Florida Stock Option Plan which provides for grant of Incentive Stock Options and Nonqualified Stock Options to executive officers

Description

How to fill out Stock Option Plan Which Provides For Grant Of Incentive Stock Options And Nonqualified Stock Options To Executive Officers?

You can devote hrs on the Internet attempting to find the legitimate file template which fits the state and federal requirements you need. US Legal Forms offers a large number of legitimate forms that happen to be analyzed by professionals. You can easily download or printing the Florida Stock Option Plan which provides for grant of Incentive Stock Options and Nonqualified Stock Options to executive officers from our support.

If you have a US Legal Forms bank account, you are able to log in and click on the Obtain switch. Afterward, you are able to complete, modify, printing, or indication the Florida Stock Option Plan which provides for grant of Incentive Stock Options and Nonqualified Stock Options to executive officers. Every legitimate file template you buy is yours forever. To get one more duplicate associated with a acquired develop, visit the My Forms tab and click on the corresponding switch.

If you are using the US Legal Forms web site for the first time, follow the straightforward guidelines below:

- Very first, ensure that you have selected the correct file template for your state/area of your choice. Read the develop explanation to ensure you have picked the proper develop. If available, take advantage of the Review switch to check through the file template as well.

- In order to find one more variation from the develop, take advantage of the Search discipline to discover the template that suits you and requirements.

- When you have found the template you would like, click Acquire now to move forward.

- Pick the costs plan you would like, type your references, and register for a merchant account on US Legal Forms.

- Total the deal. You may use your bank card or PayPal bank account to fund the legitimate develop.

- Pick the file format from the file and download it to your system.

- Make adjustments to your file if possible. You can complete, modify and indication and printing Florida Stock Option Plan which provides for grant of Incentive Stock Options and Nonqualified Stock Options to executive officers.

Obtain and printing a large number of file layouts utilizing the US Legal Forms web site, which offers the most important variety of legitimate forms. Use skilled and state-distinct layouts to deal with your organization or specific requirements.

Form popularity

FAQ

Basically, as the company profits, employees profit as well. Thus, stock options are a way to create a loyal partnership with employees. Stock options are a way for companies to motivate employees to be more productive. Through stock options, employees receive a percentage of ownership in the company.

Stock options can cause CEOs to focus on short-term performance or to manipulate numbers to meet targets. Executives act more like owners when they have a stake in the business in the form of stock ownership.

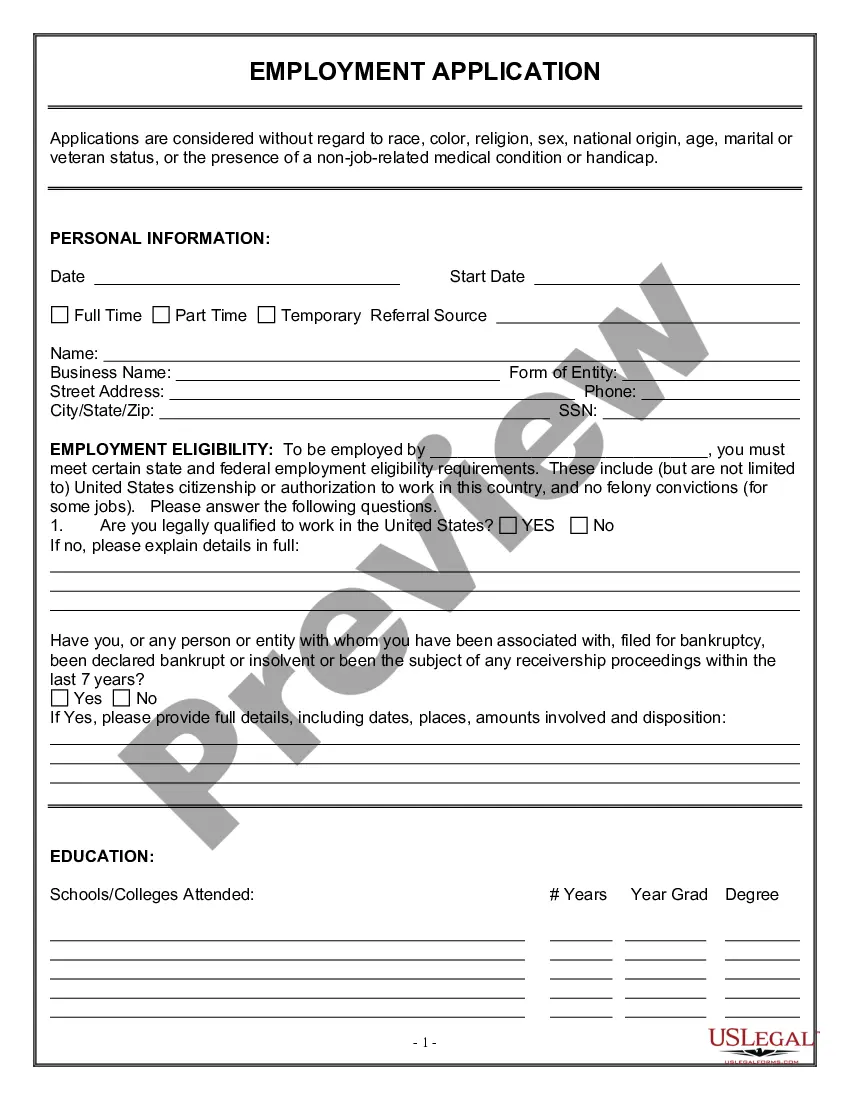

qualified stock option (NSO) is a type of ESO that is taxed as ordinary income when exercised. In addition, some of the value of NSOs may be subject to earned income withholding tax as soon as they are exercised. 5 With ISOs, on the other hand, no reporting is necessary until the profit is realized.

With this type of incentive, participants are granted a right or option to purchase stock from the company at a specific price?usually the fair market value of the stock when the option is granted. The option to purchase shares continues over an extended period that is measured in years.

What Is a Non-Qualified Stock Option (NSO)? A non-qualified stock option (NSO) is a type of employee stock option wherein you pay ordinary income tax on the difference between the grant price and the price at which you exercise the option.

COMPANY COMPENSATION PLAN The primary purpose of stock-based executive com- pensation plans is to align the economic interests of management with those of shareholders. Stock- based executive compensation plans benefit the subject sponsor company by helping to motivate, recruit, and retain executives.

A stock grant provides the recipient with value?the corporate stock. By contrast, stock options only offer employees the opportunity to purchase something of value. They can acquire the corporate stock at a set price, but the employees receiving stock options still have to pay for those stocks if they want them.

ESOs are a form of equity compensation granted by companies to their employees and executives. Like a regular call option, an ESO gives the holder the right to purchase the underlying asset?the company's stock?at a specified price for a finite period of time.