Florida Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse

Description

How to fill out Marital-deduction Residuary Trust With A Single Trustor And Lifetime Income And Power Of Appointment In Beneficiary Spouse?

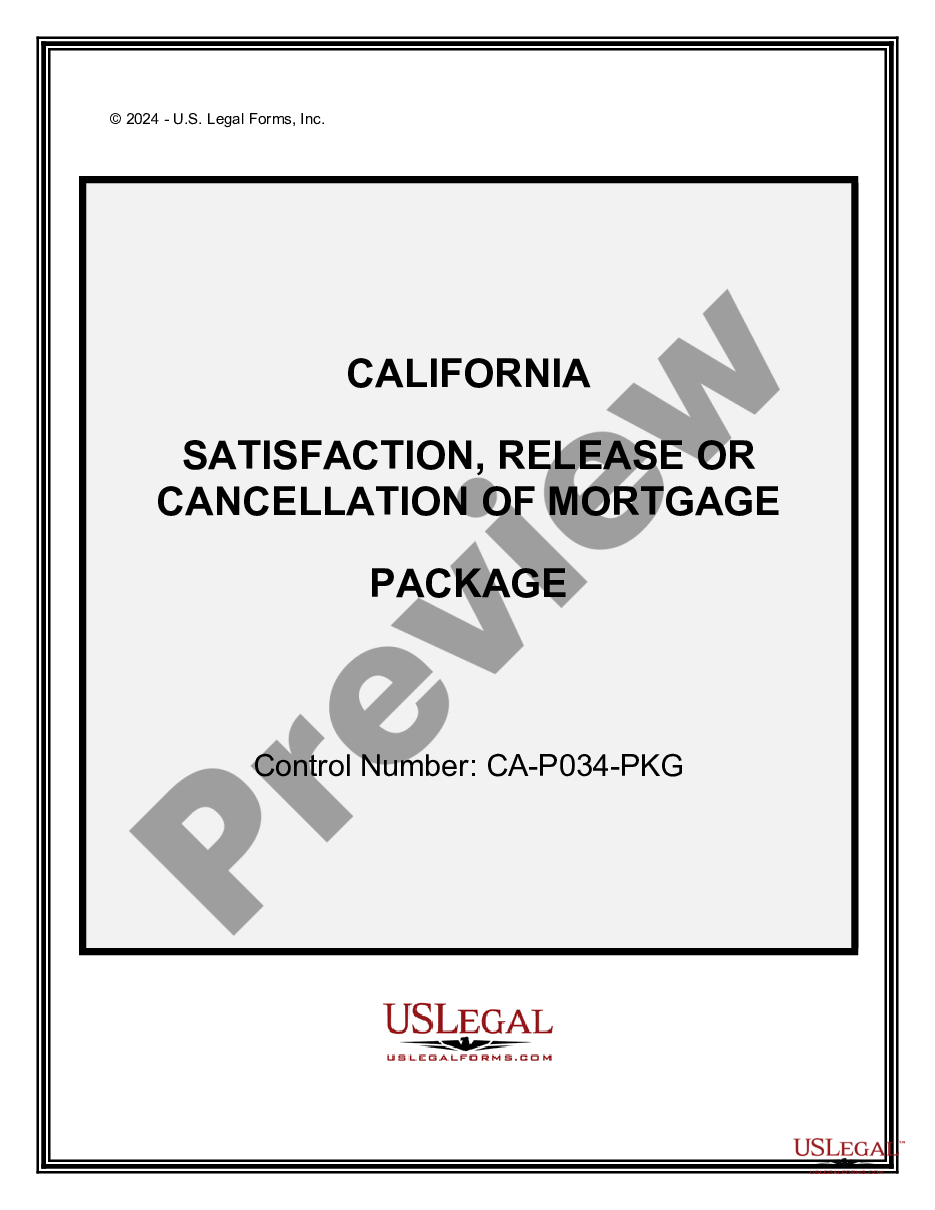

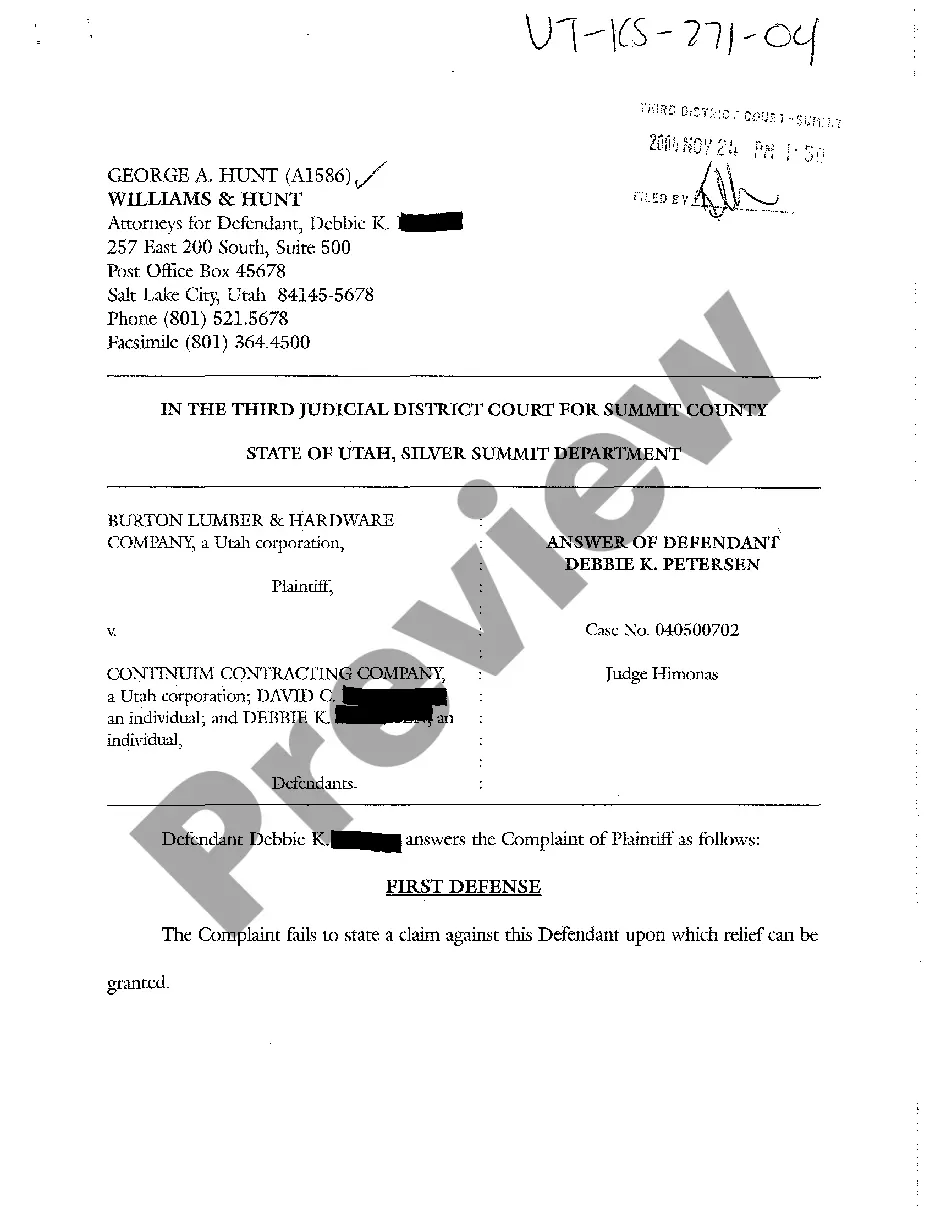

US Legal Forms - among the greatest libraries of legitimate varieties in the States - offers a wide range of legitimate file templates it is possible to down load or printing. Making use of the web site, you will get a huge number of varieties for enterprise and individual uses, categorized by types, claims, or keywords and phrases.You can get the most up-to-date types of varieties such as the Florida Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse within minutes.

If you already have a subscription, log in and down load Florida Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse through the US Legal Forms local library. The Down load button will appear on each and every type you view. You have access to all previously downloaded varieties from the My Forms tab of your bank account.

If you would like use US Legal Forms the first time, listed here are basic directions to help you started:

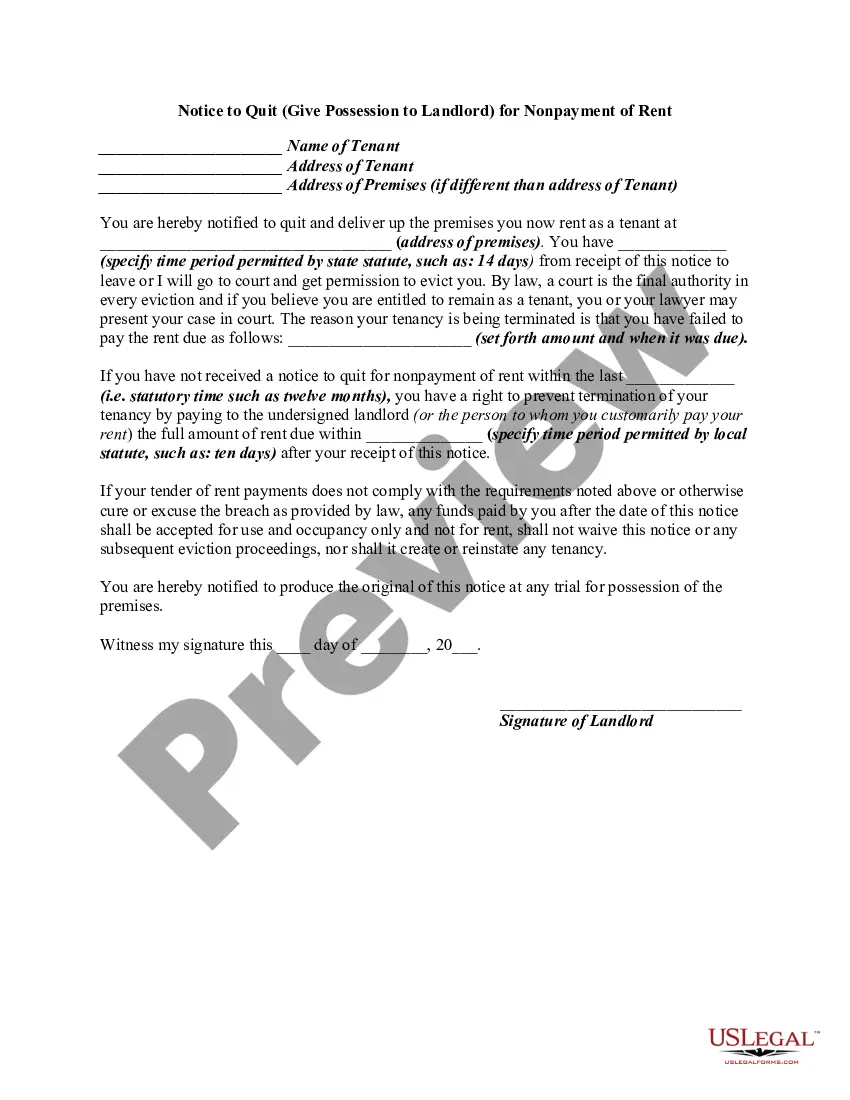

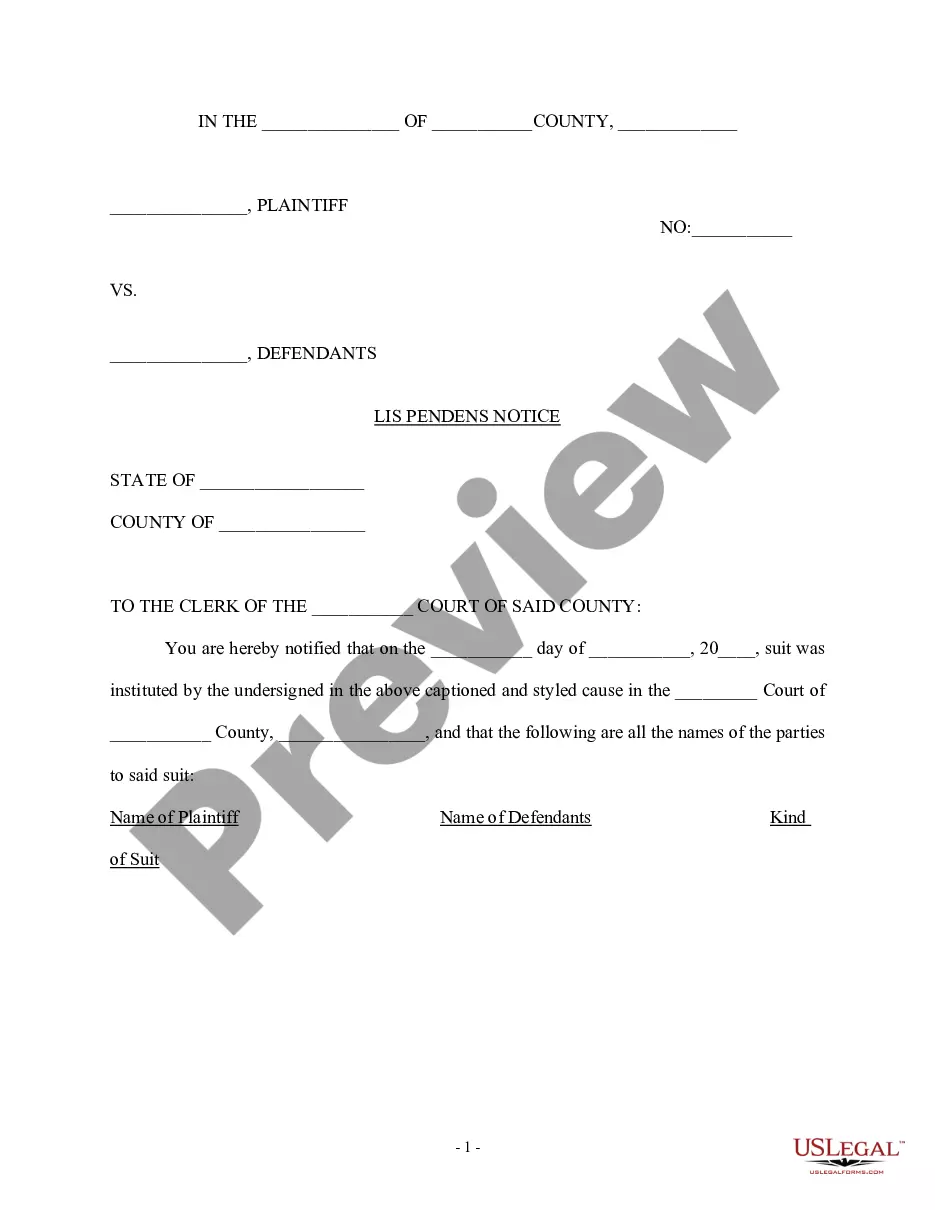

- Be sure you have chosen the best type for your personal city/state. Select the Preview button to analyze the form`s content. Look at the type information to ensure that you have chosen the proper type.

- In the event the type doesn`t fit your needs, make use of the Research industry towards the top of the monitor to obtain the the one that does.

- In case you are content with the shape, affirm your option by simply clicking the Purchase now button. Then, choose the prices strategy you like and supply your references to register for an bank account.

- Method the financial transaction. Use your bank card or PayPal bank account to complete the financial transaction.

- Find the file format and down load the shape on your system.

- Make adjustments. Fill out, revise and printing and indication the downloaded Florida Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse.

Every single web template you added to your bank account lacks an expiry day and it is your own property for a long time. So, if you wish to down load or printing yet another backup, just visit the My Forms portion and click around the type you want.

Gain access to the Florida Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse with US Legal Forms, one of the most extensive local library of legitimate file templates. Use a huge number of professional and state-particular templates that meet your organization or individual requires and needs.

Form popularity

FAQ

Property interests passing to a surviving spouse that are not included in the decedent's gross estate do not qualify for the marital deduction. Expenses, indebtedness, taxes, and losses chargeable against property passing to the surviving spouse will reduce the marital deduction.

Among the disadvantages are the following: As irrevocable trusts, once formed, they are exceedingly difficult to dissolve or amend. Only provides an estate tax exemption of up to $24.12 million in 2022 (or $25.84 million in 2023) Requires the transfer of assets into the trust, which can be a time-consuming procedure.

TESTAMENTARY TRUST These trusts can have many names including: Bypass Trust, Family Trust, Children's Trust, Residuary Trust or QTIP (Second Marriage Trust). Testamentary Trusts are typically created to provide support for surviving spouses, children or family groups.

The first trust (the ?marital? trust) is for the surviving spouse, and the second trust (the ?bypass? or ?residual? trust) is typically for the couple's heirs. The surviving spouse can access the residual trust or receive income from it during their lifetime, but it does not belong to them.

Also called an "A" trust, a marital trust goes into effect when the first spouse dies. Assets are moved into the trust upon death and the income that these assets generate go to the surviving spouse?under some arrangements, the surviving spouse can also receive principal payments.

For example, if an individual were to convey by will an entire estate to a surviving spouse, the decedent's estate would have no estate tax liability. The marital deduction is effectively a deferral of the estate tax to the date of the surviving spouse's death.

RESIDUARY TRUST. Unlike the Marital Trust, the Residuary Trust can provide for substantial flexibility and give broader discretion to the Trustee. This trust may be structured as a single trust for the benefit of all your descendants or separate trusts for each of your children (and such child's descendants).

A marital deduction is allowed in computing the taxable gifts of a married donor for property that passes to the donor's spouse ( Code Sec. 2523). As a result, an unlimited amount of property, other than certain terminable interests, can be transferred between spouses.