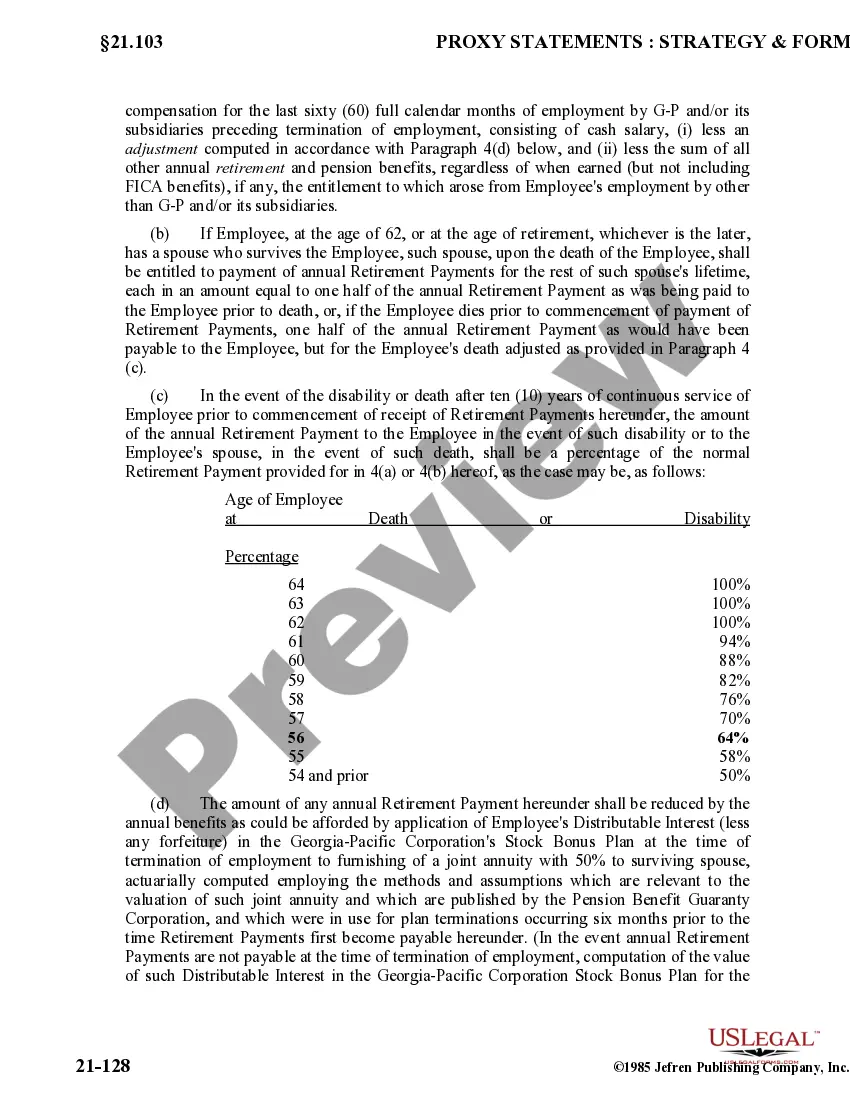

The Florida Executive Retirement Agreement (ERA) offered by Georgia-Pacific Corp. is a comprehensive retirement plan designed to provide financial security and various benefits to eligible executives upon retirement. This agreement is specifically tailored for executives based in Florida who are part of Georgia-Pacific Corp. Under the Florida ERA, executives can enjoy several key features and benefits. These include: 1. Summary Plan Description: The plan provides a detailed summary of all the benefits, eligibility criteria, and terms and conditions associated with the Florida ERA. 2. Retirement Income: The executives who qualify for the Florida ERA receive a specific monthly income after retirement. This income is calculated based on factors such as years of service, salary, and position within the company. 3. Lump Sum Payment: In addition to the monthly retirement income, executives may have the option to receive a lump sum payment upon retirement. This one-time payment can help in covering any immediate financial requirements or be invested for additional income generation. 4. Health and Welfare Benefits: The Florida ERA ensures that eligible executives continue to receive access to health and welfare benefits even after retirement. This may include medical insurance, dental coverage, vision care, and prescription drug coverage. Such benefits contribute to the retirees' overall well-being, minimizing out-of-pocket medical expenses. 5. Life Insurance: Executives enrolled in the Florida ERA may have the opportunity to maintain their life insurance coverage beyond their active employment period with Georgia-Pacific Corp. This ensures continued financial protection for their loved ones as they transition into retirement. 6. Disability Benefits: The Florida ERA may include provisions for disability benefits in case an executive becomes permanently disabled before retirement. These benefits often provide a portion of the retirement income that the executive would have received had they retired under normal circumstances. While the main structure of the Florida ERA remains consistent, there may be different types or tiers of the agreement based on an executive's position, years of service, or specific roles within the organization. The various types of retirement agreements may include: 1. Tiered Retirement Agreements: These agreements differentiate benefits based on an executive's career level or tier within the company hierarchy. Higher-ranking executives may receive enhanced benefits compared to those in lower tiers. 2. Executive-Specific Retirement Agreements: Certain Florida ERA agreements may be customized to accommodate the unique needs or circumstances of specific executives. These agreements may consider their specific roles, responsibilities, or exceptional contributions to the company. 3. Early Retirement Agreements: This type of Florida ERA may be available to executives who meet certain criteria to retire early. Typically, such agreements provide reduced benefits in exchange for retiring before the normal retirement age. It is important for executives to thoroughly review the terms, conditions, and eligibility criteria associated with the specific Florida Executive Retirement Agreement offered by Georgia-Pacific Corp. to fully understand the unique benefits and provisions applicable to their retirement plan.

Florida Executive Retirement Agreement of Georgia Pacific Corp.

Description

How to fill out Florida Executive Retirement Agreement Of Georgia Pacific Corp.?

Are you presently in a position that you require papers for either business or specific purposes virtually every day? There are a lot of legitimate record templates available on the Internet, but locating types you can depend on is not simple. US Legal Forms delivers a large number of type templates, such as the Florida Executive Retirement Agreement of Georgia Pacific Corp., which are written to satisfy state and federal requirements.

If you are already informed about US Legal Forms internet site and possess a merchant account, simply log in. Afterward, you can down load the Florida Executive Retirement Agreement of Georgia Pacific Corp. format.

Should you not offer an profile and need to begin to use US Legal Forms, follow these steps:

- Obtain the type you require and make sure it is for the correct area/area.

- Use the Review button to analyze the shape.

- Look at the information to actually have chosen the correct type.

- In the event the type is not what you are seeking, use the Look for area to discover the type that meets your requirements and requirements.

- Once you find the correct type, simply click Get now.

- Choose the pricing plan you need, fill in the specified information and facts to generate your money, and buy the order utilizing your PayPal or credit card.

- Pick a practical file formatting and down load your backup.

Locate every one of the record templates you might have purchased in the My Forms menu. You can aquire a more backup of Florida Executive Retirement Agreement of Georgia Pacific Corp. any time, if possible. Just go through the needed type to down load or print the record format.

Use US Legal Forms, by far the most considerable collection of legitimate varieties, in order to save some time and prevent errors. The assistance delivers expertly made legitimate record templates which can be used for a range of purposes. Create a merchant account on US Legal Forms and start generating your lifestyle easier.