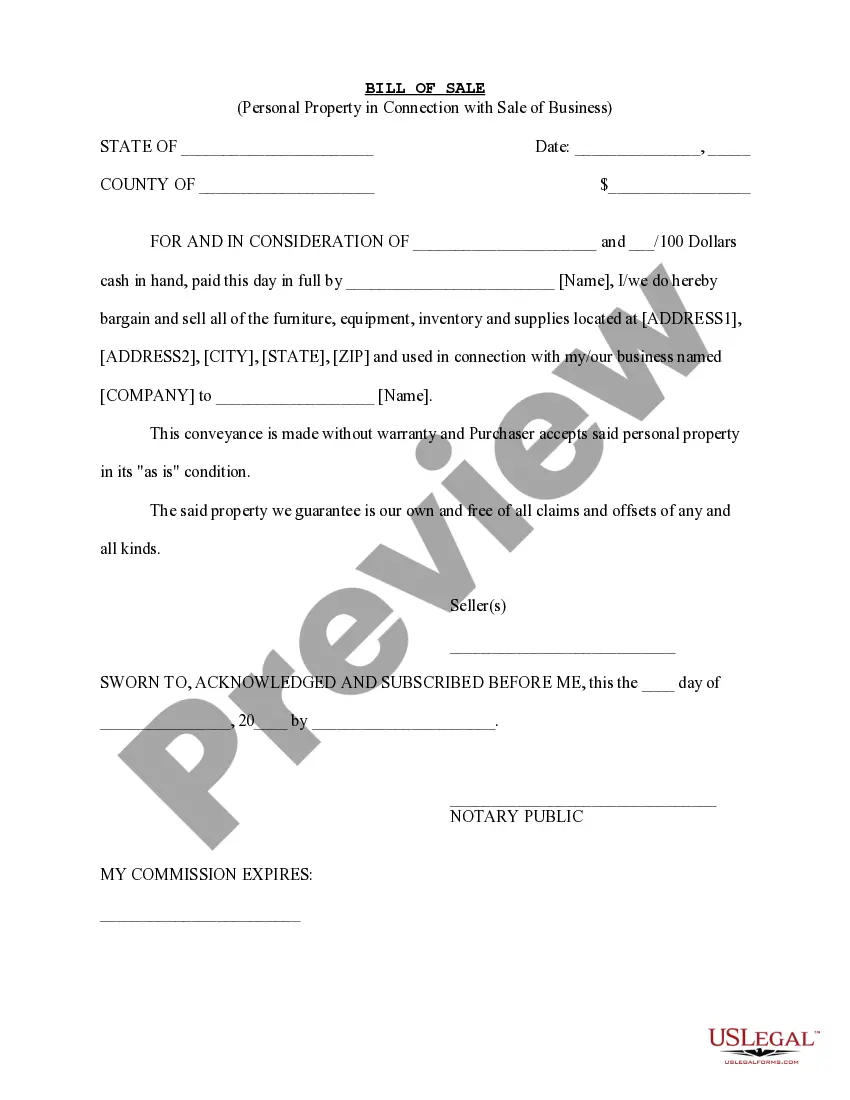

Florida Exemption Statement — Texas is a legal document that provides certain exemptions and protections related to personal property in the state of Texas. This statement is specifically designed to benefit individuals and businesses who are residents of Florida but own personal property in Texas. By filing this exemption statement, they can avail specific advantages and rights while engaging in various transactions or dealings involving their personal property in Texas. There are different types of Florida Exemption Statement — Texas based on the specific exemptions they provide. These include: 1. Homestead Exemption: The Florida Exemption Statement — Texas allows individuals who are residents of Florida and own a primary residence in Texas to claim a homestead exemption. This exemption provides protection from certain property taxes and ensures that the value of their primary residence is not subject to excessive taxation. 2. Personal Property Exemption: This type of exemption allows individuals to protect their personal property located in Texas from being seized or garnished in certain legal actions. It provides a shield against creditors or judgment creditors seeking to collect debts by exempting specific personal property items from being seized. 3. Business Exemption: The Florida Exemption Statement — Texas also extends certain exemptions and protections to businesses registered in Florida with personal property assets in Texas. It ensures that their business assets are shielded from excessive taxation or seizure in the event of legal actions, allowing them to continue operating without disruption. 4. Motor Vehicle Exemption: This type of exemption specifically applies to individuals who are Florida residents but own a motor vehicle(s) in Texas. By filing the Florida Exemption Statement — Texas, it provides protection to their motor vehicle(s) from certain legal actions, ensuring that it is exempt from being repossessed or seized under certain circumstances. 5. Agricultural Exemption: If an individual is a Florida resident and owns agricultural property in Texas, the Florida Exemption Statement — Texas also offers certain exemptions and advantages related to agricultural operations. This exemption statement can protect their agricultural land, equipment, and livestock from being subjected to excessive taxes or potential seizure from creditors. In conclusion, the Florida Exemption Statement — Texas is a crucial legal document for Florida residents who own personal property in Texas. Whether it's their primary residence, personal property, business assets, motor vehicles, or agricultural property, this statement provides various exemptions and safeguards to protect their interests and assets while engaging in transactions or facing legal actions in Texas.

Florida Exemption Statement

Description

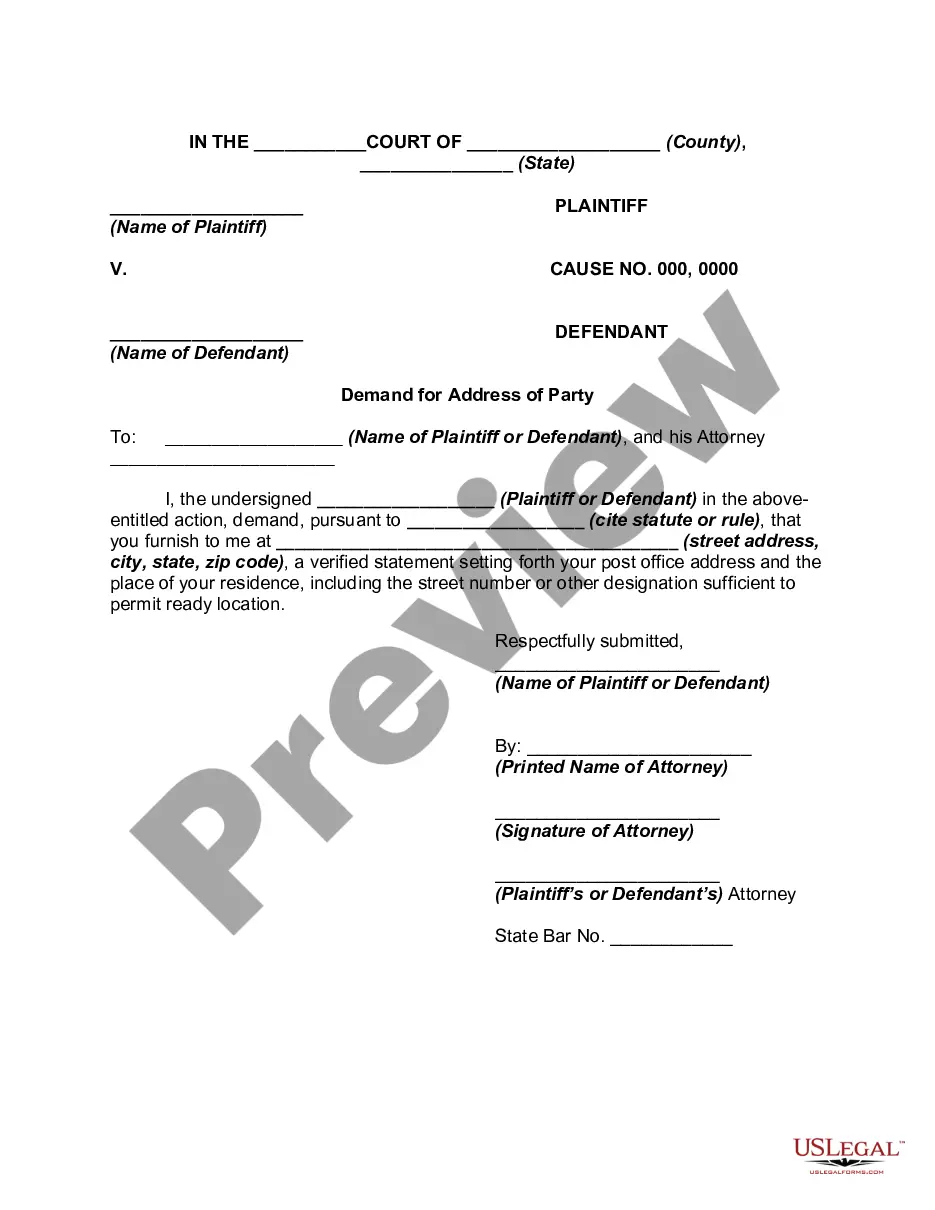

How to fill out Florida Exemption Statement?

It is possible to devote hours online trying to find the lawful file web template which fits the federal and state demands you need. US Legal Forms provides thousands of lawful forms that are examined by specialists. You can actually acquire or print out the Florida Exemption Statement - Texas from the support.

If you already have a US Legal Forms accounts, you can log in and click on the Down load button. Next, you can comprehensive, change, print out, or sign the Florida Exemption Statement - Texas. Each and every lawful file web template you acquire is your own property permanently. To get yet another copy of any obtained form, check out the My Forms tab and click on the corresponding button.

Should you use the US Legal Forms website the first time, stick to the easy directions listed below:

- First, ensure that you have chosen the best file web template for the county/town of your choice. Browse the form outline to make sure you have picked the appropriate form. If accessible, utilize the Preview button to appear throughout the file web template also.

- If you want to get yet another variation in the form, utilize the Lookup field to get the web template that meets your requirements and demands.

- Once you have found the web template you need, click Purchase now to carry on.

- Select the pricing program you need, enter your qualifications, and sign up for a free account on US Legal Forms.

- Complete the deal. You can use your Visa or Mastercard or PayPal accounts to pay for the lawful form.

- Select the file format in the file and acquire it for your gadget.

- Make modifications for your file if needed. It is possible to comprehensive, change and sign and print out Florida Exemption Statement - Texas.

Down load and print out thousands of file themes utilizing the US Legal Forms site, that offers the most important selection of lawful forms. Use specialist and condition-distinct themes to take on your business or person needs.

Form popularity

FAQ

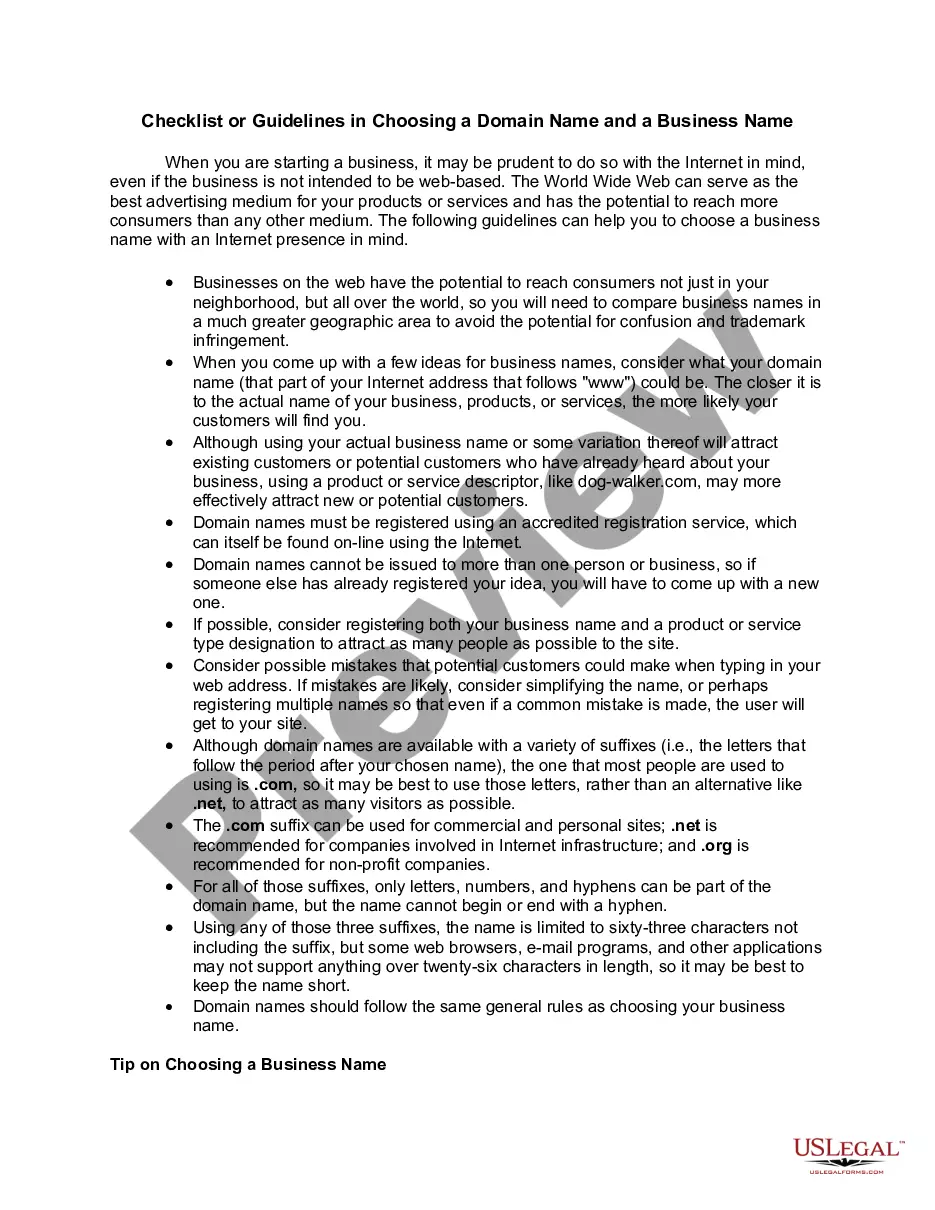

Hear this out loud PauseUse the FL Tax-Verify mobile app to verify a purchaser's Florida sales and use tax resale or exemption certificate is valid before making tax-exempt sales. To use FL Tax-Verify, dealers must be registered to collect Florida sales and use tax and have a valid resale certificate.

An exemption certificate must show: (1) the name and address of the purchaser; (2) a description of the item to be purchased; (3) the reason the purchase is exempt from tax; (4) the signature of the purchaser and the date; and. (5) the name and address of the seller.

An exemption certificate must show: (1) the name and address of the purchaser; (2) a description of the item to be purchased; (3) the reason the purchase is exempt from tax; (4) the signature of the purchaser and the date; and. (5) the name and address of the seller.

To claim exempt, write EXEMPT under line 4c. You may claim EXEMPT from withholding if: o Last year you had a right to a full refund of All federal tax income and o This year you expect a full refund of ALL federal income tax. NOTE: if you claim EXEMPT you must complete a new W-4 annually in February.

Applications for property tax exemptions are filed with the appraisal district in which the property is located. The general deadline for filing an exemption application is before May 1. Appraisal district chief appraisers are solely responsible for determining whether or not property qualifies for an exemption.

Common Texas sales tax exemptions include those for necessities of life, including most food and health-related items. In addition, goods for resale, such as wholesale items, are exempt from sales tax, as well as newspapers, containers, previously taxed items, and certain goods used for manufacturing.

HECHO! How to Fill out Texas Homestead Exemption 2022 YouTube Start of suggested clip End of suggested clip Address is different make sure you type in your mailing. Address here for section 3 put in the dateMoreAddress is different make sure you type in your mailing. Address here for section 3 put in the date you became the owner of the property. And then put the date you began living in the property.

Required Documentation for Homestead Exemption Application Your recorded deed or tax bill. Florida Drivers License or Identification Card. Will need to provide ID# and issue date. ... Vehicle Registration. Will need to provide tag # and issue date. ... Permanent Resident Alien Card. Will need to provide ID# and issue date.