Florida Approval for Relocation Expenses and Allowances

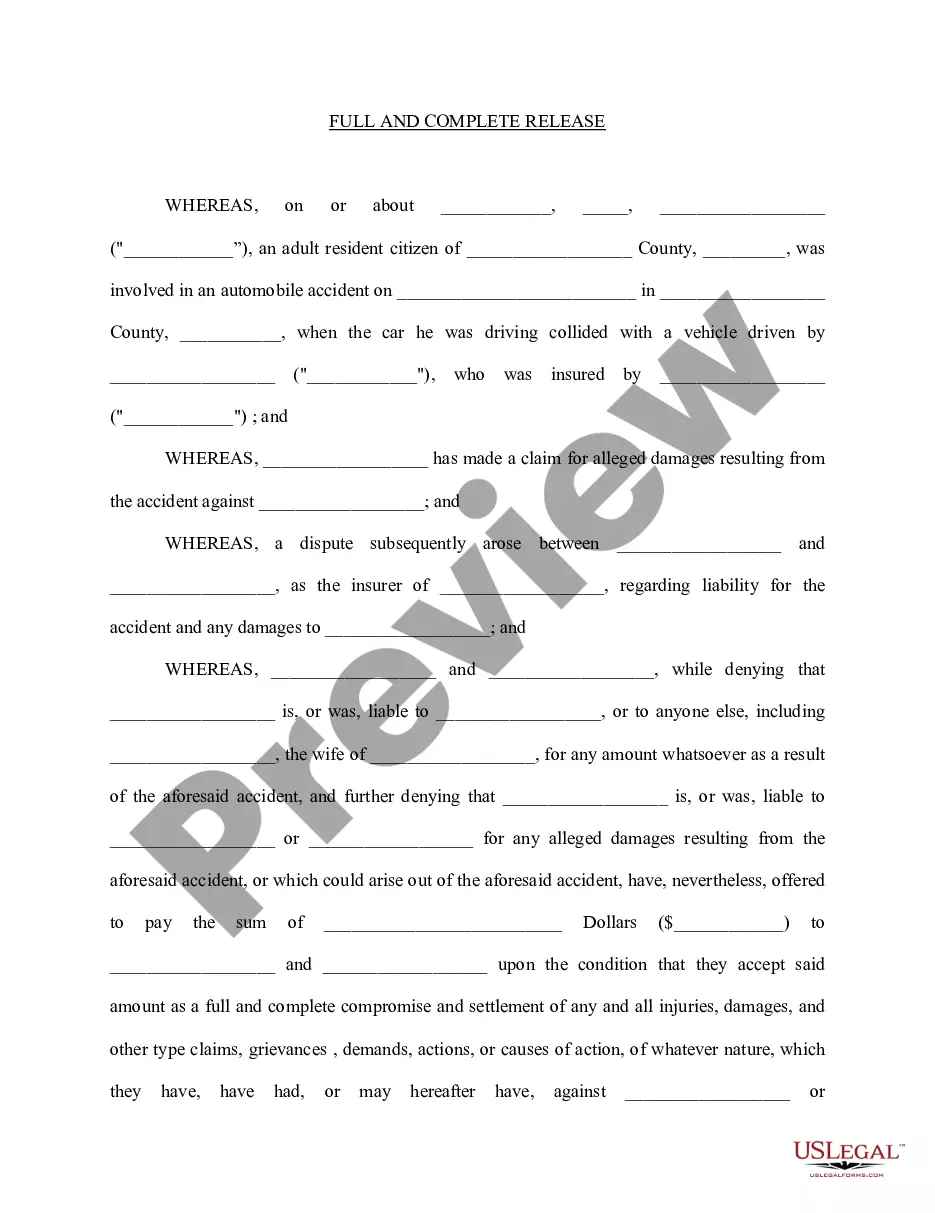

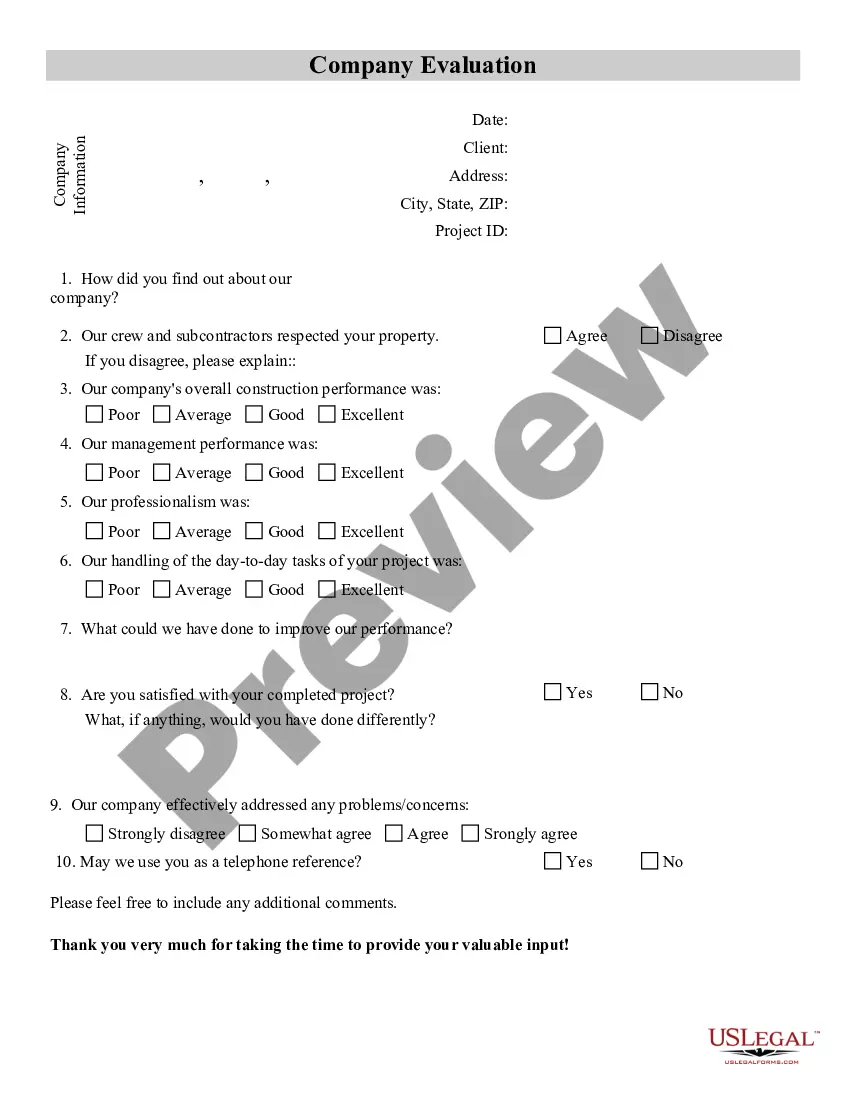

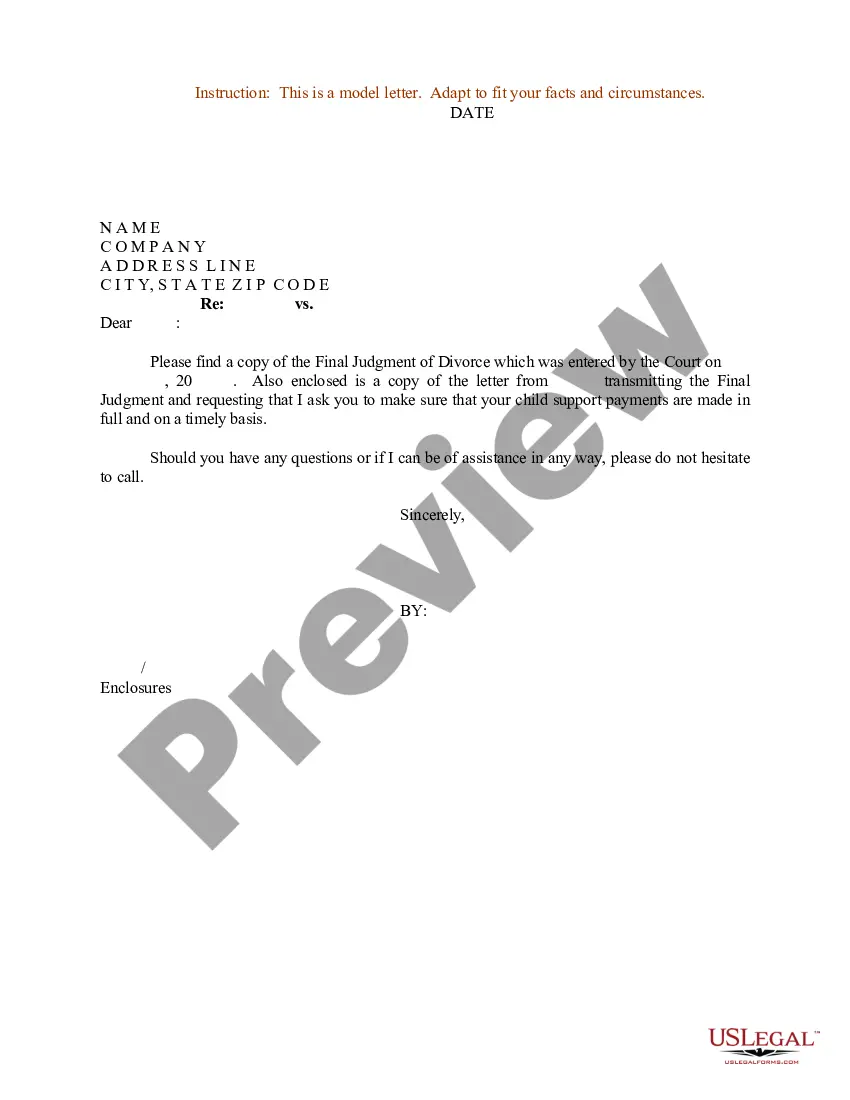

Description

How to fill out Approval For Relocation Expenses And Allowances?

Selecting the optimal legal document format may be a challenge.

Certainly, there are numerous templates accessible online, but how can you acquire the legal variant you require.

Utilize the US Legal Forms website. This service provides thousands of templates, including the Florida Approval for Relocation Expenses and Allowances, suitable for business and personal purposes.

You can review the document using the Review button and examine the document outline to ensure it meets your needs.

- All templates are reviewed by experts and comply with state and federal regulations.

- If you are already signed up, Log In to your account and click the Obtain button to locate the Florida Approval for Relocation Expenses and Allowances.

- Utilize your account to search for the legal documents you have previously purchased.

- Navigate to the My documents tab of your account and download another copy of the document you need.

- If you are a new customer of US Legal Forms, here are straightforward instructions to follow.

- First, ensure you have chosen the correct document for your city/state.

Form popularity

FAQ

How much should a lump sum relocation package be? For a flat lump sum, you should expect typically between $1,000 and $7,500. According to Dwellworks, employees across the nation receive an average lump sum of $7,200.

You can deduct certain expenses associated with moving your household goods and personal effects. Examples of these expenses include the cost of packing, crating, hauling a trailer, in-transit storage, and insurance.

For most taxpayers, moving expenses are no longer deductible, meaning you can no longer claim this deduction on your federal return. This change is set to stay in place for tax years 2018-2025.

To qualify, reimbursements or payments must be for work-related moving expenses that would have been deductible by the employee if the employee had directly paid them before Jan. 1, 2018.

These include: The cost of packing, crating and transporting household goods of the employee and family. This includes cars and pets. The cost of connecting or disconnecting utilities.

IRS moving deductions are no longer allowed under the new tax law. Unfortunately for taxpayers, moving expenses are no longer tax-deductible when moving for work. According to the IRS, the moving expense deduction has been suspended, thanks to the new Tax Cuts and Jobs Act.

You can deduct certain expenses associated with moving your household goods and personal effects. Examples of these expenses include the cost of packing, crating, hauling a trailer, in-transit storage, and insurance.

Key takeaway: Employee relocation packages vary, but some options to consider include relocation reimbursement, a flexible start date, free visits, temporary housing, familial support, real estate cost assistance, pay adjustments or bonuses, and a payback clause.

Five states have passed legislation to make moving expenses deductible or excludable.Arizona.Hawaii.Iowa.New York.Virginia.

Which states allow moving expense deduction? The following states allow moving expense deductions: Alaska, Florida and Nevada.