Florida Contract for Sale of Manufacturing Facility Pursuant to Asset Purchase Agreement: A Comprehensive Guide Introduction: The Florida Contract for Sale of Manufacturing Facility Pursuant to Asset Purchase Agreement is a legally binding document that facilitates the sale of a manufacturing facility located in the state of Florida. This agreement sets forth the terms and conditions under which the buyer will acquire the assets of the manufacturing facility from the seller. Key Elements: 1. Parties: The contract identifies the buyer and the seller involved in the transaction, along with their legal representation if applicable. It is essential to include accurate and complete contact information for both parties. 2. Asset Description: The contract provides a detailed description of the manufacturing facility's assets being sold, including equipment, machinery, inventory, intellectual property, leases, licenses, and any other relevant assets involved in the manufacturing process. The description must be precise to avoid any ambiguity. 3. Purchase Price and Payment Terms: The contract specifies the total purchase price of the manufacturing facility and establishes the payment terms agreed upon by both parties. It outlines whether the payment will be made in a lump sum or through installments, along with any applicable interest rates or penalties for late payments. 4. Due Diligence: This section outlines the buyer's right to conduct inspections, audits, and investigations of the manufacturing facility before the sale is finalized. It allows the buyer to assess the facility's condition, financial statements, contracts, and any potential risks or liabilities associated with the assets being purchased. 5. Representations and Warranties: Both the buyer and the seller provide certain representations and warranties regarding the accuracy of the information provided, the ownership of the assets, the absence of undisclosed liabilities, and the compliance with laws and regulations. This section safeguards the buyer's interests and ensures that the seller is accountable for any misrepresentation. 6. Closing Conditions: The contract sets forth the conditions that must be met for the sale to be closed successfully. These conditions may include obtaining necessary governmental approvals or permits, clearance of outstanding liens or encumbrances, and the fulfillment of any contractual obligations. 7. Confidentiality and Non-Compete Agreements: If applicable, the contract may include provisions related to the protection of confidential information and trade secrets. It may also stipulate any non-compete clauses preventing the seller from engaging in similar business activities within a specific geographic area for a certain period after the sale. Types of Florida Contracts for Sale of Manufacturing Facility Pursuant to Asset Purchase Agreement: 1. Agreement for Sale of New Manufacturing Facility: This type of contract is used when a buyer wishes to purchase a newly constructed manufacturing facility in Florida, including all the associated assets and liabilities. 2. Agreement for Sale of Existing Manufacturing Facility: This contract is employed for the sale of an already established manufacturing facility in Florida, including all the assets and liabilities such as equipment, inventory, intellectual property, and contractual obligations. Conclusion: The Florida Contract for Sale of Manufacturing Facility Pursuant to Asset Purchase Agreement is a detailed and comprehensive agreement that allows for the smooth transfer of ownership of a manufacturing facility in Florida. It addresses key aspects such as asset description, purchase price, due diligence, representations and warranties, closing conditions, and confidentiality. By understanding the types of contracts available, buyers can choose the one that best suits their specific requirements.

Florida Contract for Sale of Manufacturing Facility Pursuant to Asset Purchase Agreement

Description

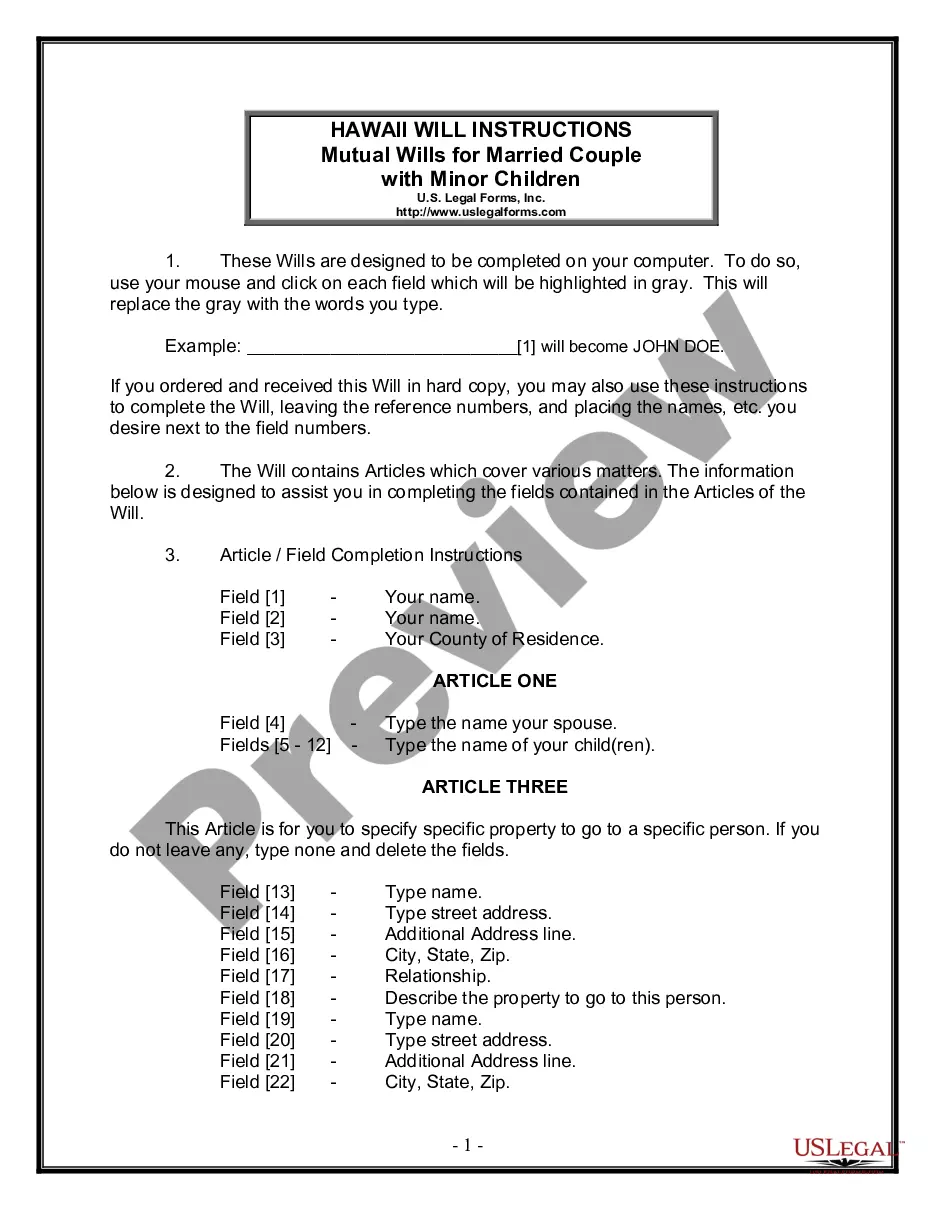

How to fill out Florida Contract For Sale Of Manufacturing Facility Pursuant To Asset Purchase Agreement?

You are able to spend hours on-line attempting to find the legal document design that suits the state and federal requirements you need. US Legal Forms gives thousands of legal varieties that happen to be analyzed by specialists. It is simple to obtain or print out the Florida Contract for Sale of Manufacturing Facility Pursuant to Asset Purchase Agreement from your support.

If you already possess a US Legal Forms accounts, you can log in and click on the Down load button. Next, you can total, modify, print out, or sign the Florida Contract for Sale of Manufacturing Facility Pursuant to Asset Purchase Agreement. Each and every legal document design you get is your own eternally. To get an additional backup associated with a obtained form, proceed to the My Forms tab and click on the related button.

If you are using the US Legal Forms website the very first time, stick to the simple instructions below:

- First, make certain you have chosen the best document design for your county/metropolis of your liking. Look at the form explanation to ensure you have picked out the right form. If accessible, utilize the Review button to search throughout the document design also.

- If you would like get an additional model from the form, utilize the Lookup field to get the design that suits you and requirements.

- When you have discovered the design you would like, just click Acquire now to move forward.

- Select the pricing strategy you would like, type your qualifications, and sign up for a free account on US Legal Forms.

- Comprehensive the purchase. You can utilize your charge card or PayPal accounts to cover the legal form.

- Select the formatting from the document and obtain it to the system.

- Make adjustments to the document if required. You are able to total, modify and sign and print out Florida Contract for Sale of Manufacturing Facility Pursuant to Asset Purchase Agreement.

Down load and print out thousands of document themes utilizing the US Legal Forms web site, which provides the largest collection of legal varieties. Use professional and status-particular themes to take on your company or person requires.

Form popularity

FAQ

Among the terms typically included in the agreement are the purchase price, the closing date, the amount of earnest money that the buyer must submit as a deposit, and the list of items that are and are not included in the sale.

An asset purchase agreement is a legal contract to buy the assets of a business. It can also be used to purchase specific assets from a business, especially if they are significant in value.

However, there are some basic items that should be included in every purchase agreement.Buyer and seller information.Property details.Pricing and financing.Fixtures and appliances included/excluded in the sale.Closing and possession dates.Earnest money deposit amount.Closing costs and who is responsible for paying.More items...?

The asset purchase agreement is often drafted up towards the end of the negotiation stage, so that the parties can have a final record of their agreement. The document essentially operates as a contract, creating legally binding duties on each of the parties involved.

Provisions of an APA may include payment of purchase price, monthly installments, liens and encumbrances on the assets, condition precedent for the closing, etc. An APA differs from a stock purchase agreement (SPA) under which company shares, title to assets, and title to liabilities are also sold.

What Should I Include in a Sales Contract?Identification of the Parties.Description of the Services and/or Goods.Payment Plan.Delivery.Inspection Period.Warranties.Miscellaneous Provisions.

Also known as a sales contract or a purchase contract, a purchase agreement is a legal document that establishes the parameters of the sale of goods between a buyer and a seller. Typically, they are used when the value is more than $500.

A purchase agreement is a type of contract that outlines terms and conditions related to the sale of goods. As a legally binding contract between buyer and seller, the agreements typically relate to buying and selling goods rather than services.

Among the terms typically included in the agreement are the purchase price, the closing date, the amount of earnest money that the buyer must submit as a deposit, and the list of items that are and are not included in the sale.

The bill of sale is typically delivered as an ancillary document in an asset purchase to transfer title to tangible personal property. It does not cover intangible property (such as intellectual property rights or contract rights) or real property.