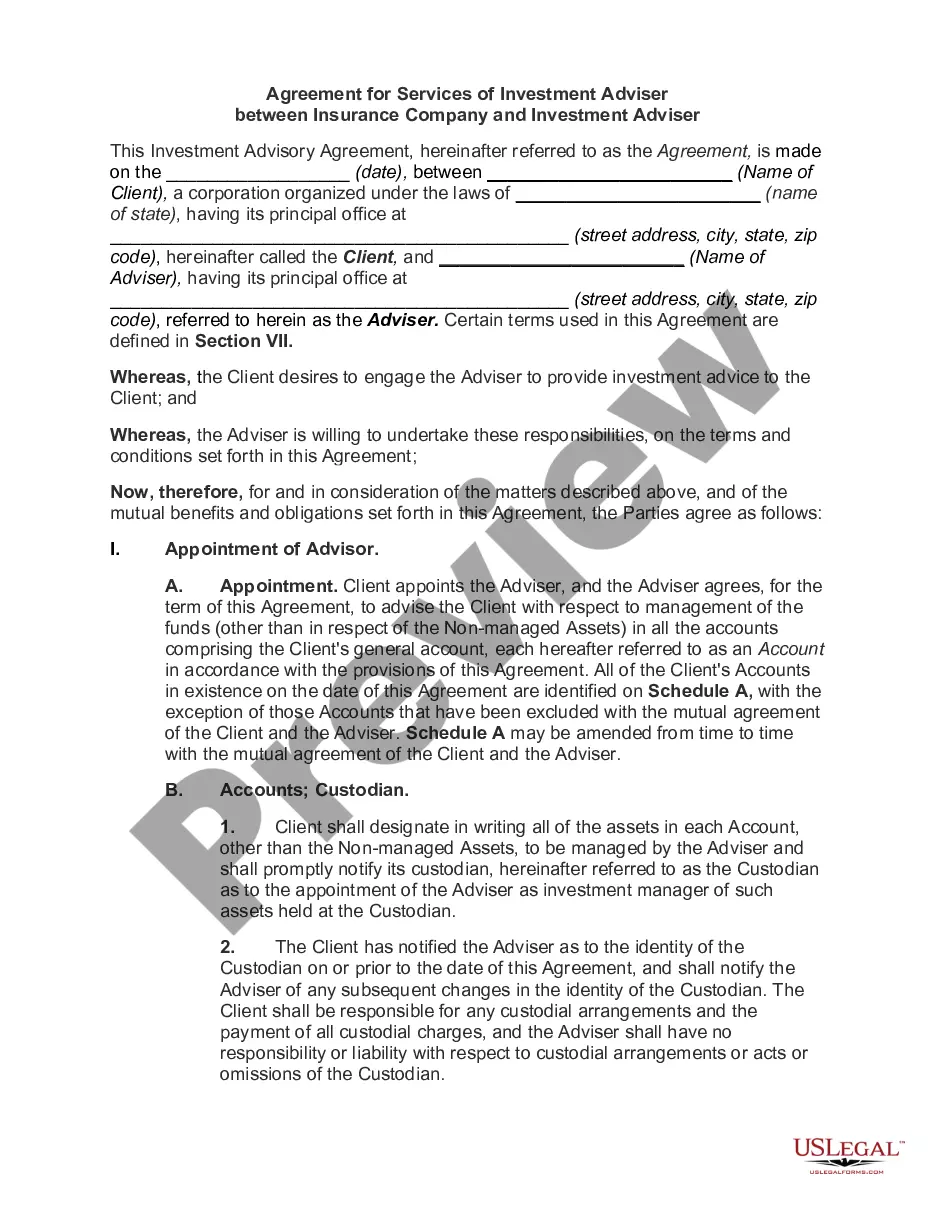

Florida Investment Management Agreement for Separate Account Clients

Description

How to fill out Investment Management Agreement For Separate Account Clients?

You might spend hours online trying to locate the legal document format that satisfies the state and federal requirements you need.

US Legal Forms offers a multitude of legal documents that have been verified by professionals.

You can download or print the Florida Investment Management Agreement for Separate Account Clients from my services.

If available, utilize the Review option to preview the document format at the same time. If you wish to obtain another version of the form, use the Search field to find the format that meets your needs.

- If you possess a US Legal Forms account, you can sign in and select the Download option.

- Afterward, you can complete, modify, print, or sign the Florida Investment Management Agreement for Separate Account Clients.

- Each legal document format you purchase is yours forever.

- To obtain an additional copy of any purchased form, access the My documents tab and select the relevant option.

- If this is your first time using the US Legal Forms website, follow the simple instructions provided below.

- First, ensure that you have selected the correct document format for the area/city of your choice.

- Review the form description to confirm that you have picked the right form.

Form popularity

FAQ

Managed Account Agreement means an agreement between a Filer and a Client, pursuant to which the Filer provides discretionary management services to the Client; Sample 1. Managed Account Agreement means a written agreement in respect of an Account.

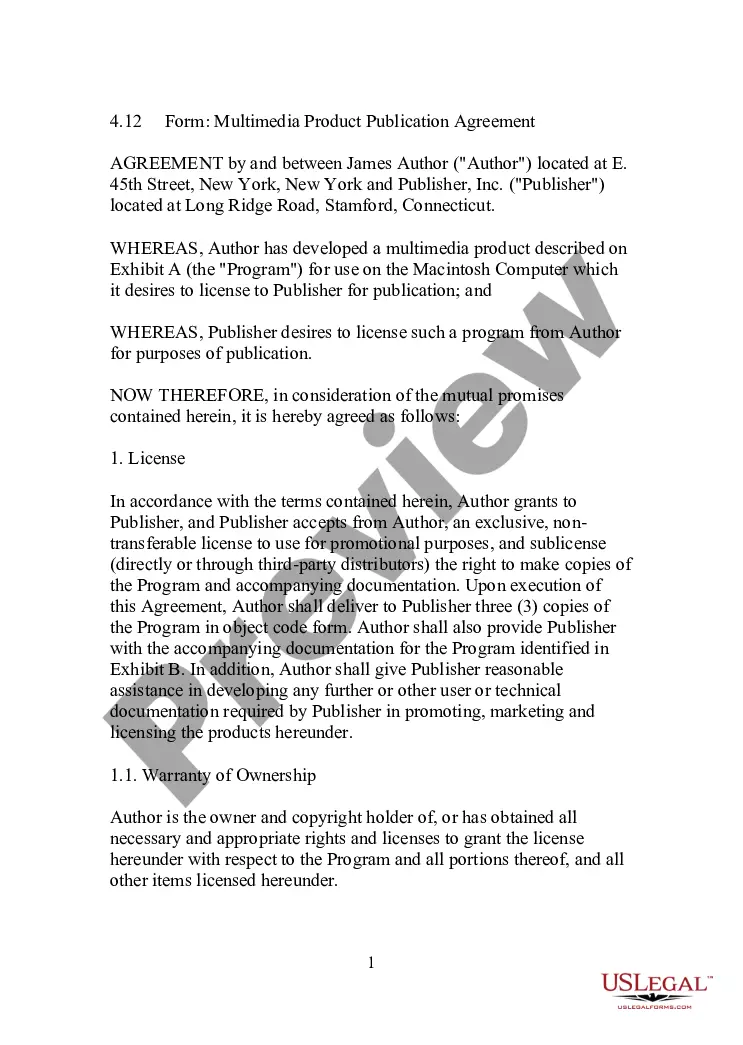

Investment management agreements (IMAs) are legal documents that give investment managers the authority to manage capital on behalf of investors. They detail the terms and conditions under which a client will invest in a shared vehicle while agreeing to pay investment management service fees and direct expenses.

Portfolio Management Agreement means an agreement to be entered into by the Issuer, the Trustee and the Portfolio Manager on the Issue Date pursuant to which the Portfolio Manager will perform certain management functions with respect to the Reference Portfolio.

Asset managers and investment managers both aim to make decisions that earn their clients the most profit possible. Asset management focuses on handling a client's physical assets, while investment management is a more general term for handling a client's investments.

To Keep Funds Safe & Secure. To Grow Your Funds Exponentially. To Earn a Steady & Additional Source of Income. Minimize Income Tax Burden.

Investment management agreements (IMAs) are legal documents that give investment managers the authority to manage capital on behalf of investors. They detail the terms and conditions under which a client will invest in a shared vehicle while agreeing to pay investment management service fees and direct expenses.

The portfolio manager shall furnish periodically a report to the client, as per the agreement, but not exceeding a period of three months and such report shall contain the following details, namely: - (a) the composition and the value of the portfolio, description of securities and goods, number of securities, value of

Investment management refers to the handling of financial assets and other investmentsnot only buying and selling them. Management includes devising a short- or long-term strategy for acquiring and disposing of portfolio holdings. It can also include banking, budgeting, and tax services and duties, as well.

The management agreement is a legally binding agreement, signed by both the Investment Manager and the General Partner on behalf of the Fund. This template contains practical guidance and drafting notes.

Wealth management is a branch of financial services dealing with the investment needs of affluent clients. These are specialised advisory services catering to the investment management needs of affluent clients.