Florida Sample "Before" Adverse Action Letter

Description

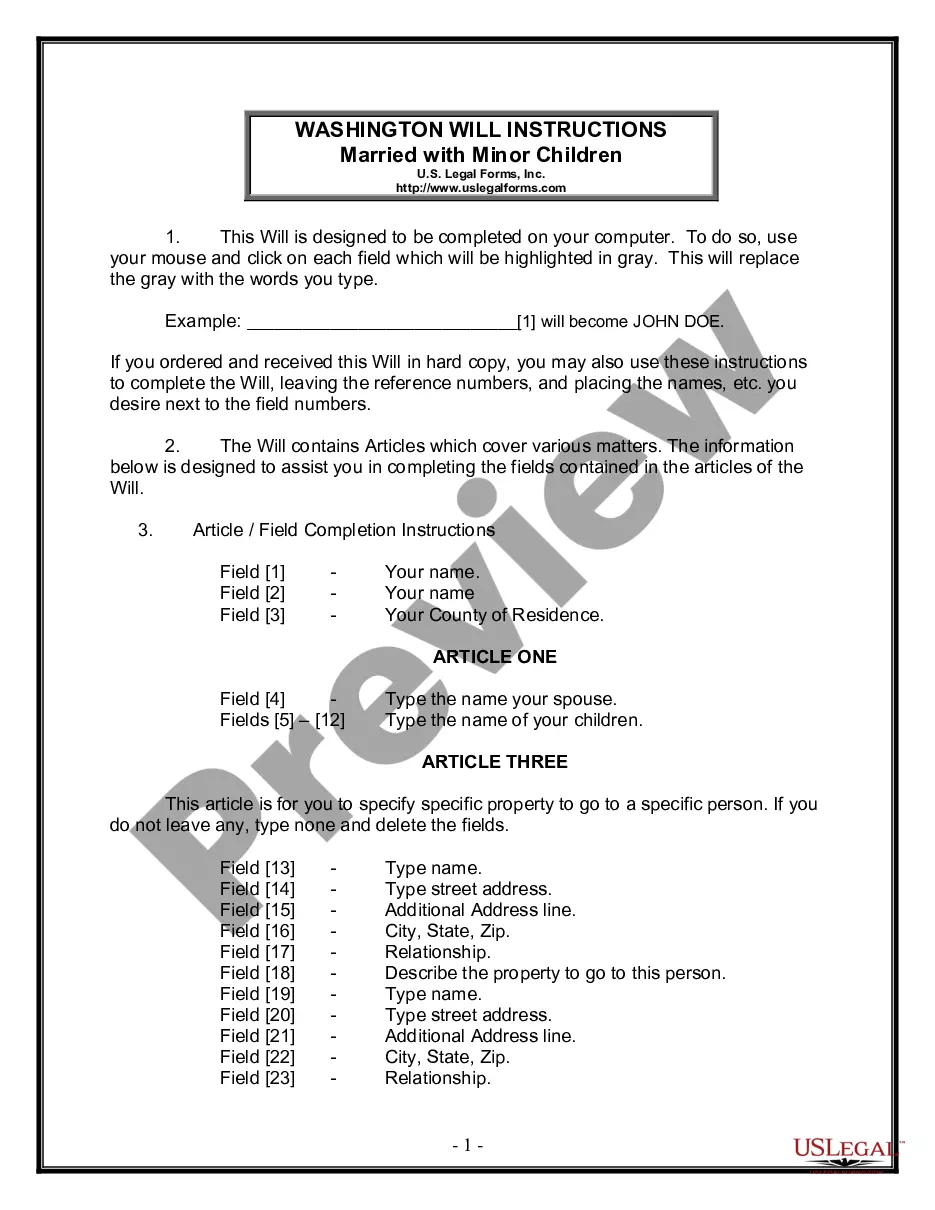

How to fill out Sample "Before" Adverse Action Letter?

Choosing the best authorized file design might be a struggle. Needless to say, there are a lot of web templates available on the Internet, but how would you find the authorized form you will need? Use the US Legal Forms website. The service gives 1000s of web templates, such as the Florida Sample Before" Adverse Action Letter", that can be used for company and private requires. All the forms are checked by pros and satisfy state and federal specifications.

In case you are presently authorized, log in to your account and click on the Acquire key to find the Florida Sample Before" Adverse Action Letter". Utilize your account to check with the authorized forms you possess bought earlier. Proceed to the My Forms tab of your respective account and acquire one more backup of the file you will need.

In case you are a fresh customer of US Legal Forms, allow me to share easy guidelines for you to comply with:

- First, be sure you have chosen the correct form for your personal city/area. You may examine the form using the Preview key and read the form description to ensure it is the right one for you.

- When the form is not going to satisfy your expectations, use the Seach industry to discover the correct form.

- Once you are positive that the form is proper, click on the Purchase now key to find the form.

- Choose the prices prepare you want and enter the essential information and facts. Build your account and pay for your order using your PayPal account or charge card.

- Choose the data file format and down load the authorized file design to your device.

- Total, edit and produce and indication the acquired Florida Sample Before" Adverse Action Letter".

US Legal Forms will be the biggest library of authorized forms for which you can see numerous file web templates. Use the service to down load skillfully-created documents that comply with express specifications.