Florida Stockholders' Rights Plan of Datascope Corp.

Description

How to fill out Stockholders' Rights Plan Of Datascope Corp.?

You can invest hours on the Internet searching for the legal papers design which fits the federal and state needs you require. US Legal Forms gives thousands of legal forms which can be examined by professionals. You can easily acquire or print out the Florida Stockholders' Rights Plan of Datascope Corp. from your services.

If you already possess a US Legal Forms account, it is possible to log in and then click the Obtain button. Following that, it is possible to comprehensive, modify, print out, or signal the Florida Stockholders' Rights Plan of Datascope Corp.. Each and every legal papers design you buy is yours for a long time. To acquire one more backup of the obtained type, go to the My Forms tab and then click the related button.

If you work with the US Legal Forms internet site for the first time, adhere to the basic recommendations beneath:

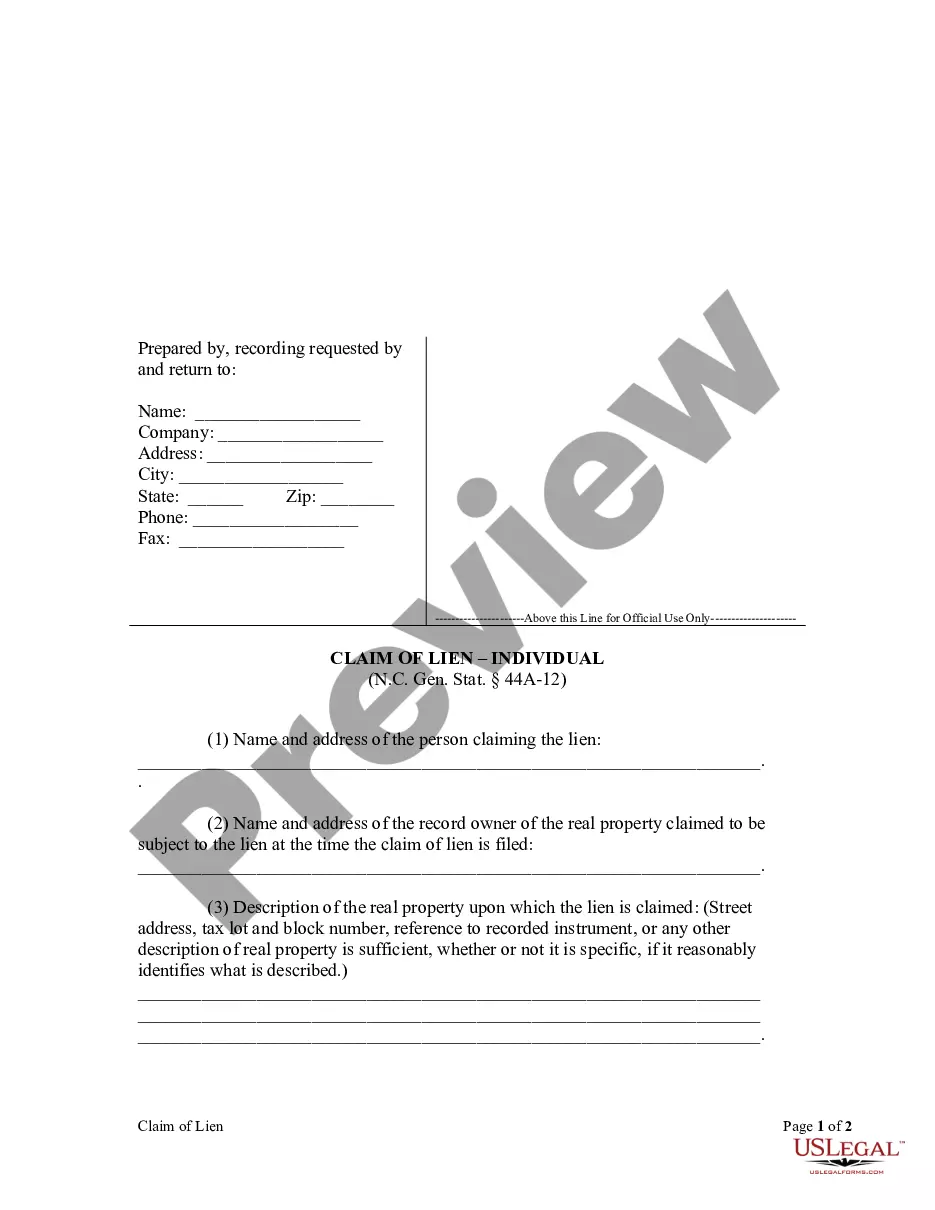

- First, make certain you have selected the correct papers design for that area/metropolis of your choosing. Read the type outline to make sure you have picked the correct type. If offered, make use of the Review button to appear from the papers design as well.

- If you wish to discover one more edition in the type, make use of the Lookup area to get the design that suits you and needs.

- When you have found the design you desire, click Acquire now to proceed.

- Select the pricing plan you desire, key in your accreditations, and register for a merchant account on US Legal Forms.

- Complete the purchase. You can utilize your bank card or PayPal account to purchase the legal type.

- Select the structure in the papers and acquire it to your system.

- Make modifications to your papers if required. You can comprehensive, modify and signal and print out Florida Stockholders' Rights Plan of Datascope Corp..

Obtain and print out thousands of papers web templates while using US Legal Forms website, which provides the greatest variety of legal forms. Use expert and state-specific web templates to tackle your small business or individual needs.