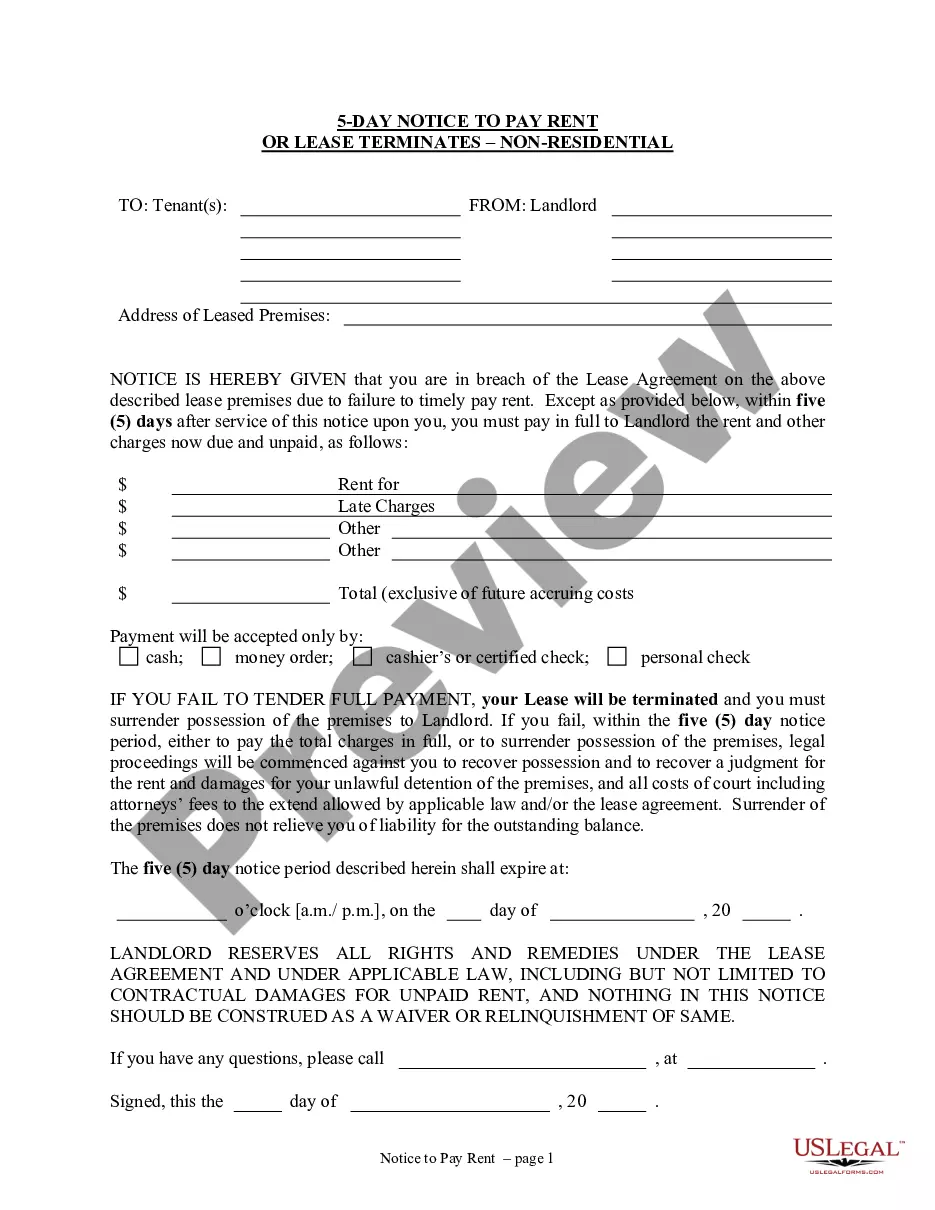

The Florida Self-Employed Independent Contractor Employment Agreement for Hair Salon or Barber Shop is a legally binding document that outlines the terms and conditions between the hair salon/barber shop owner and the self-employed independent contractor providing services at the establishment. This agreement ensures clarity and understanding regarding the working relationship and responsibilities of both parties. Keywords: Florida, self-employed, independent contractor, employment agreement, hair salon, barber shop. There may be variations of the Florida Self-Employed Independent Contractor Employment Agreement specific to hair salons or barber shops, tailored to address certain aspects or requirements unique to each industry. These variations can include: 1. Booth Rental Agreement: This type of agreement is commonly used in hair salons and barber shops where stylists or barbers rent out a designated booth or station within the establishment to perform their services independently. The agreement outlines the terms of booth rental, such as rent amount, usage hours, and responsibilities of both the salon owner and the booth renter. 2. Commission-based Agreement: This agreement is often utilized in hair salons or barber shops where stylists or barbers are compensated based on a commission earned from the services they provide. The agreement will detail the commission percentage, any applicable tier structures, and the payment terms agreed upon by both parties. 3. Contractor Lease Agreement: In cases where the self-employed contractor wishes to lease a complete work area or space within the salon or barber shop, a contractor lease agreement is used. This agreement outlines the lease terms, including the space rental amount, duration, and any restrictions or obligations associated with the lease agreement. 4. Service Agreement: This type of agreement is more comprehensive and covers various aspects of the working relationship between the salon or barber shop owner and the self-employed contractor. It can include provisions on compensation, working hours, responsibilities, non-compete clauses, termination procedures, and any other relevant details. In summary, the Florida Self-Employed Independent Contractor Employment Agreement for Hair Salon or Barber Shop is a customizable legal document that helps define the terms and conditions for individuals providing services in hair salons or barber shops. Various variations of the agreement exist to accommodate different business models and working arrangements commonly found in the industry.

Florida Self-Employed Independent Contractor Employment Agreement - Hair Salon or Barber Shop

Description

How to fill out Florida Self-Employed Independent Contractor Employment Agreement - Hair Salon Or Barber Shop?

US Legal Forms - one of several greatest libraries of authorized varieties in the USA - offers an array of authorized document themes you may download or print. Making use of the internet site, you can get 1000s of varieties for company and individual purposes, sorted by groups, suggests, or keywords.You can get the latest versions of varieties such as the Florida Self-Employed Independent Contractor Employment Agreement - Hair Salon or Barber Shop within minutes.

If you currently have a monthly subscription, log in and download Florida Self-Employed Independent Contractor Employment Agreement - Hair Salon or Barber Shop from your US Legal Forms local library. The Download key will show up on every type you perspective. You get access to all in the past acquired varieties inside the My Forms tab of your profile.

If you want to use US Legal Forms the very first time, allow me to share simple recommendations to obtain began:

- Be sure you have picked the right type for your metropolis/county. Click the Preview key to check the form`s articles. Look at the type outline to actually have chosen the appropriate type.

- When the type doesn`t suit your needs, make use of the Lookup field on top of the display screen to get the one who does.

- If you are satisfied with the shape, validate your decision by visiting the Get now key. Then, pick the costs plan you prefer and supply your qualifications to sign up for an profile.

- Process the deal. Utilize your Visa or Mastercard or PayPal profile to accomplish the deal.

- Pick the formatting and download the shape on the product.

- Make alterations. Load, revise and print and signal the acquired Florida Self-Employed Independent Contractor Employment Agreement - Hair Salon or Barber Shop.

Every template you included in your account does not have an expiration time and it is the one you have forever. So, if you wish to download or print yet another copy, just proceed to the My Forms section and click on the type you want.

Obtain access to the Florida Self-Employed Independent Contractor Employment Agreement - Hair Salon or Barber Shop with US Legal Forms, by far the most considerable local library of authorized document themes. Use 1000s of specialist and express-particular themes that satisfy your small business or individual demands and needs.

Form popularity

FAQ

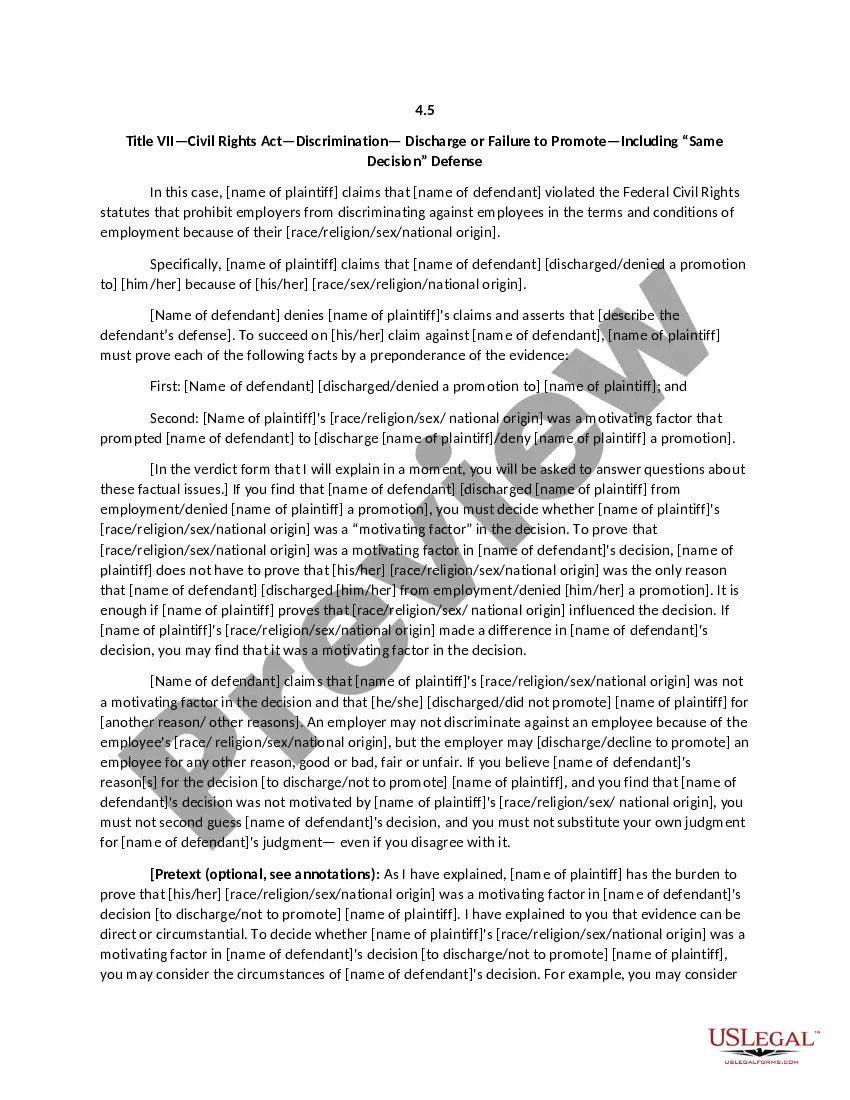

(V) The independent contractor performs work or is able to perform work for any entity in addition to or besides the employer at his or her own election without the necessity of completing an employment application or process; or.

Barbers usually serve male clients for shampoos, haircuts, and shaves. Some fit hairpieces and perform facials. Hairdressers, or hairstylists, provide coloring, chemical hair treatments, and styling in addition to shampoos and cuts, and serve both female and male clients.

The contract specifies the basis of the appointment and your expectations; it ensures that the employee clearly understands them prior to starting work. What should be included? A contract is a binding document on both parties and should be carefully worded.

Independent contractors are not entitled to benefits from the company, such as health insurance or retirement, and are ineligible for unemployment benefits. Independent contractors are even exempt from employment discrimination laws governing wages and hours worked.

A freelance job is one where a person (hairstylist in this case) works for themselves, rather than for a company. While freelancers do take on contract work for companies and organisations they are ultimately self employed. So think of you, the stylist, as a business working within a business.

Generally, if your employer treats you as an independent contractor, he/she will give you a Form 1099-Misc to show what you earned (instead of a Form W-2). Similarly, if you are paid in cash and taxes are not withheld from those payments, you are considered an independent contractor.

This blog post was written for all the salons/spas in our industry that classify workers as 1099. This includes stylists, estheticians, nail techs, massage therapists, support staff, etc. I use the term worker because a 1099 worker IS NOT an employee.

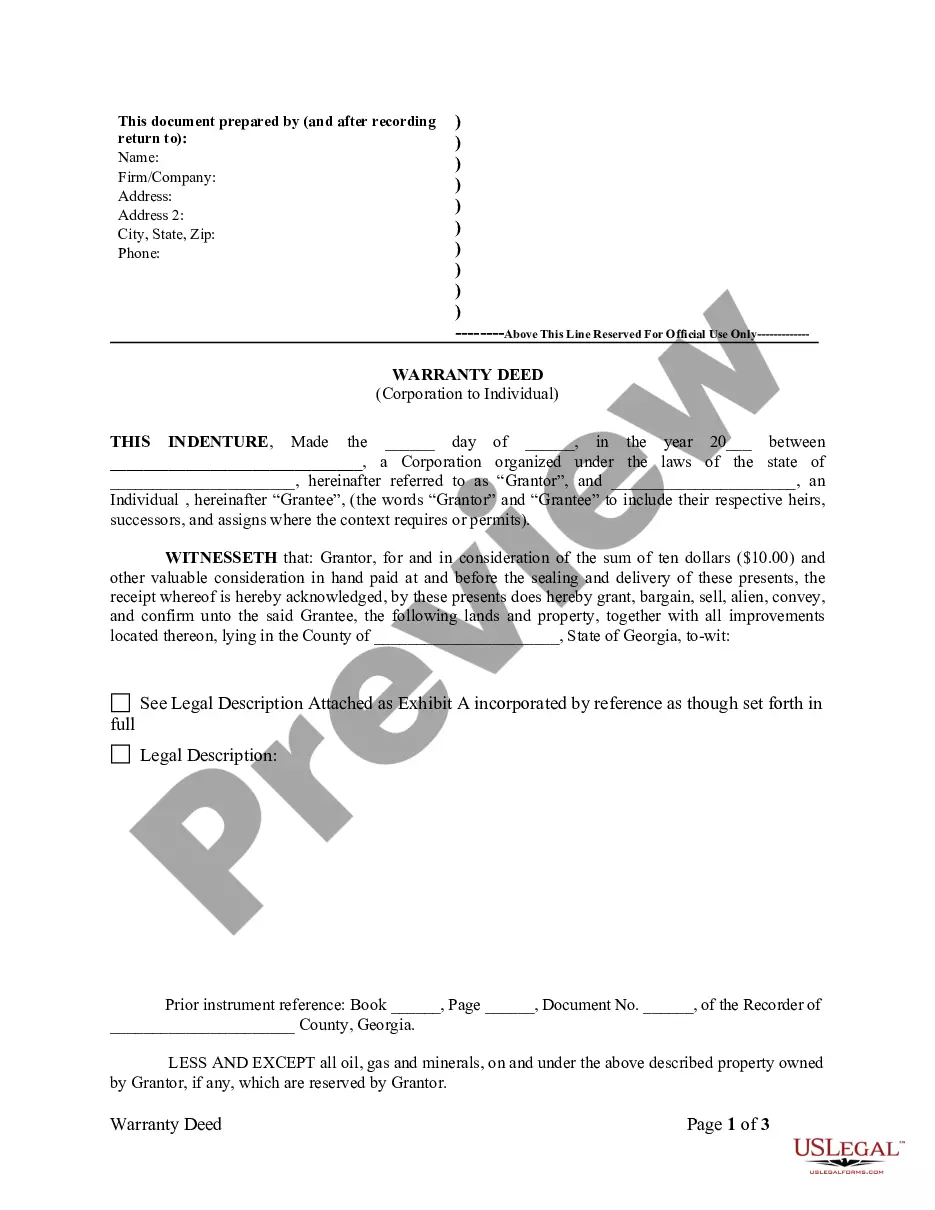

LLC vs. Sole ProprietorshipBarbers who work as independent contractors will probably start out operating as a sole proprietorship. In fact, you don't have to do anything but earn extra income to operate as a sole proprietorship.

You earn money as a contractor, consultant, freelancer, or other independent worker. You income is reported on 1099-MISC (Box 7), 1099-K (Box 1a), or you receive cash, check or credit card sales transactions, instead of a W-2.

Taxgirl says: Barbers and beauticians are generally independent contractors. Occasionally, you'll come across those that may be classed as employees but due to the nature of the business, you tend to see more classed as independent contractors.