The Florida Plan of Reorganization is a legal process utilized by businesses or individuals in Florida to restructure their financial affairs and overcome financial difficulties. This plan serves as a roadmap for debtors to regain control of their finances, repay debts, and potentially continue operating their businesses. The aim is to provide a fresh start while ensuring fair treatment for both debtors and creditors. Keywords: Florida, plan of reorganization, financial difficulties, debtors, restructuring, fresh start, repay debts, businesses, creditors. Different Types of Florida Plans of Reorganization: 1. Chapter 11 Bankruptcy: This is one of the most commonly used plans of reorganization for businesses in Florida facing substantial debt. Under Chapter 11, businesses can continue their operations while developing a plan to reorganize their debts and repay creditors in a structured manner. 2. Chapter 13 Bankruptcy: This type of plan is designed for individuals or sole proprietors in Florida who have a regular income source but are overwhelmed by debt. Under Chapter 13, individuals propose a repayment plan to repay all or a portion of their debts over a three to five-year period. 3. Out-of-Court Restructuring: In some cases, businesses or individuals in Florida may opt for an out-of-court plan of reorganization. This involves negotiations between the debtor and their creditors to reach agreements on repayment terms, debt reduction, or other restructuring options without going through a formal bankruptcy proceeding. 4. Pre-Packaged Bankruptcy: A pre-packaged bankruptcy plan is another type of reorganization plan that can be utilized in Florida. This involves negotiating and obtaining creditor support for a proposed bankruptcy plan before filing the actual bankruptcy petition. By having pre-approval, the process can be expedited, saving time and resources. 5. Small Business Reorganization Act (SARA): The SARA is a relatively new addition to the Florida Plan of Reorganization. It provides a streamlined bankruptcy process for small businesses with a debt limit of up to $7.5 million. This plan, introduced in 2020, aims to make reorganization more accessible, cost-effective, and efficient for small businesses in financial distress. In summary, the Florida Plan of Reorganization refers to various legal mechanisms designed to help businesses and individuals overcome financial difficulties. Chapter 11 and Chapter 13 bankruptcies are the most common types, with options for out-of-court restructuring, pre-packaged bankruptcies, and the recently introduced Small Business Reorganization Act. By utilizing these plans, debtors can navigate the path to financial stability and debt repayment while protecting their rights and interests.

Florida Plan of Reorganization

Description

How to fill out Florida Plan Of Reorganization?

Discovering the right legal file format could be a struggle. Obviously, there are tons of themes available online, but how will you get the legal type you will need? Make use of the US Legal Forms web site. The assistance gives thousands of themes, including the Florida Plan of Reorganization, that can be used for company and personal requires. Each of the varieties are checked out by experts and fulfill state and federal requirements.

When you are previously signed up, log in in your account and then click the Down load switch to get the Florida Plan of Reorganization. Make use of your account to check through the legal varieties you have ordered previously. Check out the My Forms tab of your respective account and acquire one more backup of the file you will need.

When you are a brand new end user of US Legal Forms, listed here are basic directions that you can stick to:

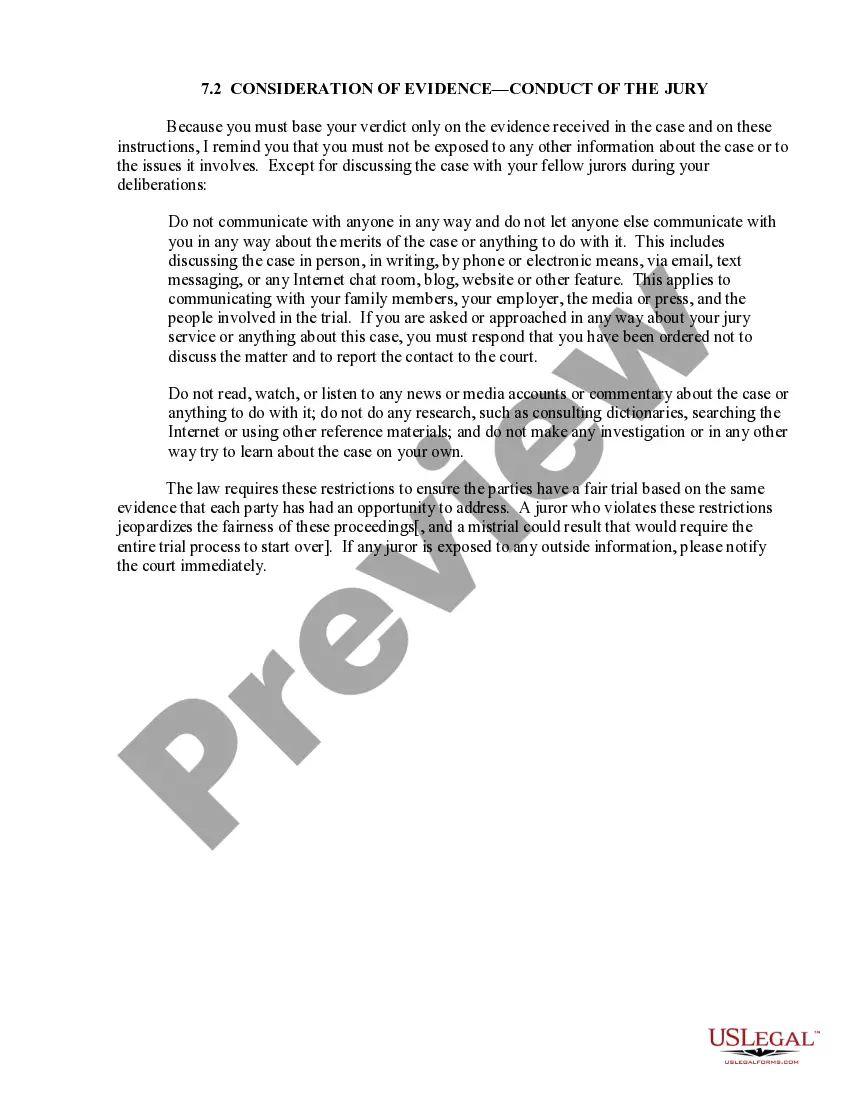

- First, make sure you have selected the correct type for your town/area. You can look over the shape while using Preview switch and browse the shape explanation to guarantee it will be the best for you.

- In case the type fails to fulfill your expectations, take advantage of the Seach discipline to get the correct type.

- Once you are certain that the shape is acceptable, go through the Get now switch to get the type.

- Choose the pricing strategy you would like and enter in the essential information. Build your account and purchase the order with your PayPal account or Visa or Mastercard.

- Pick the file structure and download the legal file format in your gadget.

- Full, modify and produce and indication the attained Florida Plan of Reorganization.

US Legal Forms will be the most significant local library of legal varieties in which you can discover various file themes. Make use of the service to download professionally-made documents that stick to status requirements.

Form popularity

FAQ

Also known as plan. A comprehensive document prepared by a debtor or another party in interest detailing how the debtor will continue to operate or liquidate, and how it plans to pay the claims of its creditors over a fixed period of time.

An equity security holder may vote on the plan of reorganization and may file a proof of interest, rather than a proof of claim. A proof of interest is deemed filed for any interest that appears in the debtor's schedules, unless it is scheduled as disputed, contingent, or unliquidated. 11 U.S.C. § 1111.

Chapter 11 Reorganization and Investor Compensation When a Chapter 11 filing doesn't result in a Section 363 sale, however, it may provide a small glimmer of hope for investors seeking to recoup at least some of their money. That's because reorganization plans sometimes include provisions for shareholder relief.

After filing for Chapter 11, the company's stock will be delisted from the major exchanges. Common stock shareholders are last in line to recover their investments, behind bondholders and preferred shareholders. As a result, shareholders may receive pennies on the dollar, if anything at all.

If your company owes a current employee wages when it files for Chapter 11, then the employee's paychecks should not be interrupted. The company will ask the court's permission to keep paying its employees as long as it stays in business.

Secured creditors like banks are going to get paid first. This is because their credit is secured by assets?typically ones that your business controls. Your plan and the courts may consider how integral the assets are that secure your loans to determine which secured creditors get paid first though.

Chapter 11 reorganization is not necessarily terminal for a business. It can provide relief from unsustainable debt levels, the ability to unravel burdensome contracts, and breathing room to develop a plan. Once a debtor and its creditors reach agreement, the business starts fresh with a new balance sheet.

The discharge received by an individual debtor in a Chapter 11 case discharges the debtor from all pre-confirmation debts except those that would not be dischargeable in a Chapter 7 case filed by the same debtor.