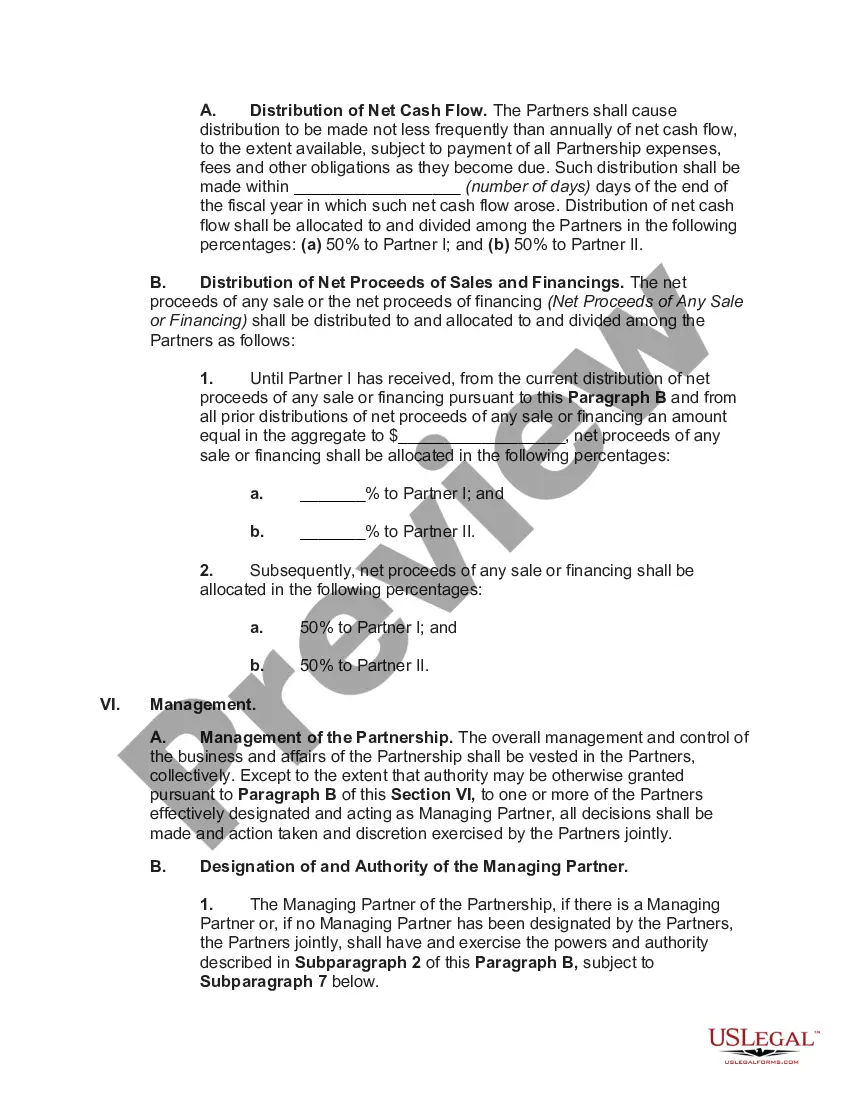

A Florida Partnership Agreement for a Real Estate Development outlines the legal contract formed between two or more individuals or entities who have agreed to collaborate on a real estate development project in the state of Florida. This document serves as a roadmap to guide the partnership throughout the entire development process, ensuring clarity, accountability, and the allocation of responsibilities. Various types of Partnership Agreements for a Real Estate Development exist in Florida to cater to different partnership structures and objectives. Some of these different types include: 1. General Partnership Agreement: This type of partnership agreement is formed when two or more parties agree to contribute money, skills, labor, or property to a real estate development project. They share equal rights and responsibilities, as well as management and decision-making authority. 2. Limited Partnership Agreement: In this type of partnership agreement, there are two categories of partners: general partners and limited partners. General partners have management control and personal liability, while limited partners contribute capital but have limited involvement in the daily operations and are not personally liable for partnership debts beyond their capital contribution. 3. Limited Liability Partnership Agreement: This type of partnership agreement combines the benefits of a general partnership and limited liability company (LLC). It allows partners to have limited personal liability for the partnership's debts and obligations while providing the flexibility of a partnership structure. 4. Joint Venture Agreement: A joint venture agreement is similar to a partnership agreement, but it is formed for a specific real estate development project rather than an ongoing partnership. Parties collaborate and pool resources for a specific objective, sharing profits, losses, and risks according to the agreed-upon terms. Regardless of the type, a Florida Partnership Agreement for a Real Estate Development typically includes several important components: a. Identification of the partners: List the legal names and addresses of all partners involved in the agreement. b. Purpose and goals of the partnership: Clearly define the specific real estate development project's objectives, target market, and expected outcomes. c. Capital contributions: Detail the amount of capital each partner will contribute to the project. Specify whether contributions will be in cash, property, services, or a combination. d. Profit and loss allocation: Specify how the profits and losses from the real estate development project will be distributed among the partners, generally based on the percentage of their capital contributions or partnership agreement. e. Management and decision-making: Describe the decision-making process and the roles and responsibilities of each partner. Determine whether decisions require a unanimous vote or can be made by a majority. f. Dispute resolution: Outline mechanisms for resolving conflicts and disputes that may arise during the development process, such as mediation or arbitration. g. Duration and termination: Specify the duration of the partnership and the conditions under which it can be terminated or extended, including events such as bankruptcy or death of a partner. h. Governing law: Specify that the agreement is governed by the laws of the state of Florida, ensuring that any legal disputes or interpretations will be resolved based on Florida statutes. A carefully drafted Florida Partnership Agreement for a Real Estate Development is crucial to protect the interests and rights of all parties involved and ensure a successful and smooth real estate development venture.

Florida Partnership Agreement for a Real Estate Development

Description

How to fill out Florida Partnership Agreement For A Real Estate Development?

If you want to aggregate, download, or print legal document samples, utilize US Legal Forms, the largest assortment of legal templates available online.

Employ the site’s straightforward and convenient search function to locate the documents you require.

Numerous templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you wish to use, click the Download now button. Choose the payment plan you prefer and provide your information to register for an account.

Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Utilize US Legal Forms to find the Florida Partnership Agreement for a Real Estate Development with just a few clicks.

- If you are already a US Legal Forms customer, sign in to your account and click on the Download button to obtain the Florida Partnership Agreement for a Real Estate Development.

- You can also access forms you previously downloaded from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct area/state.

- Step 2. Use the Preview option to review the content of the form. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search area at the top of the screen to find other versions of the legal document template.

Form popularity

FAQ

The main considerations to include in a partnership agreement are partner contributions, profit-sharing arrangements, the decision-making process, procedures for adding or removing partners, and steps for dispute resolution. These aspects help maintain a clear understanding among partners and prevent conflicts. A comprehensive Florida Partnership Agreement for a Real Estate Development should incorporate all these elements.

Filling out a partnership agreement involves outlining the necessary details such as partner names, roles, and financial contributions. Be thorough and ensure all terms reflect the partnership's goals, especially when related to a Florida Partnership Agreement for a Real Estate Development. You can utilize platforms like uslegalforms to simplify this process and ensure compliance with legal requirements.

To form a partnership, you need intent to create a partnership, an agreement between the partners, a lawful business purpose, shared profits, and joint management responsibilities. These elements establish the foundation of collaboration among partners. A Florida Partnership Agreement for a Real Estate Development solidifies these factors and creates a clear framework.

A solid partnership agreement should stipulate the roles of each partner, the financial contributions, profit sharing, responsibilities, and terms of dissolution. Additionally, it should lay out guidelines for decision-making and what happens in case of a disagreement. A Florida Partnership Agreement for a Real Estate Development will ensure each partner knows their obligations.

An example of a real estate partnership is two investors pooling their resources to buy and develop a commercial property. They may agree to share the profits based on their initial investments. By using a Florida Partnership Agreement for a Real Estate Development, these partners can clearly outline their roles and expectations.

When drafting a Florida Partnership Agreement for a Real Estate Development, key considerations include defining the scope of work, profit sharing, and decision-making processes. Additionally, include conflict resolution mechanisms to address any disputes that may arise. Clear terms help create a stable partnership and improve collaboration among partners.

You can write your own partnership agreement, but it is essential to ensure it covers all necessary details. A well-structured Florida Partnership Agreement for a Real Estate Development can protect your interests and clarify roles. Consider consulting legal advice to fine-tune your document and to avoid common pitfalls.

If you find yourself without a partnership agreement, it is essential to take immediate steps to create one. First, communicate openly with your partners about each party's expectations and objectives. Then, consider using platforms like uslegalforms to draft a comprehensive Florida Partnership Agreement for a Real Estate Development that suits your needs. This proactive approach can help safeguard your business and strengthen your partnership.

When there is no written Florida Partnership Agreement for a Real Estate Development, partners may face difficulties proving their rights and obligations. Verbal agreements can lead to misunderstandings, as they are harder to enforce in a legal context. Additionally, without documentation, resolving disputes can become complicated and costly. A written agreement provides clear, enforceable terms that protect all parties involved.

In the absence of a partnership agreement, Florida law may impose default rules that may not reflect the partners' intentions. This can result in imbalanced decision-making authority and profit distribution. Such uncertainties can harm your real estate development project and potentially lead to legal issues. It's wise to establish a Florida Partnership Agreement for a Real Estate Development to safeguard your interests.