A Florida Buy-Sell Agreement with Life Insurance to Fund Purchase of Deceased Partner's Interest in a Professional Partnership is a legal contract that outlines the terms and conditions for the buying and selling of a deceased partner's interest in a professional partnership. This type of agreement is a crucial tool for protection and smooth transition in the event of the death of a partner in a business. The purpose of this agreement is to ensure that the remaining partners have the financial means to buy out the deceased partner's share, allowing for a seamless continuation of the professional partnership without disruption or financial burden. Life insurance is utilized to provide the necessary funds for the buyout. Here are some relevant keywords and subtopics related to different types of Florida Buy-Sell Agreements with Life Insurance to Fund Purchase of Deceased Partner's Interest in a Professional Partnership: 1. Entity Purchase Agreement: Also known as a cross-purchase agreement, this type of agreement allows each partner to personally own life insurance policies on the lives of the other partners. When a partner dies, the surviving partners use the insurance proceeds to buy the deceased partner's interest in the partnership. 2. Stock Redemption Agreement: This agreement involves the partnership entity purchasing life insurance policies on the lives of the partners, and in the event of a partner's death, the entity uses the insurance proceeds to buy the deceased partner's stock or partnership interest. 3. Wait-and-See Agreement: This type of agreement combines elements of both the entity purchase and stock redemption agreements. It provides flexibility by allowing the surviving partners to determine, upon the occurrence of a triggering event, whether to use the entity or individual purchase approach to buy the deceased partner's interest. 4. Triggering Events: Florida Buy-Sell Agreements with Life Insurance to Fund Purchase of Deceased Partner's Interest in a Professional Partnership usually include triggers such as death, disability, retirement, or voluntary withdrawal. These events determine when the agreement comes into effect and the insurance proceeds can be used to buy the deceased partner's interest. 5. Valuation Methods: The agreement should outline the methods to determine the fair market value of the deceased partner's interest. Common approaches include book value, appraisals, or mutually agreed-upon formulas. 6. Funding and Insurance Policies: It is necessary to specify the funding arrangements and the life insurance policies that will be purchased on each partner. This includes the amount of coverage, allocation of premiums, and ownership of the insurance policies. 7. Successor Partners: The agreement should address any provisions regarding the admission of new partners or transfer of a deceased partner's interest to existing partners. 8. Tax Implications: It is crucial to consider the tax consequences related to the agreement and consult legal and tax professionals for guidance in structuring the agreement to minimize tax ramifications. In conclusion, a Florida Buy-Sell Agreement with Life Insurance to Fund Purchase of Deceased Partner's Interest in a Professional Partnership is a vital legal document that helps safeguard the interests of partners and their businesses. These agreements can take various forms, such as entity purchase agreements, stock redemption agreements, or wait-and-see agreements, and address triggering events, valuation methods, funding arrangements, successor partners, and tax implications. Professional advice should be sought to ensure compliance with Florida state laws and to draft a comprehensive and tailored agreement suitable for the specific partnership scenario.

Florida Buy-Sell Agreement with Life Insurance to Fund Purchase of Deceased Partner's Interest in a Professional Partnership

Description

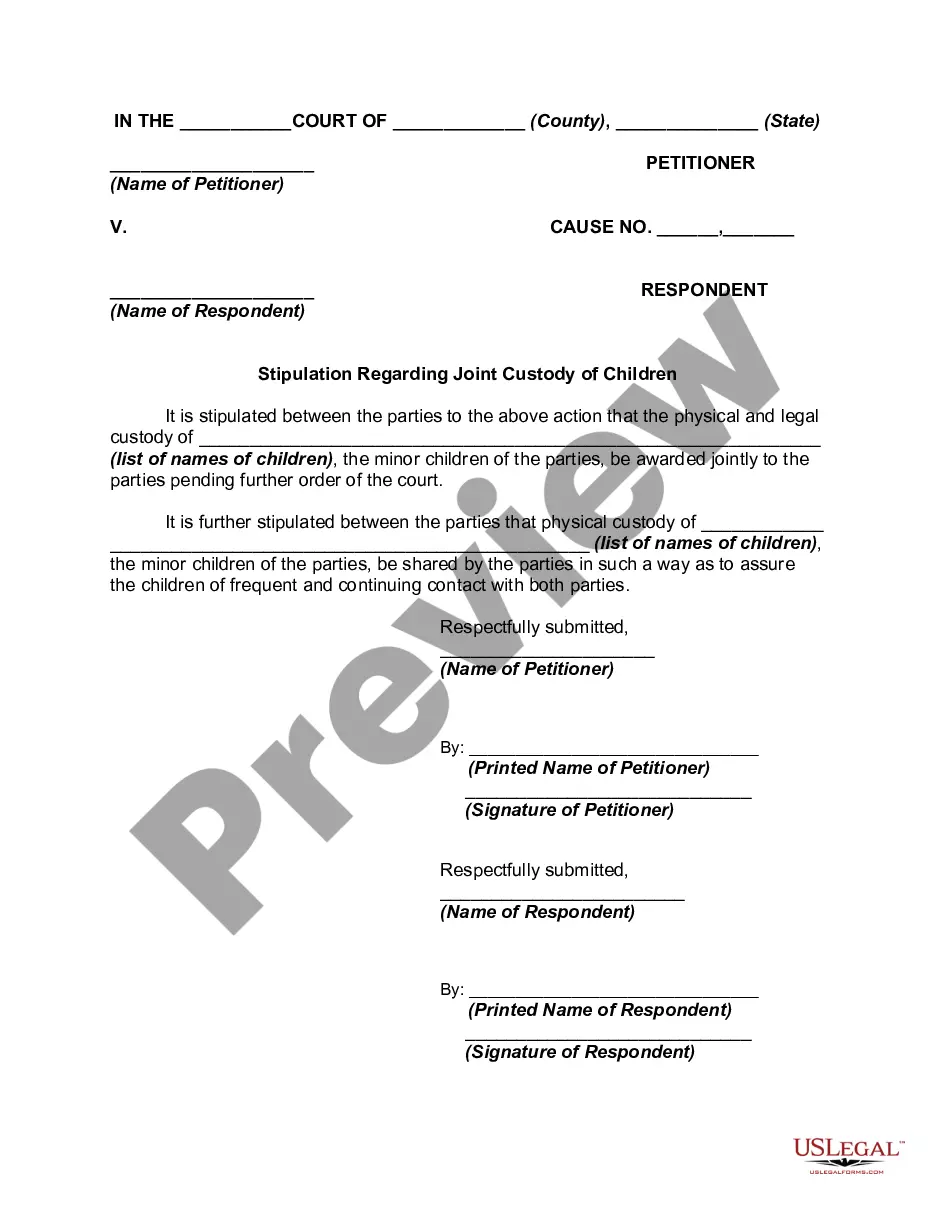

How to fill out Florida Buy-Sell Agreement With Life Insurance To Fund Purchase Of Deceased Partner's Interest In A Professional Partnership?

Are you currently in a place in which you will need documents for sometimes organization or specific reasons nearly every day? There are tons of lawful papers templates available online, but finding types you can rely on isn`t easy. US Legal Forms gives thousands of kind templates, like the Florida Buy-Sell Agreement with Life Insurance to Fund Purchase of Deceased Partner's Interest in a Professional Partnership, that are created in order to meet federal and state specifications.

Should you be already familiar with US Legal Forms site and have a merchant account, merely log in. Afterward, you are able to acquire the Florida Buy-Sell Agreement with Life Insurance to Fund Purchase of Deceased Partner's Interest in a Professional Partnership template.

Unless you come with an profile and wish to begin using US Legal Forms, abide by these steps:

- Get the kind you want and make sure it is for the right town/state.

- Use the Preview button to review the shape.

- Browse the description to ensure that you have chosen the correct kind.

- In case the kind isn`t what you`re searching for, take advantage of the Lookup industry to find the kind that fits your needs and specifications.

- If you get the right kind, click Acquire now.

- Pick the rates prepare you need, complete the required information to make your account, and pay money for an order using your PayPal or bank card.

- Decide on a convenient file file format and acquire your backup.

Get all of the papers templates you have bought in the My Forms menu. You can obtain a extra backup of Florida Buy-Sell Agreement with Life Insurance to Fund Purchase of Deceased Partner's Interest in a Professional Partnership at any time, if necessary. Just click the needed kind to acquire or printing the papers template.

Use US Legal Forms, probably the most considerable selection of lawful types, to save time and avoid errors. The assistance gives expertly made lawful papers templates which can be used for a range of reasons. Produce a merchant account on US Legal Forms and commence creating your lifestyle easier.