Title: Understanding the Florida Irrevocable Pot Trust Agreement: Types and Overview Introduction: The Florida Irrevocable Pot Trust Agreement is a legal arrangement designed to provide individuals in Florida with a versatile estate planning tool. By setting up this trust, individuals can ensure the efficient administration and distribution of their estate to beneficiaries, allowing for asset protection, tax benefits, and flexible distribution options. In this article, we will delve into the intricacies of the Florida Irrevocable Pot Trust Agreement, exploring its types and benefits associated with this estate planning tool. Types of Florida Irrevocable Pot Trust Agreements: 1. Traditional Florida Irrevocable Pot Trust Agreement: The traditional Florida Irrevocable Pot Trust Agreement establishes a trust where assets are placed in an irrevocable manner, meaning they cannot be modified, amended, or revoked without the consent of the beneficiaries. This type of trust offers significant asset protection and estate tax planning benefits. 2. Florida Irrevocable Pot Trust Agreement with Medicaid Planning: This specific type of Florida Irrevocable Pot Trust Agreement allows individuals to engage in Medicaid planning by using the trust to distribute assets in a way that preserves eligibility for Medicaid benefits. It ensures that assets are protected from being counted in Medicaid asset tests. Key Features of the Florida Irrevocable Pot Trust Agreement: 1. Granter and Beneficiary: The granter, who creates the trust, transfers assets into the trust, while the beneficiaries are individuals or entities designated to receive the benefits from the trust. The granter can also be a beneficiary, but not the sole beneficiary. 2. Irrevocability: Once assets are transferred to the trust, they become irrevocable, and the granter cannot reclaim ownership or control over them. This ensures the trust's integrity and protects the assets from numerous factors, such as taxes, creditors, and mismanagement. 3. Asset Protection: The Florida Irrevocable Pot Trust Agreement shields assets from creditors, lawsuits, and potential claims while providing beneficiaries with a stream of income. In this way, the trust safeguards assets for future generations or specific purposes. 4. Tax Planning: This type of trust can offer tax benefits and mitigation strategies, including reducing estate taxes, gift taxes, and generation-skipping transfer taxes. It enables efficient wealth transfer for beneficiaries, minimizing potential tax burdens. 5. Flexible Distribution Schedule: The Florida Irrevocable Pot Trust Agreement allows the granter to establish flexible distribution schedules for beneficiaries, specifying when and under what conditions they will receive distributions. This can include age-based or milestone-based distributions, ensuring assets are distributed responsibly. Conclusion: The Florida Irrevocable Pot Trust Agreement represents a valuable legal tool for individuals seeking comprehensive estate planning in Florida. With its irrevocable nature, asset protection, and tax planning advantages, this trust offers individuals peace of mind while navigating complex financial matters. Whether setting up a traditional agreement or incorporating Medicaid planning, individuals in Florida can tailor this trust to meet their specific needs, facilitating the smooth transfer of assets to intended beneficiaries for years to come.

Florida Irrevocable Pot Trust Agreement

Description

How to fill out Florida Irrevocable Pot Trust Agreement?

If you need to complete, acquire, or print lawful record themes, use US Legal Forms, the biggest assortment of lawful varieties, that can be found online. Use the site`s simple and convenient lookup to get the files you will need. Different themes for company and person uses are sorted by groups and claims, or key phrases. Use US Legal Forms to get the Florida Irrevocable Pot Trust Agreement with a few mouse clicks.

When you are presently a US Legal Forms buyer, log in to your profile and click on the Acquire option to get the Florida Irrevocable Pot Trust Agreement. You can even accessibility varieties you formerly downloaded inside the My Forms tab of the profile.

If you use US Legal Forms for the first time, follow the instructions below:

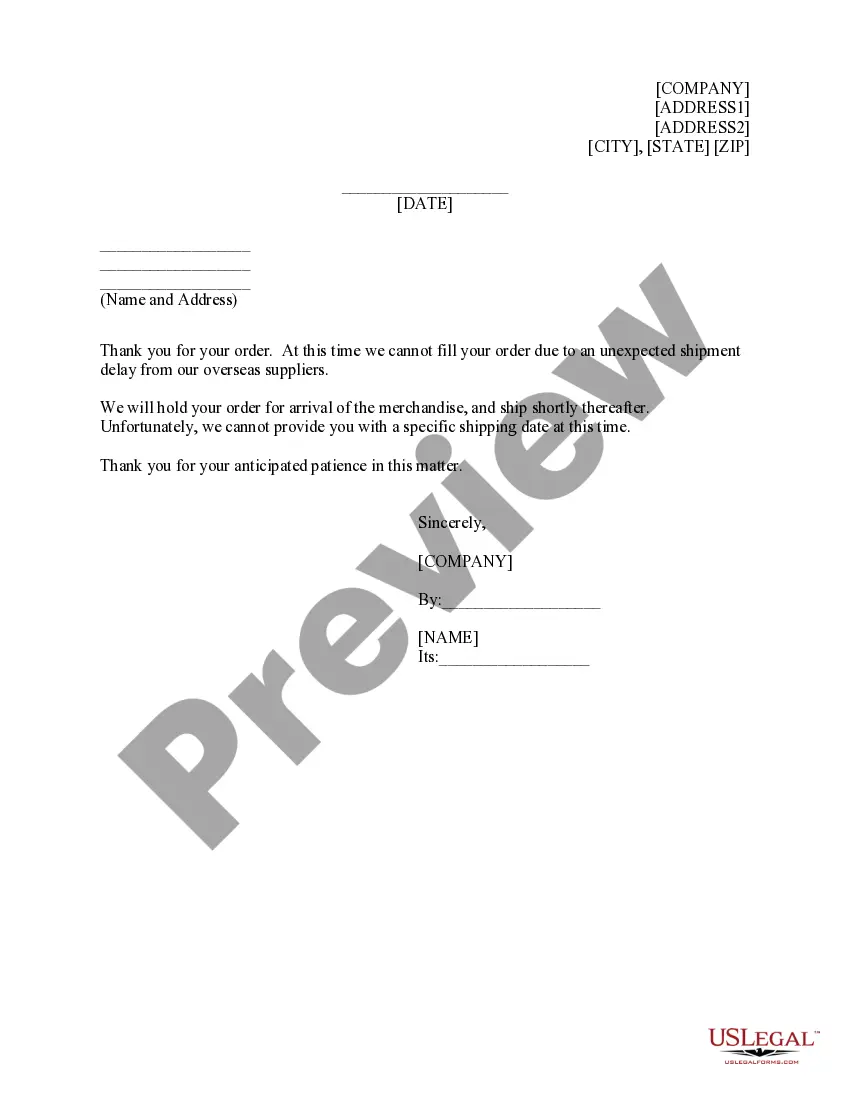

- Step 1. Be sure you have chosen the shape to the appropriate metropolis/land.

- Step 2. Make use of the Review solution to look through the form`s content. Don`t overlook to read the explanation.

- Step 3. When you are unsatisfied together with the form, utilize the Research field on top of the display to get other models of your lawful form format.

- Step 4. After you have discovered the shape you will need, click the Buy now option. Select the pricing prepare you choose and include your accreditations to sign up for an profile.

- Step 5. Process the deal. You can utilize your charge card or PayPal profile to accomplish the deal.

- Step 6. Pick the format of your lawful form and acquire it in your system.

- Step 7. Full, edit and print or indicator the Florida Irrevocable Pot Trust Agreement.

Every single lawful record format you acquire is the one you have forever. You might have acces to each form you downloaded with your acccount. Click the My Forms segment and pick a form to print or acquire again.

Be competitive and acquire, and print the Florida Irrevocable Pot Trust Agreement with US Legal Forms. There are thousands of expert and status-certain varieties you can use for your personal company or person requirements.