The Florida Amended and Restated Employee Stock Purchase Plan is a program designed to provide employees of companies in Florida the opportunity to purchase company stock at a discounted price. This plan is commonly offered by companies as a way to incentivize and reward employees for their contributions and loyalty to the organization. The Florida Amended and Restated Employee Stock Purchase Plan allows employees to contribute a portion of their salary to the plan, which is then used to purchase company stock on their behalf. The purchase is typically made at a discounted price, often at a percentage below the market value. One type of the Florida Amended and Restated Employee Stock Purchase Plan is known as a "Qualified Plan." Under this type, employees are granted favorable tax treatment on both the contributions made to the plan and the capital gains from the sale of the purchased stock. This means that employees can benefit from potential stock price appreciation while keeping their tax liabilities minimized. Another type of the Florida Amended and Restated Employee Stock Purchase Plan is the "Non-Qualified Plan." This plan differs from the qualified plan in terms of tax treatment. While contributions made to a non-qualified plan are not considered tax-deductible, employees still have the opportunity to purchase company stock at a discounted price. However, the capital gains from the sale of the purchased stock may be subject to regular income tax rates. Companies often offer the Florida Amended and Restated Employee Stock Purchase Plan as part of their overall compensation package to attract and retain talented individuals. By granting employees the opportunity to purchase company stock at a discount, employers aim to align the interests of employees with the success of the organization. This can lead to increased employee motivation and loyalty, as employees have a direct stake in the company's performance. It's worth noting that the Florida Amended and Restated Employee Stock Purchase Plan may have specific eligibility requirements, such as a minimum length of service or a minimum number of hours worked. These requirements may vary between companies offering the plan. In summary, the Florida Amended and Restated Employee Stock Purchase Plan is a program that allows employees in Florida to purchase company stock at a discounted price. This plan can come in different types, such as qualified and non-qualified plans, each with its own tax implications. By participating in this plan, employees can potentially benefit from stock price appreciation while aligning their interests with the success of the organization.

Florida Amended and Restated Employee Stock Purchase Plan

Description

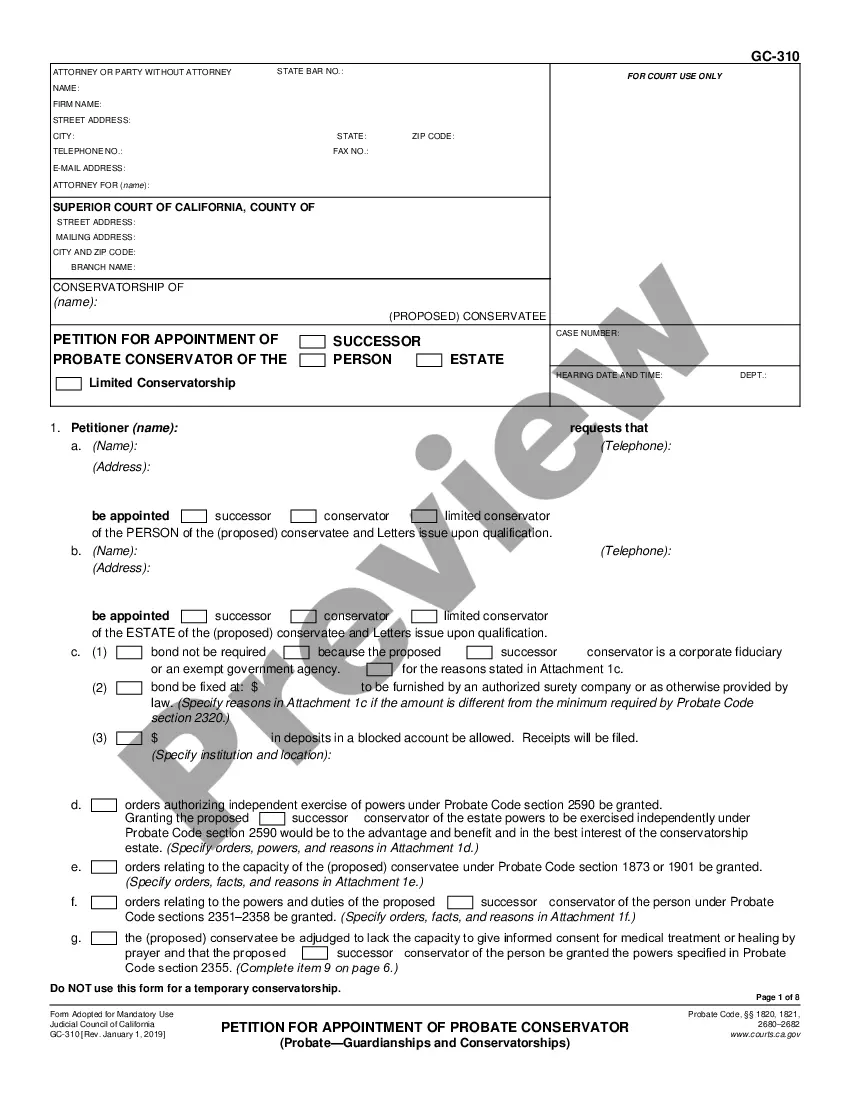

How to fill out Florida Amended And Restated Employee Stock Purchase Plan?

Choosing the right authorized file design can be quite a battle. Naturally, there are a lot of templates available on the net, but how would you get the authorized develop you need? Use the US Legal Forms site. The services provides a large number of templates, including the Florida Amended and Restated Employee Stock Purchase Plan, which you can use for enterprise and private requires. All the varieties are inspected by experts and meet up with federal and state specifications.

If you are currently registered, log in to your account and then click the Obtain option to get the Florida Amended and Restated Employee Stock Purchase Plan. Make use of account to check with the authorized varieties you might have ordered formerly. Visit the My Forms tab of the account and obtain yet another version of your file you need.

If you are a new consumer of US Legal Forms, here are simple guidelines that you should stick to:

- Initial, make sure you have chosen the proper develop to your metropolis/region. You can look over the shape while using Review option and look at the shape information to make sure it is the right one for you.

- When the develop is not going to meet up with your requirements, use the Seach discipline to get the proper develop.

- When you are certain the shape is suitable, select the Buy now option to get the develop.

- Opt for the pricing prepare you would like and type in the required info. Design your account and purchase your order utilizing your PayPal account or bank card.

- Opt for the data file format and acquire the authorized file design to your system.

- Total, revise and print and indicator the attained Florida Amended and Restated Employee Stock Purchase Plan.

US Legal Forms is definitely the greatest catalogue of authorized varieties for which you can see various file templates. Use the service to acquire professionally-manufactured paperwork that stick to express specifications.

Form popularity

FAQ

In an ESPP with a reset feature, the look-back purchase price will "reset" if the stock price at a future purchase date is lower than the stock price on the first day of the offering period. On the date that a reset feature is triggered, the terms of the award have been modified.

Qualifying disposition: You sold the stock at least two years after the offering (grant date) and at least one year after the exercise (purchase date). If so, a portion of the profit (the ?bargain element?) is considered compensation income (taxed at regular rates) on your Form 1040.

They can only report the unadjusted basis ? what the employee actually paid. To avoid double taxation, the employee must use Form 8949. The information needed to make this adjustment will probably be in supplemental materials that come with your 1099-B.

An employee stock purchase plan (or ESPP) can be a very valuable benefit. In general, if your employer offers an ESPP, we think you should participate at the level you can comfortably afford and then sell the shares as soon as you can.

Partial refunds of excess contributions If your company stock price has dropped, depending on how much you have contributed to your ESPP, it is more likely that you will hit this limit. You may then receive a refund of your accumulated contributions in excess of this amount.

ESPP lookback allows you to buy shares at a lower price point. An ESPP lookback allows you to purchase the share price of either A: the enrollment date (1 Jan) or B: the purchase date (30 Jun), whichever is lower.

If you are risk-averse, you might consider selling your ESPP shares right away so you don't have overexposure in one stock, particularly that of your own employer. ESPP shares can put you in an overexposed position. If the stock value goes down, you may suffer losses and in extreme cases, even lose your job.

If you leave your company while enrolled in their employee stock purchase program, your eligibility for the plan ends, but you will continue to own the stock the company purchased for you during employment. The company will no longer purchase shares on your behalf after your termination date.