Description: The Florida Designation of Rights, Privileges, and Preferences of Preferred Stock is a legal document that outlines the specific rights and privileges granted to holders of preferred stock in a Florida-based company. This designation is an important aspect of a corporation's bylaws and ensures that preferred stockholders have certain advantages and benefits over common stockholders. Preferred stock is a type of stock that provides its holders with priority in receiving dividends and assets if the company goes bankrupt. It is generally considered less risky than common stock, making it an attractive investment option for certain individuals or institutions. The Florida Designation of Rights, Privileges, and Preferences of Preferred Stock typically includes a range of provisions and conditions that determine the following key factors: 1. Dividend Preferences: This provision outlines the preferred stockholder's right to receive dividends before any dividends are paid to common stockholders. These dividends can be structured as a fixed rate, a percentage of profits, or be subject to other conditions as specified. 2. Liquidation Preference: This provision describes the order in which preferred stockholders receive payments in the event of the company's liquidation or sale. It ensures that preferred stockholders are reimbursed their initial investment and any unpaid dividends before any remaining assets are distributed to common stockholders. 3. Conversion Rights: This provision states the conditions under which preferred stockholders can convert their shares into common stock. It provides an option for preferred stockholders to benefit from potential increases in the value of the company. 4. Voting Rights: The designation may also outline the voting rights of preferred stockholders. In some cases, preferred stockholders have limited or no voting rights, while in others, they may have voting rights on specific matters such as merger or acquisition approvals. 5. Redemption Terms: This section specifies the circumstances and conditions under which the corporation may repurchase the preferred stock from the stockholders. Other types of Florida Designation of Rights, Privileges, and Preferences of Preferred Stock include: 1. Cumulative Preferred Stock: This type of preferred stock ensures that if the company fails to pay dividends in any given year, the unpaid dividends will accumulate and must be paid before distributing any dividends to common stockholders in subsequent years. 2. Convertible Preferred Stock: Convertible preferred stock gives the shareholders the right to convert their preferred shares into a specific number of common shares. This allows preferred stockholders to benefit from potential increases in the value of the company's common stock. 3. Participating Preferred Stock: This type of preferred stock not only guarantees a fixed dividend but also entitles the shareholders to participate in additional dividends with common stockholders, particularly in the event of high company profits. In conclusion, the Florida Designation of Rights, Privileges, and Preferences of Preferred Stock is a critical legal document that outlines the specific rights and benefits granted to holders of preferred stock in a Florida-based corporation. Whether it's dividend preferences, liquidation preferences, conversion rights, voting rights, or redemption terms, this designation ensures that preferred stockholders have certain advantages and protections over common stockholders.

Florida Designation of Rights, Privileges and Preferences of Preferred Stock

Description

How to fill out Florida Designation Of Rights, Privileges And Preferences Of Preferred Stock?

Choosing the right authorized record template can be quite a struggle. Obviously, there are a lot of web templates available on the net, but how do you obtain the authorized kind you want? Use the US Legal Forms web site. The assistance gives 1000s of web templates, such as the Florida Designation of Rights, Privileges and Preferences of Preferred Stock, that you can use for enterprise and private requires. All of the kinds are checked by professionals and meet up with state and federal specifications.

If you are previously listed, log in in your bank account and click on the Obtain button to find the Florida Designation of Rights, Privileges and Preferences of Preferred Stock. Make use of bank account to search with the authorized kinds you may have ordered in the past. Check out the My Forms tab of your bank account and acquire another duplicate from the record you want.

If you are a brand new end user of US Legal Forms, listed below are easy recommendations so that you can follow:

- First, make sure you have chosen the correct kind for your personal area/county. You may check out the form while using Preview button and browse the form information to make sure this is the best for you.

- If the kind fails to meet up with your expectations, utilize the Seach field to obtain the correct kind.

- Once you are certain that the form is acceptable, click the Get now button to find the kind.

- Pick the prices program you desire and enter in the essential info. Make your bank account and purchase your order utilizing your PayPal bank account or charge card.

- Choose the file format and down load the authorized record template in your system.

- Full, revise and print out and indication the received Florida Designation of Rights, Privileges and Preferences of Preferred Stock.

US Legal Forms is definitely the largest collection of authorized kinds that you can find numerous record web templates. Use the company to down load expertly-produced papers that follow state specifications.

Form popularity

FAQ

Preferred shareholders have priority over a company's income, meaning they are paid dividends before common shareholders. Common stockholders are last in line when it comes to company assets, which means they will be paid out after creditors, bondholders, and preferred shareholders.

Typically, company founders and employees receive common stock, while venture capital investors receive preferred shares, often with a liquidation preference. The preferred shares are typically converted to common shares with the completion of an initial public offering or acquisition.

Common shareholders are granted six rights: voting power, ownership, the right to transfer ownership, a claim to dividends, the right to inspect corporate documents, and the right to sue for wrongful acts. Investors should thoroughly research the corporate governance policies of the companies they invest in.

Preferred stockholders have a priority as to both earnings and assets in the event of liquidation. Common stockholders have the right to share in the distribution of corporate income before preferred stockholders.

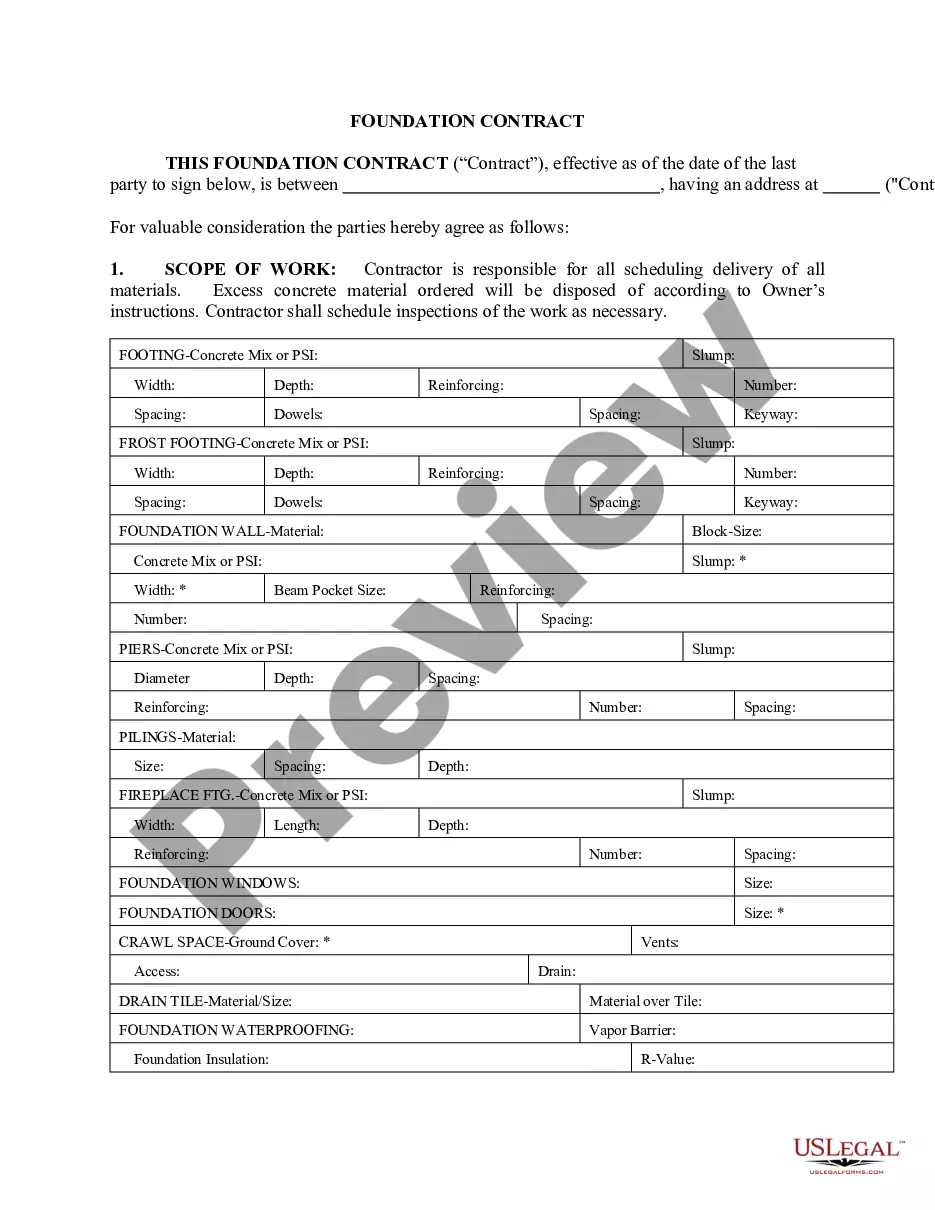

A certificate which contains a copy of the board resolution setting out the powers, designations, preferences or rights of a class or series of a class of stock of a corporation (typically a series of preferred stock) if they are not already contained in the certificate of incorporation of the corporation.

Preferred shareholders have priority over a company's income, meaning they are paid dividends before common shareholders. Common stockholders are last in line when it comes to company assets, which means they will be paid out after creditors, bondholders, and preferred shareholders.

Participating preferred stock is a type of preferred stock that gives the holder the right to receive dividends equal to the customarily specified rate that preferred dividends are paid to preferred shareholders, as well as an additional dividend based on some predetermined condition.

Preferred stocks pay a fixed dividend to shareholders, are prioritized in the event of bankruptcy, and are less impacted by market fluctuations than common stock. Preferred stocks are typically purchased for their consistent dividend payments, which offer less financial risk to shareholders than common stock.