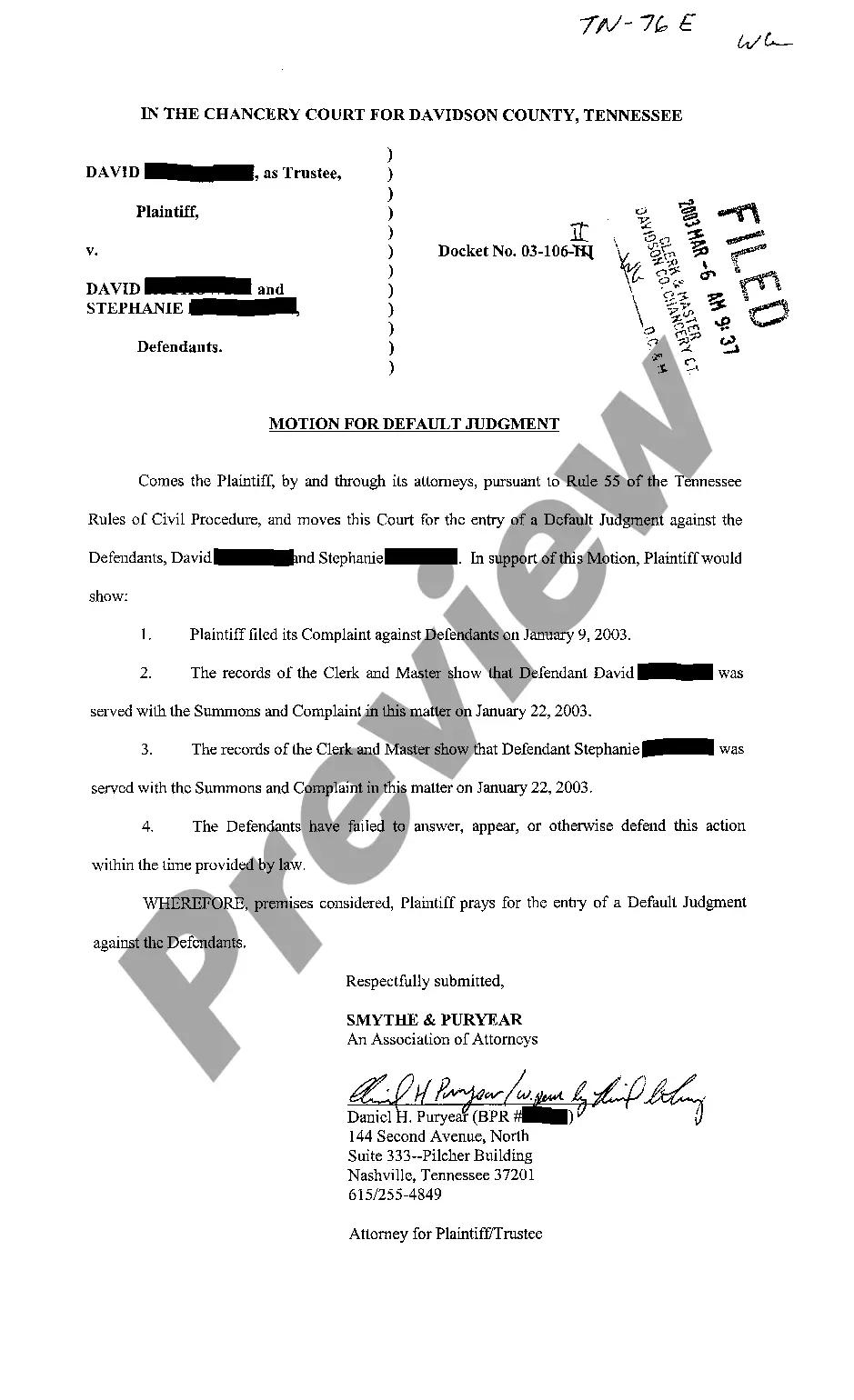

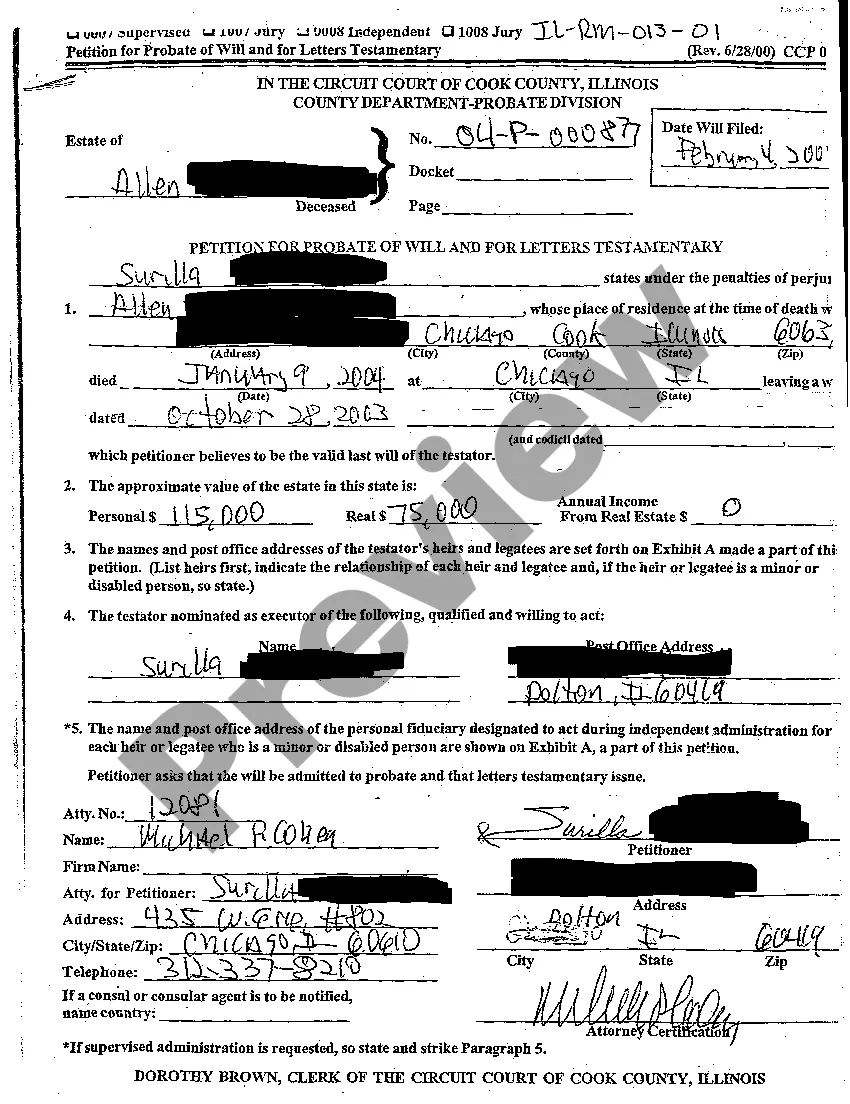

- Be sure you have selected the best form for the area/region. Go through the Review key to check the form`s content material. Browse the form explanation to ensure that you have chosen the appropriate form.

- When the form doesn`t fit your demands, take advantage of the Research field near the top of the monitor to obtain the one which does.

- Should you be satisfied with the form, affirm your selection by simply clicking the Buy now key. Then, choose the rates prepare you like and supply your qualifications to register to have an bank account.

- Process the financial transaction. Make use of your charge card or PayPal bank account to perform the financial transaction.

- Select the formatting and down load the form on the system.

- Make adjustments. Fill out, modify and produce and sign the saved Florida Jury Instruction - 1.9.4.1 Employee Self-Employed Independent Contractor.

Each and every web template you put into your bank account does not have an expiry particular date and is also the one you have for a long time. So, if you want to down load or produce an additional version, just visit the My Forms segment and click on about the form you will need.

Gain access to the Florida Jury Instruction - 1.9.4.1 Employee Self-Employed Independent Contractor with US Legal Forms, one of the most considerable library of lawful papers layouts. Use a large number of expert and status-distinct layouts that meet your business or individual needs and demands.

Form popularity

FAQ

PATTERN JURY INSTRUCTIONS WHICH PROVIDE A BODY OF BRIEF, UNIFORM INSTRUCTIONS THAT FULLY STATE THE LAW WITHOUT NEEDLESS REPETION ARE PRESENTED; BASIC, SPECIAL, OFFENSE, AND TRIAL INSTRUCTIONS ARE INCLUDED.

The court may not impose a sentence of death unless each juror individually finds the defendant should be sentenced to death. Even when death is a possible sentence, each juror must decide based on his or her own moral assessment whether life imprisonment without the possibility of parole, or death, should be imposed.

Instruction 401.12b (concurring cause), to be given when the court considers it necessary, does not set forth any additional standard for the jury to consider in determining whether negligence was a legal cause of damage but only negates the idea that a defendant is excused from the consequences of his or her ...

The instruction is as follows: "5.1(a), Legal cause generally: Negligence is a legal cause of (loss) (injury) (or) (damage) if it directly and in natural and continuous sequence has a substantial part in producing such (loss) (injury) (or) (damage)."

The judge reads the instructions to the jury. This is commonly referred to as the judge's charge to the jury. In giving the instructions, the judge will state the issues in the case and define any terms or words that may not be familiar to the jurors.

The Florida Standard Jury Instruction #501.5(a) states that jurors should try to separate the amount of harm caused by the accident versus the harm that had existed previously in the body. However, if they cannot do so, then they should award damages for the entire condition suffered by the claimant.

Meanwhile, Florida's Civil Jury Instruction Section 401.9, which can be applied to traffic regulations, holds that violation of certain statutes is considered evidence of negligence, though not necessarily conclusive evidence of negligence. Negligence of a common carrier.