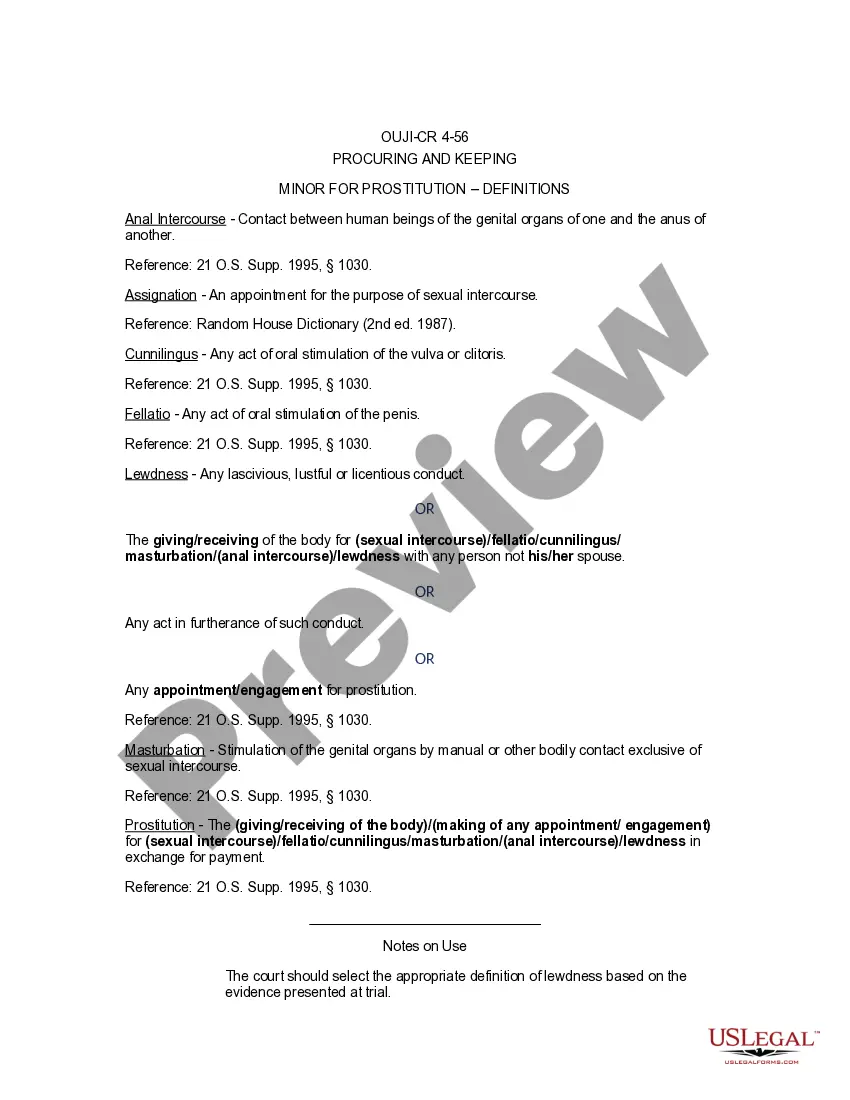

Florida Escrow Agreement and Instructions is a legal document that outlines the terms and conditions of a financial arrangement where a neutral third party, known as an Escrow Agent, holds and distributes funds or assets on behalf of two or more parties involved in a transaction. The purpose of this agreement is to safeguard the interests of all parties involved and ensure the smooth execution of the transaction. In Florida, several types of Escrow Agreements and Instructions are commonly used, depending on the nature of the transaction: 1. Real Estate Escrow Agreement and Instructions: This type of agreement is commonly used in Florida real estate transactions. It involves the deposit of funds or documents, such as the property deed, with the Escrow Agent until all the terms and conditions of the transaction are fulfilled. This agreement provides protection to both the buyer and the seller, ensuring that the funds and documents are secured until the transaction is completed. 2. Business Escrow Agreement and Instructions: This type of agreement is applicable in the context of business acquisitions, mergers, or other significant business transactions in Florida. It involves the Escrow Agent holding funds, contracts, or other essential documents until all the conditions specified in the agreement are met. It helps to protect the interests of all parties involved and ensures the smooth transitioning of ownership or control of the business. 3. Litigation Escrow Agreement and Instructions: In Florida, this type of agreement is commonly used in legal disputes or lawsuits where there is a need to hold funds or assets until a settlement or court judgment is reached. The Escrow Agent will hold the funds in a secure account until the resolution of the litigation, and then distribute them accordingly based on the instructions provided in the agreement. 4. Construction Escrow Agreement and Instructions: This type of agreement is relevant to construction projects in Florida. It involves depositing funds or documents with the Escrow Agent, who will release the funds to the contractor or suppliers as the project progresses and specific milestones or conditions are met. It helps to ensure that funds are allocated appropriately and prevent any misuse or mismanagement during the construction process. In summary, Florida Escrow Agreement and Instructions are essential legal documents that provide clear guidelines and instructions for the secure handling of funds and assets in various transactions. Whether it is for real estate, business, litigation, or construction purposes, these agreements help protect the rights and interests of all parties involved, ensuring a fair and smooth transaction process.

Escrow Agreement

Description

How to fill out Florida Escrow Agreement And Instructions?

Choosing the right legal record web template can be quite a have difficulties. Naturally, there are tons of themes available on the net, but how do you get the legal kind you want? Use the US Legal Forms internet site. The assistance provides 1000s of themes, such as the Florida Escrow Agreement and Instructions, that can be used for enterprise and personal demands. Every one of the types are checked by pros and meet up with state and federal requirements.

When you are presently signed up, log in to your bank account and click on the Acquire key to find the Florida Escrow Agreement and Instructions. Make use of your bank account to look from the legal types you might have ordered previously. Proceed to the My Forms tab of your bank account and get an additional version in the record you want.

When you are a whole new customer of US Legal Forms, allow me to share easy guidelines so that you can comply with:

- Initial, make sure you have selected the proper kind for your personal town/area. You may look over the shape while using Preview key and look at the shape description to guarantee it will be the right one for you.

- When the kind fails to meet up with your expectations, take advantage of the Seach discipline to get the right kind.

- When you are sure that the shape would work, select the Purchase now key to find the kind.

- Opt for the rates plan you would like and enter the needed details. Design your bank account and purchase the order utilizing your PayPal bank account or bank card.

- Choose the submit structure and acquire the legal record web template to your gadget.

- Comprehensive, change and print out and signal the received Florida Escrow Agreement and Instructions.

US Legal Forms is the largest library of legal types that you can find different record themes. Use the service to acquire skillfully-manufactured files that comply with status requirements.

Form popularity

FAQ

Escrow instructions. Written directions, signed by a seller and buyer, detailing the procedures necessary to close a transaction and directing the escrow officer how to proceed.

Brokers are required by law to move quickly when they receive a deposit check from a prospective buyer. The broker must deposit the money in an escrow account no later than three business days after receiving it, according to the code.

If the buyer defaults, the seller may elect to recover and retain the deposit as agreed upon liquidated damages, and buyer and seller shall be relieved from all further obligations under the contract. Or, at the seller's option, he or she may proceed in equity to enforce his or her rights under the contract.

An escrow agreement is a contract that outlines the terms and conditions between parties involved, and the responsibility of each. Escrow agreements generally involve an independent third party, called an escrow agent, who holds an asset of value until the specified conditions of the contract are met.

Earnest money is usually due within three days of a signed and accepted offer, the American family insurance blog says.

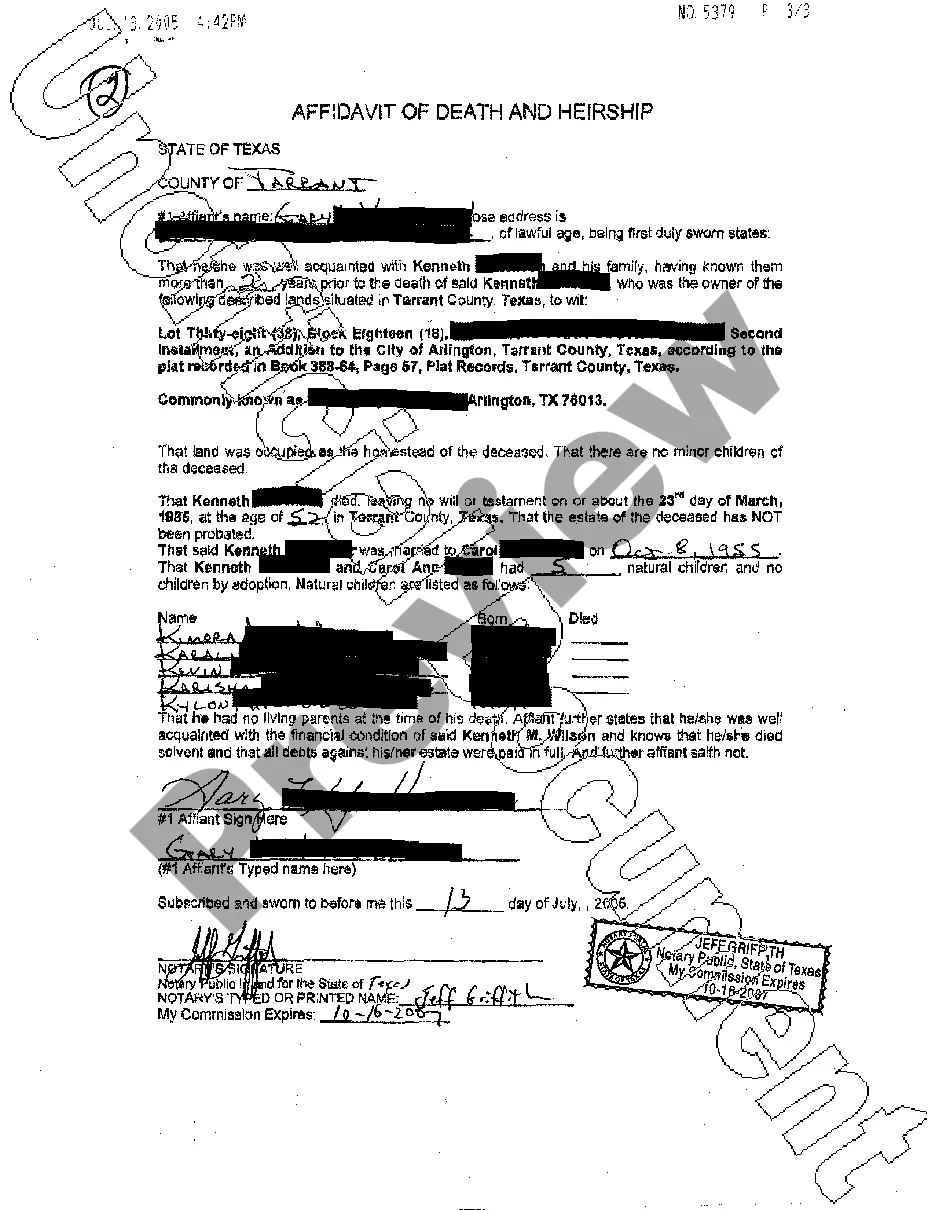

For a home purchase, these instructions must include the following: the purchase price and terms; agreements as to mortgages; how buyer's title is to vest; matters of record subject to which buyer is to acquire title; inspection reports to be delivered into escrow; proration adjustments; the date of buyer's possession

A Grant Deed is the document that legally transfers title to the property of the new owner. The seller will sign the Grant Deed as part of the escrow instructions and the escrow officer or another notary public will notarize your signatures.

Escrow instructions normally identify the escrow holder's contact information and escrow number, license number, important dates including the date escrow opened, as well as the date it is scheduled to close, the names of the parties to the escrow, the property address and legal description, purchase price and terms,

15. 15. . An escrow is a deposit of funds, a deed or other instrument by one party for the delivery to another party upon completion of a specific condition or event. It is an independent neutral account by which the interests of all parties to the transaction are protected.

Escrow instructions are prepared by the escrow officer based on the information received from the seller's agent about the transaction. See RPI Form 401; Moss v. Minor Properties, Inc. ( 1968) 262 CA2d 847 In practice, the escrow officer prepares the instructions on forms adopted for this use.