A Florida Job Invoice — Short is a simplified and concise document used for billing and recording job-related transactions in the state of Florida. It is typically used by service providers, contractors, and freelancers to outline the details of services rendered, products sold, or work performed. This invoice is customized for businesses operating in the state of Florida, ensuring compliance with specific local regulations and requirements. The content of a Florida Job Invoice — Short typically includes the following relevant information: 1. Header: The top section of the invoice usually contains the business name, logo, contact details, and official address. This ensures clear communication and assists clients in reaching out for any queries or concerns. 2. Invoice Number and Date: A unique invoice number is assigned to each invoice for tracking and referencing purposes. The date of issue is important for record-keeping purposes and acts as a reference point for both parties involved. 3. Client Information: This section includes the client's name, company name (if applicable), address, and contact information. Ensuring accurate client details is crucial for smooth communication and proper billing. 4. Job Description: Here, a detailed description of the job performed is provided. It includes the type of service, quantity, hourly rate, or fixed price (if applicable), and any additional charges or discounts. This allows both the service provider and client to have a clear understanding of the job performed. 5. Subtotal and Taxes: The invoice lists the subtotal of the job, which is the total value before taxes or any other additional fees are applied. Taxes, such as Florida's sales tax, are calculated based on the applicable tax rate and added separately to the invoice's total. 6. Total Amount Due: This section highlights the total invoice amount, combining the subtotal, taxes, and any additional charges or discounts. It is essential to clearly state the amount due and provide various payment options to ensure timely payment. Different types or variations of Florida Job Invoice — Short may include: 1. Standard Florida Job Invoice — Short: This is a general format suitable for most service-based businesses or contractors operating in Florida. 2. Florida Construction Invoice — Short: Tailored specifically for construction-related services, this invoice includes additional details such as labor hours, material costs, and any building or construction permits required. 3. Professional Services Florida Job Invoice — Short: Designed for professionals such as lawyers, accountants, or consultants, this invoice includes sections for service descriptions, hours spent, and consultation fees. 4. Freelancer Florida Job Invoice — Short: Customized for freelancers or independent contractors, this invoice may highlight projects completed, hours worked, and negotiated rates. Overall, a Florida Job Invoice — Short is a crucial tool for accurately documenting and billing job-related activities in Florida, ensuring transparent and efficient financial transactions between service providers and clients.

Florida Job Invoice - Short

Description

How to fill out Florida Job Invoice - Short?

It is possible to commit hrs on the Internet attempting to find the legitimate record template that suits the state and federal demands you need. US Legal Forms gives 1000s of legitimate forms that happen to be reviewed by experts. It is simple to obtain or produce the Florida Job Invoice - Short from the support.

If you currently have a US Legal Forms account, you are able to log in and click the Acquire button. After that, you are able to complete, revise, produce, or indicator the Florida Job Invoice - Short. Every single legitimate record template you buy is yours forever. To get another duplicate for any bought kind, check out the My Forms tab and click the related button.

If you are using the US Legal Forms web site initially, follow the simple recommendations listed below:

- Initially, ensure that you have selected the proper record template for your state/town of your liking. See the kind explanation to make sure you have picked out the appropriate kind. If accessible, take advantage of the Review button to look throughout the record template also.

- If you wish to get another version in the kind, take advantage of the Research field to get the template that meets your needs and demands.

- After you have identified the template you need, just click Purchase now to move forward.

- Find the rates strategy you need, enter your qualifications, and sign up for an account on US Legal Forms.

- Complete the transaction. You should use your Visa or Mastercard or PayPal account to fund the legitimate kind.

- Find the structure in the record and obtain it to the device.

- Make changes to the record if required. It is possible to complete, revise and indicator and produce Florida Job Invoice - Short.

Acquire and produce 1000s of record themes while using US Legal Forms web site, that offers the largest assortment of legitimate forms. Use skilled and state-specific themes to handle your company or specific requires.

Form popularity

FAQ

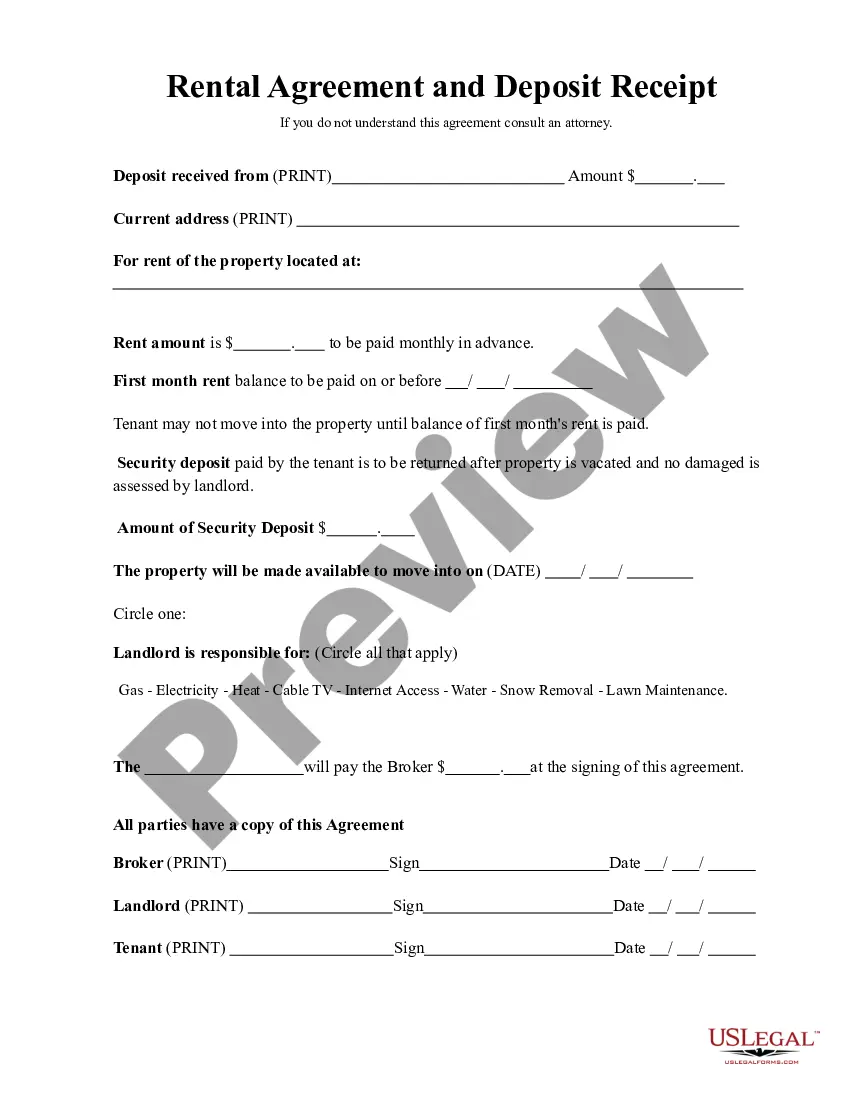

How to Fill out an Invoice Professional Invoicing ChecklistThe name and contact details of your business.The client's contact information.A unique invoice number.An itemized summary of the services provided.Specific payment terms.The invoice due date.The total amount owing on the invoice.

What should be included in an invoice?1. ' Invoice'A unique invoice number.Your company name and address.The company name and address of the customer.A description of the goods/services.The date of supply.The date of the invoice.The amount of the individual goods or services to be paid.More items...?

Your business's name and contact information. Your customer's billing information. A description of the goods or services rendered. A due date (so you get paid on time) Sales tax, if applicable.

The most basic invoice should include:A unique invoice number.Your complete information name, address and phone number.Customer's complete information name, address and phone number.List of products or services provided including cost & taxes.Payment terms and instructions.

What to include in your invoice for contract work.Your name (or company name) and contact details.Your client's name and contact details.Date of invoice.Invoice number.Itemized list and description of services.Date or duration of service.Pricing breakdowns, such as hourly or flat rates.Applicable taxes.More items...

Your invoice must include:a unique identification number.your company name, address and contact information.the company name and address of the customer you're invoicing.a clear description of what you're charging for.the date the goods or service were provided (supply date)the date of the invoice.More items...

An invoice is a document that maintains a record of a transaction between a buyer and seller, such as a paper receipt from a store or online record from an e-tailer. Invoices are a critical element of accounting internal controls and audits.

Make sure your invoice is compliantA unique invoice number.Your business's name, address, and contact details.Your customer's name and address.The invoice date.A clear breakdown of the products or services you are charging for.The amount(s) of each product or service.The total amount due.

employed invoice is a document stating the work that has to be done and the agreed rate per hour.

How to create an invoice: step-by-stepMake your invoice look professional. The first step is to put your invoice together.Clearly mark your invoice.Add company name and information.Write a description of the goods or services you're charging for.Don't forget the dates.Add up the money owed.Mention payment terms.