Florida Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse

Description

How to fill out Marital-deduction Residuary Trust With A Single Trustor And Lifetime Income And Power Of Appointment In Beneficiary Spouse?

US Legal Forms - among the greatest libraries of lawful forms in the States - provides a variety of lawful document templates it is possible to download or printing. Making use of the website, you may get a huge number of forms for business and specific reasons, categorized by categories, claims, or key phrases.You will discover the most recent versions of forms like the Florida Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse in seconds.

If you currently have a membership, log in and download Florida Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse from your US Legal Forms collection. The Download switch will appear on every single form you see. You gain access to all formerly downloaded forms in the My Forms tab of your bank account.

If you wish to use US Legal Forms initially, listed below are basic directions to obtain started out:

- Be sure you have chosen the proper form for your city/state. Click on the Preview switch to check the form`s information. Read the form description to actually have chosen the right form.

- When the form doesn`t match your specifications, use the Lookup industry on top of the screen to obtain the one who does.

- When you are happy with the form, affirm your option by visiting the Buy now switch. Then, opt for the rates program you want and offer your qualifications to register for the bank account.

- Approach the financial transaction. Make use of your Visa or Mastercard or PayPal bank account to finish the financial transaction.

- Choose the formatting and download the form in your device.

- Make adjustments. Load, edit and printing and signal the downloaded Florida Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse.

Each and every template you included with your money lacks an expiration time and it is your own forever. So, if you wish to download or printing one more backup, just visit the My Forms portion and click on in the form you want.

Get access to the Florida Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse with US Legal Forms, the most comprehensive collection of lawful document templates. Use a huge number of specialist and express-distinct templates that fulfill your business or specific demands and specifications.

Form popularity

FAQ

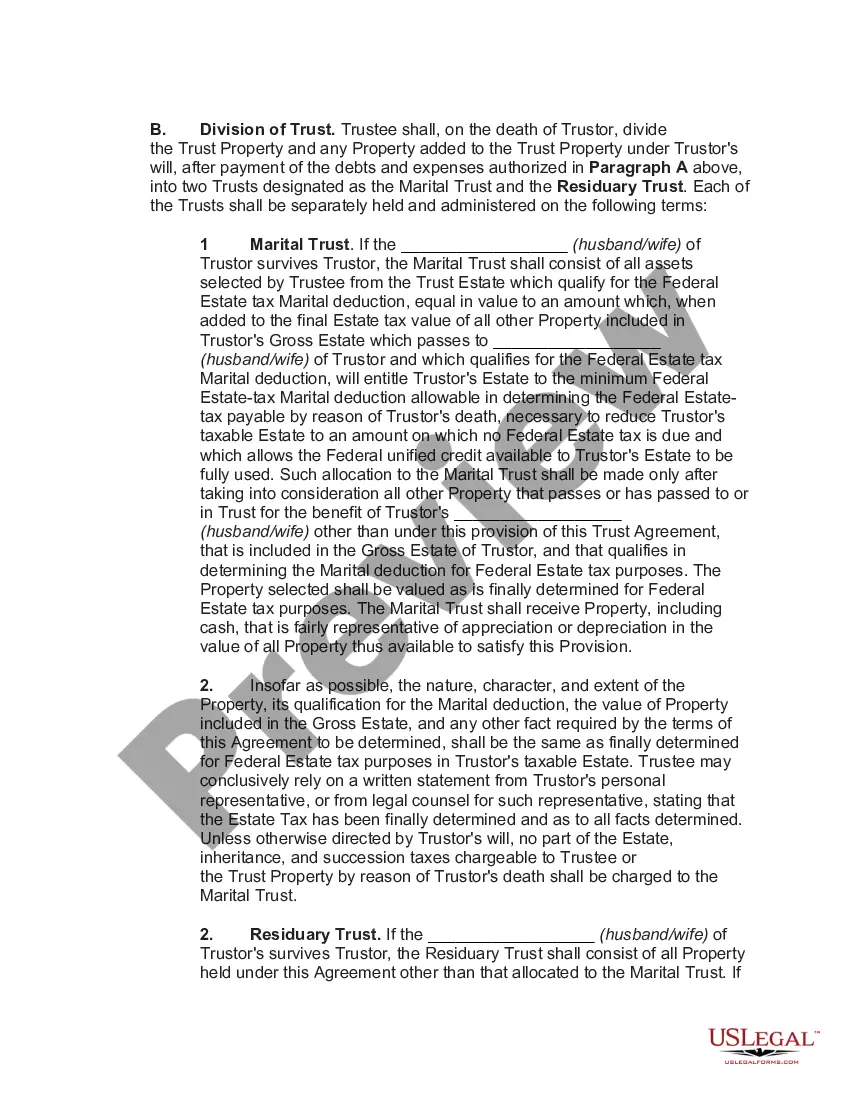

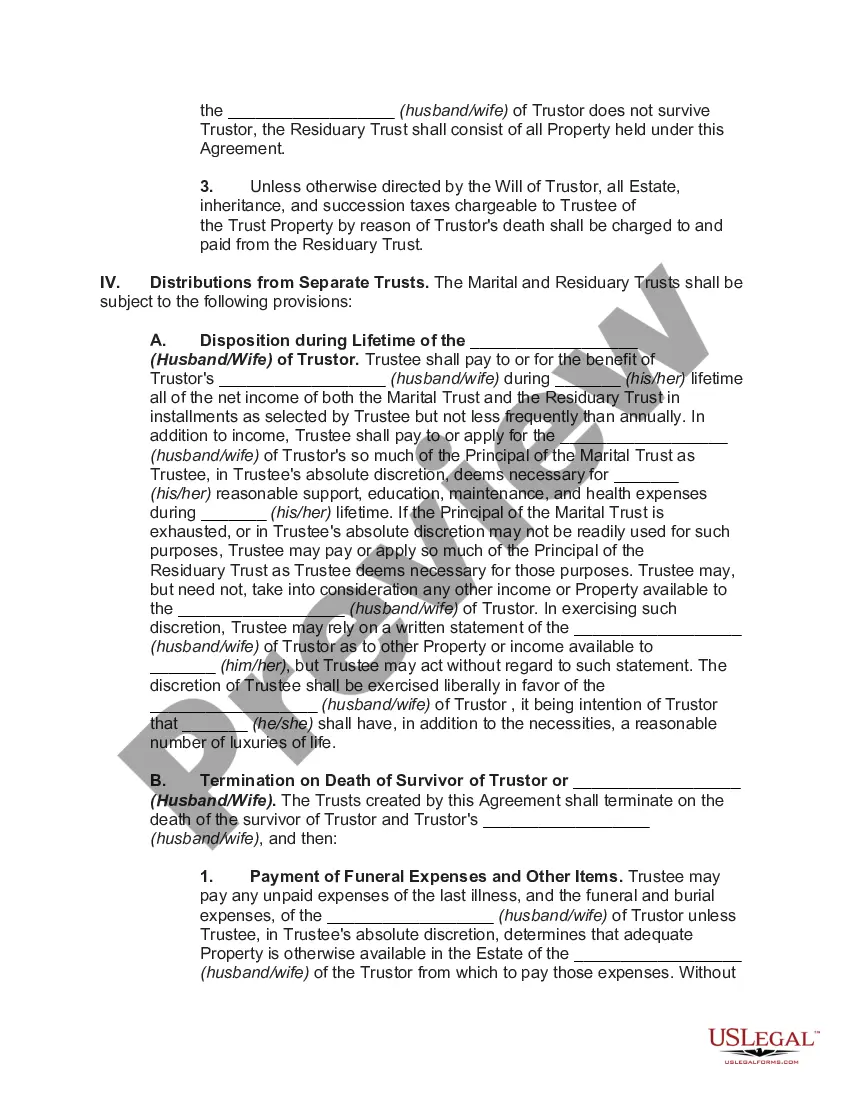

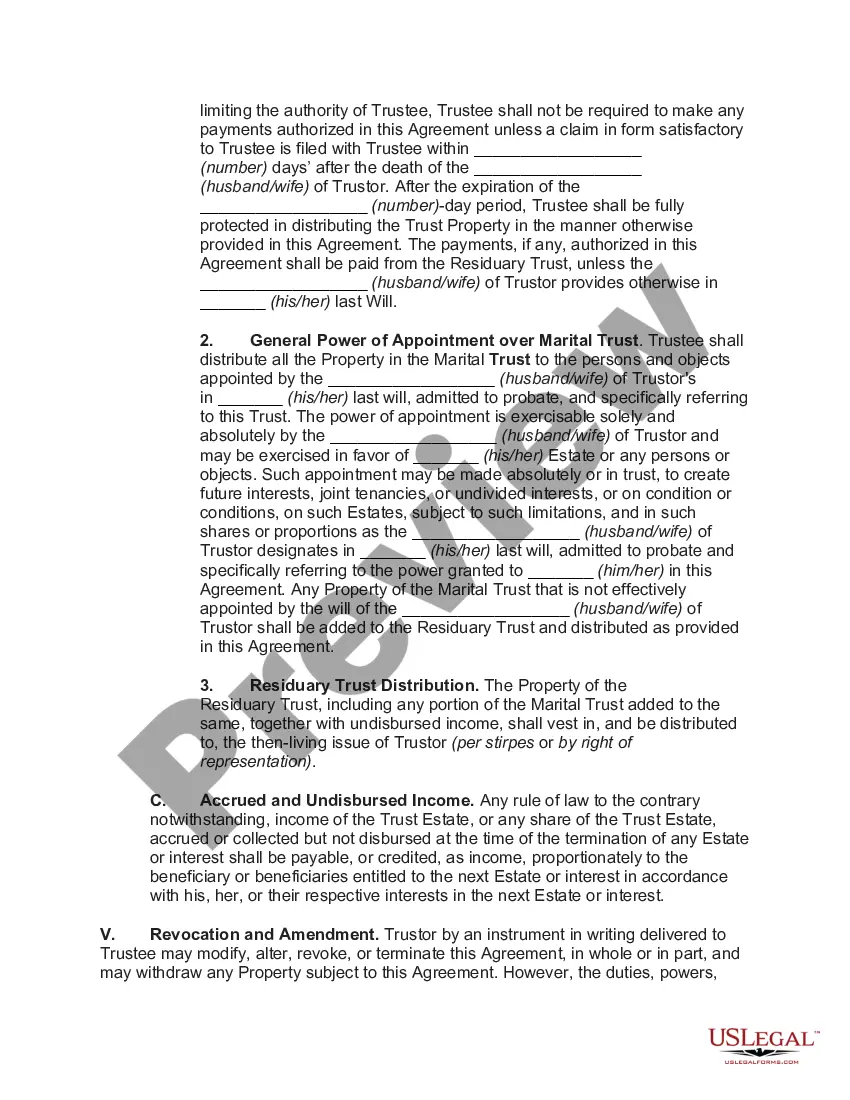

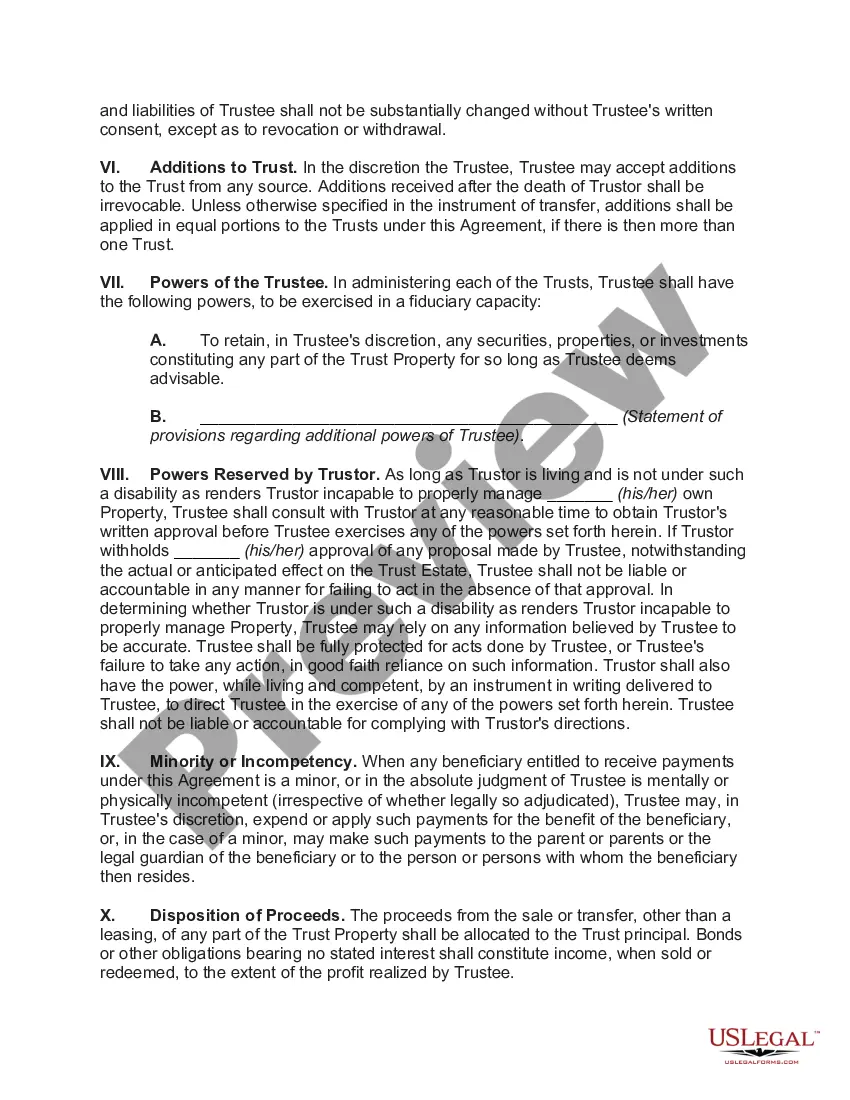

RESIDUARY TRUST. Unlike the Marital Trust, the Residuary Trust can provide for substantial flexibility and give broader discretion to the Trustee. This trust may be structured as a single trust for the benefit of all your descendants or separate trusts for each of your children (and such child's descendants).

For example, if an individual were to convey by will an entire estate to a surviving spouse, the decedent's estate would have no estate tax liability. The marital deduction is effectively a deferral of the estate tax to the date of the surviving spouse's death.

A marital deduction is allowed in computing the taxable gifts of a married donor for property that passes to the donor's spouse ( Code Sec. 2523). As a result, an unlimited amount of property, other than certain terminable interests, can be transferred between spouses.

A marital deduction is allowed in computing the taxable gifts of a married donor for property that passes to the donor's spouse ( Code Sec. 2523). As a result, an unlimited amount of property, other than certain terminable interests, can be transferred between spouses.

Terminable interests do not qualify for the marital deduction (Sec. 2056(b)(1)). An example of a terminable interest is where the decedent leaves property to a surviving spouse for the spouse's lifetime, with a remainder interest to the decedent's children.

If you're married, your spouse is entitled to give another $12.92 million (tax year 2023) in lifetime gifts without incurring a gift tax. You can give up to $17,000 (tax year 2023) per person per year to as many people as you like without those gifts counting against your $12.92 million lifetime gift tax exemption.

Property interests passing to a surviving spouse that are not included in the decedent's gross estate do not qualify for the marital deduction. Expenses, indebtedness, taxes, and losses chargeable against property passing to the surviving spouse will reduce the marital deduction.