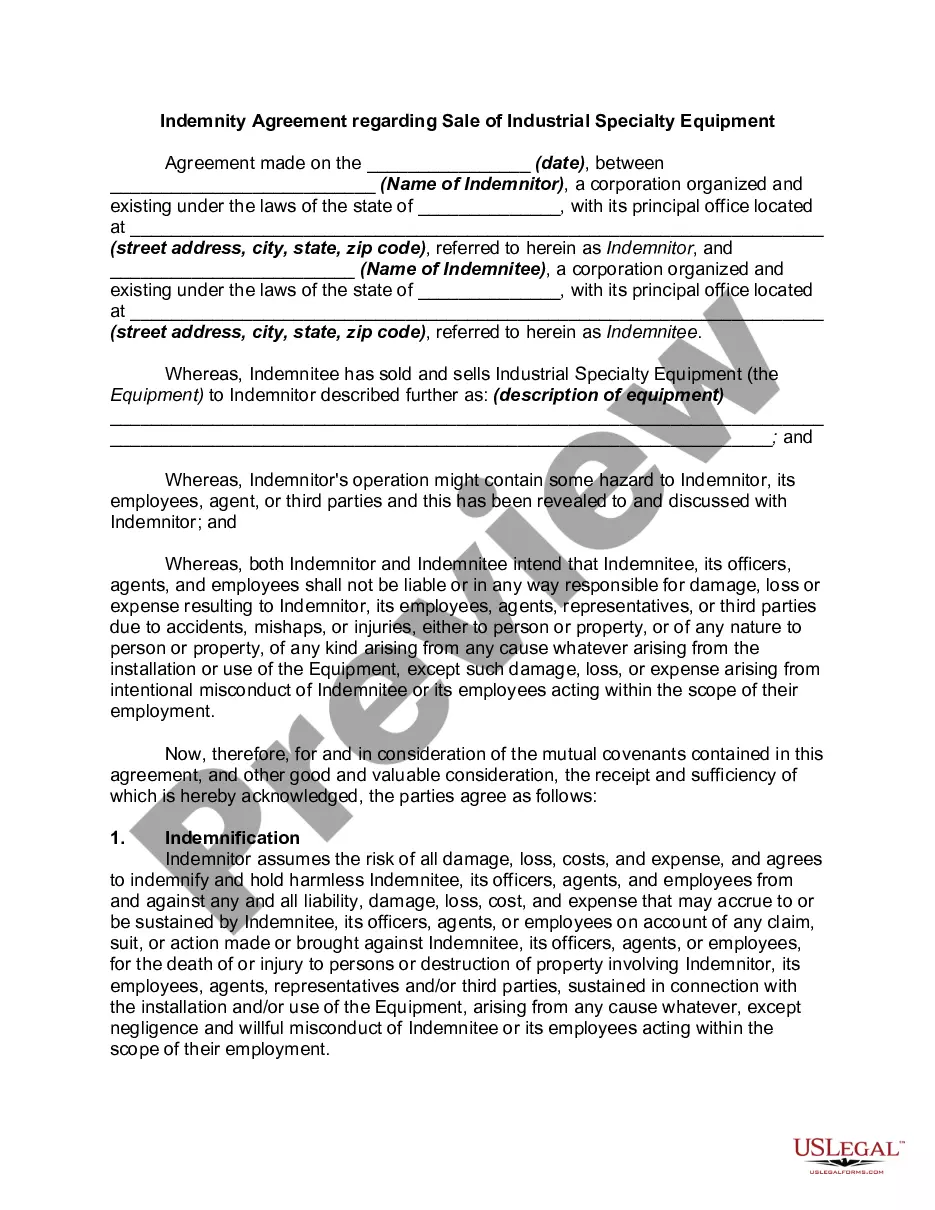

Florida Credit Information Request is a process that allows individuals or organizations to obtain various credit-related information in the state of Florida. This information is vital for those seeking to make informed decisions about credit applications, loan approvals, rental applications, employment screenings, or any other situation where creditworthiness assessment is required. The Florida Credit Information Request provides access to important details pertaining to an individual's credit history, payment patterns, outstanding debts, credit utilization, credit inquiries, public records, and other pertinent financial information. Obtaining this data plays a crucial role in assessing creditworthiness, identifying potential risks, and ensuring responsible lending practices. There are several types of Florida Credit Information Requests available, each serving specific purposes and catering to different needs: 1. Personal Credit Information Request: This type of request involves individuals seeking information about their personal credit reports and scores. It enables them to review their credit history, identify inaccuracies, and take necessary actions to improve their creditworthiness. 2. Business Credit Information Request: This type caters to entities like companies, partnerships, or sole proprietorship. It allows businesses to access their commercial credit reports, providing insights into payment trends, credit limits, trade lines, and financial stability. This information is crucial for making informed decisions regarding business expansions, partnerships, or loan applications. 3. Landlord Credit Information Request: Landlords or property managers often request credit reports from potential tenants to assess their financial responsibility, previous rental history, and potential risks. Requesting a credit report helps landlords gauge an applicant's ability to pay rent on time and maintain a stable tenancy. 4. Employment Credit Information Request: Some employers request credit reports as part of their hiring process, especially for positions involving financial responsibilities or access to sensitive data. This request helps employers evaluate an applicant's financial integrity, reliability, and potential risks that may affect their job performance or create conflicts of interest. 5. Creditors and Lenders Credit Information Request: Creditors and lenders, such as banks, credit unions, mortgage lenders, or auto financing companies, make credit information requests to evaluate an individual's creditworthiness and determine loan eligibility, interest rates, or credit limits. By providing a thorough understanding of an individual's or business's credit profile and financial stability, Florida Credit Information Requests empower individuals, organizations, and institutions to make informed decisions, mitigate risks, and uphold responsible lending and financial practices.

Florida Credit Information Request

Description

How to fill out Florida Credit Information Request?

Are you currently in a position where you need to have paperwork for both company or personal uses virtually every day? There are a variety of legal record themes available on the Internet, but discovering types you can rely isn`t easy. US Legal Forms provides a large number of type themes, like the Florida Credit Information Request, which can be written to meet federal and state demands.

When you are previously knowledgeable about US Legal Forms internet site and have a merchant account, merely log in. Next, it is possible to acquire the Florida Credit Information Request format.

Unless you have an account and would like to begin to use US Legal Forms, follow these steps:

- Get the type you require and make sure it is to the correct metropolis/region.

- Make use of the Preview option to check the shape.

- See the outline to ensure that you have selected the correct type.

- In case the type isn`t what you`re trying to find, use the Lookup industry to obtain the type that fits your needs and demands.

- If you discover the correct type, just click Buy now.

- Select the prices prepare you need, submit the specified information to create your bank account, and pay money for the transaction making use of your PayPal or charge card.

- Pick a hassle-free paper structure and acquire your version.

Get every one of the record themes you possess purchased in the My Forms menus. You can obtain a further version of Florida Credit Information Request at any time, if possible. Just click the required type to acquire or produce the record format.

Use US Legal Forms, probably the most considerable assortment of legal varieties, to conserve some time and stay away from faults. The service provides professionally produced legal record themes which can be used for a range of uses. Produce a merchant account on US Legal Forms and commence generating your way of life easier.