Florida Insurance General Agency Agreement with Exclusive Representation for All Lines of Insurance is a legally binding contract between an insurance agency and a general agent in Florida. This agreement grants the general agent exclusive rights to represent and market all lines of insurance on behalf of the agency within the state. The purpose of the agreement is to establish a mutually beneficial partnership where the general agent acts as a representative and intermediary between the insurance agency and various insurers. This arrangement allows the agency to expand its reach and provide a broader range of insurance solutions to clients across multiple lines of coverage. Different types of Florida Insurance General Agency Agreements with Exclusive Representation for All Lines of Insurance can be categorized based on the specific lines of insurance covered. Some potential categories include: 1. Property and Casualty General Agency Agreement: This type of agreement focuses on representing property and casualty insurance products such as homeowners, auto, commercial property, and liability coverage. The general agent has exclusive representation rights for these lines of insurance within Florida. 2. Life and Health General Agency Agreement: This agreement is tailored towards representing life insurance, health insurance, and related products such as disability, long-term care, and annuities. The general agent has exclusive representation rights for these lines of insurance within Florida. 3. Commercial General Agency Agreement: This type of agreement is specific to commercial insurance lines, including general liability, workers' compensation, commercial auto, and commercial property coverage. The general agent is granted exclusive representation rights for these lines of insurance within Florida. 4. Specialty Insurance General Agency Agreement: This agreement focuses on representing specialty insurance lines, such as marine, aviation, professional liability, and specialty commercial coverages. The general agent holds exclusive representation rights for these lines of insurance within Florida. The Florida Insurance General Agency Agreement with Exclusive Representation for All Lines of Insurance typically outlines the roles and responsibilities of both the insurance agency and the general agent, including marketing and sales efforts, commission structures, termination clauses, and confidentiality agreements. It also highlights the specific lines of insurance covered and the geographical limitations within Florida, if any. In summary, the Florida Insurance General Agency Agreement with Exclusive Representation for All Lines of Insurance is a contractual arrangement providing exclusive marketing and representation rights to a general agent for various lines of insurance. By entering into such an agreement, insurance agencies can benefit from the expertise and connections of a general agent to expand their insurance offerings and reach within the state of Florida.

Florida Insurance General Agency Agreement with Exclusive Representation for All Lines of Insurance

Description

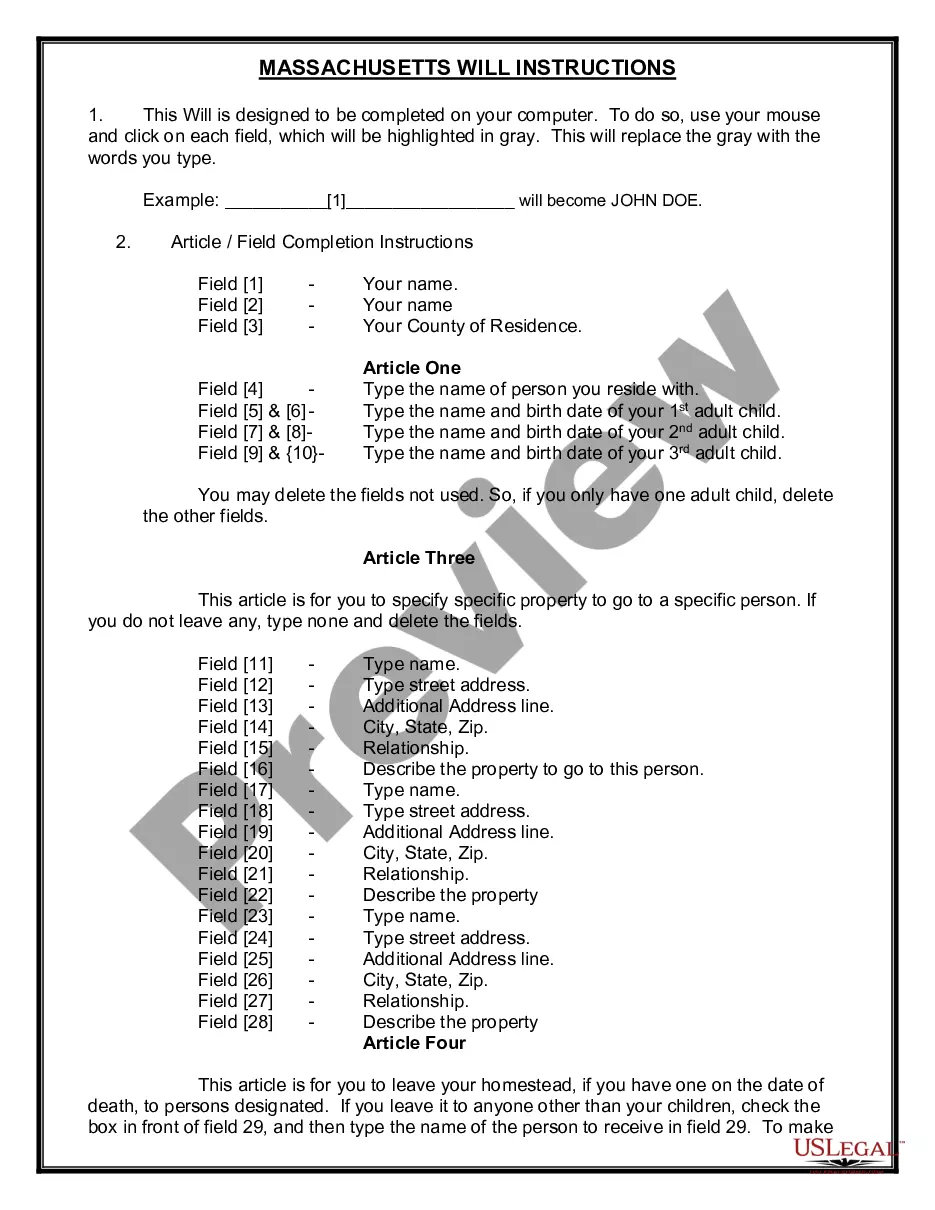

How to fill out Florida Insurance General Agency Agreement With Exclusive Representation For All Lines Of Insurance?

If you wish to be thorough, obtain, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the website's user-friendly and efficient search to find the documents you need.

Various templates for business and personal purposes are categorized by groups and states, or keywords.

Step 3. If you are not satisfied with the document, take advantage of the Search field at the top of the screen to find alternative versions of the legal document template.

Step 4. When you have found the form you need, click the Download Now button. Choose the pricing plan you prefer and provide your details to create an account.

- Use US Legal Forms to locate the Florida Insurance General Agency Agreement with Exclusive Representation for All Lines of Insurance with just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and hit the Download button to obtain the Florida Insurance General Agency Agreement with Exclusive Representation for All Lines of Insurance.

- You can also access forms you previously obtained in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Make sure you have selected the form for the correct city/state.

- Step 2. Utilize the Preview option to browse the form's content. Don't forget to review the information.

Form popularity

FAQ

The Florida injury threshold statute establishes the criteria for determining when a personal injury case can seek damages in court. This statute impacts insurance claims, particularly concerning medical benefits and lost wages. Having a solid understanding of this statute is beneficial for those engaged in a Florida Insurance General Agency Agreement with Exclusive Representation for All Lines of Insurance, as it can affect underwriting and claims processes.

Statute 626.9551 addresses the conduct of insurance agencies and sets forth guidelines for handling various insurance transactions in Florida. This statute plays a significant role in regulating agreements that involve exclusive representation, such as the Florida Insurance General Agency Agreement with Exclusive Representation for All Lines of Insurance. Familiarizing yourself with this statute can help agents stay compliant and effectively service their clients.

An independent agent can represent multiple insurance companies, distinguishing them from captive agents who work exclusively for one insurer. This flexibility allows independent agents to offer a wider range of options tailored to client needs. Opting for a Florida Insurance General Agency Agreement with Exclusive Representation for All Lines of Insurance can enhance the independence and marketability of these agents in the competitive landscape.

The RCE law, also known as the Regulation of Controlled Entities, outlines how insurance firms manage relationships with agents and brokers in Florida. It is crucial for ensuring transparency and fairness in dealings, particularly for those involved in a Florida Insurance General Agency Agreement with Exclusive Representation for All Lines of Insurance. Understanding this law can aid both agents and clients in fostering trust and compliance within the industry.

An exclusive listing agreement is typically considered non-assignable because it is based on the trust and specific interest of the original parties. However, some agreements may allow for assignment with prior consent from the involved parties. If you're looking at a Florida Insurance General Agency Agreement with Exclusive Representation for All Lines of Insurance, be sure to evaluate the allowable terms regarding assignment.

In most cases, a contract can be assigned to another party, unless the original contract expressly prohibits such an action. Assigning a contract typically involves notifying the relevant parties and possibly obtaining their consent. When dealing with a Florida Insurance General Agency Agreement with Exclusive Representation for All Lines of Insurance, always consult the contract’s specific terms to avoid any complications.

An agency agreement establishes a relationship between an agent and an insurer, allowing the agent to represent the insurer in selling and servicing insurance policies. Conversely, an underwriting agreement involves the assessment of risk and the terms under which an insurer will issue a policy. Understanding these distinctions is essential when navigating the Florida Insurance General Agency Agreement with Exclusive Representation for All Lines of Insurance.

Generally, a personal service agreement is not assignable due to the unique skills or qualities of the individuals involved. Such agreements are often based on trust and the particular relationship between the parties. If you are considering a Florida Insurance General Agency Agreement with Exclusive Representation for All Lines of Insurance, it's crucial to understand the personal nature of these arrangements before attempting an assignment.

An exclusive agency agreement can often be assigned, but it depends on the terms set within the contract. In many cases, the original party must obtain consent from the insurer or the principal before making an assignment. This ensures that the integrity and agreements made in the Florida Insurance General Agency Agreement with Exclusive Representation for All Lines of Insurance remain intact.

An exclusive agency in insurance represents one insurance company and focuses solely on its products. This model promotes specialized knowledge about the company's offerings. The Florida Insurance General Agency Agreement with Exclusive Representation for All Lines of Insurance exemplifies this structure, ensuring clients receive personalized guidance based on a deep understanding of specific insurance solutions.