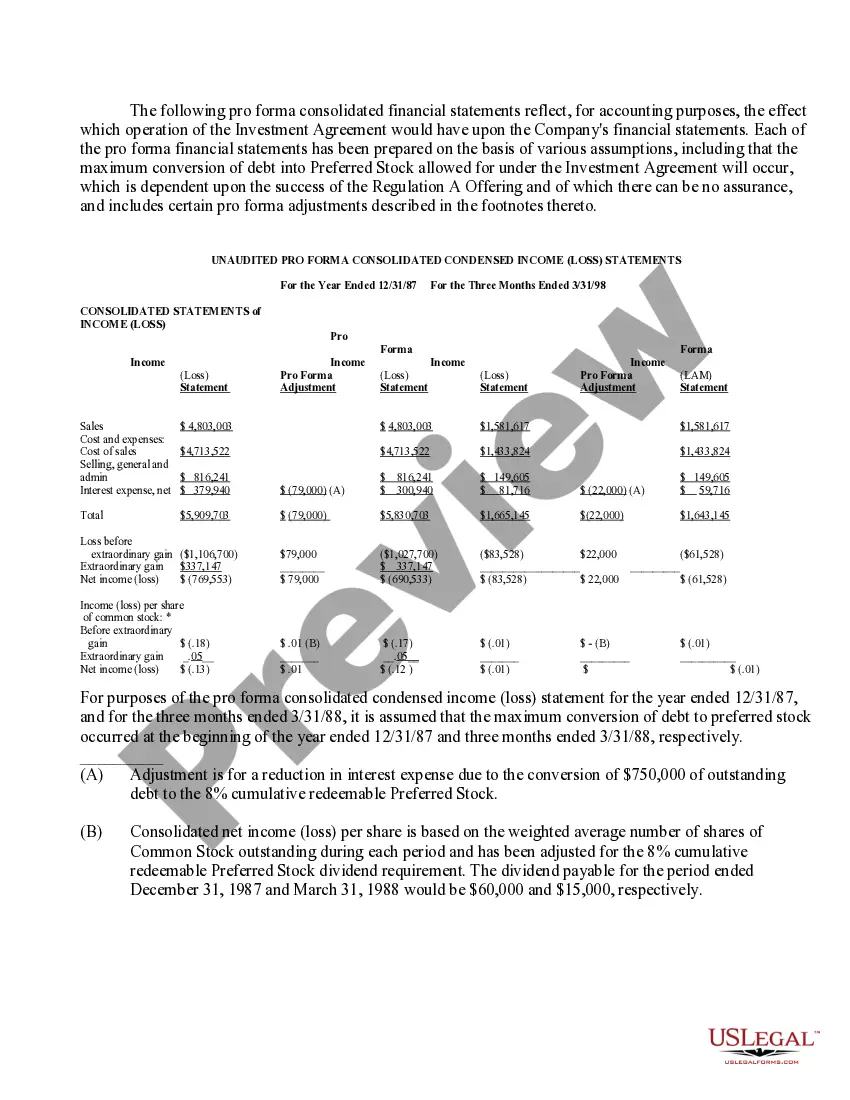

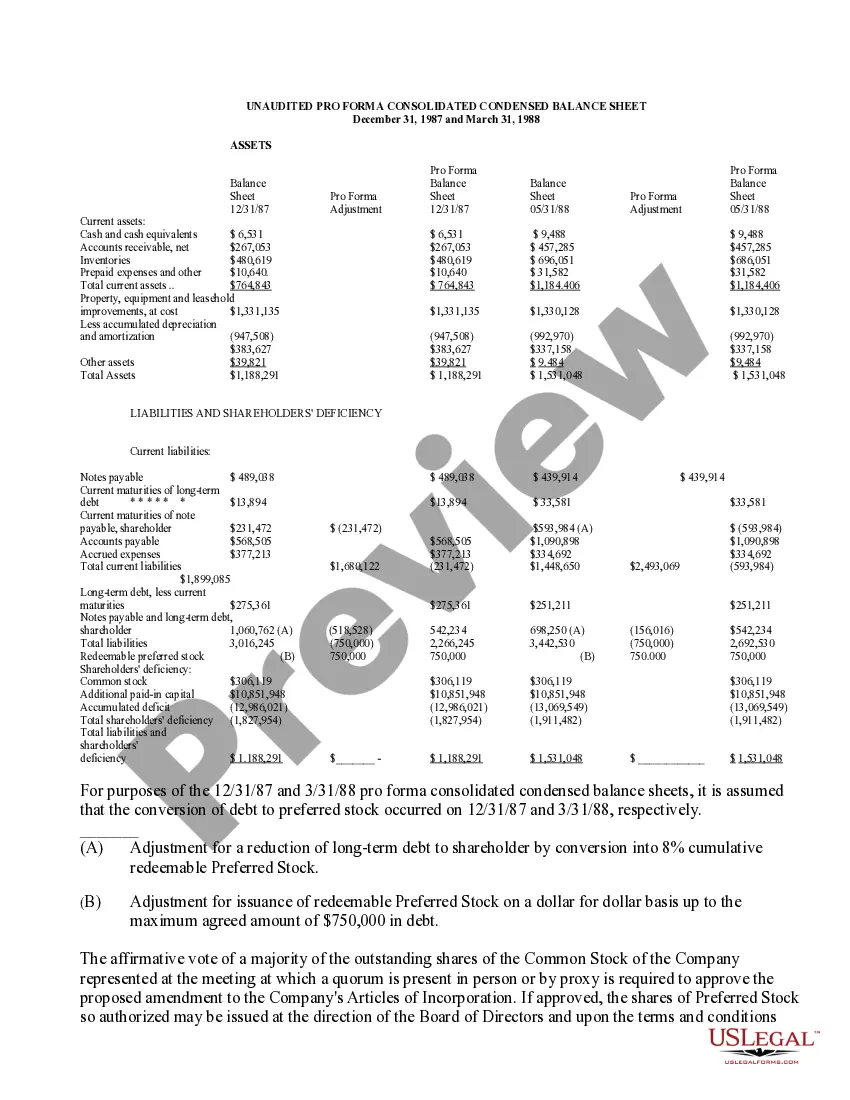

Florida Approval of Authorization of Preferred Stock is a legal process that enables a corporation to issue preferred stock shares, granting certain preferences and rights to the stockholders. This type of stock offers specific benefits and advantages over common stock, helping companies attract investors for financial support and growth. Here is a detailed description of Florida's approval process and different types of authorized preferred stock: Approval Process: To obtain Florida's approval for the authorization of preferred stock, corporations must follow a specific procedure outlined by the state's laws and regulations. Initially, the corporation's board of directors proposes the issuance of preferred stock and negotiates its terms and conditions. Once the proposal is finalized, it is presented to the corporation's existing stockholders for approval. A majority vote, often requiring a two-thirds majority, is typically necessary for the authorization of preferred stock by the shareholders. Once approved by the shareholders, the corporation files the necessary documentation with the appropriate state authorities, such as the Florida Department of State, to officially authorize the issuance of preferred stock. Types of Authorized Preferred Stock: 1. Cumulative Preferred Stock: This type of preferred stock accumulates unpaid dividends. If the corporation suspends dividend payments or cannot fulfill them, the unpaid dividends carry over to subsequent periods and must be paid before common stockholders receive any dividends. 2. Non-Cumulative Preferred Stock: Contrary to cumulative preferred stock, non-cumulative preferred stock does not accumulate unpaid dividends. If the corporation cannot distribute dividends in a particular period, the unpaid dividends are not carried forward, and the preferred stockholders forfeit their entitlement to those dividends. 3. Convertible Preferred Stock: This type of preferred stock provides stockholders with the option to convert their shares into a predetermined number of common stock shares. Conversion typically occurs at the stockholder's discretion, often triggered by specific events or dates. 4. Callable Preferred Stock: Callable preferred stock grants the corporation the right to redeem or repurchase the shares at a predefined price or within a specific timeframe. This allows the corporation to reclaim the preferred stock at its discretion, usually to reduce interest payments or restructure capital. 5. Participating Preferred Stock: Participating preferred stockholders have the right to receive additional dividends, alongside common stockholders, once predetermined thresholds or conditions are met. This type of preferred stock provides an opportunity for increased profitability but is less common than other types. 6. Restricted Preferred Stock: Restricted preferred stock is subject to specific limitations and restrictions imposed by the issuing corporation. These restrictions can include limitations on transferability, voting rights, or dividend payments. In summary, the approval of authorization of preferred stock in Florida follows a defined legal process. Corporations propose the issuance of preferred stock to the shareholders, who then vote on the proposal. Upon approval, the corporation files the necessary documents with the appropriate state authorities. Different types of authorized preferred stock in Florida include cumulative, non-cumulative, convertible, callable, participating, and restricted preferred stock. Each type offers distinct features and benefits, tailored to attract specific types of investors and fulfill the company's financial objectives.

Florida Approval of authorization of preferred stock

Description

How to fill out Florida Approval Of Authorization Of Preferred Stock?

If you need to full, down load, or printing lawful papers themes, use US Legal Forms, the most important collection of lawful forms, that can be found on the Internet. Utilize the site`s simple and easy convenient look for to find the files you will need. Various themes for enterprise and personal purposes are sorted by classes and suggests, or keywords and phrases. Use US Legal Forms to find the Florida Approval of authorization of preferred stock within a number of mouse clicks.

If you are previously a US Legal Forms buyer, log in to the bank account and then click the Acquire option to obtain the Florida Approval of authorization of preferred stock. You can also accessibility forms you in the past acquired within the My Forms tab of your own bank account.

If you are using US Legal Forms initially, refer to the instructions beneath:

- Step 1. Be sure you have chosen the shape for your correct area/land.

- Step 2. Use the Preview solution to examine the form`s content. Never forget about to see the outline.

- Step 3. If you are not happy using the kind, utilize the Research industry near the top of the display screen to locate other models of your lawful kind design.

- Step 4. Upon having found the shape you will need, select the Buy now option. Opt for the rates program you prefer and add your credentials to register on an bank account.

- Step 5. Method the transaction. You can use your Мisa or Ьastercard or PayPal bank account to complete the transaction.

- Step 6. Choose the file format of your lawful kind and down load it on your product.

- Step 7. Full, change and printing or sign the Florida Approval of authorization of preferred stock.

Each lawful papers design you get is the one you have permanently. You possess acces to every single kind you acquired in your acccount. Click the My Forms area and choose a kind to printing or down load yet again.

Remain competitive and down load, and printing the Florida Approval of authorization of preferred stock with US Legal Forms. There are many skilled and status-certain forms you can use to your enterprise or personal demands.