Florida Savings Plan for Employees

Description

How to fill out Savings Plan For Employees?

Choosing the right authorized document web template could be a battle. Obviously, there are tons of templates available on the net, but how can you discover the authorized develop you will need? Utilize the US Legal Forms site. The services gives 1000s of templates, for example the Florida Savings Plan for Employees, which you can use for organization and private requirements. Every one of the varieties are checked by experts and fulfill state and federal requirements.

If you are presently listed, log in to your bank account and click the Download option to get the Florida Savings Plan for Employees. Use your bank account to look from the authorized varieties you possess bought formerly. Go to the My Forms tab of your own bank account and have another duplicate of your document you will need.

If you are a brand new end user of US Legal Forms, listed below are straightforward directions for you to comply with:

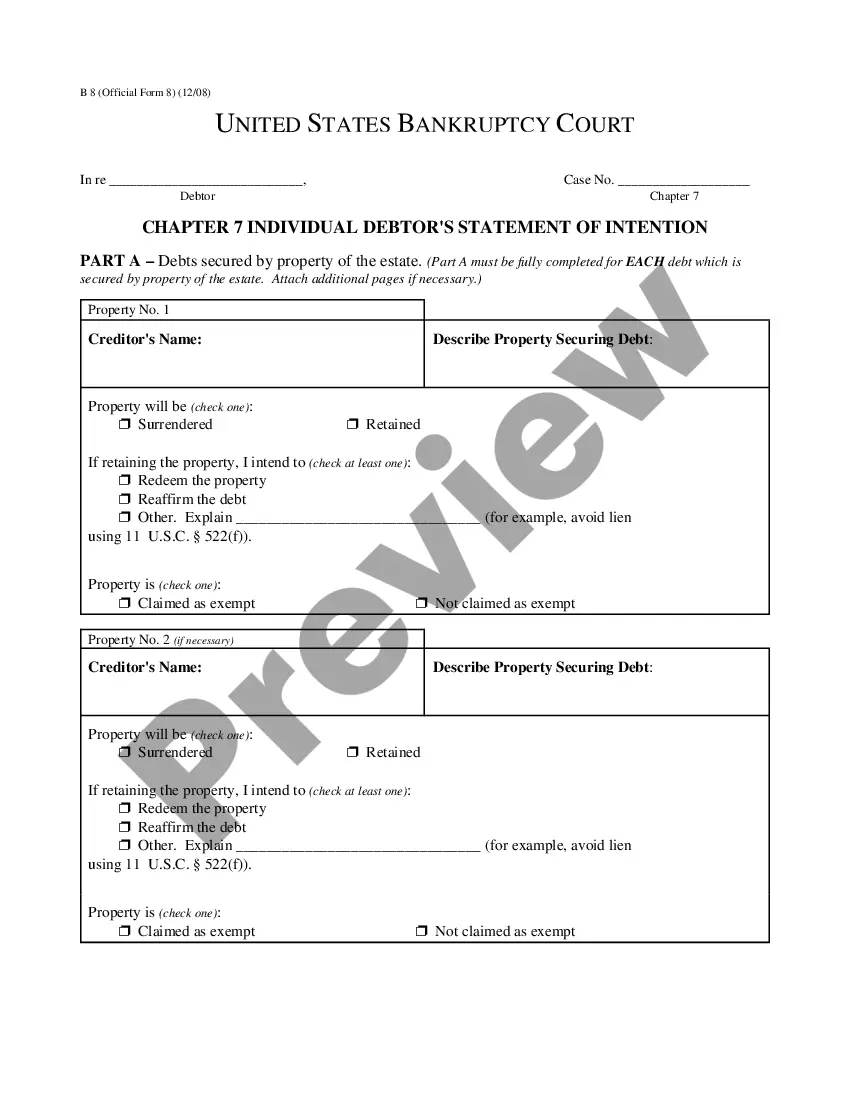

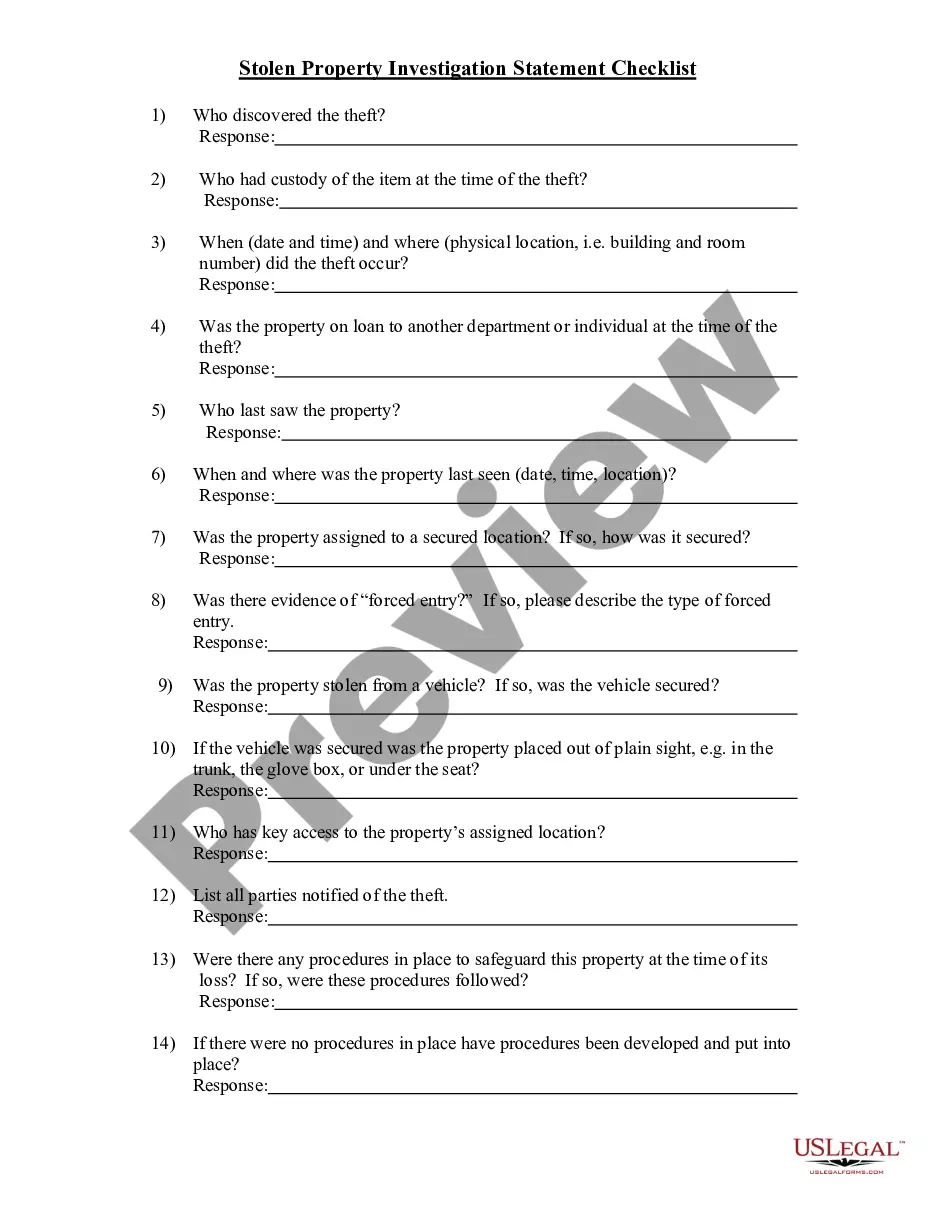

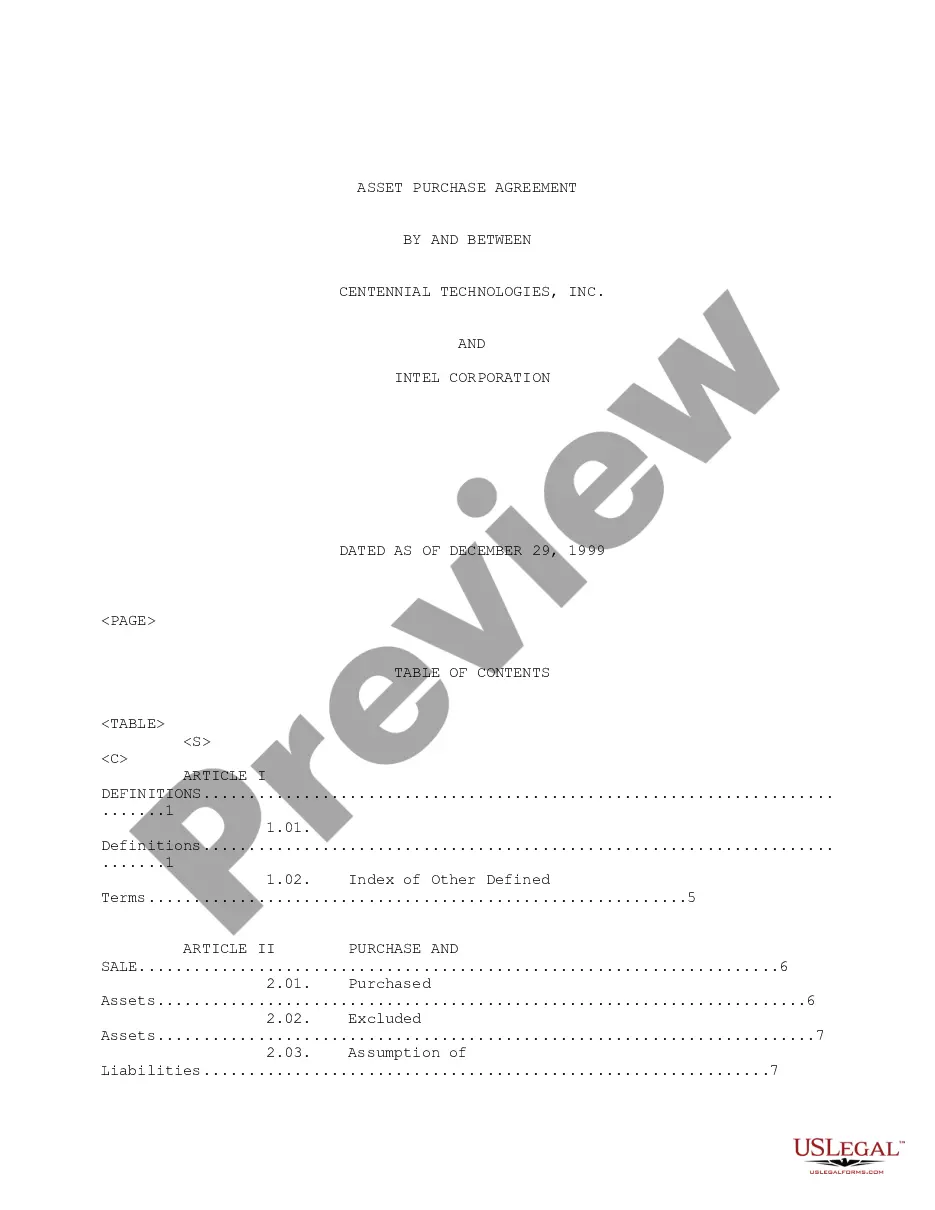

- Initial, ensure you have chosen the right develop to your city/state. It is possible to check out the shape using the Review option and browse the shape description to make sure it is the right one for you.

- If the develop will not fulfill your requirements, use the Seach area to obtain the proper develop.

- When you are certain the shape is suitable, select the Purchase now option to get the develop.

- Select the pricing program you want and type in the essential details. Design your bank account and pay money for the order making use of your PayPal bank account or charge card.

- Choose the document file format and down load the authorized document web template to your device.

- Total, modify and print and indicator the acquired Florida Savings Plan for Employees.

US Legal Forms is definitely the largest catalogue of authorized varieties where you can find different document templates. Utilize the company to down load professionally-manufactured papers that comply with condition requirements.

Form popularity

FAQ

A savings plan involves putting aside a portion of your income over a fixed period of time in order to reach a specific financial goal. It's also useful to set aside money not only for your savings account or emergency fund, but also for investing. Saving money can help you feel more financially secure.

A 401(k) is intended for long-term retirement savings that grow through investments in the financial markets. But 401(k) plans come with restrictions on when funds can be accessed. Savings accounts are lower risk and don't have as many limitations, but can't be invested like a 401(k).

You will be eligible for a Pension Plan benefit (i.e. be vested) when you complete six years of service (if you were enrolled in the FRS prior to July 1, 2011) or eight years of service (if you were enrolled in the FRS on or after July 1, 2011).

As a member of the FRS Investment Plan, you contribute 3 percent of your gross monthly salary on a pre-tax basis to help fund your FRS Investment Plan account. The state also contributes a percentage of your gross monthly salary based on your membership class.

The Employee Savings Plan, or ESP, is a savings plan offered by employers that allows employees to save over many years via paycheck deductions for a variety of goals, such as retirement.

The TSP is a retirement savings and investment plan for federal employees. The purpose of the TSP is to provide retirement income through savings and tax deferred benefits that many private corporations offer their employees. The TSP is similar to private sector 401(k) plans.

FRS Investment Plan Employment ClassJuly 1, 2023 RatesEmployeeEmployerRegular3%8.30%Special Risk3%16.00%Special Risk Administrative Support3%9.95%7 more rows

Employer-sponsored savings plans such as 401(k) and Roth 401(k) plans provide employees with an automatic way to save for their retirement while benefiting from tax breaks. The reward to employees who participate in these programs is they essentially receive free money when their employers offer matching contributions.