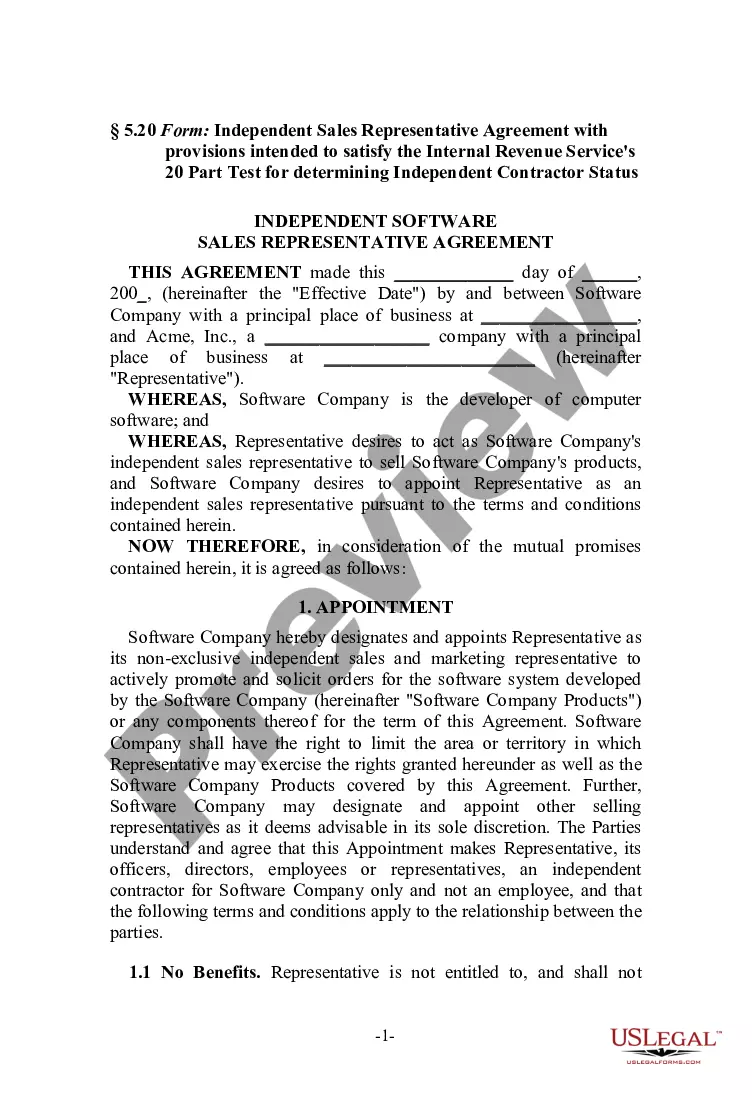

Florida Independent Sales Representative Agreement with Developer of Computer Software with Provisions Intended to Satisfy the Internal Revenue Service's 20 Part Test for Determining Independent Contractor Status

Description

How to fill out Independent Sales Representative Agreement With Developer Of Computer Software With Provisions Intended To Satisfy The Internal Revenue Service's 20 Part Test For Determining Independent Contractor Status?

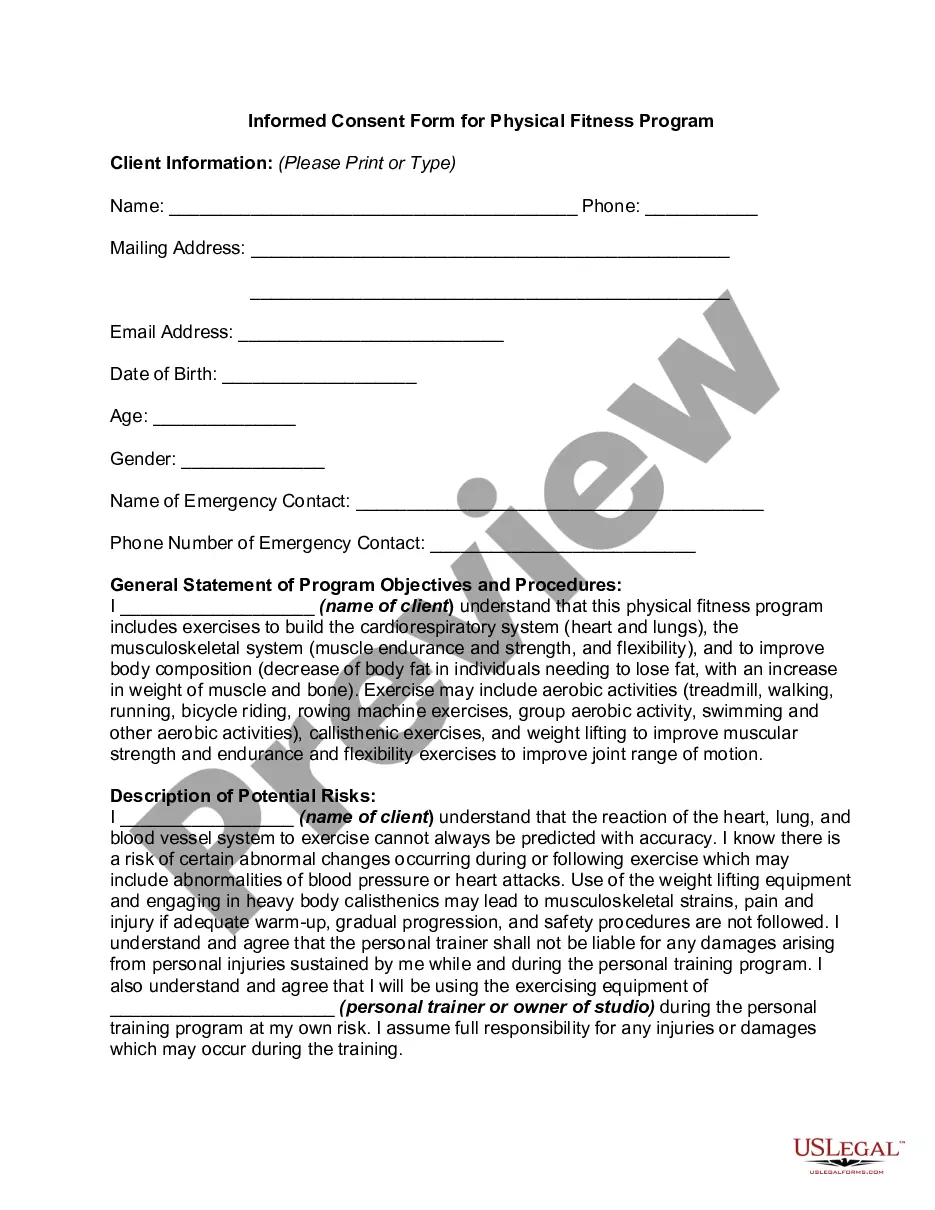

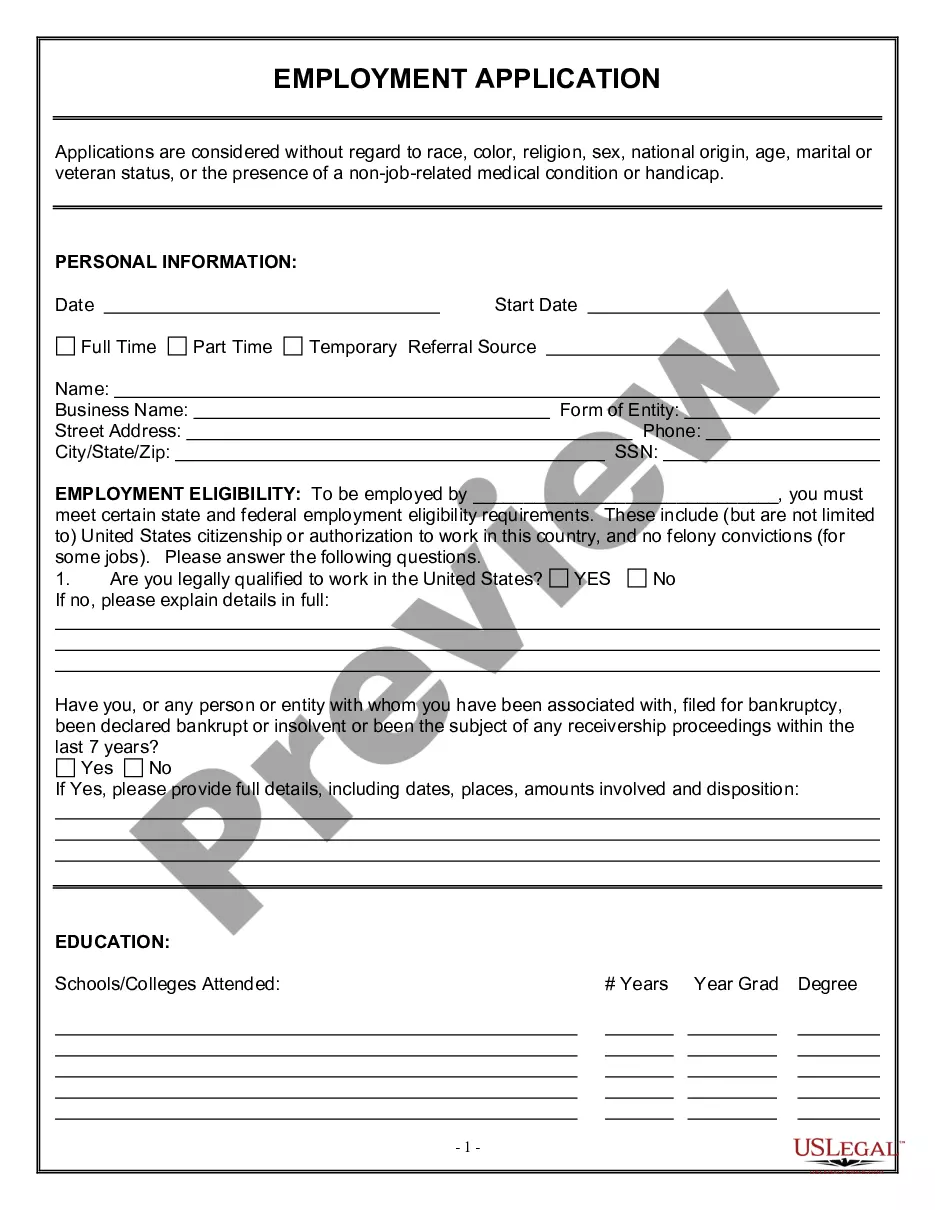

US Legal Forms - one of the largest collections of legal documents in the United States - provides a broad selection of legal form templates that you can download or print.

By using the platform, you can discover thousands of forms for business and personal purposes, categorized by types, states, or keywords.

You can access the latest versions of forms like the Florida Independent Sales Representative Agreement with Developer of Computer Software containing Provisions Designed to Meet the IRS's 20 Part Test for Determining Independent Contractor Status in moments.

If the form does not meet your needs, use the Search box at the top of the screen to find the one that does.

If you are satisfied with the form, confirm your choice by clicking the Buy now button. Then, choose the payment plan you prefer and provide your details to register for an account.

- If you have a subscription, Log In to obtain the Florida Independent Sales Representative Agreement with Developer of Computer Software containing Provisions Designed to Meet the IRS's 20 Part Test for Determining Independent Contractor Status from your US Legal Forms library.

- The Download button will be visible on each form you view.

- You can access all previously acquired forms from the My documents section of your account.

- If you want to use US Legal Forms for the first time, here are simple instructions to get started.

- Ensure you have selected the correct form for your city/state.

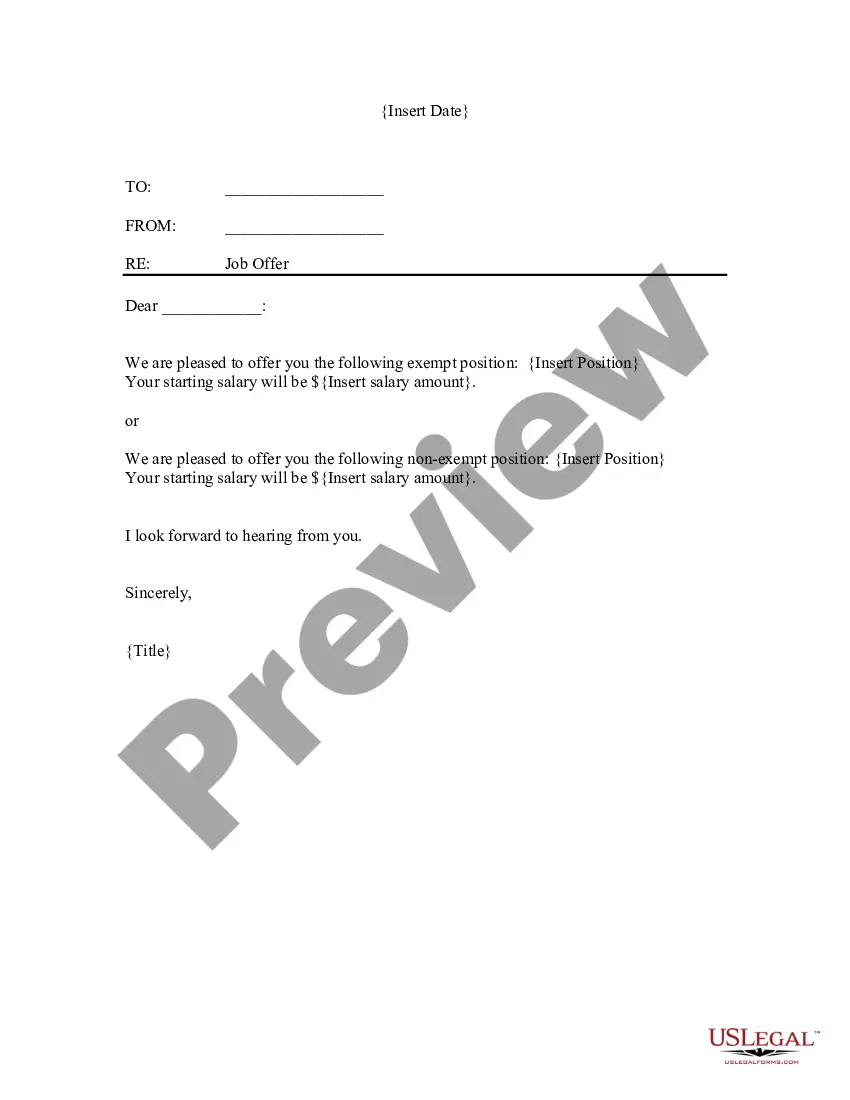

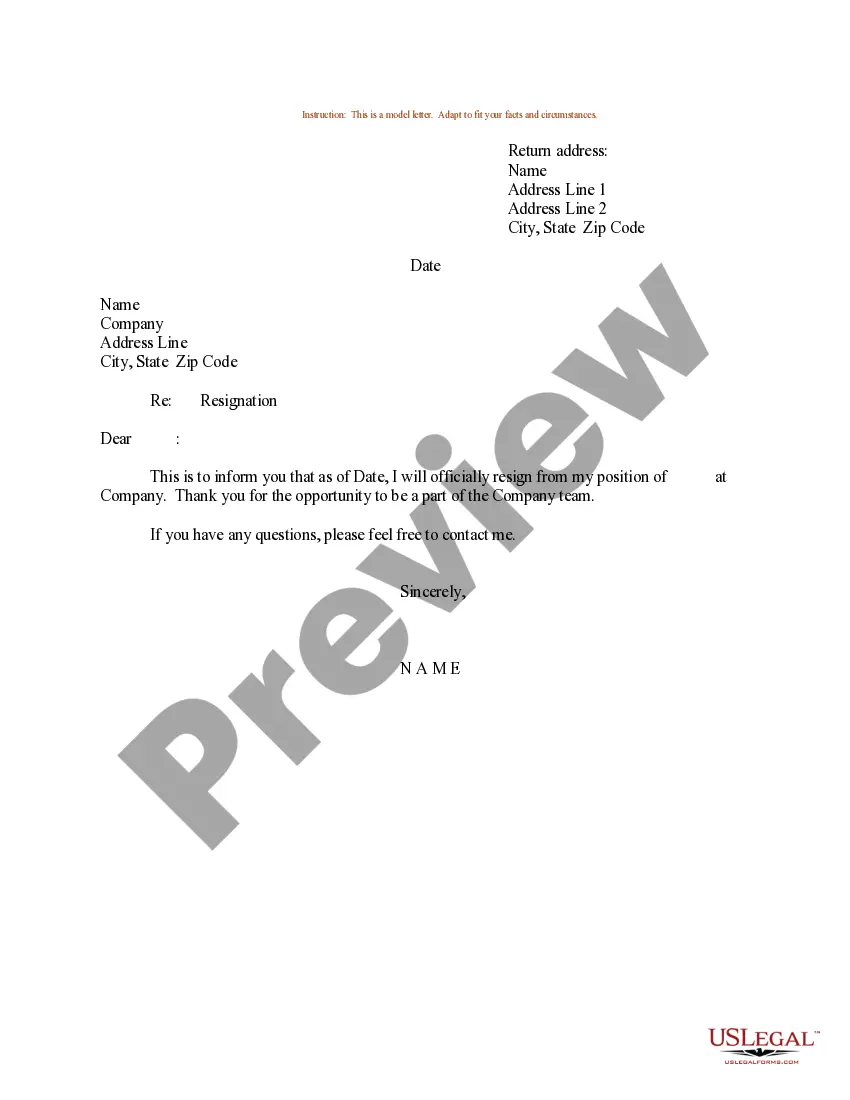

- Click the Preview button to review the content of the form.

Form popularity

FAQ

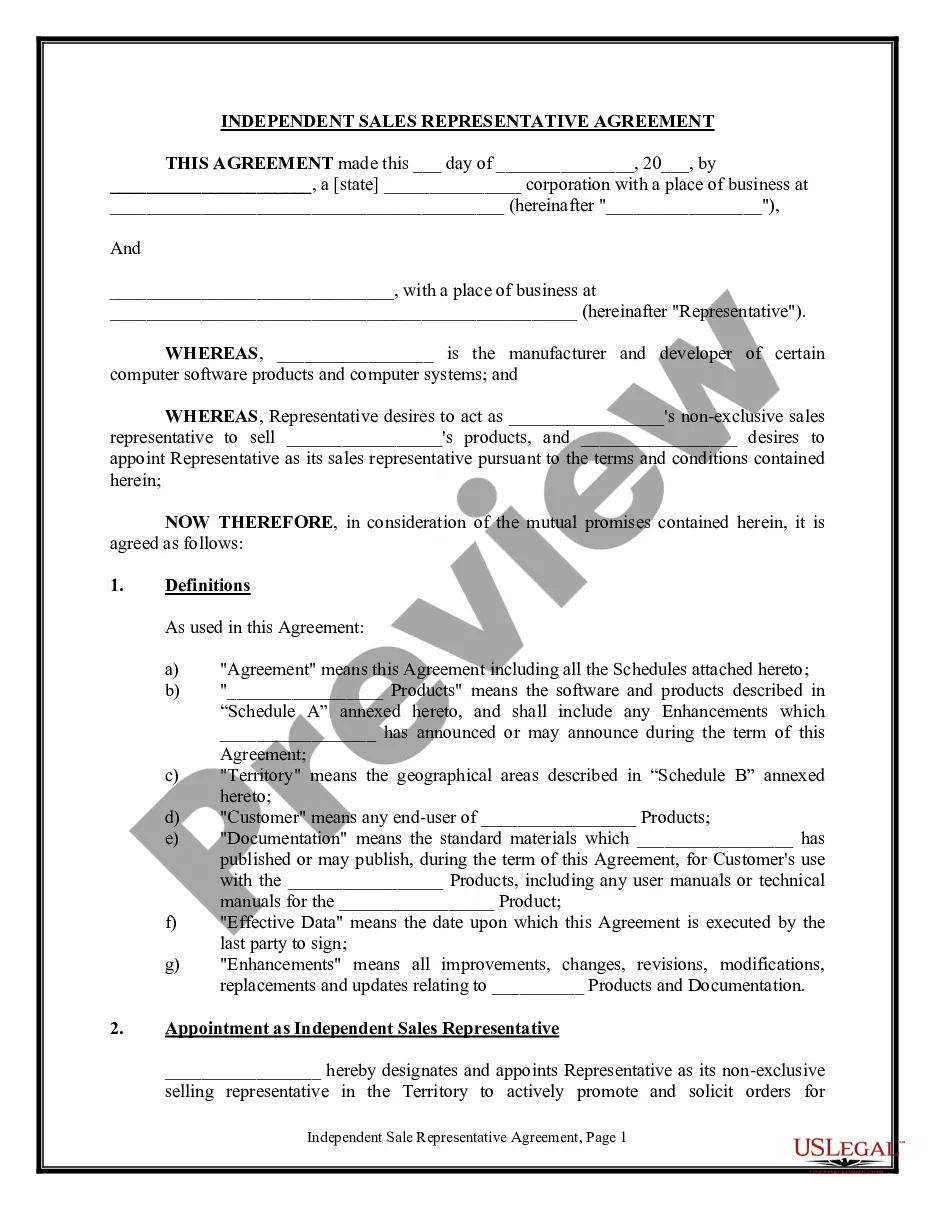

A sales agency agreement defines what the terms are when a sales agent acts as an independent contractor for a company. They will promote the company's services or products in exchange for the commission on each sale that comes through. This contract is very similar to a general independent contractor agreement.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

Instead of providing a W-2 for traditional employees to report pay, you issue a 1099-MISC to independent contractors to whom you paid more than $600 over the course of the year. They, in turn, pay their own self-employment taxes.

These factors are: (1) the kind of occupation, with reference to whether the work usually is done under the direction of a supervisor or is done by a specialist without supervision; (2) the skill required in the particular occupation; (3) whether the employer or the individual in question furnishes the equipment used

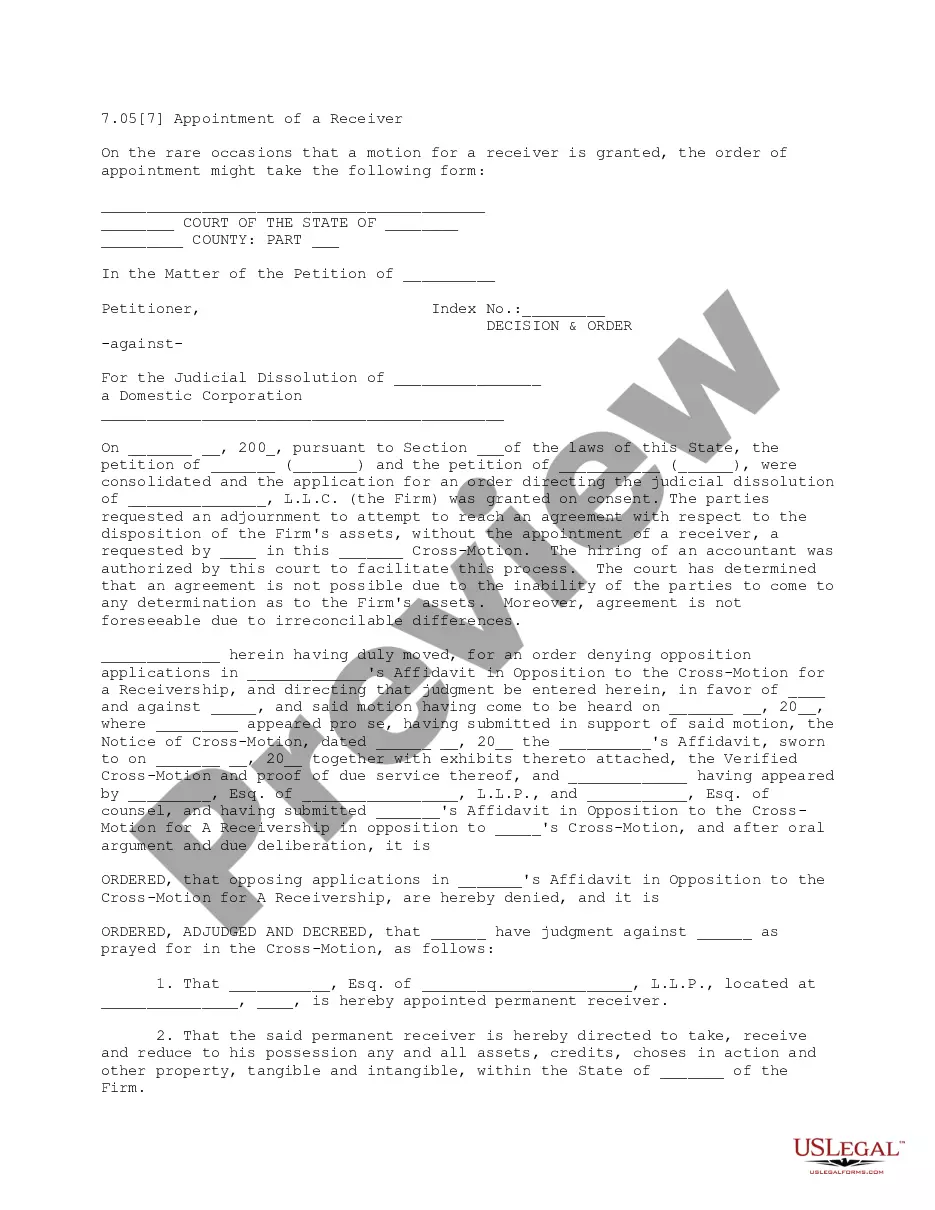

A worker does not have to meet all 20 criteria to qualify as an employee or independent contractor, and no single factor is decisive in determining a worker's status. The individual circumstances of each case determine the weight IRS assigns different factors.

A sales representative contract, sometimes known as a sales representative agreement, is a contract between a company and the contractor performing sales and marketing services on behalf of the company.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

Four ways to verify your income as an independent contractorIncome-verification letter. The most reliable method for proving earnings for independent contractors is a letter from a current or former employer describing your working arrangement.Contracts and agreements.Invoices.Bank statements and Pay stubs.

Independent contractors may have a registered legal business name, earned any necessary certifications or licenses, and pay their estimated taxes quarterly to the IRS.

A sales representative, quite simply, sells products or services for a company and represents their brand. They manage relationships with customers, serving as the key point of contact, from initial lead outreach to when a purchase is ultimately made.