Florida Proposed Merger with the Grossman Corporation: A Comprehensive Analysis Keywords: Florida, proposed merger, Grossman Corporation, acquisition, strategic partnership, benefits, synergies, expansion, growth, shareholders, stakeholders, due diligence, finance, operations, market share, competitive advantage, legal considerations, regulatory approvals Description: The Florida Proposed Merger with the Grossman Corporation represents a significant development in the business landscape, showcasing the potential for strategic partnerships and market expansion in Florida. This potential merger, which would involve the integration of the Grossman Corporation into a prominent Florida-based company, aims to leverage synergies and fortify competitive advantages for both entities involved. Under this proposed merger, shareholders and stakeholders of both Florida and the Grossman Corporation would be poised to reap substantial benefits. With extensive due diligence conducted on both sides, this merger promises not only financial gain but also operational efficiencies and enhanced market share. The Florida Proposed Merger seeks to explore new avenues of growth and further solidify the company's position in the market. By combining the resources, expertise, and networks of both entities, this merger is anticipated to create a significant competitive advantage, which would enable Florida to expand its market reach and tap into previously untapped opportunities. Furthermore, the merger promises to unlock various operational synergies between Florida and the Grossman Corporation. By integrating the two firms, redundant processes can be eliminated, leading to cost-savings, streamlined operations, and improved overall efficiency. The resulting integration of finance, operations, and technology would position the merged entity as a stronger player in the market. It is crucial to note that legal considerations and regulatory approvals play a pivotal role in the successful execution of this merger. Both Florida and the Grossman Corporation will meticulously adhere to prevailing laws and regulations to ensure a smooth transition. Lawyers, experts, and consultants specialized in mergers and acquisitions are actively involved in navigating these legal intricacies. Different types of Florida Proposed Mergers with the Grossman Corporation may exist, such as horizontal mergers or vertical mergers. A horizontal merger refers to the combination of two companies operating in the same industry, while a vertical merger involves the integration of companies operating at different stages of the supply chain. In conclusion, the Florida Proposed Merger with the Grossman Corporation introduces a transformative opportunity for both entities. This forward-thinking move aims to maximize synergies, unlock potential growth, and create value for all stakeholders involved. As the due diligence process continues and regulatory approvals are obtained, the Florida Proposed Merger with the Grossman Corporation holds immense promise for the future of both organizations.

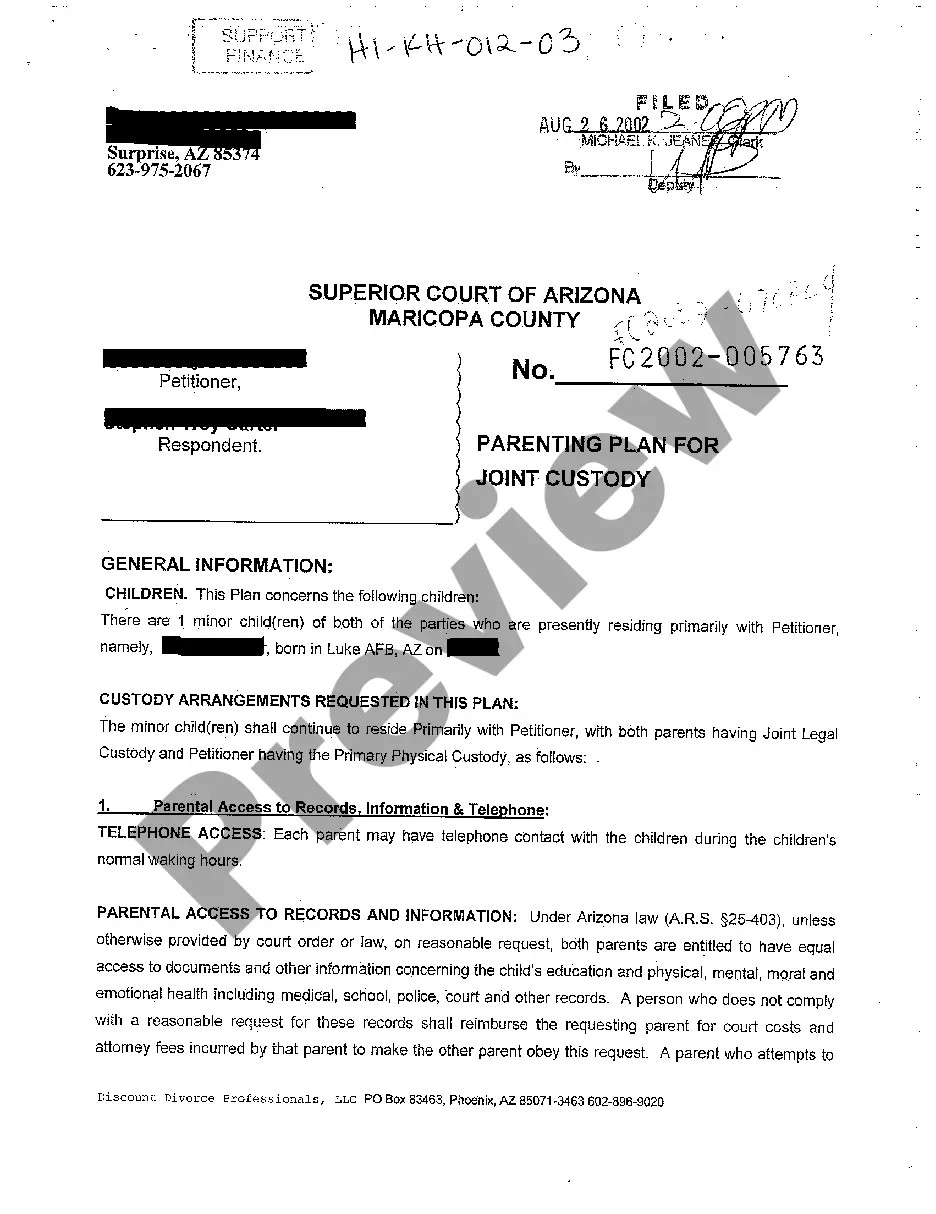

Florida Proposed merger with the Grossman Corporation

Description

How to fill out Florida Proposed Merger With The Grossman Corporation?

US Legal Forms - one of many greatest libraries of authorized forms in the States - offers an array of authorized record web templates you are able to download or print. While using web site, you may get a huge number of forms for organization and personal purposes, sorted by types, suggests, or keywords.You will discover the latest models of forms much like the Florida Proposed merger with the Grossman Corporation within minutes.

If you currently have a membership, log in and download Florida Proposed merger with the Grossman Corporation from your US Legal Forms collection. The Acquire button can look on each and every develop you view. You have access to all earlier saved forms inside the My Forms tab of your accounts.

If you want to use US Legal Forms for the first time, listed here are basic directions to obtain started:

- Ensure you have selected the best develop to your town/area. Click on the Preview button to check the form`s information. See the develop explanation to ensure that you have selected the correct develop.

- When the develop doesn`t suit your specifications, make use of the Look for field towards the top of the screen to find the one that does.

- Should you be satisfied with the shape, confirm your choice by simply clicking the Get now button. Then, select the prices strategy you favor and supply your qualifications to sign up for the accounts.

- Process the deal. Make use of your credit card or PayPal accounts to perform the deal.

- Pick the file format and download the shape on the product.

- Make alterations. Fill out, change and print and signal the saved Florida Proposed merger with the Grossman Corporation.

Every web template you included with your bank account lacks an expiry time and is also your own property for a long time. So, if you wish to download or print yet another duplicate, just go to the My Forms section and click on around the develop you require.

Obtain access to the Florida Proposed merger with the Grossman Corporation with US Legal Forms, by far the most substantial collection of authorized record web templates. Use a huge number of expert and state-particular web templates that meet up with your company or personal needs and specifications.

Form popularity

FAQ

623.07 - Consolidation or Merger of Corporations. (1) Any two or more corporations existing under the provisions of this act and operating within the same county may consolidate into a new corporation or merge into any one of the constituent corporations, as shall be specified in the consolidation or merger agreement.

The document required to form an LLC in Florida is called the Articles of Organization. The information required in the formation document varies by state. Florida's requirements include: Registered agent.

You can order a Certified Copy? You can download uncertified copies at any time for free on the FL Division of Corporations' website by simply performing an entity search and downloading the formation documents.

Articles of merger are legal documents outlining the roles and responsibilities of two or more parties as they merge into a single entity. Articles of merger may also be called a certificate of merger. This agreement outlines the intent of multiple parties to merge and outline the merger's operational aspects.

(2) The articles of merger must contain the following: (a) The name, jurisdiction of formation, and type of entity of each merging entity that is not the surviving entity. (b) The name, jurisdiction of formation, and type of entity of the surviving entity.