Florida Checking Log

Description

How to fill out Checking Log?

Are you presently in a position where you require documents for either corporate or personal uses almost all the time.

There are numerous legal document templates accessible online, but finding versions you can trust is challenging.

US Legal Forms offers thousands of forms, such as the Florida Checking Log, which are designed to comply with state and federal requirements.

Once you find the correct form, click Buy now.

Choose the payment plan you wish, enter the necessary information to set up your payment, and complete the transaction using your PayPal or Visa/MasterCard.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Florida Checking Log template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Select the form you need and ensure it is for the appropriate city/region.

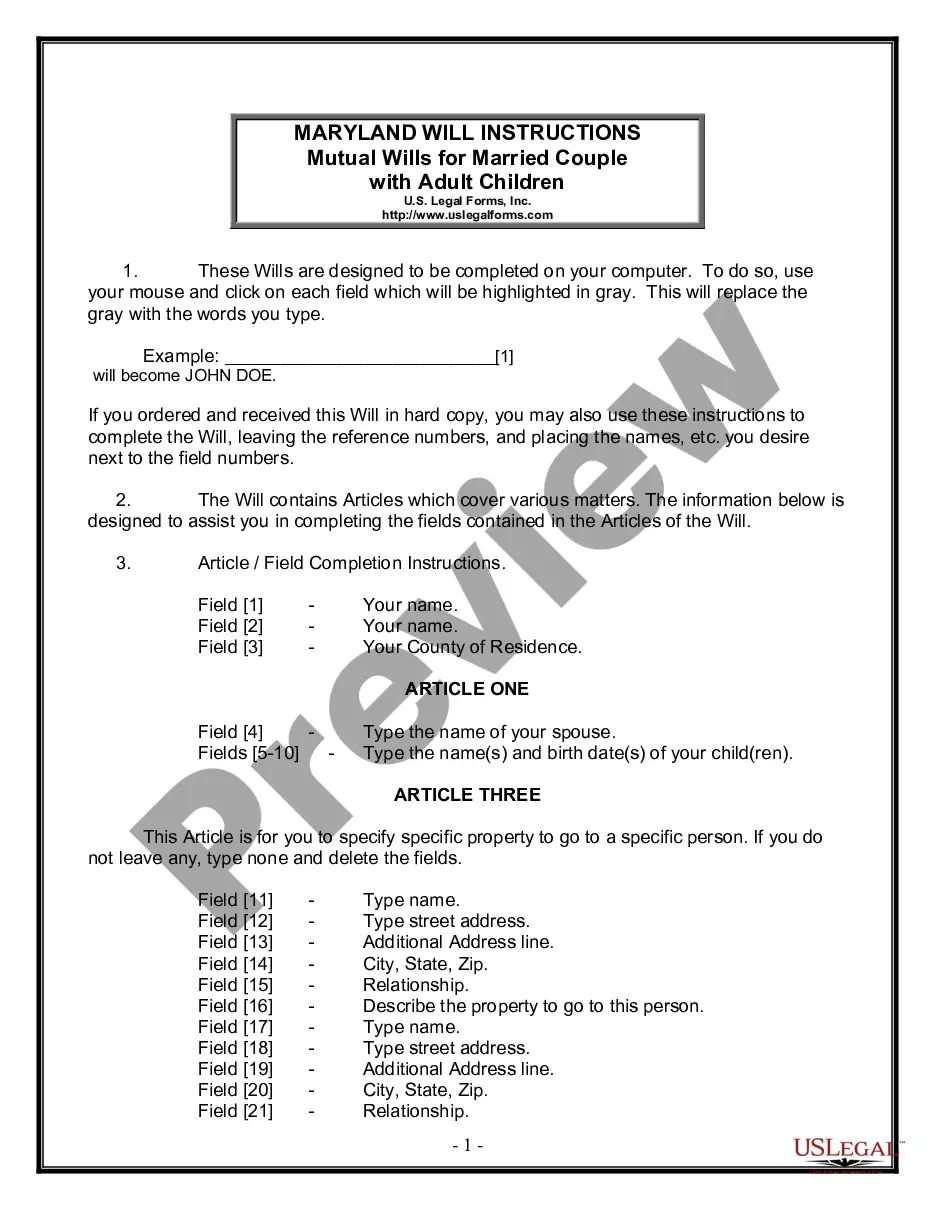

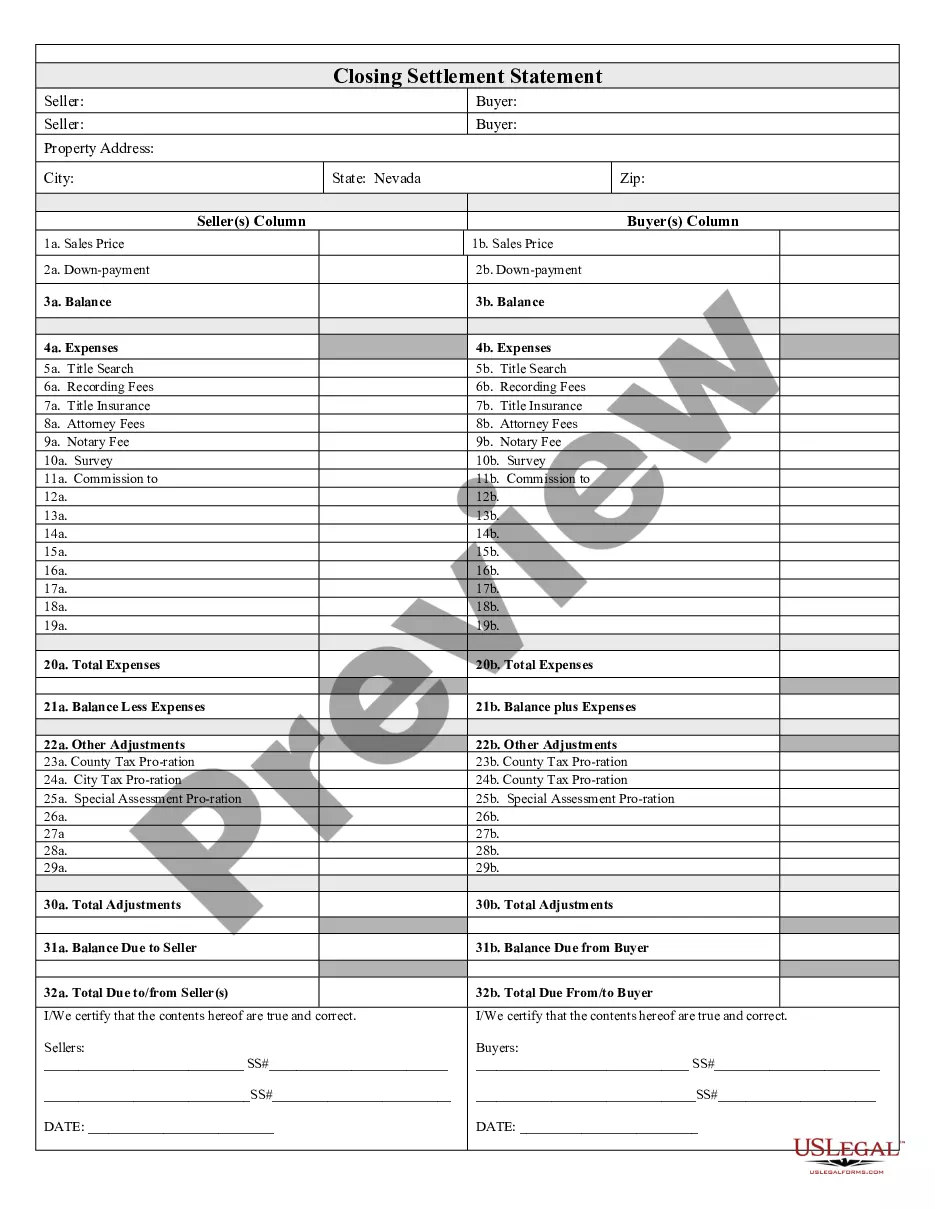

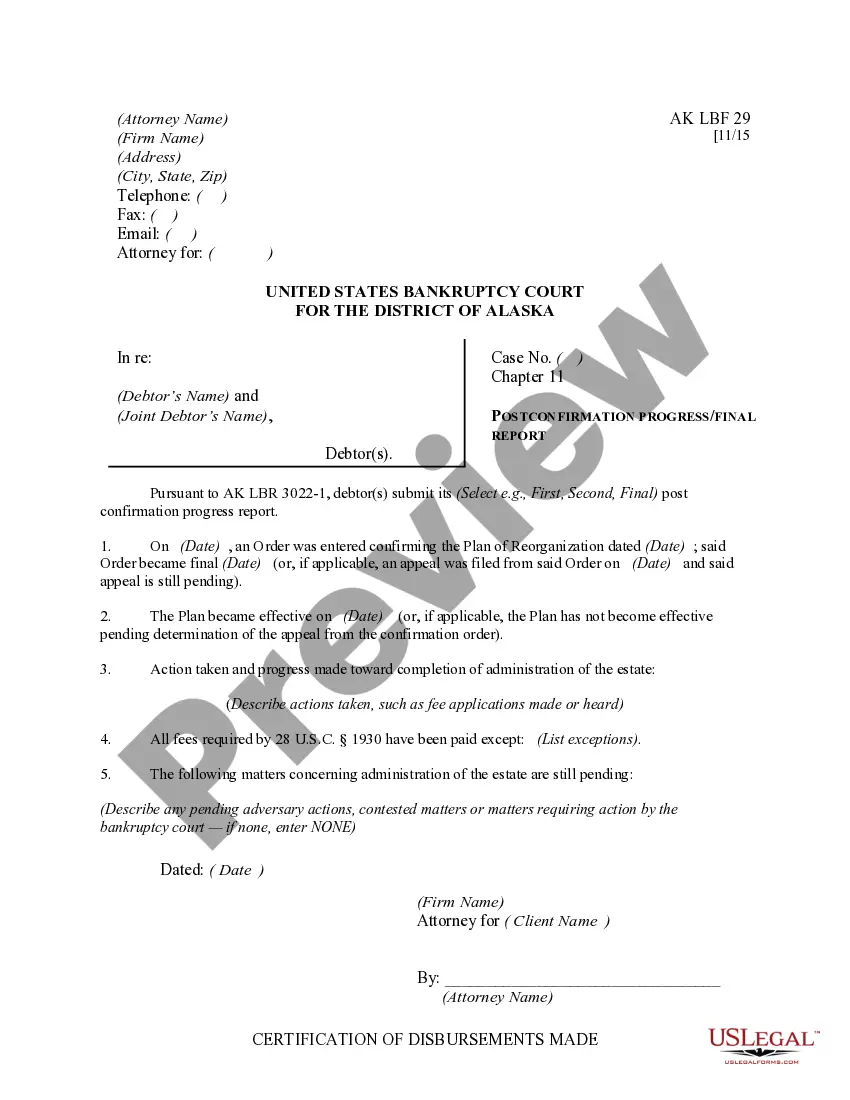

- Utilize the Review option to preview the form.

- Check the description to ensure you have selected the correct document.

- If the form isn't what you are looking for, use the Search field to find the form that matches your needs.

Form popularity

FAQ

BeenVerified memberships come in two value plans: 1-Month Membership $22.86 a month. 3-Month Membership $14.86 a month.

A landlord will not be allowed to just have a blanket policy or procedure allowing for the denial of rental applicants with any criminal record of conviction. HUD indicates that criminal arrests and even in certain cases, prior criminal convictions will not be sufficient to deny housing to a rental applicant.

Information is considered outdated if it is more than seven years old for negative information or for bankruptcies more than 10 years old. It could be a violation of the Fair Housing Act for a landlord to have a blanket policy of refusing to rent to anyone with a criminal record.

How Far Back Do They Check? Generally, background checks look at your credit and employment history for the past 7-10 years.

The services at BeenVerified are not free, and users must pay for access through either a one- or three-month billing plan. BeenVerified has an opt-out process for anyone wanting to remove their own information from the site.

Yes, criminal records are public records under the Florida Sunshine Laws and members of the public have the right to access the documents unless specifically restricted by statute or court order.

BeenVerified has a consumer rating of 2.88 stars from 316 reviews indicating that most customers are generally dissatisfied with their purchases. Consumers complaining about BeenVerified most frequently mention credit card, day trial and criminal records problems. BeenVerified ranks 6th among Background Check sites.

But, for the most part, anyone can go to a court clerk's office (and, sometimes, on a court or state agency website) and search the files for records of conviction for a certain person. Sealed records. An exception to the public access rules applies when convictions have been sealed by the court from public view.

All Federal court records are available online at PACER.gov, an electronic public access service that is overseen by the Administrative Office of the United States Courts. This includes all Federal civil court cases, criminal charges, as well as bankruptcies. In all, there are over 500 million documents on PACER.

SUMMARY: Police crime and arrest reports are public records subject to public inspection as provided in s. 119.07(1), F. S., and the custodian of public records must supply copies of any public record under his control upon payment of fees as set out in the Public Records Law.