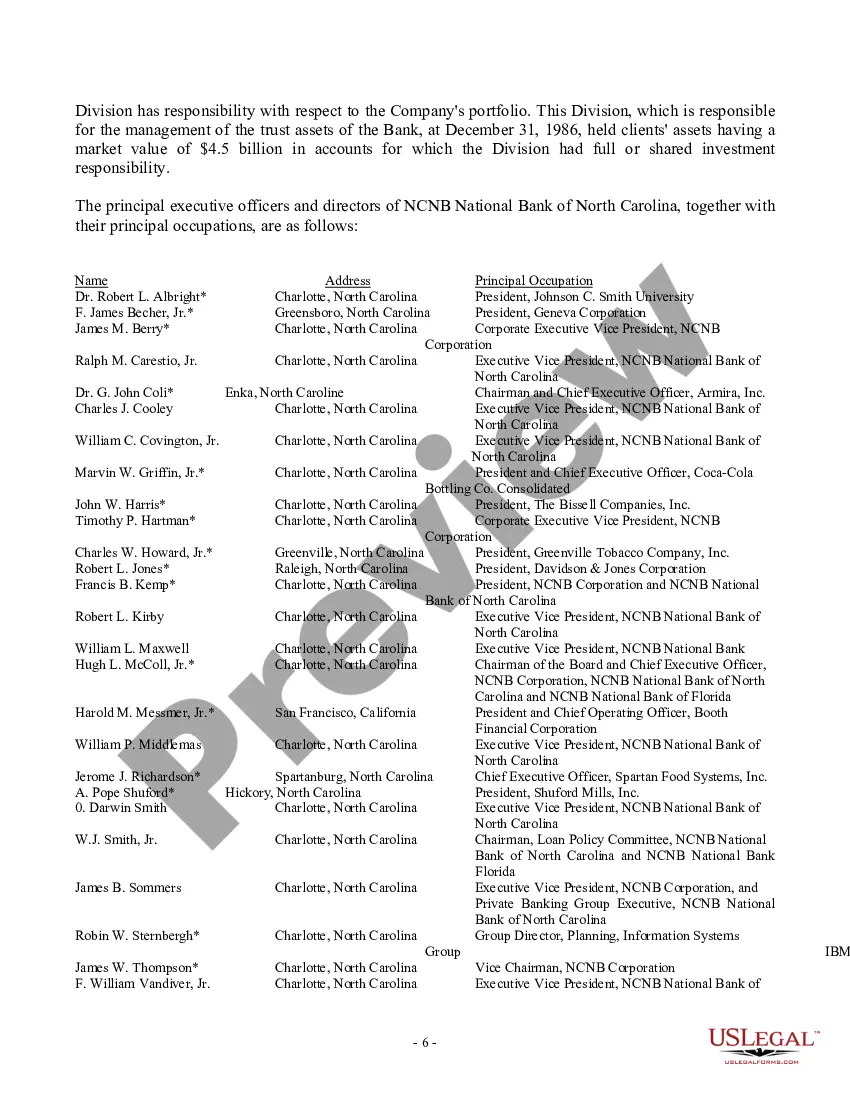

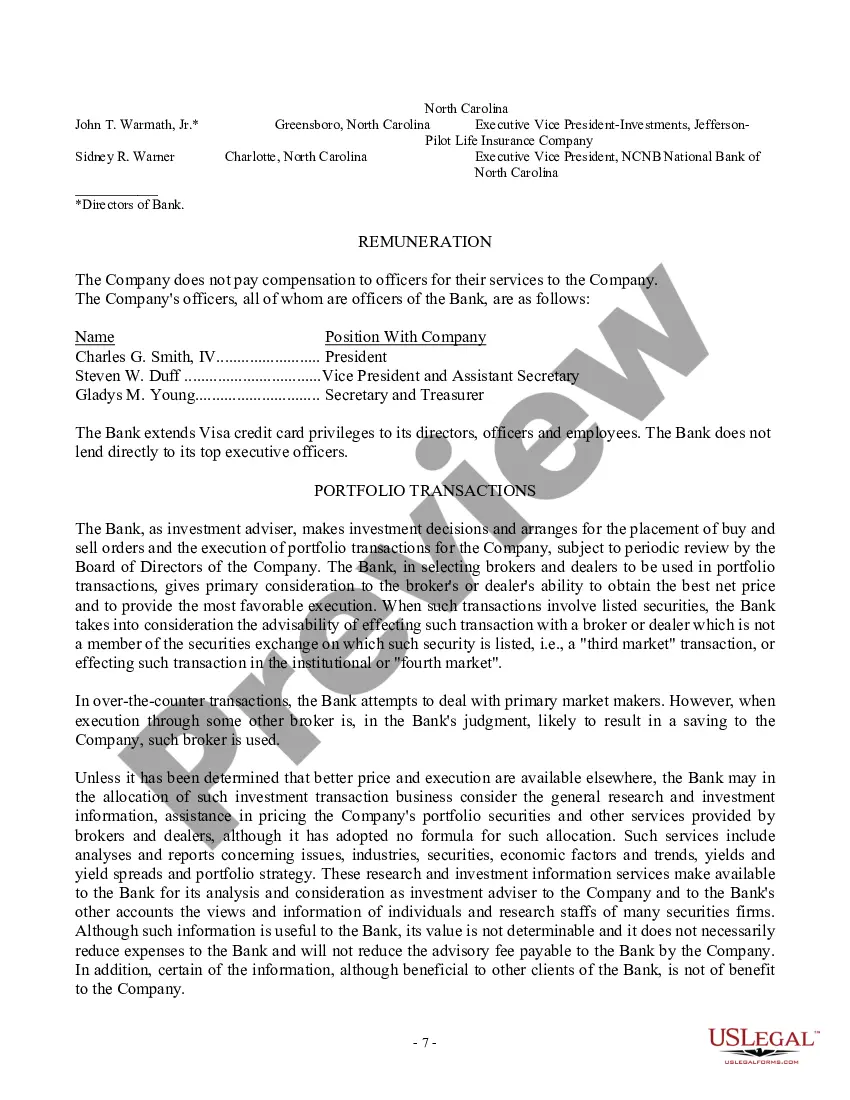

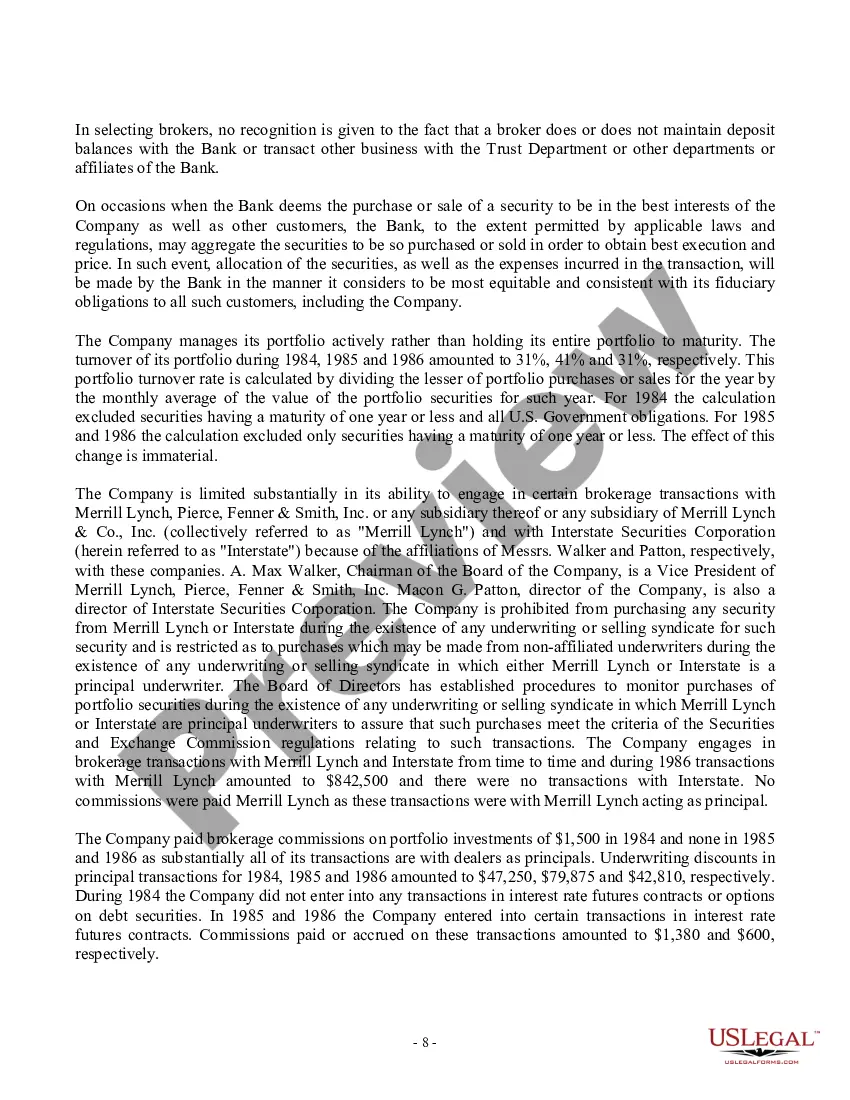

Florida Proxy Statement - Hatteras Income Securities, Inc. with copy of advisory agreement

Description

How to fill out Proxy Statement - Hatteras Income Securities, Inc. With Copy Of Advisory Agreement?

US Legal Forms - one of many most significant libraries of legitimate varieties in America - provides a wide array of legitimate file themes you can down load or produce. While using website, you may get thousands of varieties for business and specific uses, sorted by classes, claims, or search phrases.You will discover the most up-to-date versions of varieties like the Florida Proxy Statement - Hatteras Income Securities, Inc. with copy of advisory agreement in seconds.

If you have a membership, log in and down load Florida Proxy Statement - Hatteras Income Securities, Inc. with copy of advisory agreement through the US Legal Forms local library. The Down load button can look on each and every kind you see. You have access to all earlier downloaded varieties from the My Forms tab of your bank account.

If you would like use US Legal Forms the very first time, listed here are straightforward instructions to obtain started out:

- Be sure you have picked out the correct kind to your city/state. Select the Preview button to analyze the form`s information. Read the kind outline to actually have selected the correct kind.

- In case the kind does not fit your specifications, take advantage of the Search area near the top of the display to discover the the one that does.

- If you are pleased with the form, verify your selection by clicking on the Purchase now button. Then, select the prices prepare you want and supply your accreditations to register to have an bank account.

- Method the transaction. Use your bank card or PayPal bank account to accomplish the transaction.

- Select the formatting and down load the form on your own system.

- Make modifications. Fill out, modify and produce and sign the downloaded Florida Proxy Statement - Hatteras Income Securities, Inc. with copy of advisory agreement.

Every web template you added to your bank account lacks an expiry time and it is your own property eternally. So, if you wish to down load or produce yet another duplicate, just check out the My Forms segment and then click in the kind you want.

Obtain access to the Florida Proxy Statement - Hatteras Income Securities, Inc. with copy of advisory agreement with US Legal Forms, probably the most considerable local library of legitimate file themes. Use thousands of skilled and express-particular themes that fulfill your company or specific needs and specifications.