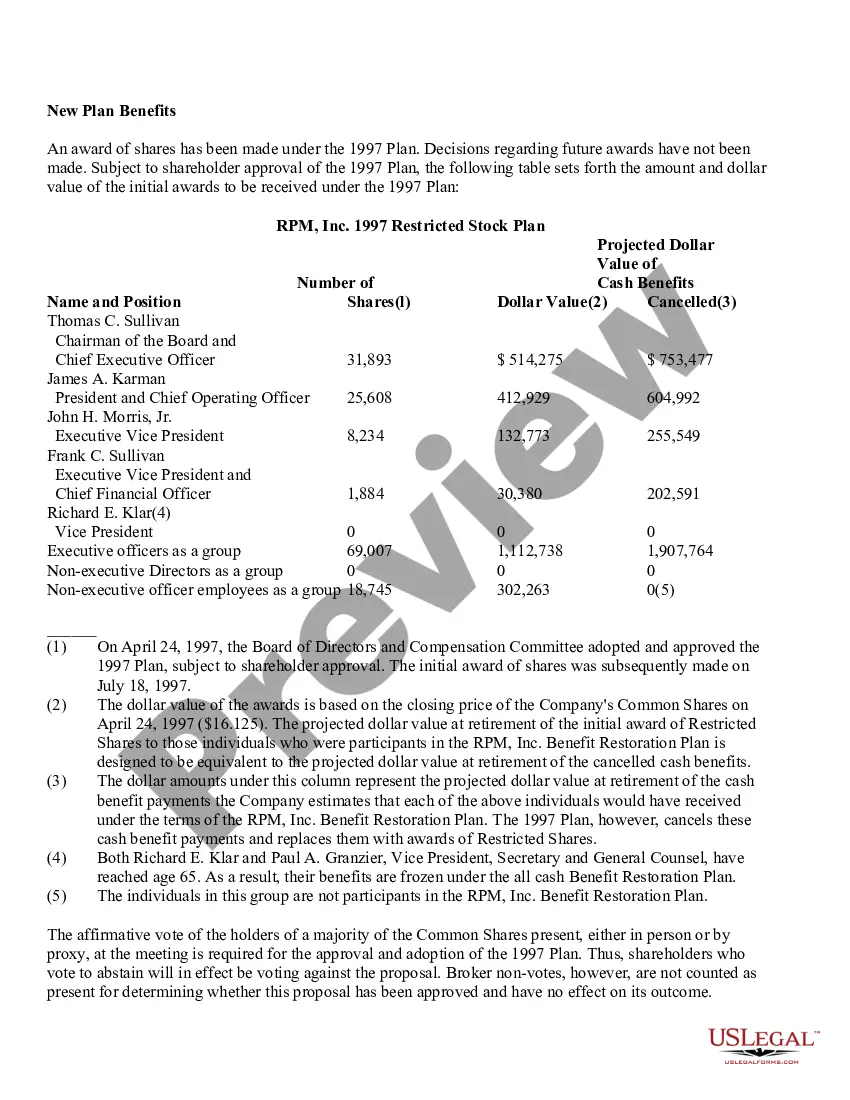

Florida Adoption of Restricted Stock Plan of RPM, Inc. The Florida Adoption of Restricted Stock Plan refers to the implementation and utilization of a restricted stock plan by RPM, Inc., a company operating in the state of Florida. A restricted stock plan is a popular compensation strategy that allows a company to grant shares of its stock to employees or directors. These shares are typically subject to certain restrictions or conditions. In the case of RPM, Inc., the restricted stock plan signifies a method through which the company can incentivize its employees and align their interests with those of the company's shareholders. By granting restricted stock, RPM, Inc. aims to encourage employee retention, reward excellent performance, and attract top talent. The Florida Adoption of Restricted Stock Plan of RPM, Inc. entails the establishment of guidelines and provisions governing the issuance, vesting, and transferability of restricted stock. Some key features and terms that may be included in the plan are: 1. Eligibility Criteria: The plan may specify which employees or directors are eligible to receive grants of restricted stock. This could be based on position, tenure, or specific performance criteria. 2. Granting of Restricted Stock: The plan would explain the process of granting restricted stock, including the number of shares to be awarded and the valuation method utilized. 3. Vesting Schedule: RPM, Inc. may specify a vesting schedule, indicating the period over which the granted shares will become fully owned by the employee or director. This encourages loyalty and continued service to the company. 4. Restriction Period: The plan would outline the period during which the restricted stock cannot be sold or transferred by the employee or director. It may also include provisions for early termination of such restrictions in certain circumstances. 5. Forfeiture and Clawback Provisions: RPM, Inc. may outline conditions under which the employee's rights to the restricted stock could be forfeited, such as termination for cause. Additionally, clawback provisions could be implemented to enable the company to recoup shares in cases of financial restatements or misconduct. 6. Dividend and Voting Rights: The plan could clarify whether employees or directors with restricted stock are entitled to receive dividends and exercise voting rights, even during the restriction period. It is important to note that the specific details and variations of the Florida Adoption of Restricted Stock Plan may differ for each company, including RPM, Inc. itself. RPM, Inc. may have multiple types or iterations of the plan catering to different employee levels or specific purposes, such as executive or equity incentive plans. To obtain a comprehensive understanding of the various types of plans adopted by RPM, Inc., referring to the company's official documents or consulting with a legal professional would be necessary.

Florida Adoption of Restricted Stock Plan of RPM, Inc.

Description

How to fill out Florida Adoption Of Restricted Stock Plan Of RPM, Inc.?

If you need to comprehensive, down load, or produce authorized record web templates, use US Legal Forms, the greatest assortment of authorized kinds, that can be found on the Internet. Utilize the site`s easy and hassle-free lookup to discover the paperwork you want. Numerous web templates for organization and person functions are sorted by types and states, or keywords. Use US Legal Forms to discover the Florida Adoption of Restricted Stock Plan of RPM, Inc. in a number of clicks.

Should you be previously a US Legal Forms client, log in in your accounts and click the Obtain key to have the Florida Adoption of Restricted Stock Plan of RPM, Inc.. You may also access kinds you formerly downloaded within the My Forms tab of your respective accounts.

If you are using US Legal Forms for the first time, follow the instructions beneath:

- Step 1. Make sure you have selected the form for that correct city/nation.

- Step 2. Use the Preview solution to look through the form`s content material. Do not overlook to read through the explanation.

- Step 3. Should you be not happy with the develop, use the Search industry near the top of the screen to locate other models from the authorized develop format.

- Step 4. When you have discovered the form you want, click the Buy now key. Pick the pricing strategy you choose and add your accreditations to sign up to have an accounts.

- Step 5. Procedure the purchase. You can use your credit card or PayPal accounts to complete the purchase.

- Step 6. Choose the format from the authorized develop and down load it in your gadget.

- Step 7. Complete, edit and produce or sign the Florida Adoption of Restricted Stock Plan of RPM, Inc..

Every single authorized record format you buy is yours permanently. You may have acces to each develop you downloaded in your acccount. Click on the My Forms section and choose a develop to produce or down load yet again.

Contend and down load, and produce the Florida Adoption of Restricted Stock Plan of RPM, Inc. with US Legal Forms. There are many specialist and status-certain kinds you can use for your personal organization or person requirements.