Florida Directors and Officers Indemnity Trust, also known as D&O Indemnity Trust, is a type of insurance policy specifically designed to protect directors and officers of organizations based in Florida. It provides comprehensive coverage against potential legal actions and financial losses arising from their decisions and actions while serving their respective roles. The primary purpose of Florida Directors and Officers Indemnity Trust is to shield directors and officers from personal liability, ensuring their ability to effectively manage and lead their organization without fear of personal financial ruin. In the complex and dynamic business landscape, directors and officers often face a wide range of risks, including breach of fiduciary duty, mismanagement claims, negligence, fraud, and employment-related disputes. This trust acts as a safety net, safeguarding their personal assets and reputation should these allegations result in legal action. By obtaining a Directors and Officers Indemnity Trust, Florida-based organizations can attract and retain top talent for executive positions. Potential candidates are likely to prefer entities that offer this coverage, as it demonstrates a commitment to protecting their directors and officers against potential legal and financial risks. There are different types of Florida Directors and Officers Indemnity Trust, each tailored to specific sectors or industries. Some common variations include: 1. Corporate Directors and Officers Indemnity Trust: This type of coverage is designed for directors and officers in corporations, regardless of their size or industry. It offers protection against claims arising from corporate governance, regulatory compliance, intellectual property disputes, shareholder actions, and more. 2. Non-Profit Directors and Officers Indemnity Trust: Non-profit organizations face unique risks, including fundraising, grant management, and compliance with tax regulations. This trust provides coverage for directors and officers involved in non-profit organizations, protecting them from lawsuits related to mismanagement of funds, allegations of negligence, discrimination claims, or wrongful termination. 3. Financial Institutions Directors and Officers Indemnity Trust: Banks, credit unions, investment firms, and other financial institutions require specialized coverage due to the nature of their operations. This trust provides protection to directors and officers in the financial sector from lawsuits related to financial mismanagement, breach of duty, or regulatory violations. 4. Healthcare Directors and Officers Indemnity Trust: Directors and officers in the healthcare industry are exposed to unique risks resulting from medical malpractice, patient privacy breaches, billing errors, and regulatory compliance. This trust offers coverage for these individuals against the potential financial ramifications of such claims. In summary, Florida Directors and Officers Indemnity Trusts play a crucial role in safeguarding the personal assets and reputation of directors and officers, enabling them to make critical decisions without fear of personal financial ruin. Different types of trusts cater to various sectors, ensuring that directors and officers in different industries are adequately protected.

Florida Directors and Officers Indemnity Trust

Description

How to fill out Directors And Officers Indemnity Trust?

US Legal Forms - one of many biggest libraries of authorized varieties in the USA - offers a variety of authorized papers templates you may download or print out. Using the web site, you can find 1000s of varieties for company and individual purposes, categorized by classes, suggests, or keywords.You can get the most up-to-date types of varieties like the Florida Directors and Officers Indemnity Trust within minutes.

If you currently have a registration, log in and download Florida Directors and Officers Indemnity Trust from the US Legal Forms collection. The Download button will show up on every single type you view. You gain access to all formerly delivered electronically varieties inside the My Forms tab of your accounts.

If you wish to use US Legal Forms initially, listed below are easy directions to obtain started:

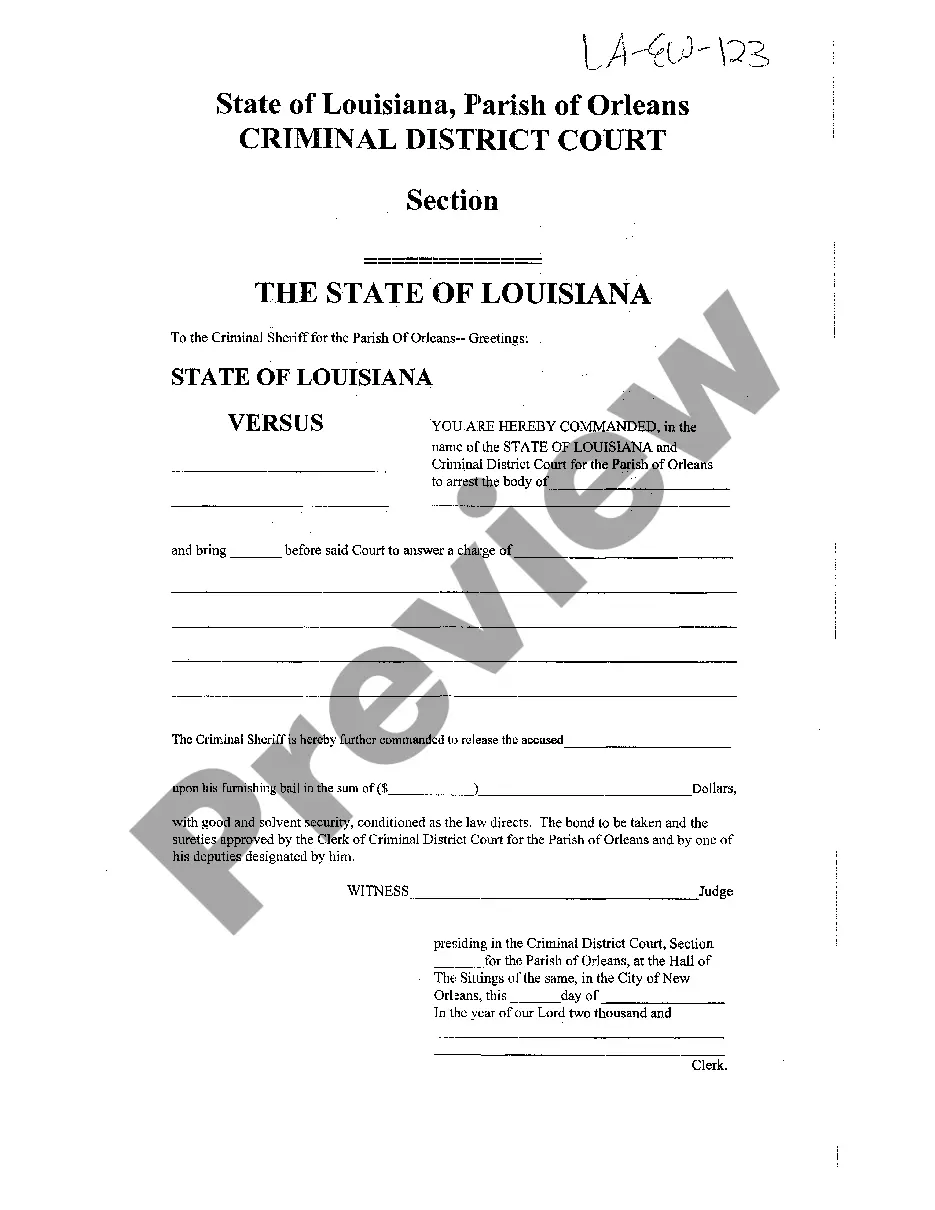

- Make sure you have selected the proper type to your town/region. Click on the Review button to examine the form`s articles. Browse the type information to actually have chosen the appropriate type.

- In case the type does not fit your demands, make use of the Lookup area on top of the monitor to get the one who does.

- Should you be content with the shape, affirm your option by simply clicking the Buy now button. Then, choose the pricing strategy you favor and give your references to register for an accounts.

- Process the financial transaction. Make use of bank card or PayPal accounts to complete the financial transaction.

- Select the structure and download the shape on the system.

- Make modifications. Complete, modify and print out and indicator the delivered electronically Florida Directors and Officers Indemnity Trust.

Each template you added to your bank account lacks an expiration time and is also your own property eternally. So, if you wish to download or print out another duplicate, just visit the My Forms section and click on around the type you require.

Gain access to the Florida Directors and Officers Indemnity Trust with US Legal Forms, the most comprehensive collection of authorized papers templates. Use 1000s of expert and condition-specific templates that meet up with your small business or individual demands and demands.

Form popularity

FAQ

Section 627.912(1)(d), Florida Statute- After any calendar year in which no claim or action for damages was closed, the entity shall file a no claim submission report. Such report shall be filed with the office no later than April 1 of each calendar year for the immediately preceding calendar year.

The indemnity may cover liability incurred by the director to any person other than the company or an associated company. This may include both legal costs and the financial costs of an adverse judgement.

Most indemnification provisions require the indemnifying party to "indemnify and hold harmless" the indemnified party for specified liabilities. In practice, these terms are typically paired and interpreted as a unit to mean "indemnity."

Indemnifications, or ?hold harmless? provisions, shift risks or potential costs from one party to another. One party to the contract promises to defend and pay costs and expenses of the other if specific circumstances arise (often a claim or dispute with a third party to the contract).

A director and officer indemnification agreement is a contract that allows executives to protect themselves from claims made against them while performing job. Indemnification means that in the event a lawsuit is filed against a company, the indemnified party is "held harmless" from claims.

A director and officer indemnification agreement is a contract that allows executives to protect themselves from claims made against them while performing job.

These provisions generally require the portfolio company to expressly acknowledge that the director has rights of indemnification, advancement, and insurance from the sponsor; to agree that it is the indemnitor of first resort and that it is obligated to advance all expenses and indemnify for all judgments, penalties, ...

To state a claim for common law indemnity [under Florida law], a party must allege that he is without fault, that another party is at fault, and that a special relationship between the two parties makes the party seeking indemnification vicariously, constructively, derivatively, or technically liable for the acts or ...