Florida Agreement and Plan of Merger by Cascade Financial, Cascade Bank, Amfirst Bancorporation, and American First National Bank

Description

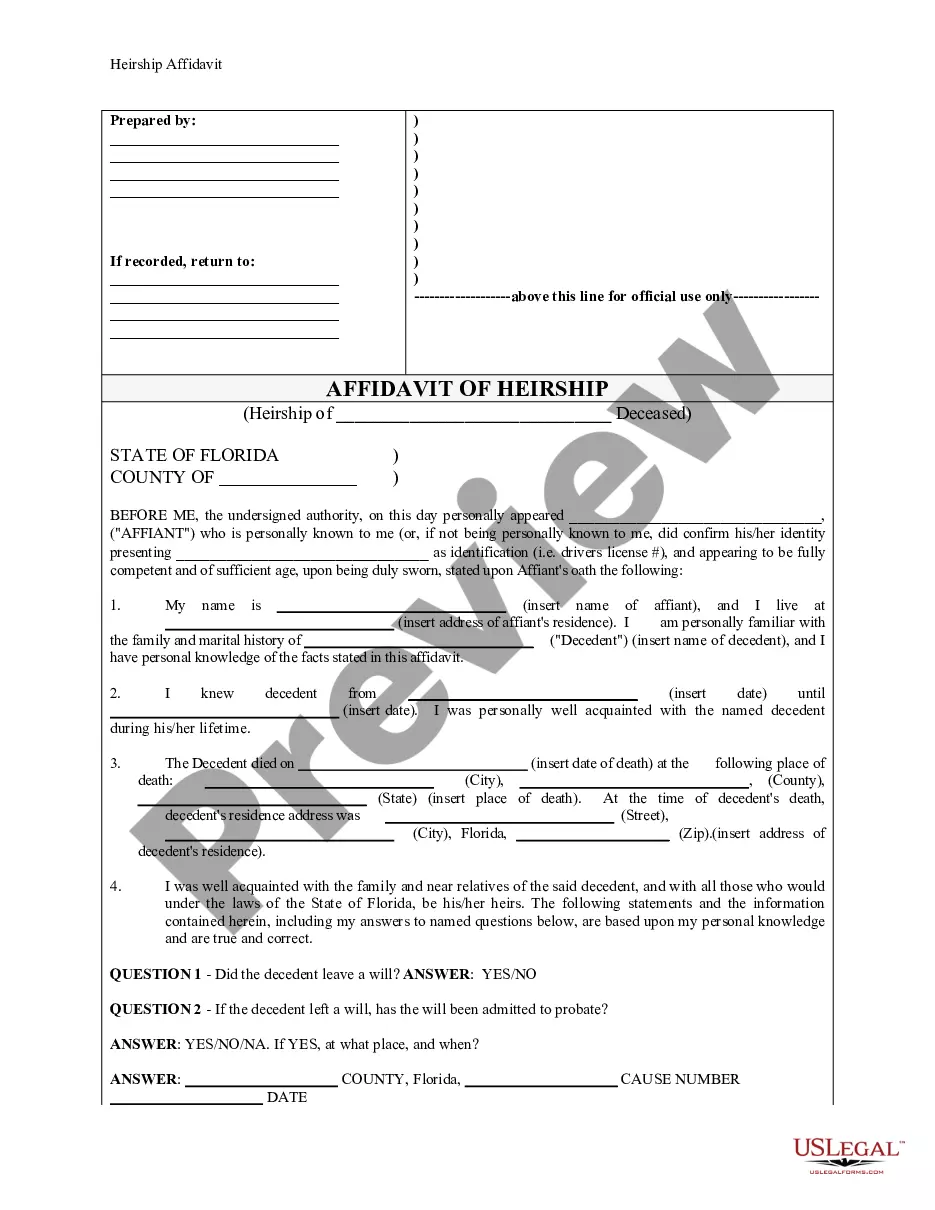

How to fill out Agreement And Plan Of Merger By Cascade Financial, Cascade Bank, Amfirst Bancorporation, And American First National Bank?

US Legal Forms - one of the greatest libraries of legal types in the USA - delivers a variety of legal record layouts you can download or printing. Using the internet site, you may get a large number of types for company and individual reasons, sorted by types, says, or key phrases.You will find the latest variations of types such as the Florida Agreement and Plan of Merger by Cascade Financial, Cascade Bank, Amfirst Bancorporation, and American First National Bank within minutes.

If you have a subscription, log in and download Florida Agreement and Plan of Merger by Cascade Financial, Cascade Bank, Amfirst Bancorporation, and American First National Bank through the US Legal Forms local library. The Down load button can look on every single kind you perspective. You have accessibility to all in the past downloaded types inside the My Forms tab of your own accounts.

In order to use US Legal Forms initially, listed here are basic guidelines to help you started out:

- Make sure you have picked out the correct kind for the town/region. Click on the Review button to examine the form`s articles. Read the kind information to actually have selected the appropriate kind.

- If the kind does not match your specifications, take advantage of the Search field at the top of the monitor to obtain the one that does.

- Should you be happy with the shape, affirm your selection by visiting the Get now button. Then, opt for the costs prepare you prefer and provide your qualifications to register for an accounts.

- Approach the purchase. Make use of your charge card or PayPal accounts to accomplish the purchase.

- Select the structure and download the shape in your gadget.

- Make alterations. Complete, change and printing and signal the downloaded Florida Agreement and Plan of Merger by Cascade Financial, Cascade Bank, Amfirst Bancorporation, and American First National Bank.

Each web template you included with your account does not have an expiration time and is the one you have eternally. So, in order to download or printing another backup, just visit the My Forms section and click in the kind you will need.

Get access to the Florida Agreement and Plan of Merger by Cascade Financial, Cascade Bank, Amfirst Bancorporation, and American First National Bank with US Legal Forms, one of the most comprehensive local library of legal record layouts. Use a large number of professional and status-distinct layouts that meet your small business or individual requires and specifications.