Title: Florida Acquisition, Merger, and Liquidation: Exploring the Processes and Types Introduction: In the dynamic business world, companies in Florida often explore strategic options such as acquisition, merger, and liquidation to adapt to changing market conditions, maximize growth potentials, or resolve financial challenges. This article provides a detailed description of these processes, along with relevant keywords to help you understand the various types of acquisition, merger, and liquidation in Florida. Keywords: Florida, Acquisition, Merger, Liquidation, Companies, Strategic options, Market conditions, Growth potentials, Financial challenges. 1. Florida Acquisition: Florida Acquisition refers to the process through which a company acquires another existing company, either in part or in entirety, to expand its business operations, gain market share, or access new technology or markets. Several types of Florida Acquisition exist: a) Vertical Acquisition: In this type, a company acquires a business entity within its supply chain, typically either a supplier or a distributor. This allows for greater control over the entire production and distribution process, enhancing efficiency and cost-effectiveness. b) Horizontal Acquisition: Here, a company acquires another company operating in the same industry or market. This type of acquisition aims to eliminate competition, gain economies of scale, and strengthen market position. c) Conglomerate Acquisition: In this scenario, a company acquires another organization that operates in an unrelated industry. Conglomerate acquisitions diversify the acquiring company's portfolio, reduce risks, and create new business opportunities. 2. Florida Merger: Florida Merger involves the combination of two or more companies into a single entity to create synergy, enhance competitiveness, or achieve strategic objectives. Different types of Florida Merger include: a) Horizontal Merger: This type occurs when two or more companies operating in the same industry or market merge to benefit from shared resources, complementary strengths, and expanded customer bases. b) Vertical Merger: In this case, companies operating at different stages of the same supply chain merge to optimize coordination, streamline operations, and potentially reduce costs. c) Conglomerate Merger: Here, two or more companies from unrelated industries merge to diversify their business portfolios, benefit from synergies, and capitalize on new growth opportunities. 3. Florida Liquidation: Florida Liquidation occurs when a company decides to wind up its operations, selling off assets to repay its debts or distribute funds to shareholders. Two main types of Florida Liquidation are: a) Voluntary Liquidation: In this case, a company's shareholders make a collective decision to dissolve the business due to various reasons such as financial insolvency or strategic realignment. b) Involuntary Liquidation: Involuntary liquidation occurs when a company is forced to cease operations by external parties, often due to the company's inability to fulfill its financial obligations. This may include court-ordered liquidation or creditors' intervention. Conclusion: Florida Acquisition, Merger, and Liquidation play crucial roles in the business landscape, allowing companies to adapt, grow, or resolve challenges effectively. Whether it's acquiring another entity to expand, merging for synergy, or liquidating to address financial concerns, businesses in Florida use these strategic options to navigate the ever-changing market dynamics and seize new opportunities. Keywords: Acquisition, Merger, Liquidation, synergies, competitiveness, strategic options, market dynamics.

Florida Acquisition, Merger, or Liquidation

Description

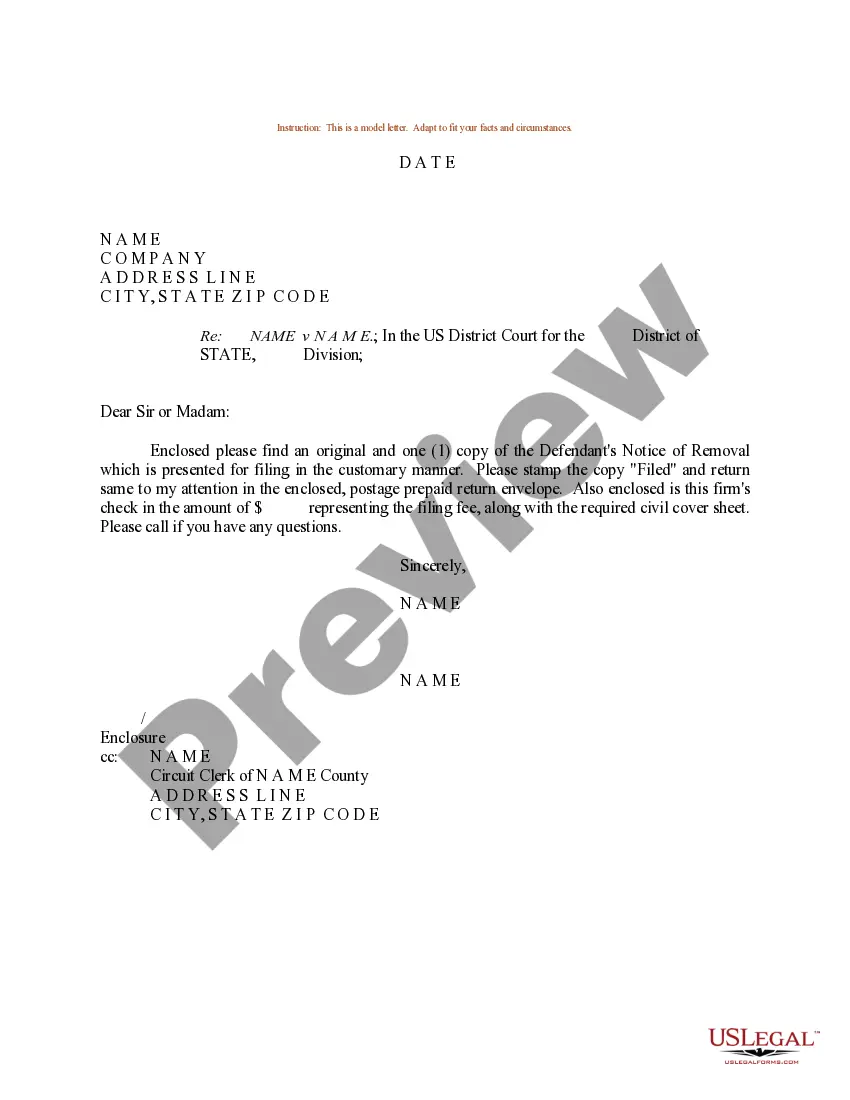

How to fill out Florida Acquisition, Merger, Or Liquidation?

US Legal Forms - among the most significant libraries of legal kinds in the USA - provides an array of legal record web templates you can acquire or produce. Making use of the site, you can get thousands of kinds for company and personal purposes, categorized by classes, states, or keywords and phrases.You can get the latest variations of kinds much like the Florida Acquisition, Merger, or Liquidation in seconds.

If you already have a monthly subscription, log in and acquire Florida Acquisition, Merger, or Liquidation in the US Legal Forms library. The Down load key will appear on every single type you perspective. You get access to all previously delivered electronically kinds within the My Forms tab of your account.

If you want to use US Legal Forms the very first time, here are simple directions to help you get started:

- Ensure you have chosen the correct type for the area/state. Go through the Review key to review the form`s content material. Look at the type information to actually have selected the correct type.

- In the event the type does not satisfy your requirements, utilize the Look for area at the top of the display screen to discover the the one that does.

- If you are satisfied with the form, verify your selection by clicking the Buy now key. Then, select the costs strategy you like and offer your credentials to register for an account.

- Procedure the financial transaction. Use your Visa or Mastercard or PayPal account to finish the financial transaction.

- Find the formatting and acquire the form on the product.

- Make modifications. Load, change and produce and signal the delivered electronically Florida Acquisition, Merger, or Liquidation.

Every template you included in your money lacks an expiry time and is your own for a long time. So, in order to acquire or produce an additional copy, just check out the My Forms segment and click on on the type you need.

Obtain access to the Florida Acquisition, Merger, or Liquidation with US Legal Forms, one of the most considerable library of legal record web templates. Use thousands of expert and status-particular web templates that fulfill your business or personal demands and requirements.

Form popularity

FAQ

Solely for purposes of determining whether a lower-tier partnership is a section 368(c) controlled partnership, any interest in a lower-tier partnership that is owned by a section 368(c) controlled partnership shall be treated as owned by members of the qualified group. (iv) Effective/applicability dates.

(a) As used in this section, ?control-share acquisition? means the acquisition, directly or indirectly, by any person of ownership of, or the power to direct the exercise of voting power with respect to, issued and outstanding control shares.

Multi-entity, interstate, and parent-subsidiary mergers Other entity types such as limited partnerships or limited liability partnerships can also merge with corporations or LLCs and in most states, either party may be the survivor.

"Control share acquisition" means the direct or indirect acquisition, other than in an excepted acquisition, by any person of beneficial ownership of shares of a public corporation that, except for this article, would have voting rights and would, when added to all other shares of such public corporation which then ...

Section 607.0821 - Action by directors without a meeting (1) Unless the articles of incorporation or bylaws provide otherwise, action required or permitted by this chapter to be taken at a board of directors' meeting or committee meeting may be taken without a meeting if the action is taken by all members of the board ...

Florida Statute 893.135(1)(a) ? Trafficking Cannabis This paragraph applies when a person sells, purchases, manufactures, delivers, brings into Florida, or possesses more than 25 pounds of cannabis or more than 300 cannabis plants.

623.07 - Consolidation or Merger of Corporations. (1) Any two or more corporations existing under the provisions of this act and operating within the same county may consolidate into a new corporation or merge into any one of the constituent corporations, as shall be specified in the consolidation or merger agreement.

607.01401 Definitions. ?As used in this chapter, unless the context otherwise requires, the term: (1) ?Acquired eligible entity? means the domestic or foreign eligible entity that will have all of one or more classes or series of its shares or eligible interests acquired in a share exchange.