Florida Indemnification of Surety on Contractor's Bond by Subcontractor

Description

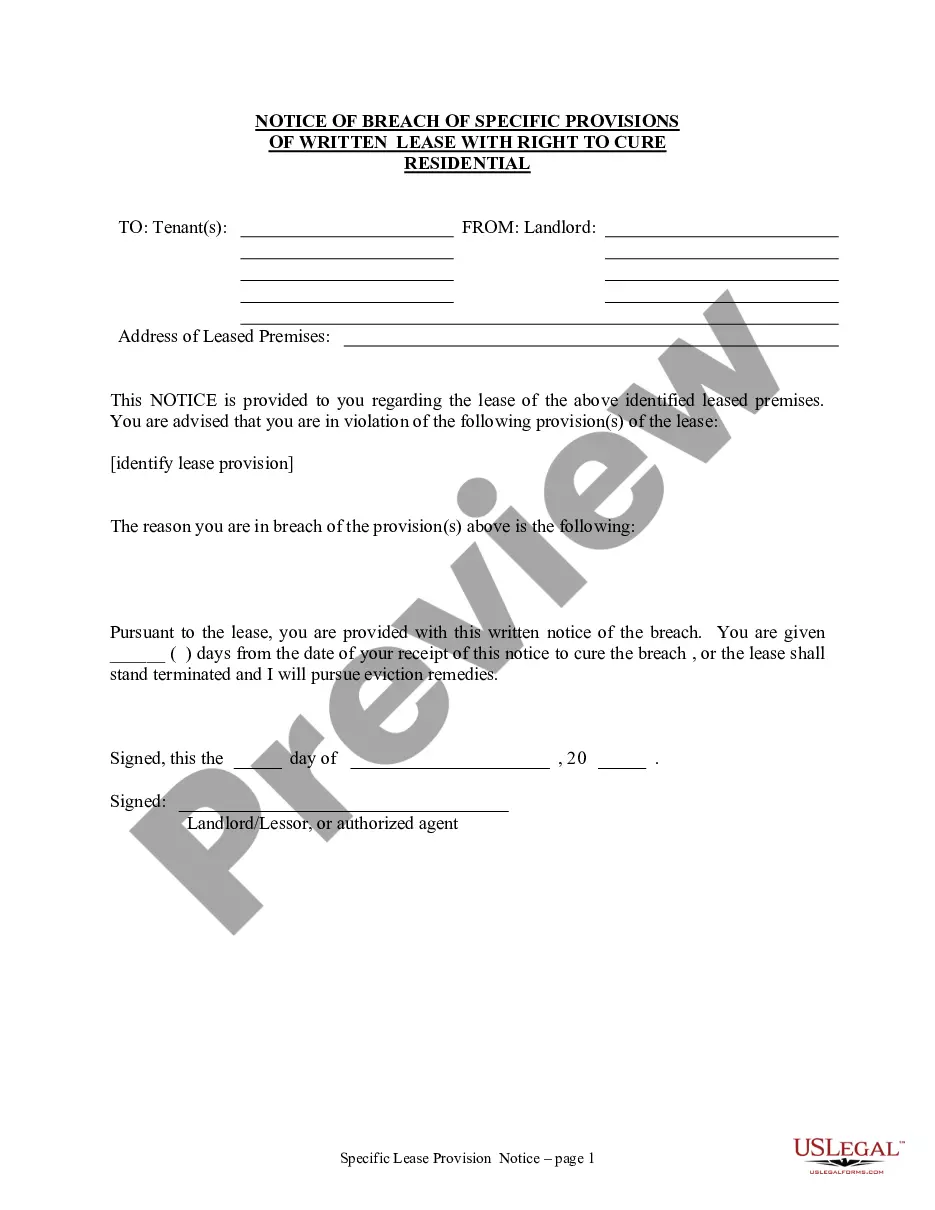

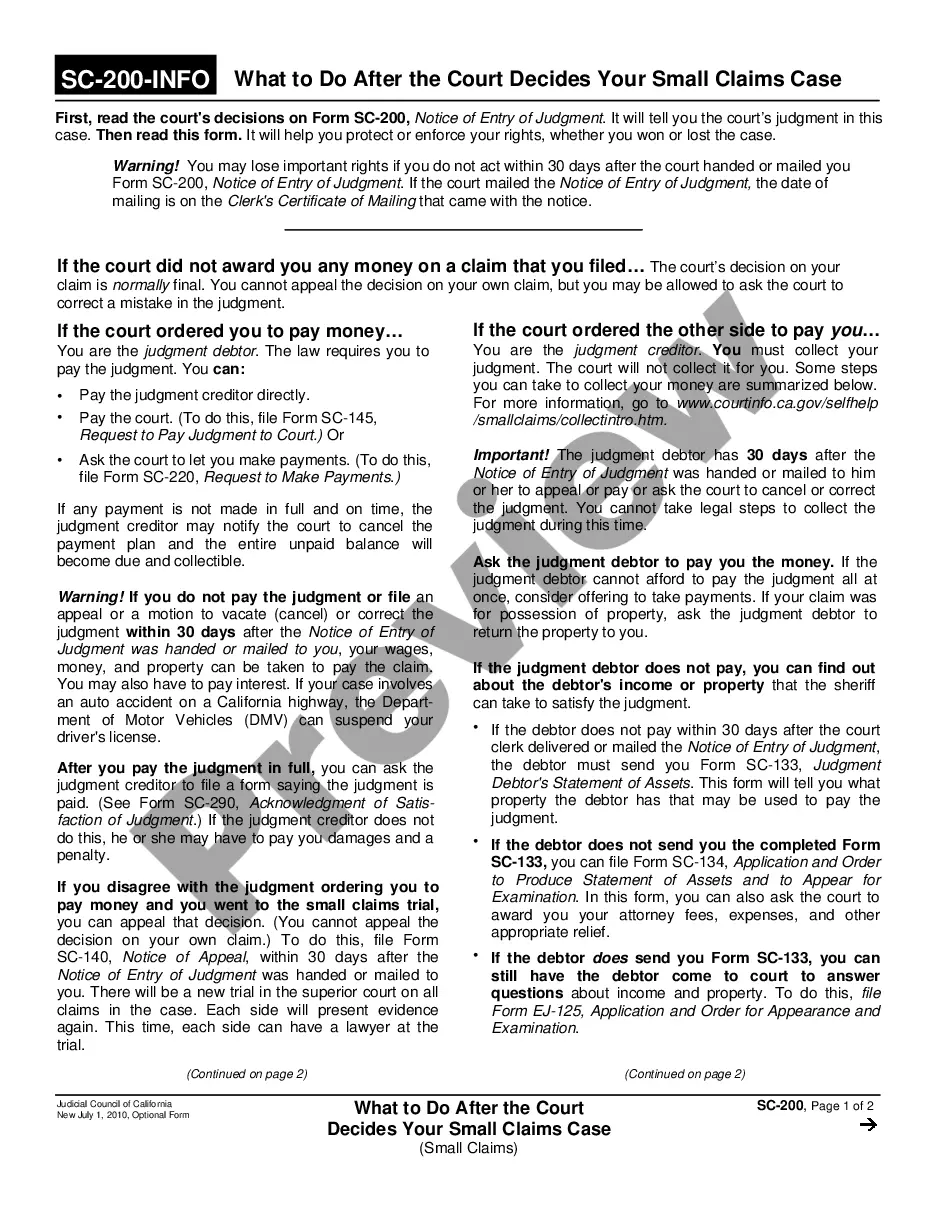

How to fill out Indemnification Of Surety On Contractor's Bond By Subcontractor?

US Legal Forms - one of the largest libraries of lawful kinds in America - provides a wide array of lawful file themes you are able to download or produce. Utilizing the web site, you can find 1000s of kinds for business and personal uses, categorized by types, states, or search phrases.You will discover the newest variations of kinds like the Florida Indemnification of Surety on Contractor's Bond by Subcontractor in seconds.

If you already possess a registration, log in and download Florida Indemnification of Surety on Contractor's Bond by Subcontractor in the US Legal Forms catalogue. The Download key can look on every type you view. You get access to all earlier delivered electronically kinds from the My Forms tab of your accounts.

If you want to use US Legal Forms initially, allow me to share basic instructions to get you began:

- Ensure you have picked out the proper type to your area/county. Click the Review key to review the form`s content. See the type outline to ensure that you have selected the correct type.

- When the type doesn`t match your specifications, make use of the Research discipline near the top of the monitor to obtain the the one that does.

- Should you be content with the shape, confirm your option by visiting the Get now key. Then, opt for the costs program you want and supply your references to sign up to have an accounts.

- Approach the financial transaction. Make use of your Visa or Mastercard or PayPal accounts to accomplish the financial transaction.

- Select the format and download the shape on your own product.

- Make modifications. Fill up, edit and produce and indicator the delivered electronically Florida Indemnification of Surety on Contractor's Bond by Subcontractor.

Every design you included in your money does not have an expiration particular date and is your own forever. So, if you wish to download or produce an additional backup, just visit the My Forms segment and click on the type you will need.

Gain access to the Florida Indemnification of Surety on Contractor's Bond by Subcontractor with US Legal Forms, by far the most substantial catalogue of lawful file themes. Use 1000s of professional and state-specific themes that satisfy your small business or personal requires and specifications.

Form popularity

FAQ

By law, Subcontractor shall indemnify, defend (at Subcontractor's sole expense) and hold harmless Contractor, the Owner (if different from Contractor), affiliated companies of Contractor, their partners, joint ventures, representatives, members, designees, officers, directors, shareholders, employees, agents, ...

In construction cases, an indemnity agreement is a promise to safeguard or hold the general contractor harmless against either existing or future loss liability and provides the general contractor with a cause of action to recover against the subcontractor.

With respect to the scope of an indemnity clause, an IC will typically agree to cover any third party claims arising in connection with the death or injury of a person, damage to property, or breach of the agreement as a result of the actions or inactions of the IC or its representatives and employees.

Most subcontracts contain indemnification clauses, also sometimes referred to as ?hold harmless clauses.? Their purpose is to transfer the risk of certain losses or expenses on construction projects from the GC to the subcontractor.

Refund to the Government the said sum of Rs. ???????? and shall otherwise indemnify and keep the Government harmless and all costs incurred in consequence of the claim thereto THEN the above written bond or obligation shall be void and of no effect but otherwise it shall remain in full force, effect and virtue.

Indemnity is the backbone of many surety bonds. In short, indemnity compels a party to compensate another party. Regarding a surety bond, this means that the obligee has the legal right to collect from the surety if the principal of the bond fails to uphold their end of the bond.

A typical indemnity clause in a subcontractor agreement for a construction project may say something like: ?Subcontractor agrees to indemnify and hold harmless Contractor for and against any and all claims arising out of the work Subcontractor performs pursuant to this Agreement.?

What is an indemnity agreement for surety? Generally speaking, the indemnity provision in the agreement grants the surety the broad legal right to recover from the indemnitor whatever it pays on the principal's behalf under the related bonds, as well as those amounts for which it remains liable.