The Florida Depreciation Schedule refers to a document or set of guidelines used to determine the depreciation rates for property and assets in the state of Florida. Depreciation is the reduction in value of an asset over time, and calculating it accurately is crucial for accounting and tax purposes. In Florida, there are different types of depreciation schedules that apply to various assets. Here are some notable ones: 1. Commercial Property Depreciation Schedule: This schedule outlines the depreciation rates for commercial buildings, such as offices, retail spaces, warehouses, and industrial structures. It takes into account factors such as the building's age, condition, and useful life to calculate the annual depreciation deduction. 2. Residential Property Depreciation Schedule: This schedule focuses on residential real estate, including houses, apartments, and condominiums. It provides guidelines for determining the depreciation rates applicable to these properties. The schedule considers factors like the property's age, type, and condition to estimate the yearly depreciation value. 3. Vehicle Depreciation Schedule: Florida also has a depreciation schedule for vehicles, including cars, trucks, motorcycles, and other motorized vehicles. This schedule helps determine the annual depreciation deduction for tax purposes, considering factors such as the initial cost, model year, mileage, and condition of the vehicle. 4. Equipment and Machinery Depreciation Schedule: This depreciation schedule applies to the depreciation of equipment and machinery used in various industries, including manufacturing, construction, and agriculture. It outlines guidelines for calculating the yearly depreciation expense based on variables like the asset's cost, useful life, and estimated salvage value. Understanding the Florida Depreciation Schedule is crucial for individuals, businesses, and tax professionals as it assists in accurately calculating and reporting the depreciation deductions on their tax returns. It is important to consult the specific depreciation schedule that corresponds to the asset or property type for accurate calculations and compliance with Florida tax regulations.

Florida Depreciation Schedule

Description

How to fill out Florida Depreciation Schedule?

Are you presently in the situation where you will need documents for possibly enterprise or person uses just about every working day? There are tons of legal record layouts available online, but getting kinds you can trust isn`t simple. US Legal Forms provides a large number of kind layouts, much like the Florida Depreciation Schedule, that happen to be created in order to meet federal and state needs.

When you are previously informed about US Legal Forms website and get an account, just log in. After that, it is possible to acquire the Florida Depreciation Schedule web template.

Should you not offer an profile and need to begin using US Legal Forms, abide by these steps:

- Discover the kind you will need and make sure it is for that right city/state.

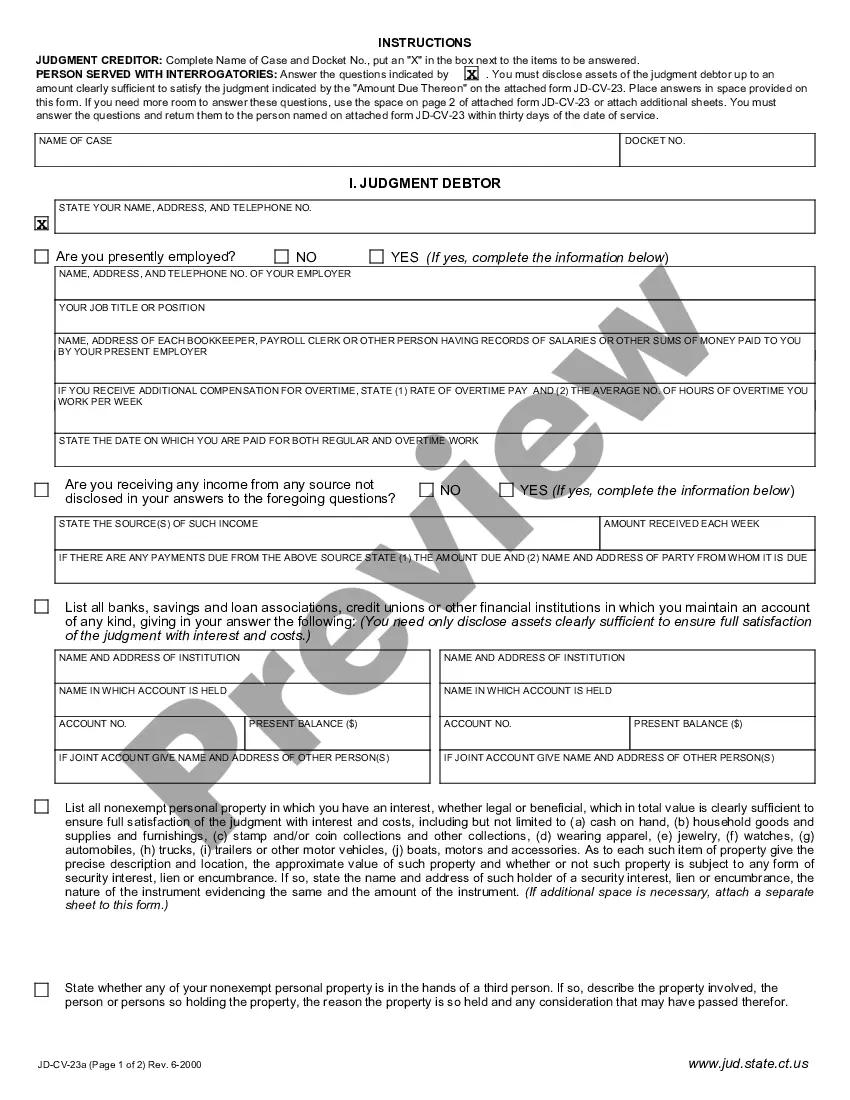

- Use the Preview key to review the form.

- Read the information to actually have selected the appropriate kind.

- In the event the kind isn`t what you`re seeking, use the Look for area to get the kind that suits you and needs.

- If you obtain the right kind, click Get now.

- Choose the costs strategy you want, submit the desired information and facts to make your bank account, and purchase your order utilizing your PayPal or credit card.

- Decide on a practical paper structure and acquire your version.

Locate every one of the record layouts you may have purchased in the My Forms menu. You can aquire a further version of Florida Depreciation Schedule at any time, if needed. Just click on the essential kind to acquire or produce the record web template.

Use US Legal Forms, probably the most comprehensive selection of legal varieties, to save lots of some time and prevent faults. The service provides professionally made legal record layouts that can be used for a range of uses. Produce an account on US Legal Forms and initiate making your life easier.