Florida General Consent Form for Qualified Joint and Survivor Annuities (JSA) is an essential legal document that enables individuals to make informed decisions regarding their retirement plans. JSA refers to a type of annuity that provides steady income payments to an individual (the annuitant) during their lifetime while ensuring continued benefits for their surviving spouse or beneficiary after their demise. This form is particularly crucial for individuals residing in the state of Florida, as it adheres to the specific laws and regulations of the state. The Florida General Consent Form for JSA allows the annuitant to grant consent or waiver for the option of a joint and survivor annuity. By signing this form, the annuitant agrees to the reduction of their monthly pension or annuity payment in exchange for providing financial security to their spouse or beneficiary in the event of their death. This ensures that the surviving spouse or beneficiary receives a predetermined percentage (typically 50% or 100%) of the annuitant's payment upon their passing. It is important to note that without this consent, the annuity will default to a single-life option, ceasing payments upon the annuitant's death. Different variations of the Florida General Consent Form may exist, depending on the specific terms and conditions outlined by the annuity provider. Companies may offer multiple options, allowing annuitants to select the desired percentage of benefits to be passed on to their surviving spouse or beneficiary. Some forms may require additional information, such as the social security numbers of both parties or the name of the designated beneficiary. It is essential for individuals to carefully review and understand the provisions outlined in the consent form before signing, as it directly affects their retirement income and the financial security of their loved ones. In summary, the Florida General Consent Form for Qualified Joint and Survivor Annuities (JSA) is a crucial document that allows individuals to choose the joint and survivor annuity option as part of their retirement plan. By signing this form, annuitants can ensure their surviving spouse or beneficiary receives a portion of their monthly payment after their death. Understanding the terms and conditions outlined in the form is vital to make an informed decision about the financial security of loved ones.

Florida General Consent Form for Qualified Joint and Survivor Annuities - QJSA

Description

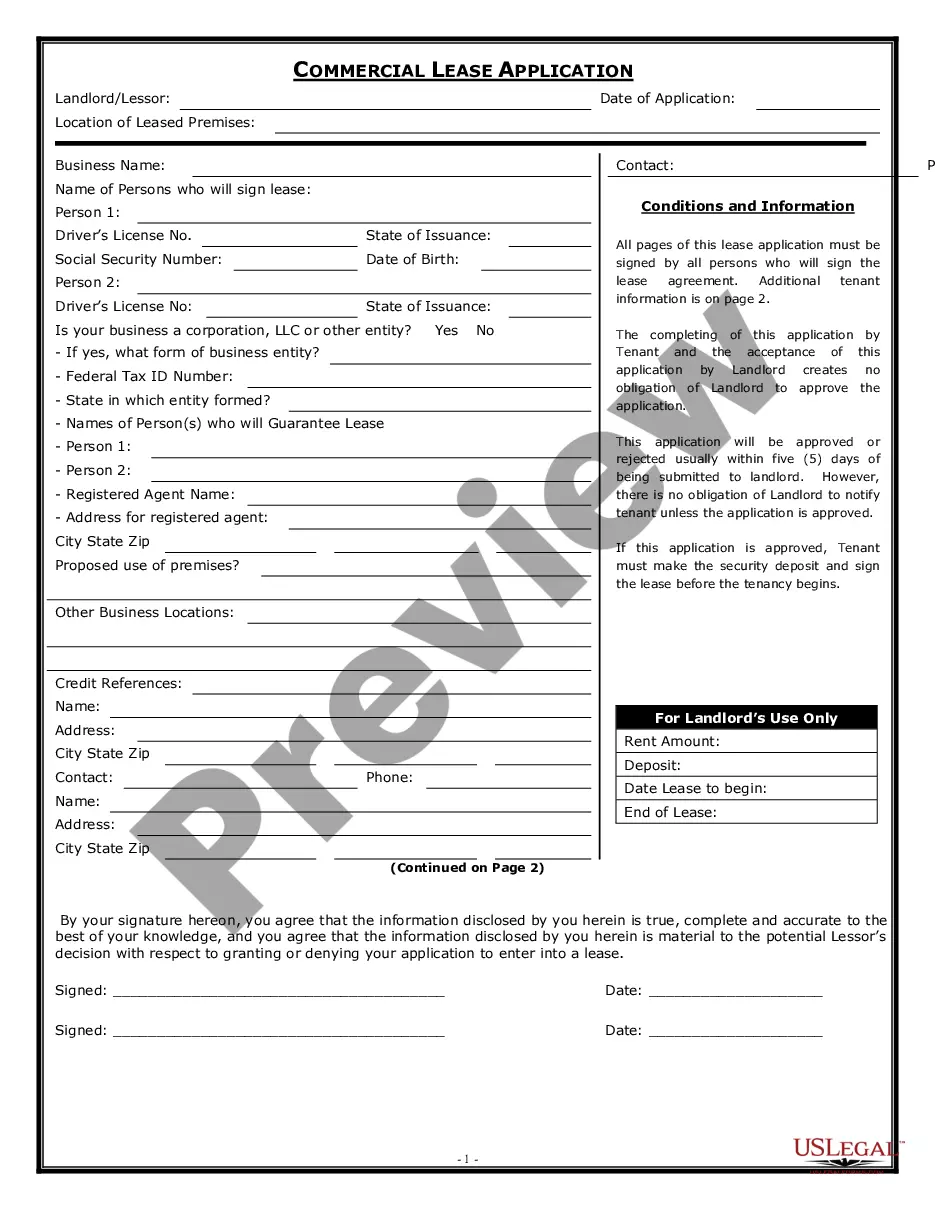

How to fill out Florida General Consent Form For Qualified Joint And Survivor Annuities - QJSA?

Choosing the right legitimate papers template can be quite a struggle. Of course, there are a variety of themes accessible on the Internet, but how would you discover the legitimate kind you want? Make use of the US Legal Forms internet site. The services offers 1000s of themes, like the Florida General Consent Form for Qualified Joint and Survivor Annuities - QJSA, which can be used for enterprise and private requirements. All the kinds are inspected by professionals and satisfy state and federal requirements.

In case you are currently signed up, log in in your account and click the Acquire option to get the Florida General Consent Form for Qualified Joint and Survivor Annuities - QJSA. Utilize your account to check with the legitimate kinds you possess purchased earlier. Go to the My Forms tab of your respective account and have an additional backup in the papers you want.

In case you are a new customer of US Legal Forms, listed here are straightforward directions that you can follow:

- Initial, ensure you have selected the right kind for your personal city/region. It is possible to check out the shape making use of the Review option and study the shape description to make sure this is basically the right one for you.

- In the event the kind will not satisfy your expectations, use the Seach area to get the appropriate kind.

- Once you are certain the shape would work, go through the Get now option to get the kind.

- Opt for the costs prepare you desire and enter in the necessary info. Make your account and buy the order with your PayPal account or charge card.

- Pick the submit format and down load the legitimate papers template in your device.

- Complete, edit and print out and signal the acquired Florida General Consent Form for Qualified Joint and Survivor Annuities - QJSA.

US Legal Forms is the largest collection of legitimate kinds that you can discover different papers themes. Make use of the company to down load skillfully-created files that follow status requirements.